Original Title: Monthly Outlook: How Do You Define a Crypto Bear Market?

Original Author: David Duong, CFA - Global Head of Research

Original Translation: Daisy, ChainCatcher

Key Points Summary:

As of mid-April, the total market capitalization of cryptocurrencies, excluding Bitcoin, has fallen from a peak of $1.6 trillion in December 2024 to $950 billion, a decline of 41%. Additionally, venture capital funding has decreased by 50% to 60% compared to the levels of 2021-2022.

We believe a conservative risk management strategy should be adopted at this stage. However, we expect cryptocurrency market prices may stabilize in the latter half of the second quarter of 2025, laying the groundwork for a rebound in the third quarter.

Overview

Multiple factors are converging, potentially signaling the arrival of a new round of "crypto winter." With global tariff policies being rolled out and possibly escalating further, market sentiment has noticeably deteriorated. As of mid-April, the total market capitalization of cryptocurrencies, excluding Bitcoin, has dropped to $950 billion, down 41% from the $1.6 trillion peak in December 2024, representing a year-on-year decline of 17%. Notably, this level is even lower than the market capitalization performance during almost the entire period from August 2021 to April 2022.

In the first quarter of 2025, venture capital in the crypto industry rebounded compared to the previous quarter but remains 50% to 60% lower than the peak levels of 2021 to 2022. This significantly limits new capital entering the ecosystem, particularly impacting the altcoin sector. The structural pressures mentioned above primarily stem from the current macroeconomic uncertainties. Fiscal tightening and tariff policies continue to suppress traditional risk assets, leading to a stagnation in investment decisions. Although the regulatory environment provides some support, the path to recovery for the crypto market remains challenging against the backdrop of a generally weak stock market.

The interplay of multiple factors has placed the digital asset market in a precarious cyclical outlook, necessitating caution in the short term (expected in the next 4 to 6 weeks). However, we believe investors should adopt flexible tactics to respond to market fluctuations. Once market sentiment is restored, a rebound could initiate rapidly. We remain optimistic about market performance in the second half of 2025.

Defining Bull and Bear Markets

In the stock market, a common empirical standard for determining a bull or bear market is a rise of 20% from recent lows or a drop of 20% from highs. However, this standard is inherently subjective and does not apply to the highly volatile crypto market. Crypto assets often experience price fluctuations of over 20% in a short period, but this does not necessarily indicate a fundamental change in market trends. Historical data shows that, for example, Bitcoin can drop 20% in a week while still being in a long-term upward trend, and vice versa.

Moreover, the crypto market operates 24/7, making it a barometer of global risk sentiment during traditional financial market closures (such as nights or weekends). As a result, cryptocurrency prices often react more strongly to global events. For instance, during the Federal Reserve's aggressive interest rate hikes from January to November 2022, the U.S. stock market (represented by the S&P 500 index) fell a cumulative 22%; meanwhile, Bitcoin, which began its decline earlier in November 2021, saw a cumulative drop of 76% during the same period, approximately 3.5 times the decline of U.S. stocks.

The Truth in Contradiction

It is important to note that the "20% rule," traditionally used to define bull and bear markets, is essentially just a rule of thumb, and there is no unified standard to date. As U.S. Supreme Court Justice Potter Stewart famously said when commenting on "what is obscene": "I can't define it, but I know it when I see it." Similarly, identifying market trends often relies more on experience and intuition than on strict computational models.

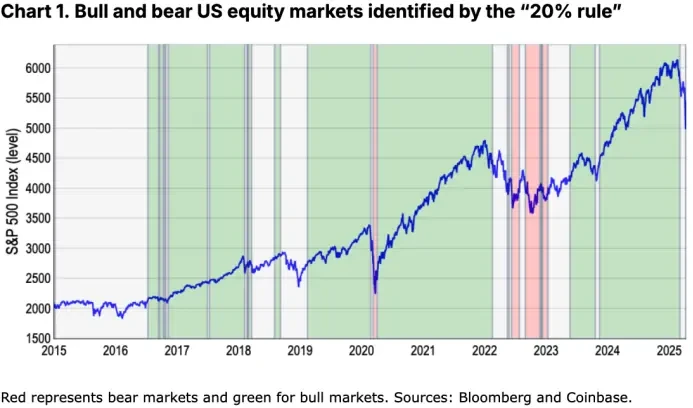

Nevertheless, to make judgments more systematic, we refer to the closing price peaks and troughs of the S&P 500 index over a rolling one-year time window to identify key market reversals. According to this method, the U.S. stock market has roughly experienced four bull markets and two bear markets over the past decade—this does not include the latest downturn from late March to early April (our model has begun signaling a bear market). See Chart 1.

