Guest: JP Mullin, Co-founder of Mantra

Original Translation: zhouzhou, BlockBeats

Editor’s Note: The podcast discussed JP Mullin's explanation of the OM token crash. He expressed a sense of responsibility for the losses suffered by investors and the community, despite no malicious intent. JP committed to providing comprehensive and transparent information and launching a buyback and burn plan to support investors. He emphasized the importance of transparency and ongoing communication, stating that he would do everything possible to rectify the current situation and restore the project's health. He thanked supporters and promised to strengthen interaction and commitment with the community in the future to ensure better development and respond to investors' needs.

The following is the original content (reorganized for better readability):

JP Mullin: Putting market cap aside, I am not happy about this at all. This is an unprecedented event, and many people have lost money and been hurt because of it. I am hurt myself; I feel our community is hurt, the token holders are hurt, and the investors are hurt. Even if I did nothing wrong, with no negligence or malicious intent, I still feel a sense of responsibility.

Host: I’m a bit curious; you mentioned that investors are hurt, but if the current trading price is 70 cents, I wonder if they really have lost money?

JP Mullin: I think they actually haven’t lost yet. And precisely because of that, those investors holding circulating tokens have not sold out until now.

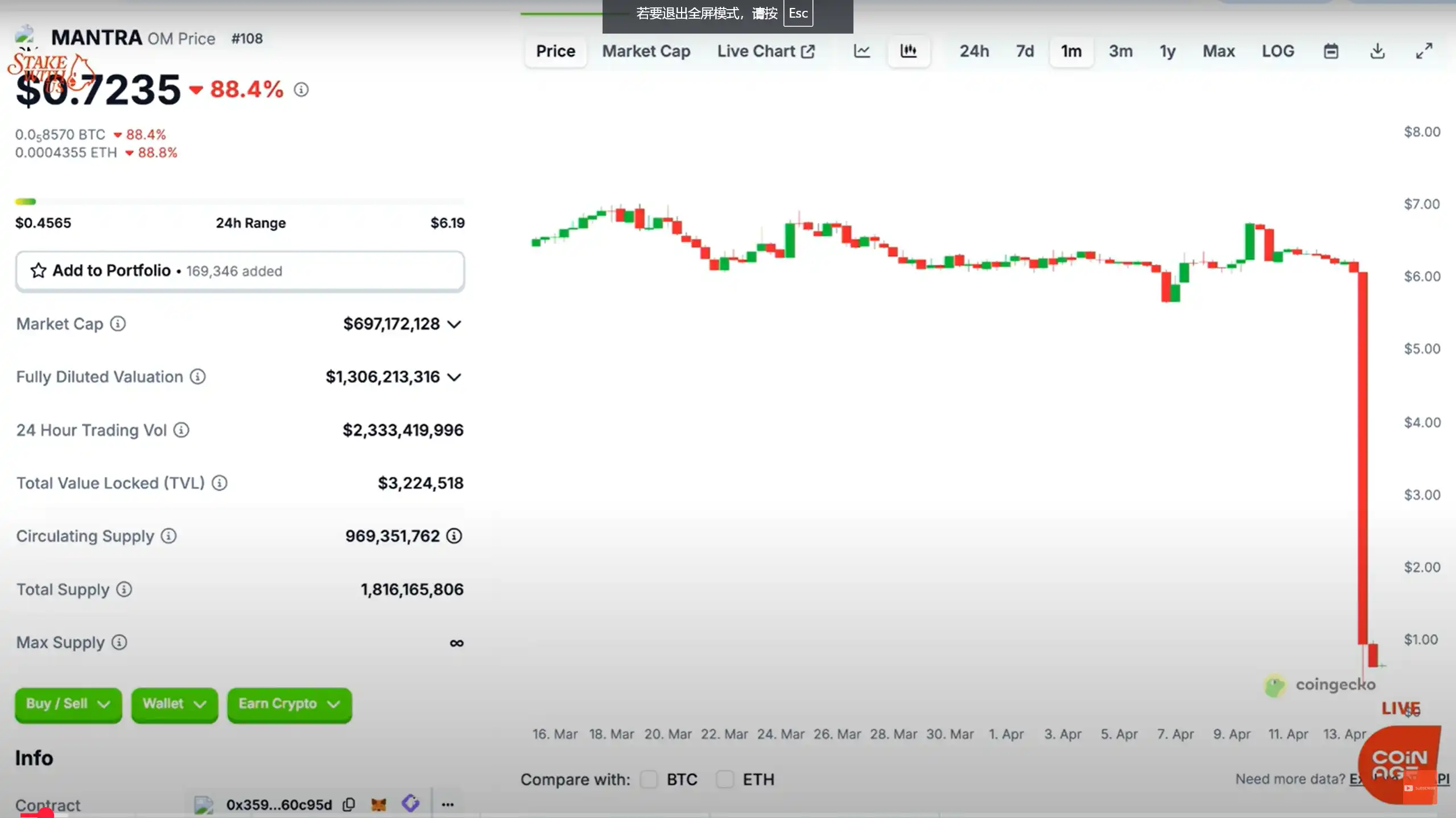

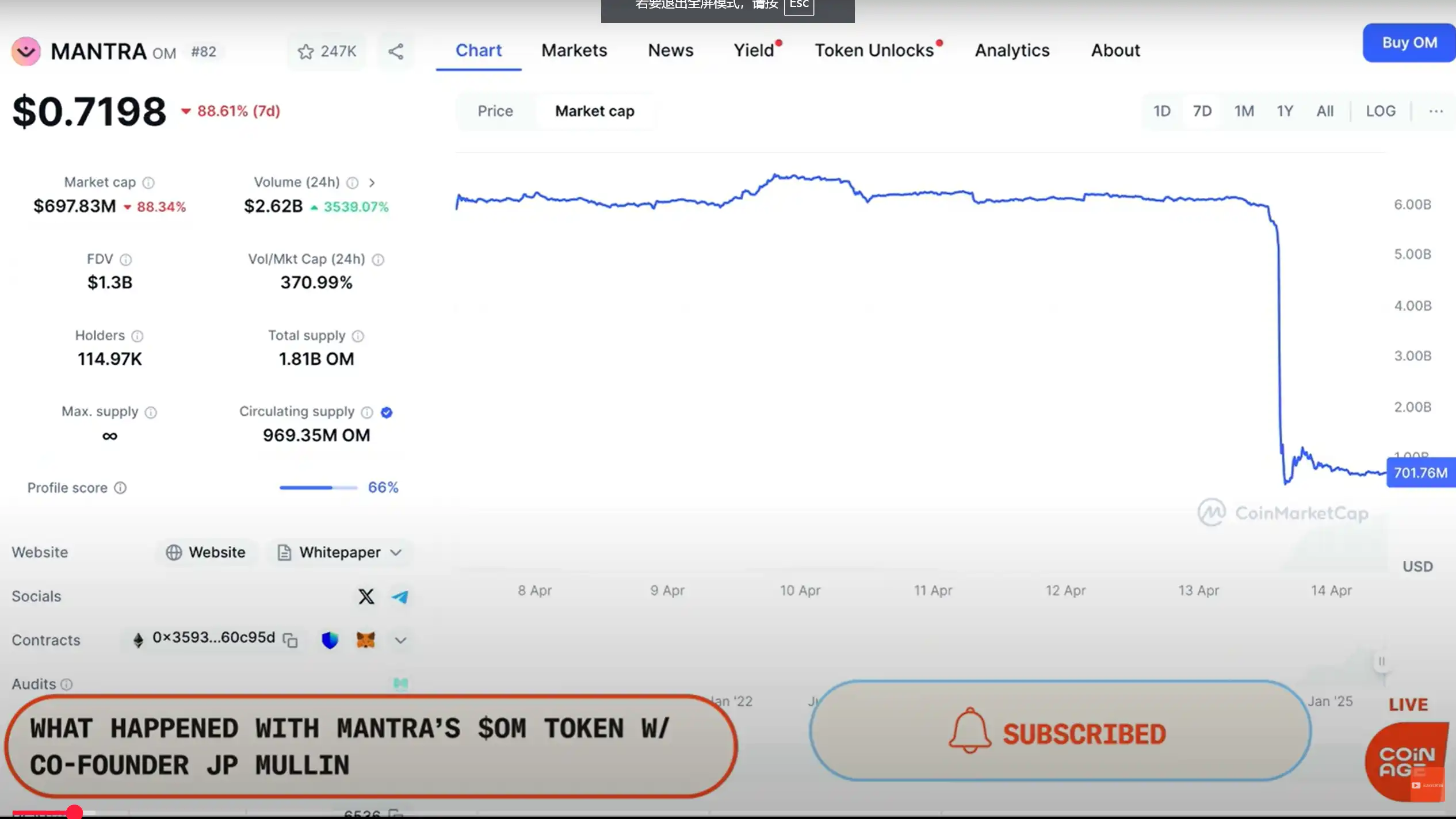

Host: I’m the host Akuzhman. A lot has been happening in the crypto space recently, and this weekend, the entire community has been focused on the plummeting token of a real asset blockchain project.

The chart we see now shows that the OM token dropped over 80% in a single day, with a market cap evaporating by about $5 billion (at least on paper).

Many people are asking what exactly happened, and we hope to find some answers today. We also want to thank the co-founder of Mantra for answering these questions; welcome John Patrick Mullin, or JP.

JP Mullin: I’m also grateful for the opportunity to talk about this incident and how we plan to respond moving forward.

Host: Since you noticed this incident, what has happened in the past 24 hours? How has this time been for you?

JP Mullin's Response to the OM Crash

JP Mullin: This day has been very difficult for me, for the team, and especially for the community. Perhaps I can explain from the beginning how this whole thing happened, breaking down the sequence of events and our current situation.

I attended Paris Blockchain Week last week. On Saturday Paris time, I boarded a flight to Seoul, and now I’m in a hotel in Seoul. We held an artist-focused summit here today, which I attended, and I can talk about that later. Basically, I went to sleep around midnight local time. At that time, I tweeted that I was on the plane, and since there was no WiFi, everyone thought I was in flight.

