Original text from The Defi Report

Translation|Odaily Planet Daily Golem (@web3golem)_

Editor's note: At the end of March, researchers from The Defi Report predicted that Bitcoin would fall below the key support level of $85,000 in April (Related reading: Bear Market Set, Bitcoin May Fall Below Key Support Area in April). This indeed happened, as the introduction of Trump's tariff policy in early April severely impacted the crypto market, causing Bitcoin to drop to $74,501. The Defi Report has long held the view that the market has entered a bear market, concluding this as early as the beginning of March this year (Related reading: The Evidence is Clear, We are Entering a Bear Market), and advised investors not to easily bottom-fish.

But after Trump's tariff policy triggered market turmoil, The Defi Report decisively bottom-fished Bitcoin at $77,000, believing that the liquidity situation in the market is improving. We are experiencing a once-in-a-century transformation in world trade and global market structures, and the tension in tariffs and trade between China and the U.S. will bring buying pressure to Bitcoin.

In the following report, The Defi Report analyzes from a macro perspective that the world is currently in a "Fourth Turning" period, with the U.S. tariff policy targeting China, and explains why the trade game between the two major powers is favorable for the rise of risk assets like Bitcoin. Odaily Planet Daily has translated the full text as follows, enjoy~

The Changing World Order

Now everyone is focused on tariffs. But do not lose sight of the bigger picture; macro-wise, we are in a "Fourth Turning" period (which occurs approximately every 80 years).

If you are not familiar with "The Fourth Turning," the authors Neil Howe and William Strauss define it as a period of turmoil and reconstruction that occurs roughly every 80-90 years. During a Fourth Turning, society enters a survival crisis, typically catalyzed by war, revolution, and other tumultuous factors, during which the old order is destroyed or fundamentally reshaped to respond to perceived threats.

The Fourth Turning often coincides with the end of a long-term debt cycle (which we are also experiencing). This is the "winter" of historical cycles, where significant changes will occur in all aspects of our lives, such as social and political turmoil, a reshaping of the global monetary system, economic and technological disruption, cultural and moral resets, and geopolitical upheaval.

To some extent, the "Fourth Turning" represents a reset of society—a time of destruction and rebirth. Historical examples include the American Revolutionary War (1775), the Civil War (1861), and the Great Depression/World War II (1939). At the same time, the end of the Fourth Turning will also give rise to positive changes, solidifying a new social order.

Look at today's world; how divided and unequal the U.S. is (class struggle, social wars), the collapse of institutions in the U.S. and globally, the spread of populism, geopolitical conflicts, and the rise of Bitcoin and artificial intelligence, etc. These are all evidence that we are experiencing a "Fourth Turning."

Trump is a byproduct of all this; he fits perfectly into the "Fourth Turning" because during this period, voters tend to elect "strongman" leaders to tackle the challenges of the day.

Only with the right perspective can we clearly observe what is happening today. If we do not study history, we have no reference point to understand everything we are experiencing. So, in this context, does Trump's tariff policy make sense?

Are Tariffs Really Effective?

These tariffs seem to make no sense on the surface. Of course, the Trump administration will defend them in the media, claiming they will bring manufacturing back to the U.S., create a fairer environment for Americans, and strengthen the middle class.

But some of these points are indeed correct. Over the past few decades, as manufacturing shifted to China, the American middle class has been severely impacted. However, this still does not explain the significance of "Liberation Day," as "Liberation Day" itself has no real meaning. Everyone understands that free markets operate better than markets distorted by government intervention. (Odaily note: On April 2, 2025, Trump announced a series of new trade policies centered on "reciprocal tariffs" in a speech at the White House Rose Garden, naming this day "Liberation Day.")

America's Delusion of Using Tariffs to Pressure Other Countries Against China

We analyzed the tariffs imposed on China during Trump's first term, hoping to find clues to explain it all. As a result, we discovered a key clue and concluded that the tariffs imposed on other countries on "Liberation Day" were intended to pressure China.

When the U.S. raised tariffs on Chinese goods in 2018-2019, China actively redirected its exports to other markets and third-world countries. Chinese companies did not lose sales; instead, they found alternative buyers. For example, China's exports to the EU and ASEAN countries (Cambodia, Malaysia, Singapore, Thailand, Vietnam) increased, compensating for the losses in exports to the U.S. By early 2020, China's exports to the EU ($580 billion) surpassed those to the U.S. ($440 billion), a trend that accelerated after the initial tariffs were imposed by the U.S. in 2018-2019.

Many Chinese manufacturers also rerouted products through neighboring countries to evade U.S. tariffs. A study by Harvard Business School found that from 2017 to 2022, Vietnam captured nearly half of China's share in the U.S. import market (growing from $42 billion to $109 billion), while imports from China to Vietnam also increased—indicating that Chinese products were being rerouted to the U.S. through Vietnam, with similar trends seen in Taiwan and Mexico.

In short, Chinese goods can reach the U.S. indirectly. In fact, according to Chinese statistics, China's exports to the U.S. have hardly declined, while U.S. data shows a significant decline, with both sides holding different views.

