原文作者: YBB Capital Researcher Zeke

前言

“现实资产(RWA)的代币化旨在增强流动性 、透明度和可访问性,使更广泛的个体能够接触高价值资产”,这是Coinbase对于RWA一词的解释,亦是科普文中关于RWA的普遍解释。但这句话在我看来并不清晰也不全对,本文将以我的个人视角去尝试解读这个时代背景下的RWA。

一、破碎的棱镜

Crypto与现实资产的结合可以追溯到十余年前比特币上的Colored Coins,通过对比特币UTXO添加元数据实现“染色”,赋予特定Satoshi代表外部资产的属性,从而在比特币链上标记和管理现实资产(如股票、债券、房产)。这种形似BRC20的协议是人类首次在区块链上实现非货币功能的系统性尝试,同时也是区块链迈向智能化的开端。但受限于比特币脚本有限的操作码,Colored Coins的资产规则需通过第三方钱包解析,用户必须信任这些工具对UTXO“颜色”的定义逻辑。中心化信任夹杂着流动性不足等因素,使得RWA的初次概念验证还是以失败告终。

而后的数年里区块链以以太坊为转折,开启了图灵完备时代。各类叙事都有过疯狂的时刻,但RWA在这十来年里除了法抵稳定币外,始终是雷声极大,雨点又小的情况。这是为何?

我还记得我曾在关于稳定币的文章中写道过,区块链上从来不存在真正的美元。USDT又或是USDC的本质只是一家私人公司给你的“数字债券”,USDT相比美元理论上来说要脆弱的多。而Tether之所以能成功,其实是源自区块链世界迫切需求又无法创建价值稳定媒介的无奈。

在RWA的世界里从不存在所谓的去中心化,信任假设必须建立于一个中心化实体之上,而这个实体的风险把控只能寄托于监管。Crypto基因里的无政府主义本质上就与这个理念相悖,任何公链的底层架构都是为了抵抗监管。公链之上监管难存,是RWA始终无法成功的首要因素。

第二点是资产复杂性,RWA虽然包罗一切实体资产的Tokenization,但我们还是能将其粗略分为金融资产与非金融资产两个类别。对于金融资产而言它们本身就具有同质化的属性,底层资产与Token间的纽带可以建立于受监管的托管机构下。对于非金融资产而言,这个问题则要复杂百倍,其解决方案基本只能依赖于IoT系统,但依然无法应对人为作恶及自然灾害等突发因素。所以在我的认知里RWA作为现实资产的棱镜,能折射出的光并非无限的,未来的非金融资产要想在链上长存必然要符合同质化且易估值这两个前提。

第三,相比具有高度波动性的数字资产,现实世界资产中基本难以找到波动率与之相媲的资产。而DeFi中动辄数十甚至上百的APY更是让TradFi相形见绌,收益低、缺乏参与的动机,则是RWA的又一痛点。

既如此,那么圈内如今为什么又要再次聚焦于这个叙事?

二、上有政策

依据上文所诉,TradFi对于监管的推进是RWA能够存在的关键因素,当信任假设成立这个概念才得以推进。当前对于Web3发展友好的地区,例如香港、迪拜、新加坡等地基本都是于近期才相继落地RWA监管的相关框架。所以当这个起始点出现时,RWA的启程之旅也才刚刚开始,但就目前的情况而言监管碎片化和TradFi对于风险的高度警惕还是为这条赛道披上了一层迷雾。

以下是截至2025年4月全球主要司法管辖区关于RWA的监管框架详情:

美国:

监管机构:SEC(证券交易委员会)、CFTC(商品期货交易委员会)

核心法规:

证券型代币:需通过豪威测试(Howey Test)判断是否属于证券,适用《1933年证券法》注册或豁免条款(如Reg D、Reg A+)。

商品型代币:由CFTC监管,比特币、以太坊等被明确归类为商品。重点措施:

KYC/AML:BlackRock的BUIDL基金仅向合格投资者(净资产≥100万美元)开放,强制链上身份验证(如Circle Verite)。

证券认定扩大化:任何涉及分红的RWA均可能被认定为证券。例如:SEC对代币化房地产平台Securitize的处罚(2024年未注册证券发行)

香港:

监管机构:金管局(HKMA)、证监会(SFC)

核心框架:

《证券及期货条例》将证券型代币纳入监管,需符合投资者适当性、信息披露及反洗钱要求。

非证券型代币(如代币化商品)受《打击洗钱条例》约束。

重点措施:

Ensemble沙盒计划:测试代币化债券的双币种结算(港元/离岸人民币)、房地产跨境抵押(与泰国央行合作),参与机构包括汇丰、渣打、蚂蚁链等;

稳定币闸门政策:仅允许使用金管局认可稳定币(如HKDG、CNHT),禁止USDT等未备案币种。

欧盟:

监管机构:ESMA(欧洲证券和市场管理局)

核心法规:

MiCA(加密资产市场监管):2025年生效,要求RWA发行方设立欧盟实体,提交白皮书并接受审计。

代币分类:资产参考代币(ARTs)、电子货币代币(EMTs)、其他加密资产。

重点措施:

流动性限制:二级市场交易需持牌,DeFi平台可能被定义为“虚拟资产服务商”(VASP)。

合规捷径:卢森堡基金结构(如Tokeny黄金代币)成为低成本发行通道,小型RWA平台合规成本预计增加200%。

迪拜:

监管机构:DFSA(迪拜金融服务管理局)

核心框架:

代币化沙盒(2025年3月启动):分两阶段(意向申请、ITL测试群组),允许测试证券型代币(股票、债券)和衍生品型代币。

合规路径:豁免部分资本和风控要求,测试期6-12个月后可申请正式牌照。

优势:与欧盟监管等效,支持分布式账本技术(DLT)应用,降低融资成本。

新加坡:

证券型代币纳入《证券与期货法》,适用豁免条款(小额发行≤500万新币、私募≤50人)。

功能型代币需遵守反洗钱法规,MAS(新加坡金管局)通过沙盒推动试点。

澳大利亚:

ASIC(证券和投资委员会)将赋予收益权的RWA代币归类为金融产品,需持金融服务牌照(AFSL)并披露风险。

综上所述,欧美国家侧重合规门槛,亚洲及中东等地虽通过实验性政策吸引项目,但合规门槛依然不低。所以目前的RWA协议现状是在公链上可以存在,但必须辅以各种合规模块以适配合规框架。这些合规协议并不能与传统DeFi协议进行直接交互,其次基于司法管辖区的不同,一个符合香港合规框架的协议也不能与其他地区的合规协议进行交互。从当前的现状来看,RWA协议并不具备足够的可访问性,也极度缺乏互操作性,形似“孤岛”与理想中的形态背道而驰。

那么在这些框架内真的找不到一条寻回去中心化的路径吗?其实并不,我们以Ondo这个RWA中的龙头协议为例,该团队构建了一个名为Flux Finance的借贷协议,允许用户使用USDC等开放代币以及OUSG等受限代币作为抵押品进行借贷。借出一种名为USDY的代币化的不记名票据(复利稳定币),该代币通过40-50天锁定期的设计,避免被归类为证券。根据美国SEC的Howey Test标准,证券需满足“资金投资于共同事业,依赖他人努力获取利润”等条件。USDY的收益来自底层资产的自动复利(如国债利息),用户被动持有即可,不依赖Ondo团队的主动管理,因此不符合“依赖他人努力”这一要素。Ondo再通过跨链桥简化USDY在公链中的流通,最终实现了一条与DeFi世界交互的路径。

但如此繁杂且不能反向切入的方式,或许并不是我们想要的RWA。法抵稳定币如今成功的另一关键要素在于优秀的可访问性,在现实世界才能实现低门槛的普惠金融。而RWA在孤岛问题上还需要TardFi与项目方共同探索,如何先实现不同司法辖区内的互联,并在一些可能的范围内与链上世界交互。最终才能符合前言中对于RWA一词的普遍解释。