But I was actually just asleep because it was already late at night. Later, around 5 AM, I was woken up by a call from the hotel. Our team couldn’t reach me, so they called the hotel front desk. When I woke up, I was immediately bombarded with messages: the token has crashed, something has happened, etc. We immediately started checking to ensure it wasn’t an on-chain attack, that the tokens weren’t stolen, or any similar issues.

Did Liquidation Trigger the Token Crash?

After communicating with some key partners, investors, and exchanges, we quickly discovered that the problem lay with centralized exchanges—there were large-scale liquidation operations because someone was using OM tokens as collateral for leveraged positions, and there were also many positions directly long on OM. These positions were forcibly liquidated in a short time, coinciding with Sunday night in Asia when liquidity was very poor.

And I was still asleep at that time, resulting in these positions being quickly liquidated, triggering a price crash and leading to more liquidations and sell-offs, ultimately causing this massive drop.

So I woke up in this state, and we immediately issued a statement saying we were investigating the matter and promised to maintain communication and transparency. We have contacted all investors, partners, exchanges, and community members to clearly explain what happened, what measures we will take, and to answer any questions they may have, as the situation is indeed very complex.

Host: To let everyone know—before the show, we didn’t have much communication, just a brief arrangement. So like everyone else, I’m just starting to understand what exactly happened.

But I’m a bit surprised that you and your project Mantra have been around for quite a long time. So can we start by talking about what you were doing before this crash? Because many people may not be familiar with your work. You are working on a Layer 1 protocol linked to real-world assets, and the project is primarily based in Dubai, where you spend most of your time, in the UAE.

The core of your project is to tokenize real-world assets, but actually, the OM token existed for several years before you launched the mainnet last year; it was an ERC-20 token on Ethereum, right? So can we start from the beginning and see how this project has developed to where it is now? Because I see your tokens are circulating on several chains. I’m also curious about which exchange you mentioned that was selling? If it wasn’t your investors and you didn’t sell the tokens, then who caused this crash? Do you have any further insights?

Founding of Mantra, Token Design, and Bridging

JP Mullin: I’ll start from the founding of Mantra so you can better understand the relationship between these two tokens: one is the early ERC-20 version, and the other is the later mainnet coin.