But this also indicates that the "import gap" of over $150 billion means a large number of Chinese export products have been rerouted or mislabeled. Who are the biggest beneficiaries? Clearly, countries like Vietnam, Malaysia, Cambodia, Thailand, Mexico, and Europe.

Interestingly, after the tariffs were imposed on April 2, these countries were also the hardest hit: Cambodia (49%), Vietnam (46%), Thailand (36%), and the EU (20%).

Now everything makes sense. We believe that Trump did not genuinely intend to collect revenue through tariffs on these countries, but rather wanted to use tariffs as leverage to corner them. The purpose of Trump's actions was to negotiate and encourage them to exclude Chinese products from their markets. In return, we speculate he might offer to lower tariffs on them, increase trade with the U.S., and provide security guarantees.

Mexico and Canada may have already agreed to exclude Chinese products from their markets, as these two countries are not on the "Liberation Day" list.

But it is important to clarify that this is merely our conclusion after studying the U.S.'s past tariffs on China and questioning the motives behind imposing reciprocal tariffs on all other countries. Our goal is to find trading signals within all the rhetoric; we believe this remains a confrontation between the U.S. and China.

As Charlie Munger once said, "Tell me the incentives, and I will tell you the outcome." The U.S. has the incentive to impose tariffs on Vietnam (and other countries) to pressure them to exclude China from their markets and shift supply chains away from China.

What’s Next for Tariffs?

U.S. Treasury Secretary Scott Bessenet may be the main architect of this plan (and the one who persuaded Trump to suspend the 90-day tariffs to save the market), the same person who helped overthrow the Bank of England is now trying to make China yield.

Bessenet may have seen an opportunity to fundamentally change the U.S. trade deficit with China and has a deep understanding of the leverage behind it all. For example, the People's Bank of China absorbs dollars from exports and uses these dollars to stabilize the yuan exchange rate (to lower export prices). There may be a larger game behind this, concerning the changing world order.

So, the next step for the U.S. government must be negotiations; the Trump team will seek to negotiate with all countries except China.

In terms of market trends, after announcing the 90-day tariff suspension, the crypto market did rebound, but the extent was weaker than that of stocks; we currently view this as a bear market rebound. It is common to see a roughly 50% pullback after a significant sell-off. If the S&P 500 maintains at 5,550 points and the Nasdaq at 17,600 points, we will reassess.

We know that in this game, China remains the biggest influencing factor. But Trump does not want to negotiate with China; he wants to gain the support of other countries on the "Liberation Day" list and then work to shift supply chains away from China, which feels more like a power struggle, unrelated to tariffs and "fairness."

If the U.S. reaches an agreement with countries like Vietnam to exclude China, then China may also adopt corresponding macro policies to retaliate. Subsequent markets may view the agreements reached between the U.S. and various countries as positive, but China's countermeasures will awaken the market, as it will gradually realize that a trade war will trigger a capital war, and may even lead to a hot war.

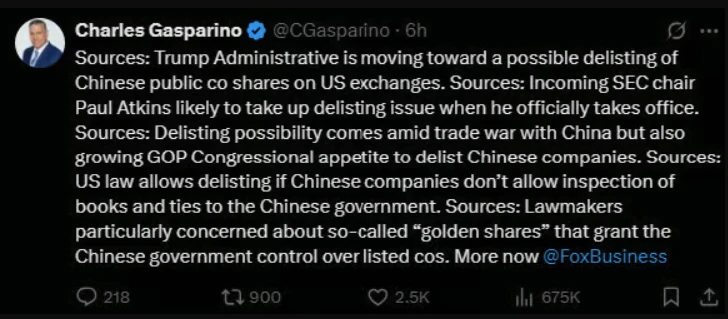

Although there is now a 90-day cooling-off period, there is currently no solution that can give investors and businesses more confidence in planning for the future. As Trump raises tariffs on China to 145% again, the situation is getting worse. As revealed by senior Forbes reporters, the Trump administration may delist Chinese companies from U.S. exchanges.

Bitcoin May Rise Against the Background of the Tariff War

But looking ahead, the fundamentals of Bitcoin are improving. We have recently allocated about 15% of our funds into Bitcoin (with an average cost price of $77,000) and hold a small amount of TI (with an average cost price of $2.34) as a long-term hold.