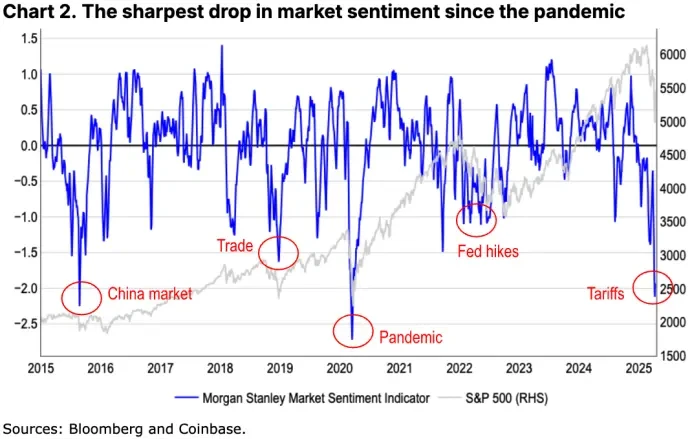

However, this "20% threshold" also overlooks at least two significant events that impacted market sentiment but had declines between 10% and 20%. For example, the volatility spike caused by the turmoil in the Chinese stock market at the end of 2015, and the market turbulence resulting from escalating global trade tensions in 2018 (as indicated by the Federal Reserve's global trade policy uncertainty index). See Chart 2.

In the past, we have seen that sentiment-driven market declines often trigger defensive adjustments in portfolios, even if the declines do not reach the artificially set 20% threshold. In other words, we believe that a bear market is essentially a reflection of a structural change in the market, characterized by deteriorating fundamentals and liquidity contraction, rather than merely the magnitude of price declines. Additionally, the "20% rule" carries the risk of complacency, as it ignores early warning signals such as weakened market depth and rotation into defensive sectors, which are often precursors to significant downturn cycles in history.

Alternative Indicators

Therefore, we attempt to find alternative indicators that can more accurately reflect the relationship between price movements and investor sentiment, applicable to both stocks and crypto assets. The definition of a bear market involves not only asset returns but is also closely related to market sentiment— the latter often determines whether investors believe the downward trend will continue and adjust their strategies accordingly. This concept is complex because we are not observing simple continuous rises or falls, but rather turning points in long-term trends. For example, the COVID-19 pandemic is a typical case where the market experienced a rapid and severe decline followed by a swift rebound. Of course, the brevity of that bear market was largely due to the massive fiscal and monetary stimulus policies subsequently introduced by governments, which prevented investors from falling into a prolonged drawdown.

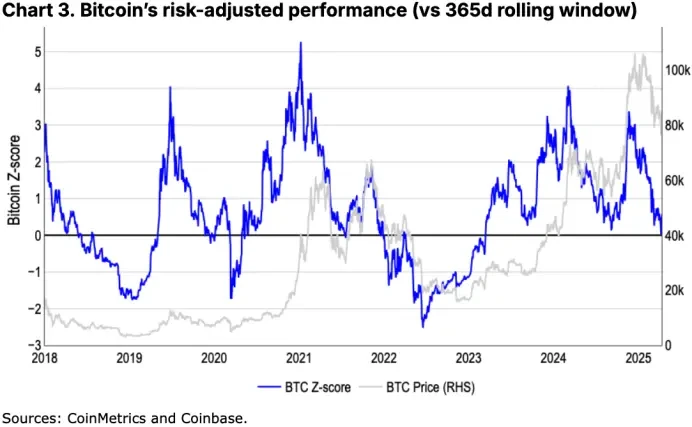

Rather than relying on empirical rules like the "20% rule," we prefer to use two types of risk-adjusted indicators: (1) risk-adjusted return performance measured by standard deviation; (2) the 200-day moving average (200DMA). For instance, from November 2021 to November 2022, Bitcoin's performance relative to the average of the previous 365 days declined by 1.4 standard deviations; during the same period, the U.S. stock market's decline also reached 1.3 standard deviations. From a risk-adjusted perspective, Bitcoin's 76% drop and the S&P 500's 22% drop can be seen as comparable in magnitude.

Since the standard deviation indicator naturally reflects the high volatility of the crypto market, the z-score (standard score) is very suitable for crypto asset analysis. However, it also has certain limitations: on one hand, it is relatively complex to calculate; on the other hand, it may provide fewer signals when market trends are stable, potentially lacking sensitivity to trend changes. For example, our model indicates that the most recent bull market cycle ended in late February, after which the market state was classified as "neutral," reflecting the model's potential lag during periods of significant market volatility.