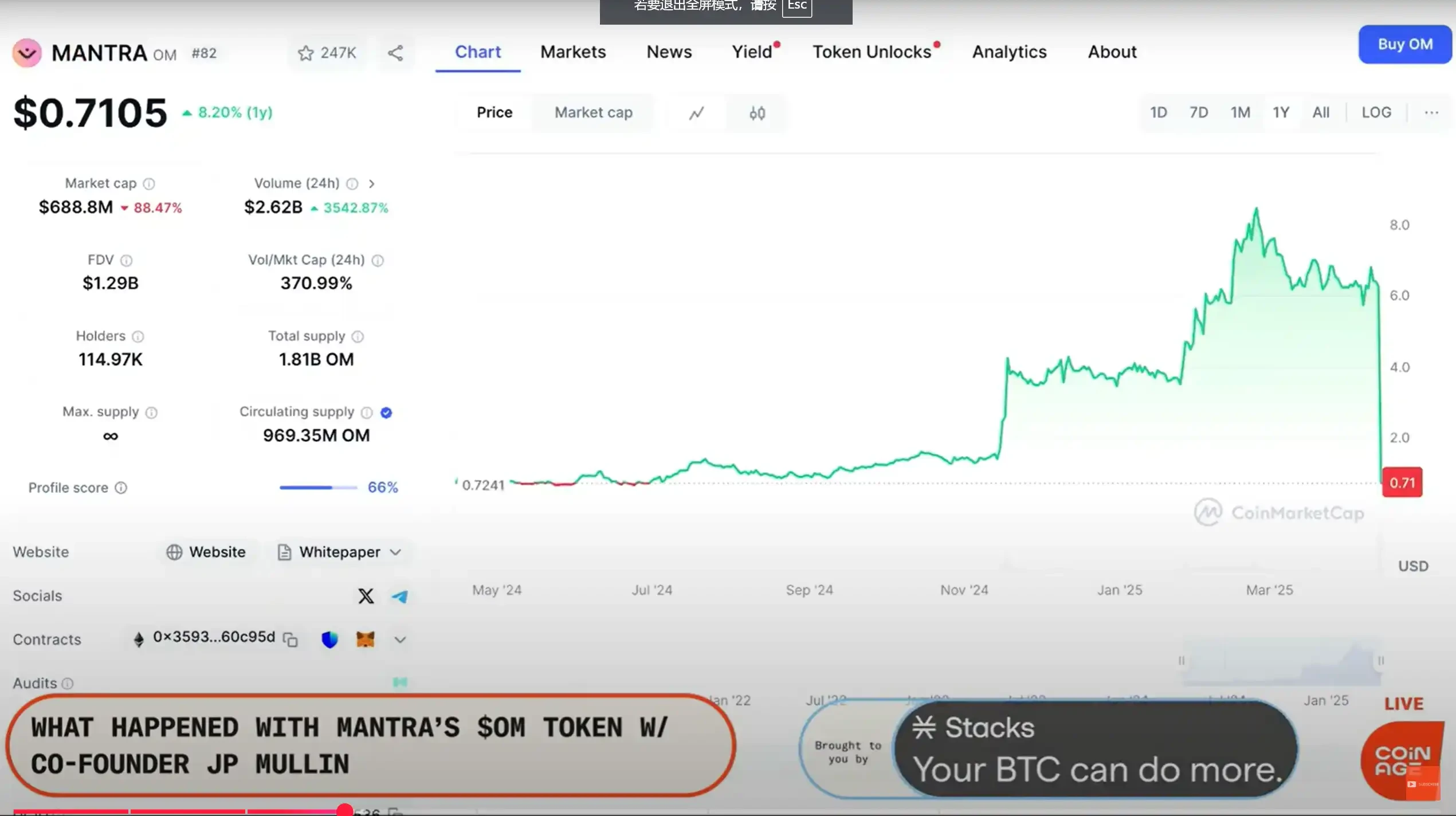

Mantra was founded in early 2020 during the pandemic, and we launched the ERC version of OM on August 18, 2020. So now, the entire project is almost five years old. In March 2021, we launched on Bybit. At that time, we started as a DeFi protocol and also developed some early products. We seized the opportunity of the first wave of DeFi Summer, and initially, it rose well, but later, like the entire market, it fell all the way down.

By 2023, our situation had become quite difficult; for example, in October 2023, our coin price dropped to $0.017 at one point. Then, by the end of 2023 to early 2024, I began meeting with some of our core partners, including Shorooq—a fund based in the UAE—and Laser Digital, which is the crypto division of Nomura Securities. They helped us bring in some institutional funds and pushed us to further develop the concept of a "regulated DeFi protocol."

At that time, we were also working with Dubai's regulatory body, VARA, on the licensing process. Earlier this year, we actually obtained the world’s first official license for a DeFi protocol. Our new Layer 1 chain is designed for the tokenization of real-world assets, with built-in compliance frameworks, permission management, identity layers, and other features.

Around that time (end of 2023 to early 2024), we began thinking about how to integrate the token models. Initially, we planned for these two token systems to operate independently: one based on Ethereum, the Mantra ERC token, and the other the AUM token we intended to launch on the new chain Omega.

But later, we brought this to the community for a vote, and the community wanted us to concentrate resources on supporting one token rather than two. So based on the voting results, we merged these two paths and began focusing on how to develop an institutional-level real asset tokenization business in the UAE.

In the past month, we have actually announced several significant partnerships, such as collaborations with Mag and Damac Group in the real estate sector. At the same time, we officially obtained VARA's compliance license and launched our own chain at the end of last year.