三、资产与收益

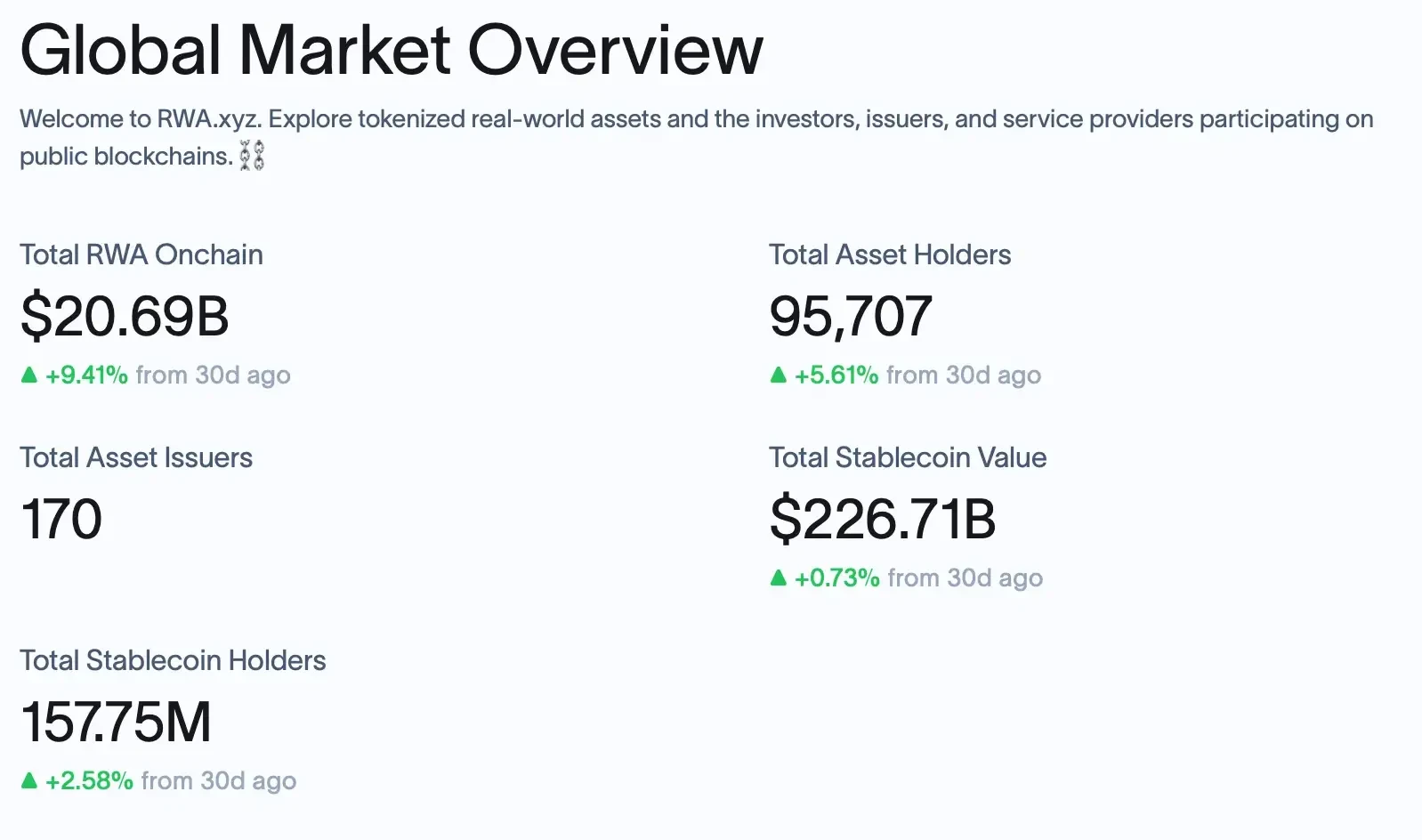

据rwa.xyz(RWA的专业分析网站)数据,如今链上RWA资产的总值为206.9亿美元(不包含稳定币),其主要构成为私人信贷、美债、大宗商品、房地产、股票证券。

其实从资产类别而言,我们也不难看出RWA协议主要面向的群体其实并非DeFi原生用户,而是传统金融用户。诸如Goldfinch、Maple Finance、Centrifuge等头部RWA协议,它们针对的客户群体甚至大多是中小企业、机构级的用户。那么为什么要把这件事搬到链上来做呢?(前四点仅以这几个协议的优势为例)

1.7*24小时的即时结算:这是传统金融的依赖于中心化系统的痛点之一,区块链提供无休止的交易系统。同时也能实现即时赎回、T+0放款等操作;

2.地域流动性割裂:区块链是一个全球金融网络,通过这个网络使第三世界国家的中小企业也可通过最低成本绕过本地机构吸引外部投资者的资金;