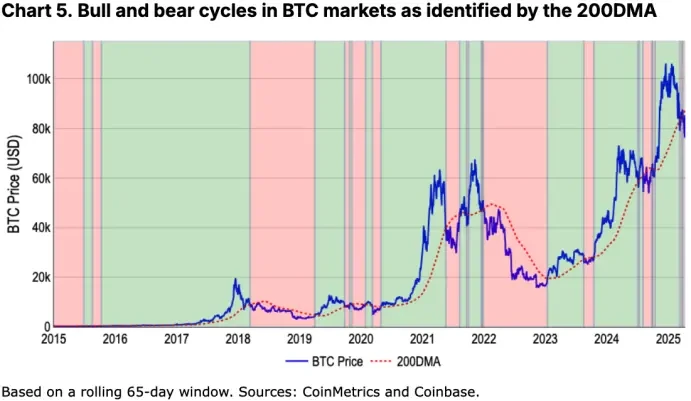

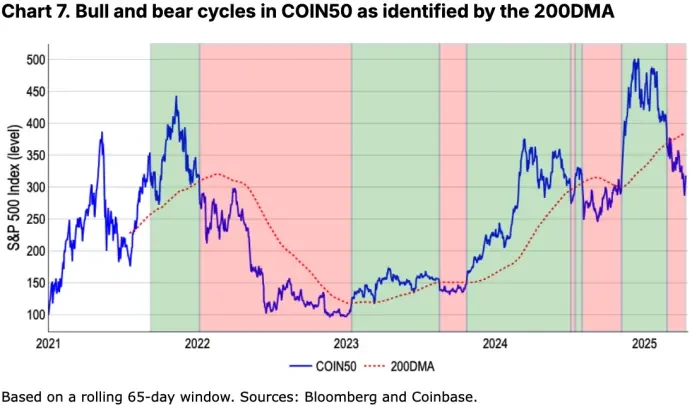

In contrast, the 200-day moving average (200DMA) provides a simpler and more robust method for identifying sustained market trends. Because it is based on long-term data, it effectively smooths short-term fluctuations and adjusts promptly based on the latest price movements, thereby providing clearer momentum signals.

The judgment method is also relatively intuitive:

When prices consistently remain above the 200DMA and are accompanied by upward momentum, it is generally considered a bull market;

When prices remain below the 200DMA for an extended period and are accompanied by downward momentum, it often indicates the formation of a bear market.

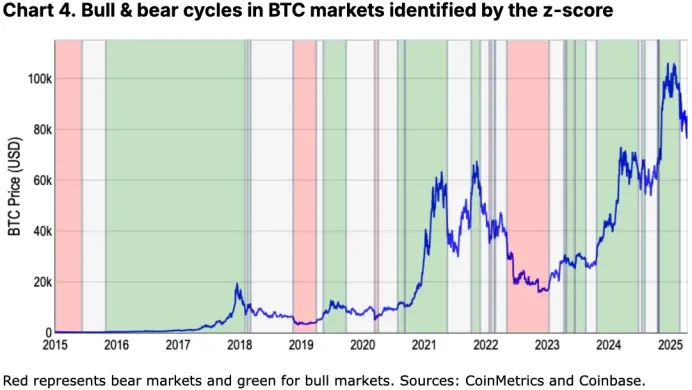

This method not only aligns with the broad trend signals reflected by the "20% rule" and z-score models but also enhances the practicality and foresight of insights in a dynamic market environment. For example, it successfully captured key downturn cycles such as the early pandemic in 2020 and the Federal Reserve's interest rate hike cycle from 2022 to 2023, while also reflecting the crypto winter of 2018 to 2019 and the pullback triggered by China's mining ban in 2021.

In our view, this method not only aligns with the broad trend signals reflected in the "20% rule" and z-score models but also enhances the precision of extracting actionable insights in a dynamic market environment.

Additionally, we have found that the 200DMA better reflects the dramatic fluctuations in investor sentiment over different periods. See Charts 5 and 6.

Crypto Winter?

So, have we entered a crypto bear market? Previous analyses have primarily focused on Bitcoin, as it has sufficient historical data to compare with traditional markets like the U.S. stock market. However, as the category of crypto assets continues to expand into emerging areas (such as meme coins, DeFi, DePIN, AI agents, etc.), Bitcoin is gradually becoming less representative of the overall market trend.

For example, Bitcoin's 200DMA model indicates that since late March, its sharp pullback has entered bear market territory. Analyzing the same model for the COIN50 index (which covers the top 50 tokens by market capitalization) reveals that since the end of February, these assets have clearly been in a bear market. This aligns with the trend of the total market capitalization of cryptocurrencies, excluding Bitcoin, which has fallen 41% from its peak of $1.6 trillion in December 2024 to $950 billion; in contrast, Bitcoin's decline during the same period has been less than 20%. This gap reflects the higher volatility and risk premium of altcoins at the end of the risk curve.

Conclusion

As Bitcoin's "store of value" attribute continues to strengthen, we believe that a more systematic and comprehensive approach is needed to assess the overall performance of the crypto market, in order to more accurately define its bull or bear market status, especially in the context of an increasingly diverse asset class. Nevertheless, both Bitcoin and the COIN50 index have fallen below their respective 200-day moving averages, signaling that the market may be in the early stages of a long-term downtrend. This aligns with the trends of declining total market capitalization and shrinking venture capital, both of which are important characteristics that may indicate the arrival of a "crypto winter."

Therefore, we recommend maintaining a defensive risk management strategy at this stage. Although we still expect cryptocurrency asset prices to stabilize in the latter half of the second quarter of 2025, laying the groundwork for improvements in the third quarter, the complex macro environment still requires investors to remain highly cautious.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。