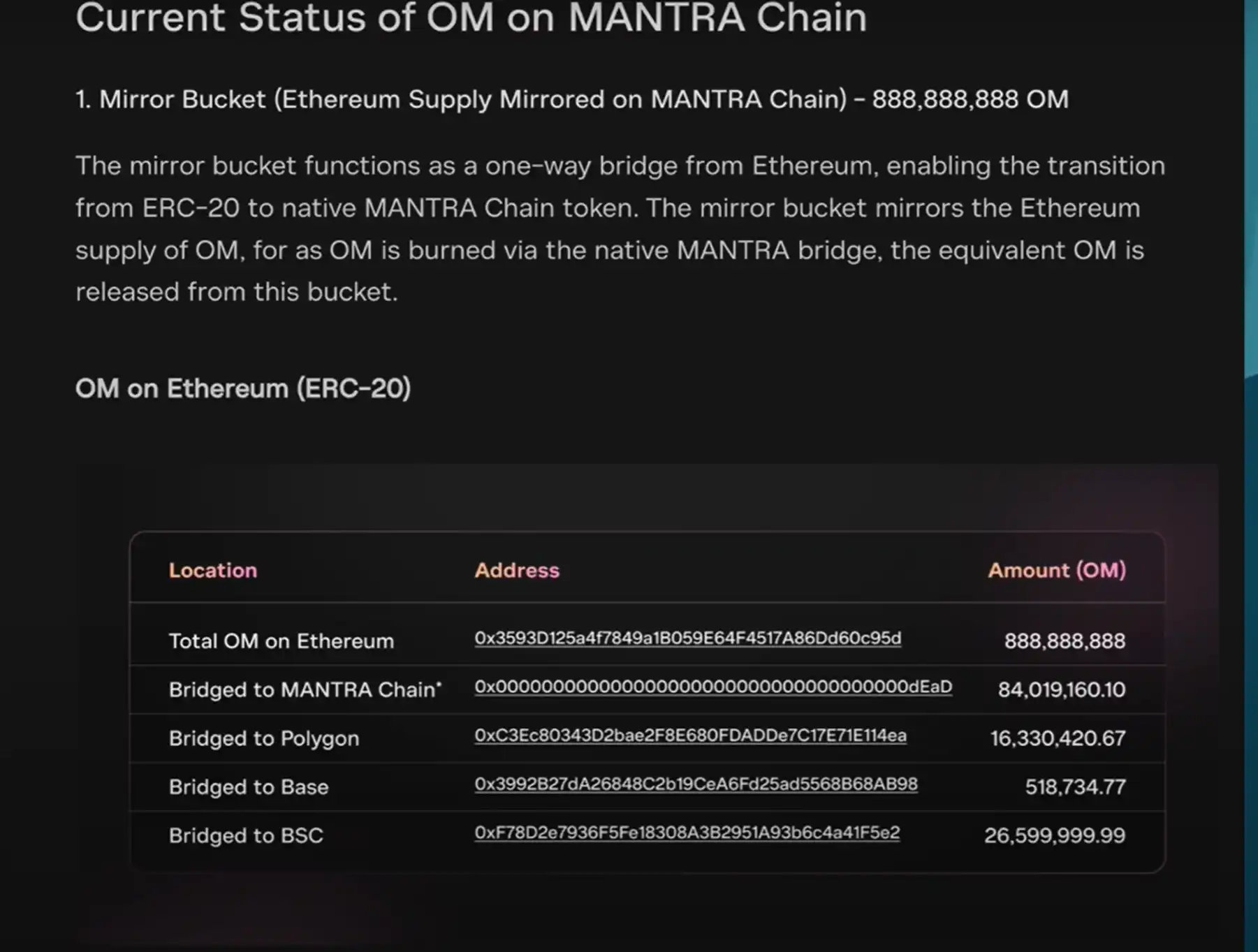

Along with the launch of the chain, we also initiated the cross-chain bridging process. At the time we launched the mainnet, about 95% to 96% of the ERC version of the token was already in circulation, and now it’s about 98%. This ERC token has a hard cap of 8 million, and all of this can be verified on Etherscan; the wallet addresses and distribution are very clear, with many in exchange wallets and some in marked wallets.

Most of the tokens on the mainnet are still locked, held by third-party institutions like compliant custodians such as Anchorage, and there is also a mandatory vesting mechanism.

We actually just released a transparency report last week to address concerns about the details of the tokens. Moving forward, we will continue to provide more transparent information about wallets and distributions.

Now the ERC tokens have also been bridged to multiple chains, such as Polygon (via the Polygon POS Bridge), Binance Smart Chain (BSC version of OM), and even a version on Base.

However, all of these still belong to the original ERC total of 8 million, with no new supply; they are just circulating on other chains through bridging.

Host: I find this part quite interesting; you mirrored the tokens from the old chain to the new chain, meaning if someone wants to transfer tokens from the old chain to the new chain, they must first burn the old ones and then exchange them for the new ones, right?

These designs are one of the important decisions that established projects need to make during their evolution. Now that everyone understands the development background of Mantra and how its tokens are distributed across multiple chains.

Let’s return to the core of this incident; you mentioned yesterday that someone might have built a large leveraged position using OM on an exchange, which was later forcibly liquidated. During this process, a large number of tokens were dumped into the market, leading to the crash.

So I want to ask a few questions: First, do you have any further understanding of who was behind these operations? Second, which exchange did this happen on? Third, did you receive any notification before the liquidation occurred?

JP Mullin: We have actually been communicating with some exchanges for a while, asking them questions like, "When were these tokens listed?" "Do you know who the owners of these wallets are?" "Are these from the team? Are they market makers?" and so on.

Regarding this incident, we have been discussing these types of issues with some exchanges for the past few months, not just in the last 24 hours. We pay attention to which tokens are flowing into the exchanges and whether they are coming in as collateral. But these tokens all came from some clean wallets—so-called clean wallets are those that were transferred from other exchanges, have no historical activity, and are not connected to wallets we are familiar with.

I personally label all the wallets I know on Etherscan so I can track them at any time. However, the wallets involved this time are all clean, unmarked, and brand new wallets. This means they are not directly associated with the team or entities we are familiar with.

We do know that some exchanges played a role in this incident, but I cannot name them at this time. We are currently working with institutional investors and partners to assess whether there are legal avenues we can pursue to protect our community and investors, as we believe they have indeed suffered harm and injustice in this incident.

It is clear that this occurred in a low liquidity environment, late on a Sunday night, resulting in large-scale forced liquidations. We have not yet contacted the investors who were liquidated, but we have been in communication with some institutional partners, such as Cheroke and Laser.

Host: It should be noted that both Cheroke and Laser have publicly stated that they are not the main players in this sell-off. So you mentioned that this incident occurred during a low liquidity time, which is one of the reasons project teams typically collaborate with market makers—to stabilize the market in such situations. Can you reveal which market makers you are working with? And how did they respond during this incident? After all, theoretically, this is when market makers should step in.

JP Mullin: We do have multiple market makers, and they are also our investors. We collaborate with some large trading institutions; on one hand, they are investors, and on the other hand, they hold OM and have loan agreements with us.

However, to be honest, I don’t think their positions were sufficient to handle this extreme situation. Based on our current understanding, the scale of the forced sell-off could be as high as several hundred million dollars, but we do not have exact figures yet, which is also part of what we are further investigating. Once we obtain more information, we will disclose it as soon as possible.

Host: The position you mentioned is around one hundred million dollars; is that the scale you are referring to?

JP Mullin: We believe it is roughly in that range; it is indeed a very large position. OM is a token with a market cap of several billion dollars, and there are many long-term large investors who use these tokens to support other collateral positions and as part of leveraged operations.

And all of this happened very quickly—I remember I went to sleep at midnight and woke up at five in the morning; this had already been happening for an hour or two. We were passively responding to this situation with almost no prior knowledge.

This is also why we have been emphasizing that this is an unprecedented, sudden, and rapid event. We are now working hard to clarify more details and share them with everyone as transparently as possible.

Host: I agree that this is indeed a very rare situation, especially occurring during a low liquidity time on the weekend. The price charts clearly show this. I am curious that now the community is discussing on-chain transparency; people are asking if it wasn’t your core investors, then who could establish a position of one hundred million dollars? Such a large-scale liquidation event clearly cannot entirely occur within the transparent range of on-chain operations; many things may involve off-chain activities.

As a project founder, I know these decisions are complex, and you have to make choices between many trade-offs. You need to find ways to list the tokens on centralized exchanges, collaborate with market makers, and also worry about them not "backstabbing" you at critical moments.

So let’s start from 2024: what decisions did you make in the process of promoting the project’s launch? For example, were there any OTC agreements? What was the structure of these agreements? How did you gradually arrive at the current situation? Because we all know that many tokens were already circulating in the market before the project officially launched; did this lay the groundwork for what happened today?

Situation Before the Project's Official Launch?

JP Mullin: We actually conducted two rounds of financing for the mainnet tokens, and these situations have been explained in the transparency report we mentioned earlier. These tokens are currently still held on the Anchorage platform and are in a locked state.

The first round started in October last year, with a 12-month and 24-month lock-up period, and the release time for the other round is also approaching, with a 12-month lock-up period.

In addition, we also had some investors who purchased the ERC version of the tokens through OTC, and these investors are long-term investors like Shorooq and Laser. Their wallet addresses are public, and anyone can verify that they have not sold any tokens to date. These tokens were designed with an 18-month vesting period and are still in the vesting process.