Despite the many uncertainties, why did we choose to bottom-fish at this time? Given the following signals, we believe that liquidity conditions are improving:

Inflation rate is at 1.4% (according to Truflation data);

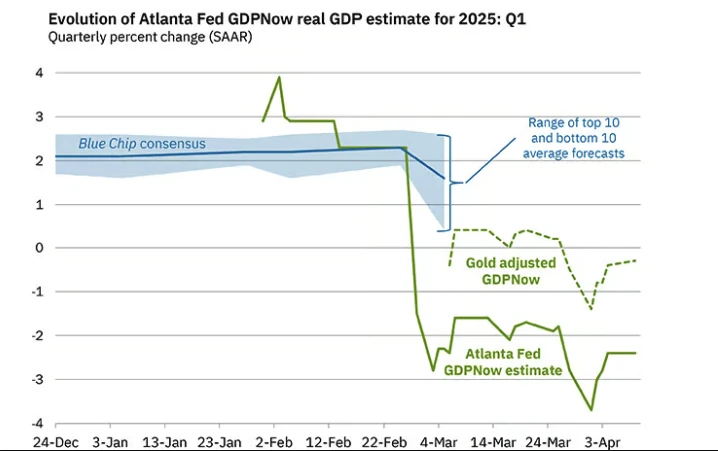

Economic growth is slowing down. We believe tariffs will accelerate this process, while the Atlanta Fed expects U.S. GDP to shrink by 2.4% in the first quarter.

Data: Atlanta Fed

The probability of a recession is high (possibly over 50%).

The U.S. Treasury needs to refinance $2.5 trillion in debt by the end of the year and reissue $2 trillion (to cover the deficit), with more needed in 2026.

The dollar index has significantly declined (falling below $100).

Additionally, China has begun to stimulate its economy, and we believe there will be more stimulus measures in the future. As the yuan comes under pressure, we think Bitcoin will receive some buying interest (similar to when the Chinese yuan depreciated in 2015 and during the escalation of the trade war in 2019).

However, even so, given Bitcoin's volatility and its close correlation with the stock market, along with the uncertainty surrounding tariffs and Chinese policies, we still tend to be cautious.

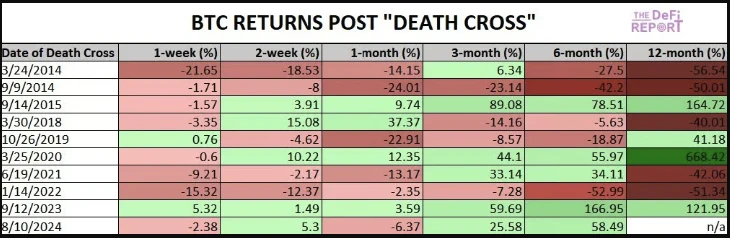

In terms of momentum indicators, Bitcoin's 50-day moving average fell below the 200-day moving average last week (a "death cross"), and it is currently trading below the critical 200-day moving average ($85,000). If Bitcoin falls below the previous high ($70,000), then the bear market will likely last longer, so caution is warranted.

However, as this situation develops, we are also starting to see signs of "fatigue" among sellers, as shown in the chart below, which observes Bitcoin's performance after the "death cross."

It is also important to note that if the Federal Reserve begins to ease policies and bond yields rise again, Bitcoin should perform well in this more stagflationary environment. But the challenge is that stocks (and altcoins) may not perform as well, given Bitcoin's correlation with the Nasdaq index and other risk assets, which could pose resistance to Bitcoin's rise in the short term.

Conclusion

We believe that, for caution's sake, we should look at the bigger picture. We are in the early stages of a "once-in-a-century transformation," so we need to be well-prepared. The possibilities we need to address next are as follows:

China participates in negotiations;

Trump backs down;

The U.S. Supreme Court intervenes to stop or reduce tariffs, which could change the situation rapidly.

The true intention of the U.S. is to exclude Chinese goods from the global market, and it is still unclear whether this strategy will be effective, but tensions may escalate further. Trump's aggressive style has worked in many cases, but this time it may fail because he cannot coerce the bond market. The more pressure he puts on China, the greater the resistance from the bond market.

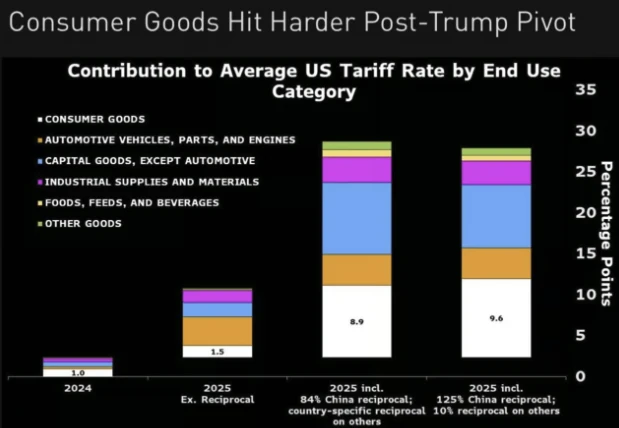

Although the tariffs have been paused for 90 days, the market still has not found a long-term solution. Additionally, given the 145% tariffs imposed on China, the revised tariff combination (10% on other products) actually causes more harm to consumers than the tariff combination implemented on April 2 (due to the increase in the quantity of goods imported from China).

Source: Bloomberg Economic Research, Anna Wong

If tensions between major powers escalate and economic conditions continue to deteriorate, we expect market prices to decline further, and the Federal Reserve will adopt quantitative easing policies (or signal quantitative easing). This will become a key catalyst for investors to actively allocate risk assets like Bitcoin.

Of course, as always, we will update our views based on the developments in the situation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。