3.降低边际服务成本:通过智能合约管理,一个资产池服务100家企业的成本与服务1万家企业几乎相同;

4.服务矿企、中小交易所:此类企业普遍缺乏传统信用记录,难以获得银行机构的贷款,通过传统供应链金融逻辑可将设备与应收账款等用于融资;

5.降低准入门槛:虽然早期成功的RWA协议普遍针对企业、机构或是高净值用户设计,但如今随着监管框架的推出,许多RWA协议也在尝试将金融资产分割以降低投资者门槛。

对于Crypto而言如果RWA能够成功,那确实具备Trillion级别的想象空间。而除此之外我相信RWAFi最终也会到来,对于DeFi协议而言资产底层在加入了具有真实收益的Token后将会更加牢固,而对于DeFi原生用户而言在资产选择与搭配上又新添了花样。尤其是当下这个地缘政治动荡且经济前景充满不确定性的世界来说,一些现实世界资产也许是比只拿U去理财更好的低风险选择。我在这里提供一些目前已经实现的RWA产品选择,又或者未来可能存在的选择:比如黄金从23年初至25年本月的涨幅是80%;卢布在俄罗斯的定存利率是3个月期20.94%,半年期21.19%,一年期20.27%;受制裁国家的能源资产折价通常也在40%以上;短期美债的收益率在4%-5%;纳斯达克里各种腰斩的股票或许要比你的山寨币更有基本面;再细化一点到充电桩甚至是Pop Mart的盲盒可能都是一些的不错选择。

四、执剑人

在三体世界里,罗辑以自身生命为触发机制,将核弹部署在太阳轨道上,利用黑暗森林法则构建出了对抗三体文明的威慑体系。在人类的世界里,他是地球的执剑人。

“黑暗森林”同样是大部分圈内人对区块链的别称,这也是去中心化特性与生俱来的“原罪”。针对于一些特别领域,RWA或许可以充当这个平行世界的执剑人。虽然PFP小头像与GameFi的故事在如今已化为泡影,但回想三四年前的疯狂时代,我们也曾诞生出无聊猿、Azuki、Pudgy等匹敌传统IP的项目。但我们真的购买到了IP知识产权吗?事实是从来没有,NFT从某种程度上来说更像是消费品,区块链对于10K PFP的定义很模糊。它确实利用降低投资门槛创造了一些辉煌一时的IP,但在收益与项目发展上,“三体人”则独揽大权。

我们以无聊猿为例,无聊猿的原始知识产权明确归属于其发行方 Yuga Labs LLC。根据用户协议及官网信息,Yuga Labs 作为项目运营主体,拥有无聊猿作品的著作权、商标权等核心知识产权。持有者购买NFT仅获得对特定编号头像的所有权和使用权,而非版权本身。

而在决策上 Yuga Labs对无聊猿设计的路线是Metaverse,通过无限增发子IP来换取资金,脱离了原有的奢侈品叙事。关于这点NFT的持有者既无知情权,也无决策权,更无收益权。在传统世界里投资一个IP,投资者通常具有IP整体的直接使用权、直接收益分配、决策参与甚至开发主导权。

Yuga Labs至少属于PFP项目中的佼佼者,曾经还有大量NFT项目的权利分配更为混乱,当一把巨剑悬于头上时,他们是否会选择更尊重自己的社区呢?

五、载体之上

综上所诉,RWA存在重塑金融的潜力,同时也能将现实世界蕴含的机会带往链上,对于整治区块链的乱象或许也是一条新出路。但受限于TradFi当前的监管框架,其形态依旧像是存于公链之上的私有协议,不能迸发出最高的想象空间,在时间的推移之下我希望未来能有一个引路人或是联盟来打通这层屏障。

资产在不同载体上,所能释放的光芒其实难以想象。从西周时期的青铜铭文到明代的鱼鳞图册,资产确权保证了社会的安稳与发展。假如RWA能进入最终形态该是什么样的?我可以在香港的白天购买纳斯达克的股票,在凌晨将钱存入俄罗斯联邦储蓄银行,隔天又可以与世界上数百个互相不知道姓名的股东们共同投资迪拜的地产。

是的,运行在一个巨大的公有账本上的世界,就是RWA。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。