Our first financing was completed around February or March of last year, and these tokens have been in circulation for a long time now. But on-chain, it can be seen that no one has sold. We have a group of very long-term, value-aligned investors, and I am truly grateful for their continued support during this incident; we will continue to support them.

So we completely deny the external accusations of "someone selling tokens in the dark."

Host: Regarding the "accusations" you just mentioned, I want to clarify what we are actually talking about. Because I have not seen anyone publicly accusing you, and as a journalist, I must be very rigorous.

I don’t think everything that happens in the crypto space can simply be defined as "running away," just like the Terra incident; I don’t think that was running away either. Many times, the problems that arise are not due to malicious fraud, and we are not discussing those meme coin projects.

We are now discussing your team building a Layer 1 blockchain related to real assets, and you are also collaborating with many large institutions, such as the projects you mentioned in Dubai.

So I think it is necessary to talk about where you think the whole incident went wrong. If you are serious about creating a real and useful project, where do you think the mistake occurred? From what you just said, it seems to hint that a certain exchange has issues.

Additionally, numerically speaking, the one hundred million dollar position you mentioned is basically equivalent to the daily trading volume in many days. Such a scale of liquidation, to be honest, is very severe.

Where Did the Problem Occur?

JP Mullin: I am not suggesting that this is just one person’s operation; to be honest, we believe it is the result of a group of people acting together. We do believe that the core of the incident occurred at a specific exchange, but we are currently working with all exchanges to investigate and hope to gather as much information as possible.

This is indeed an unprecedented event, and it is very sad for our community; we will do our utmost to resolve this issue. I have also participated in many AMAs and Spaces in the past few days, hoping to let everyone know that we are not avoiding responsibility.

Moving forward, we will take some measures; the most important thing now is to address public opinion and communication with the community. This morning, we also attended a summit based on RWA in Korea, and I was there in person because I wanted to tell everyone that we are not running away or hiding.

Our project has been ongoing for five years, and we will continue to move forward, not just for five years, but possibly for much longer.

Buyback and Burn Plan Preview

What we need to do next is to restore the confidence of our community and token holders. We are actively considering launching a buyback plan. At the same time, we are also considering whether to burn some of the future released token supply. If these two measures can be combined, we hope to announce a plan as soon as possible.

In addition to this buyback support plan, we also hope to provide as much detailed information and transparent on-chain data as possible, using facts and evidence to prove that what we say is true, allowing the community to verify our claims and see that we are indeed handling this matter responsibly.

Host: There is a very practical question: the number of your token holders has actually increased after the incident—meaning many people bought in after the drop. Now that you are proposing a buyback, everyone will also be concerned: how much capital do you have to execute this plan? Can you talk about your current financial situation?

JP Mullin: I want to emphasize a few things: our current operational status is completely healthy, with sufficient funds, and the business is fully solvent. In addition to existing investors, we have also received proactive support from many new investors, including providing funds, participating in the buyback plan, and engaging in long-term OTC transactions.

We are actively evaluating these options and will launch a complete solution as soon as possible. During this period, the business will continue to operate normally, and we will maintain communication and updates. So from a financial perspective, we currently have no issues and will continue to move forward.

Transparency, Investors, and Market Makers

Host: You just mentioned "long-term OTC transactions," which I think is also worth noting. Because in the token trading structure, OTC is actually a relatively common but not very transparent method.

You previously mentioned that investors like Laser Digital and Shrooks have their tokens locked, and they have publicly stated that they have not sold, but OTC transactions may involve the project team privately selling tokens to others, possibly below market price.

These tokens later flow into the market and may be perceived as "the project team dumping." So I want to ask, has your project already conducted many OTC transactions before this incident? Is the volume large?

JP Mullin: We have indeed conducted OTC transactions with some institutional investors, high-net-worth individuals, and family offices. But these are all long-term locked, and in fact, none of them have been unlocked yet.

We have set many restrictions in these agreements, such as prohibiting resale or transfer in the secondary market. We have also been working hard to ensure that investors are aligned with us, meaning they will not hedge, will not engage in short-term operations, but are long-term bullish holders who believe in the project. We do not want any unnecessary selling pressure to appear in the spot or perpetual markets.

In addition, we also value the health of the entire secondary market, so we handle all such transactions through our officially approved methods. We do collaborate with some brokers, and sometimes they come to tell us that institutions want to buy or sell, and we coordinate to ensure these transactions are conducted with our knowledge and oversight, ensuring the market operates healthily.

Host: I understand you have control mechanisms, but back to the previous question: this matter has already been fermenting in the market. I have also looked at your token distribution chart, and there are actually quite a few early ERC-20 version tokens that can be mapped to your mainnet new tokens. In this case, isn't it still quite difficult to control the circulating token quantity? It's no wonder that some people can establish a seemingly valuable but actually illiquid large position on-chain, right?

JP Mullin: It's not as difficult as you think. From the data I looked at earlier today, over 100 million OM tokens have been bridged from Ethereum to the mainnet. This means, yes, a large number of tokens have indeed entered the market.

But we need to clarify one point: we are not selling these "high liquidity" tokens in the market. What we are selling are those long-term locked tokens that cannot be freely circulated.

Host: I understand that your official stance is not to sell these circulating tokens, but the existing old tokens in the market can be used by some people to build positions. So when exchanges see someone using these tokens as collateral to create a large position on-chain, they might worry: "These tokens seem to have a high value on paper, but in reality, not many people are willing to take them or the liquidity is poor." Thus, they might liquidate. Is this the core issue behind this incident?

JP Mullin: Why do these tokens appear valuable on paper but are not worth that much in reality? Is it due to liquidity issues? Here, we are not talking about locked tokens being used as collateral, but rather those freely circulating tokens being put on exchanges.

I believe that major exchanges have their own risk control mechanisms. Of course, we have communicated with some exchanges, but such liquidations should be matters between the exchanges and investors.

Typically, such things do not happen overnight; there is usually a process of ongoing communication. I was not involved in the specific conversations this time, so I cannot comment on the details, but from what we have seen, this liquidation action was very aggressive and rapid, which is why we are paying close attention to this matter and considering all possible legal avenues.

We are also working with investors to evaluate all feasible options.

Host: I also want to talk about the token plan you previously announced, as this incident actually occurred shortly after your round of airdrops had just ended, and at that time, you were also preventing "Sybil attacks"—where someone creates a large number of fake wallets to claim airdrops.

As a founder, how do you view the relationship between this incident and the timing of the liquidation? Has this already exposed some risk signals, such as some tokens possibly being incorrectly distributed to the wrong people?

JP Mullin: To be honest, I think this is just an unfortunate coincidence. We conducted the first round of airdrops of 10% a few weeks ago, which was actually postponed from before.

