In a report shared with Bitcoin.com News, Aurelie Barthere, Principal Research Analyst at Nansen, argues that recent U.S. tariff negotiations suggest a shift toward pragmatism, easing some investor fears. The report highlights Treasury Secretary Bessent’s growing influence over trade policy, contrasting with the diminished role of hardline aides like Navarro and Commerce Secretary Lutnick.

This shift, coupled with temporary tariff exemptions for semiconductors and tech products, signals a potential de-escalation, Nansen’s research analyst notes. However, Barthere says risks linger. Sectoral tariffs and unresolved negotiations with China could prolong uncertainty, impacting consumer spending and business investment.

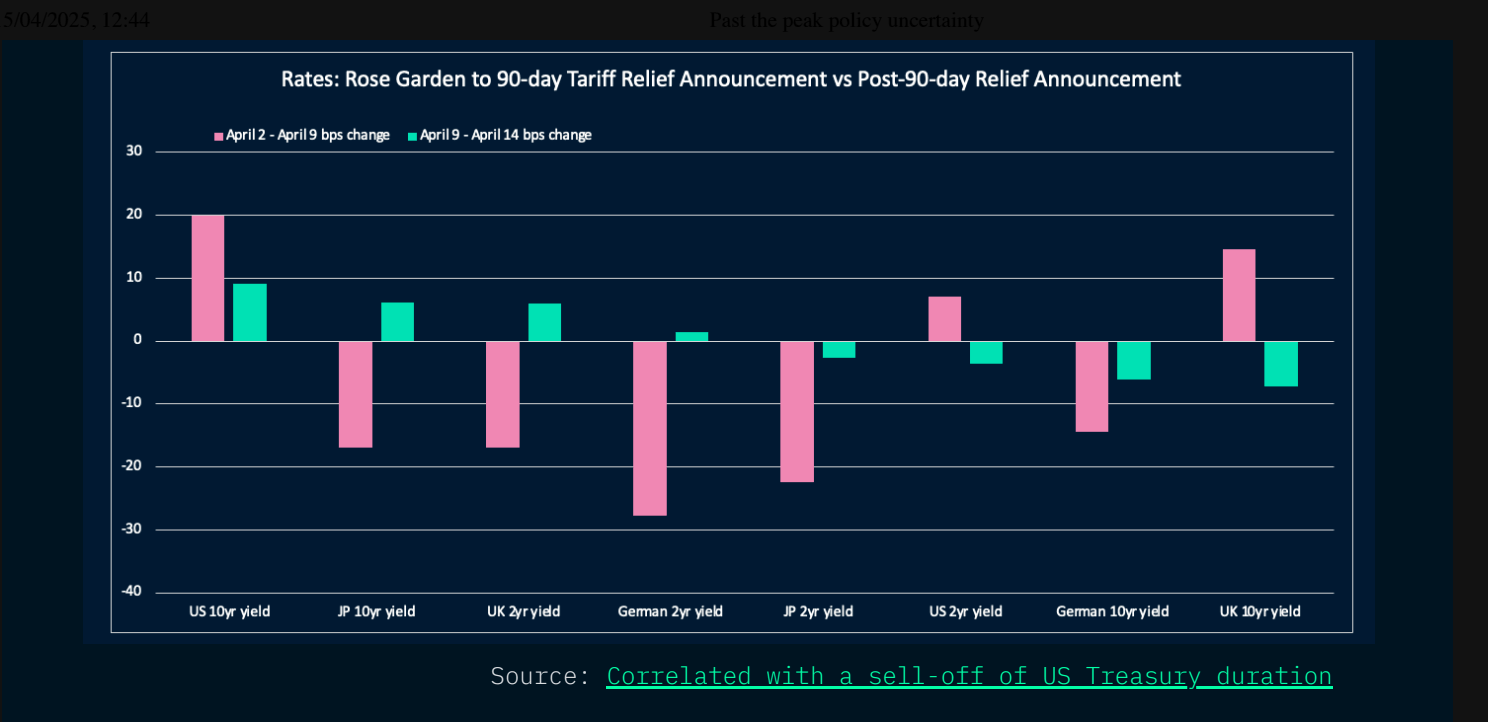

The report points to weakening U.S. Treasury demand and a falling dollar as signs of foreign capital hedging against further volatility. Equities outside the U.S., particularly in Europe and China, underperformed during the height of tariff tensions, Nansen data shows. Yet, the firm cautions that the lack of viable alternatives may keep global investors anchored to U.S. markets.

Barthere’s analysis recommends a conservative approach, favoring assets like bitcoin ( BTC), discounted tech stocks such as Nvidia, and high-margin European pharma companies. Gold is also cited as a geopolitical hedge. The firm’s Risk Barometer turned “risk-on” late last week, reflecting cautious optimism. But Barthere warns the climb will be bumpy:

We have likely passed the peak tariff uncertainty, with risk assets now climbing a bumpy wall of worry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。