Let me briefly introduce our overall token economic model: we announced the first airdrop plan in February 2024, distributing 50 million tokens, with a total value of about 5 to 10 million dollars. Later, this number rose to a market cap of 400 million to even 500 million dollars.

This also means that a portion of the tokens were airdropped at zero cost, which is certainly a concern for those long-time users who paid for their tokens. So we adjusted the lock-up rules to try to balance the interests on both sides. Even so, we still conducted the first round of airdrops.

At the same time, we filtered the airdrop addresses for Sybil attacks, and the proportion was very large. We found that there were indeed a large number of malicious operations, such as hundreds of thousands of addresses attempting to game the airdrop, which is clearly not what we want to see. We want to protect those community members who genuinely spent money and supported the project.

We made the filtering decision back in March, and this airdrop was completed about one to two weeks ago with the first round of 10% distribution.

Host: So I want to add, why do you want to protect the cost price of those users who genuinely invested in buying tokens? Logically, it is to prevent those who received tokens without spending money from impacting them, right?

JP Mullin: Yes, I think this is very important—if someone is willing to use their hard-earned money to support your project and your tokens, I truly feel it is my responsibility.

As a founder, this is not only my fiduciary duty but also a responsibility I genuinely want to take on.

When we find that some people exploit loopholes to game the airdrop and seize resources, and then directly dump these tokens to our true holders who have always supported us, it harms our project itself. I cannot allow such things to happen.

Of course, this does not mean we do not welcome everyone to participate in the airdrop. In fact, after our airdrop, there were still over 200,000 wallet addresses participating in activities on the mainnet.

These people are real users who passed our anti-Sybil attack mechanism and did not use false identities. They conducted transfer operations and are still holding tokens—these are the people we must protect.

Moreover, we are not only protecting these addresses on the mainnet; we also have over a hundred thousand original holders on Ethereum, not including wallet addresses on exchanges. So overall, the number of users involved is very large, and I take this matter very seriously.

Host: Since you say you take this responsibility seriously, as a founder, there are actually two key tasks: the first is to ensure that the lock-up mechanism is clear and enforced, as some projects do not even implement lock-ups.

The second is the matter you mentioned earlier about the token price rising continuously. In fact, we have seen in the past that this situation often occurs when market liquidity is poor, and some market makers use very little capital to continuously push the price up.

Your project is quite special; on one hand, there is an existing token, and on the other hand, you have launched a new L1 mainnet, allowing users to swap between the two tokens.

As a founder, when you see these things happening, do you feel nervous? You have also mentioned that you do not want anyone to take over at a high price; if there is actually not enough real trading volume or activity in the market to support this price increase, it can easily lead to inflated prices.

From the perspective of the entire crypto space, many founders and market makers are actually gambling when they collaborate—betting that your team can drive token demand beyond the existing and future unlocked supply, especially for projects like yours that have an original design with airdrop + unlocking mechanisms.

So how do you view this gamble? Regarding this incident, how much responsibility do you think founders should bear?

JP Mullin: I can explain a bit about some adjustments we made to our token economic model, so you can have a clearer understanding of the overall context.

When we modified the release mechanism (vesting) for this airdrop, we also adjusted the token release schedule for the team. The team's tokens are still locked in Anchorage, and the wallet addresses have been made public and are written in our transparency report.

At the same time, as part of the new airdrop rules, we extended the lock-up period for the team and advisors' tokens to one of the longest in the industry—specifically, a 30-month cliff (no release during the lock-up period) + 30 months of linear release.

You should know that I actually received the original ERC version tokens long ago, but I returned all of those tokens and reset the unlocking period. So my tokens will be locked for another six years, plus I have already spent four and a half years building the Mantra project. We are in it for the long haul.

I will accompany this project through its highs and lows. This is not the first time we have faced turmoil. I certainly have to take responsibility for this incident. This situation is indeed something we have never encountered before. I believe there are indeed some malicious behaviors, and we are investigating what exactly happened.

The reason I am willing to sit here and accept your interview, and why I went to Korea to attend the summit, and have been communicating as openly and transparently as possible, is because—this project is truly important to me, and the community means everything to me.

We will continue to do what we need to do to support the community. Whether in good times or bad, I have to bear it. This is indeed one of our most difficult times, but we will continue to move forward, building on the solid foundation we have, alongside our strong partners.

Host: I want to follow up on what you said about "malicious behavior," as this is new information for me. Can you explain? Because it sounds more like someone held a large number of tokens and then got liquidated, which to me seems like market behavior and does not necessarily constitute "malicious" behavior, right?

JP Mullin: I would say the timing of this incident is very suspicious, and the entire process is too "uniform," not like something that happened randomly. You are unlikely to see such a large "cascade liquidation" suddenly erupt overnight. That is why we need to investigate seriously to find out what really happened.

Generally speaking, such situations cannot "suddenly occur." You know, if you have experience with margin calls or loan liquidations, you would understand—if you maintain communication with the exchange or lender, proactively contact them, provide additional collateral, or seek solutions, they will not directly liquidate you completely, especially not all at once for over a hundred million dollars in positions.

That is a very large position and must be managed very carefully. Our current feeling is that this matter was not handled properly, which is why we are investigating what happened, as this has indeed hurt many people.

Host: I also agree with your statement, but this is precisely where everyone's concern lies, especially regarding the relationship between market makers and the communication issues between you. From the perspective of us external observers, we can only rely on speculation. As the project leader, you are the one most likely to know the truth. So the core question is: how did this happen?

Many people say that this logic is not difficult to understand—like the liquidation example you mentioned: if the price of a token is not formed under natural supply and demand but is artificially pushed up by some participants, then when the price corrects, the exchange might feel: this price is not real, the market does not have real buy orders, and once no one is willing to take over, it will collapse rapidly.

From this perspective, the triggering of the liquidation is actually "reasonable." As the founder of the project, I guess you should have participated in discussions about tokens, circulating supply, which exchanges to list on, trading volume distribution, and so on. At least you should understand how these relationships operate, right?

JP Mullin: To some extent, yes. We do have some exchanges that proactively contact us, asking us: "What are these tokens? Where did they come from? Why are these tokens being used as collateral?"

They send me a wallet address, and that address is a new wallet created from another exchange, looking completely like a strange new address.

I cannot make decisions, nor do I have precise information to determine where these tokens came from, especially if they came from a centralized exchange. Clearly, we have partnerships with several market makers who are also our investors, and I am more than willing to tell you who they are: including Laser, Amber, and Manifold Trading. These are all our investment partners.

I can state clearly that we have never collaborated with market makers to engage in any form of "pump" or token price manipulation. We simply do not have the capital to do such things, and the funds raised by Mantra over the past 12 to 16 months have been limited; this is not something we would do, and I am willing to make this public statement.

Regarding the value of the tokens, you can comment on it however you like; whether it is fair is up to the market to decide. I hope we can ultimately reach a fair market value, and this applies to the project we are building as well.

Over the past 12 to 15 months, we have indeed received a lot of attention, and the execution has been strong. We have made many significant announcements and received a lot of support, including from institutional investors, real estate developers, and web2 partners like Google.

So from a due diligence perspective, we have passed all reviews. We are a regulated project, and we have shown all our compliance to regulators and partners, maintaining transparency and communicating with regulatory bodies.

Host: If this is a project approved by Vera, I am curious if you have had discussions with them regarding the events that have occurred?

JP Mullin: We certainly contacted them immediately. So, we have been in touch with them. Overall, everyone wants to understand what exactly happened. We are committed to maintaining transparency and presenting every fact and piece of information as much as possible.

In addition to the recovery plan, the next step is to present a detailed post-analysis, making all facts and information public, including public wallets, etc. We will disclose everything we know to regain the trust of the community and clearly present our perspective on-chain.

Shrug has already published their wallet, Laser has also published their wallet, and we have released our wallet address as well. We will continue to provide more information and maintain transparency as much as possible; we are not avoiding this matter; we are right here.

How Will the OM Token Develop?

Host: I want to continue discussing the issue of transparency. As I mentioned earlier, Sheriff released their report and stated that the tokens being sold were not theirs. Speaking of transparency, where do we go from here? What direction should Mantra take? How will the OM token develop? Because, as you said, there are many questions surrounding these issues now.

Before this incident occurred, while preparing for this conversation, I saw a discussion on Twitter where someone mentioned the issue of transparency, and you responded that we had discussed the vicious cycle issue regarding the supply of this airdrop.

You basically responded at the time, "I am not engaging in any form of pump, nor am I saying this is a bad investment or a good investment. We have maintained transparency from the beginning, and recently released another report to the community." I am a bit curious about which report you were referring to?

I am not sure if you were referring to the part about the vicious cycle, but the main issue is whether there is transparency regarding the supply dynamics. I even saw that Binance recently mentioned a warning about listing the OM token due to concerns about the increase in supply. I am curious if you were referring to this issue.

I mean the transparency report you previously showcased, which listed different categories. I would be happy to provide a link; this report was published about a week ago.

As you mentioned, throughout Mantra's history, we have been releasing updates regarding the issuance and supply of the OM token. These have been ongoing since last year when we merged the ERC tokens with the new chain tokens, which went through governance voting and received approval from the ERC20 Mantra community, and the entire process has been validated. Over the past few months, we have also continuously released updates; although I do not have those links right now, I would be happy to provide them.

You can see the process of these changes. We have been closely collaborating with Binance and other exchanges, and whenever there are changes in token economics, we communicate with them immediately. If there are any economic changes, we will publicly release them through verified governance proposals or media articles, and we will also share this information directly with Binance and other exchanges.

I know Binance is certainly aware of this change, and because of that, many exchanges have decided to support this change, with Binance being one of them. We have contacted them regarding this change, and they are aware of the changes in token supply; this is not new information; it happened back in October.

This matter does seem a bit strange to me, especially the idea you proposed about "mirrored destruction on a one-to-one ratio." Has there ever been a discussion about whether some of the tokens should be converted if the existing token supply is too large? Just like we discussed earlier, the supply of OM tokens is already quite large.

I am currently reviewing the proposal, and many people mentioned that this proposal might be of that type; I remember you said it had 91 votes. I recall you saying that when we were doing this, many people said we were done for. As the leader of Mantra, could you talk about the decision-making process for this? And would you go back and make a different decision?

JP Mullin: I would not change the decision. In fact, if this proposal had not passed, we would not even have Mantra's Layer 1 chain.

Initially, we planned to use Mantra's ERC tokens, and we intended to build a completely independent L1 chain that would conduct some form of airdrop to reward OM, and this new token was called Omega AUM.

We had discussions with investors and core team members about this, which took place at the end of 2023 and the beginning of 2024, when almost no one had heard of Mantra.

In fact, our token dropped by 95%, and many people thought we were done for, right? Then we had this almost impossible recovery, which was supported by the repricing of the OM token, and Mantra's chain was launched with the goal of supporting RWAs. These different narratives and the efforts we made came together to ultimately achieve what we have today.

Regarding this "mere bucket," when we created this new supply for the chain, everything was public, and everyone supporting this project was fully aware of the situation. From the moment the proposal was released, we have been communicating this information.

The mirrored bucket is essentially a bridge between the ERC tokens and the mainnet tokens; we effectively replicated the existing supply of ERC tokens, and it is also verifiable on-chain. When people send ERC tokens over, those tokens are sent to a burn address, and currently, about 100 million tokens have been burned.

The entire process is an exchange of fungible tokens on a one-to-one ratio; you can even see this on Bybit, where they have both the ERC version of OM and the Mantra chain version of OM. You can deposit ERC version OM and withdraw Mantra chain version OM, and vice versa.

We set a threshold of 30,000 tokens, and when you send tokens through the bridge, this amount will be automatically filled within minutes. After verifying that the tokens have been sent to the burn address, new tokens will be released. If the amount exceeds 30,000 tokens, we will need a manual processing step, which requires approval and sending tokens through a multi-signature wallet. This process may take up to 24 hours to ensure everything is secure, as it involves significant capital movement.

Even when we launched, I forgot what the price of OM was at that time, but there were still tens of billions of dollars worth of tokens stored in this bridging wallet. We want to ensure that this does not become a target for attacks. We also want to ensure that people can correctly bridge their tokens to the mainnet tokens, which is where all new activities begin and is the direction for our future development.

Host: Looking back at this 90% drop, considering those who may have entered the market at much higher prices, the current price is far below their investment price at that time. If so, as you said, they may have lost their hard-earned money. Do you think you and your team have done enough in terms of transparency? Did you inform everyone that these things might happen?

JP Mullin: I do feel that we have always tried to maintain transparency. I do not think the issue lies in transparency. I genuinely hope to continue to be as transparent as possible, allowing everyone to see that, in fact, we have not sold any tokens, nor have the investors.

Host: I think people are not necessarily unhappy about you selling tokens; the strange thing is, I know you are not in the U.S., but the SEC recently released their stance on transparency. Specifically, they pointed out that if you are involved in cryptocurrency trading, you need to disclose which are market makers, publish the agreements you have signed, disclose who may hold tokens, and how the supply changes; this is basically their requirement.

So if we were to start over now, considering that the current trading price of OM is 70 cents, while it was previously close to $7, having dropped to a thousandth of its original price, what would you do? If you want to talk about the transparency of these agreements, especially considering the cost basis of these large market makers or investors, this could put significant pressure on the supply. So if you were to communicate with new people, what would you disclose?

JP Mullin: I think the best thing we can do now is to release as much on-chain information as possible, showing where the tokens are located and what exactly has happened.

Host: This is about off-chain content, like those agreements and over-the-counter transactions; that is what my question means.

JP Mullin: I believe the off-chain part is relatively public, including the attribution plan we have been open about from the beginning.

So, clearly, we are willing to provide as much information as possible related to any agreements involving the currency association. We are fully committed to doing this. You know, I will support this, and we will publish, but we cannot do everything.

I think right now, investors want to know what exactly happened. I am glad you raised the two aspects of on-chain and off-chain issues. We are fully committed to providing as much information as possible, and I make this commitment.

Future Roadmap for Mantra

Host: What to do next is undoubtedly a big question, and it is clearly the reason many people are paying attention to our conversation right now.

I want to give you the opportunity to talk about your upcoming plans and the direction you intend to take because, frankly, I had not heard of Mantra before this, perhaps because you are over there and we are over here; there is indeed a difference between New York and global crypto users. At least I have not heard much about you.

But now, considering the reality of this on-chain world asset, you mentioned that your funding is limited. So when you mention a buyback plan and plan to recover, I want to say that you might even agree that it is almost impossible to return to those previous levels now. But how do you view the plan to return to that level, and what assets can you operate with now?

JP Mullin: Of course, you know, this situation has happened before. We once dropped over 95%, and at that time, everyone thought we were done, but we successfully came back. We know we will do it again.

From a founder's perspective, I am willing to do whatever it takes to ensure the community is well taken care of. This is more important to me than anything else; we need to take action during this difficult time to restore normalcy and support our community.

We do have strong long-term institutional partners, as I mentioned, our company is financially supported, and the business remains healthy. We will continue to move forward and execute our plans. In hindsight, the institutional interest we have seen is very strong, and I am really glad to see that.

We are committed to doing everything we can to execute the buyback plan, starting with my personal founder tokens, which I have already re-locked. At this stage, I am not focused on financial benefits; to be honest, it was never about financial purposes from the beginning. So, I want to ensure we can restart this project and keep moving forward.

We will work with our partners, such as Subaru and Laser, to develop a reasonable buyback plan while creating a burn mechanism to show everyone what is happening and to burn any unnecessary supply. I have communicated with our investors, and they have also committed to helping and supporting this plan.

Host: Regarding the points you mentioned, I want to confirm the normalcy of these processes, particularly the clearing issues you talked about. If there is investor interest or institutional demand, they might intervene at this time. Are you saying these conversations have not happened, right?

I mean, up until now, regarding the demand situation, you mentioned institutional support and investor support, and this is after a 90% drop, right?

JP Mullin: This happened very quickly, almost overnight. It was on a Sunday night, and the situation was sudden; we did not have much time to react. I was also asleep at the time.

So we have clearly been working with partners holding tokens who will continue to support the project and have financial backing. But we have also attracted many new investors who have shown interest in the project and will continue to support it, demonstrating their willingness to stay involved.

So, seeing these new investors join makes me feel good; everyone understands that we have done a lot of work, and this is not the first time we have faced such challenges. We are ready to stand up again.

Host: Speaking of the personal impact this has on you, I also want to ask, you mentioned you have been working on this project for a while, and I have seen your past interviews, from discussing Home to the mainnet launch last year.

For you personally, going through all of this, how do you view the process? I have previously interviewed many founders, including Do Kwan after the Terra collapse and SBF after the FTX collapse, as well as many other project founders.

For you, after experiencing these fluctuations, do you feel a sense of release? Of course, I know it sounds like you are not feeling relieved today. But from the perspective of token volatility, perhaps the price is at a low level now. As you said, you have experienced similar collapses; do you also have a thought of "maybe we should be at this point"?

JP Mullin: I do not think so. You know, putting aside market value, this is not something I would feel relieved about. Unprecedented events have occurred, many people have lost money and been hurt, and I do not feel comforted by that at all.

I feel very frustrated; today is very difficult for me. I feel sad for our community, I feel sad for those who have lost money, and I feel sad for our team and some foreign investors; it is really terrible. To be honest, I feel very sad.

So, this is not something I would feel any relief about. I feel terrible, but I am committed to doing everything I can, spending every moment to fix this, to do the right thing, and I stand behind these words. I believe those who have seen us over the past five years will support me on this. You know, I will keep my promises and do what I can to support this project, take responsibility, and not shy away.

Host: You said you feel terrible; I actually want to clarify which part makes you feel bad. Obviously, the price drop is one thing, but it sounds like you are saying this is not your fault. So, if there is a part that makes you feel bad, aside from the price, what specifically is it?

Because it sounds like you are saying you have not sold, and your investors have not either. So, from an external perspective, especially for those not in the Mantra ecosystem, what do you think you did wrong?

JP Mullin: What makes me feel sad is those who believed in this project and this token, and as a result, they lost money. They did not participate in this event, and then they woke up to find the token had dropped 80%, 90%. This is really terrible, and I feel sad for those who supported us.

Host: Part of the responsibility lies with you, right? I want to clarify one last point: what exactly makes you feel bad? Is it about what you did?

JP Mullin: They believed in me; they believed in this project, and as a result, they lost money in the process. As I said, this makes me feel that as a responsible founder, I have a duty to take care of the token holders and our supporters. I cannot avoid it; I just feel sad for them, and frankly, I do not know how else to say it.

I feel very sad. I feel that our community has been hurt, our token holders have been hurt, and our foundation has been hurt. I feel a sense of responsibility, even if I did not do anything negligent or malicious, I still feel a heavy responsibility.

Host: I am curious, if your investors are hurt, I want to know if they really lost money, even though the current trading price of the token is $0.70.

JP Mullin: I feel they have not lost money, which is also why those investors holding liquidity tokens have not sold any liquidity tokens to date.

Host: So perhaps they have not been too affected, but rather those who came in later have been more affected. As you said, this is why we are having these conversations, why we are here to talk to you. Maybe if we had talked earlier, it could have helped more people understand the true situation of the project. Again, I am just starting to understand what you are doing and how it relates to real-world assets; clearly, this is a very hot area.

It sounds like you have been through a long time dealing with what happens next. So, in closing, what would you like to say to those holding this token?

JP Mullin: First of all, I want to thank you for giving us the opportunity to come out and share our position. I want to reiterate that we will develop a plan to ensure complete transparency, to publicly disclose what has happened and where the problems occurred.

So, everyone can follow my personal Twitter and our company's Twitter account; all this information will be released. We will also launch our buyback and burn plan in the coming days to ensure we do everything possible to support investors. We will maintain ongoing communication with the community. Again, I assure you, community friends, we will do everything we can to correct this situation.

Thank you to those who support us and actively reach out; we really appreciate it. This means a lot to us. For those who are skeptical of us at this moment, we will continue to work as hard as we can and will become stronger than ever.

Host: I really appreciate it. I think sometimes people are reluctant to maintain transparency and let everyone know the latest situation. And this situation is relatively unique, especially with the events that happened over the weekend. Therefore, I think letting people know everything you know is exactly the transparency that this field expects.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。