Original Author: Kit

Original Source: RootData

The Fatigue of Cryptocurrency Compliance Under AI Technology Updates

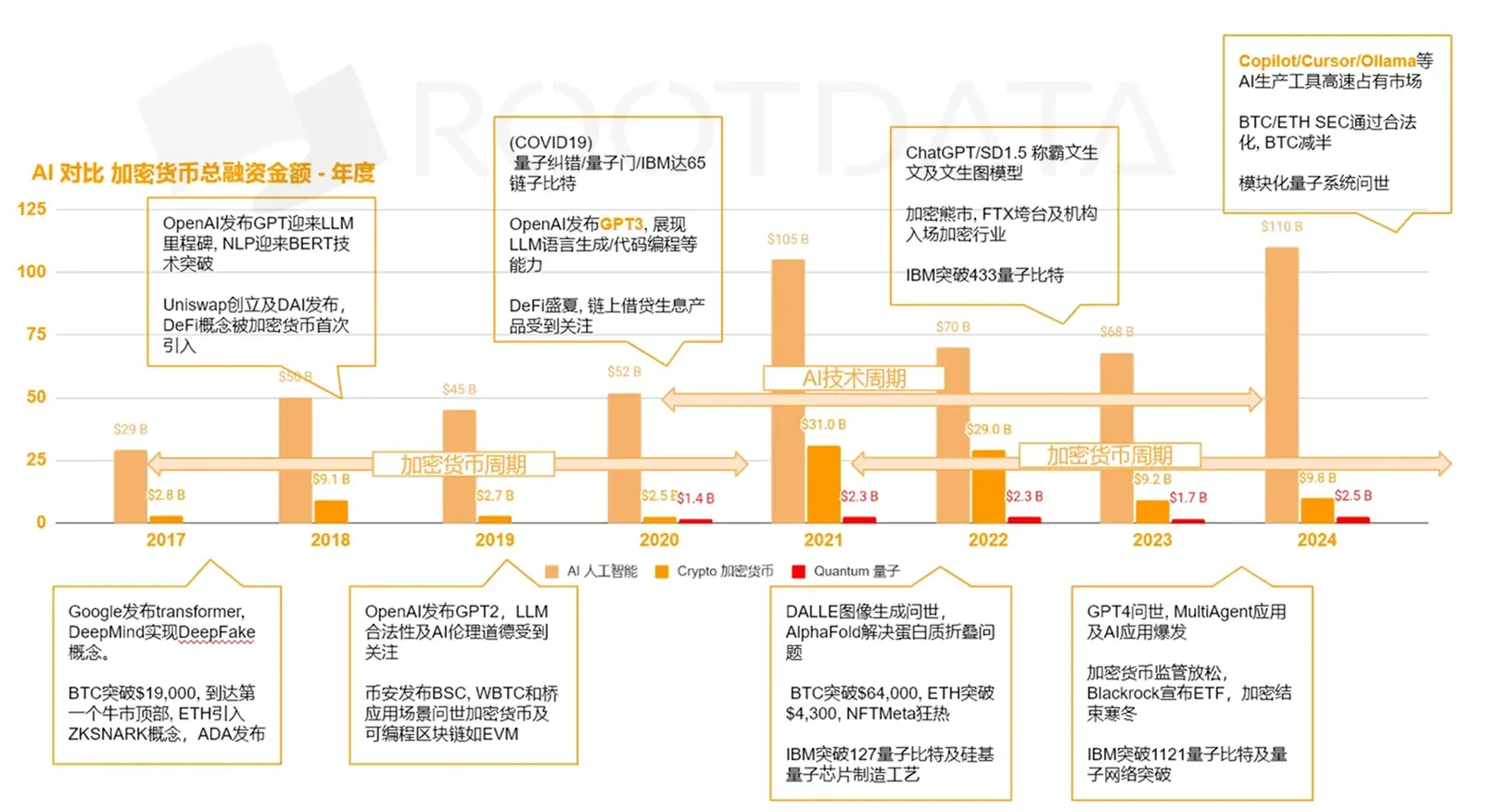

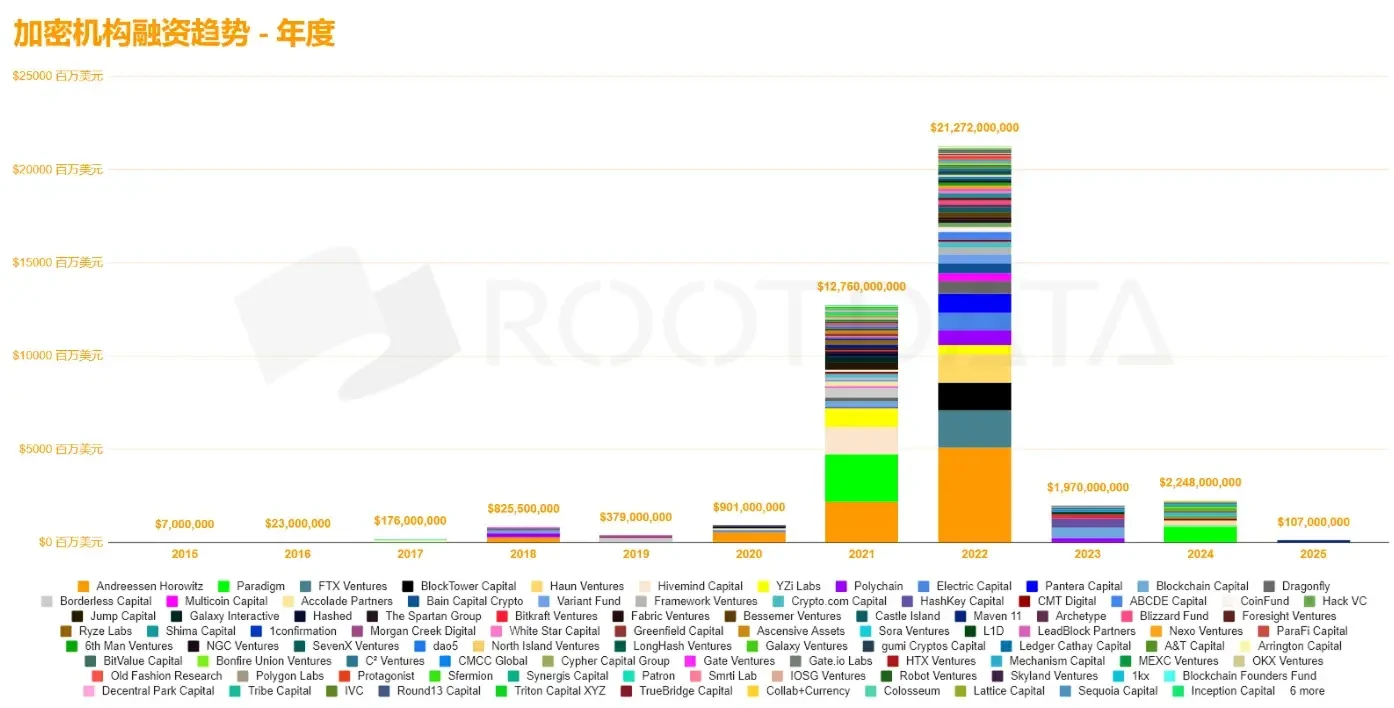

The cryptocurrency market is undergoing its second four-year technological cycle transformation since the ICO boom in 2017, while the AI industry has entered its 10th development cycle with breakthroughs from GPT-3 to LLM technology. According to Moore's Law of technological iteration, the cryptocurrency industry faces a cyclical test in 2025—total financing dropped sharply from a peak of $31 billion in 2021 to $9.8 billion in 2024, a decrease of 68%. Meanwhile, AI financing is set to exceed $110 billion in 2024, creating a stark capital siphoning effect.

Behind this structural shift is a divergence in the technology maturity curve. Since the DeFi summer of 2020, the cryptocurrency industry has yet to present a breakthrough technological narrative, while AI continues to release productivity dividends through the evolution of the Transformer architecture. The differentiation in financing scales essentially reflects capital's vote on the potential of technological applications—while cryptocurrency projects are still repeating the traditional "token issuance-exchange" path, AI has already achieved commercial closed loops in fields such as healthcare, manufacturing, and education.

The AI Monsoon Has Not Arrived, Cryptocurrency Believers Still Need to Strive

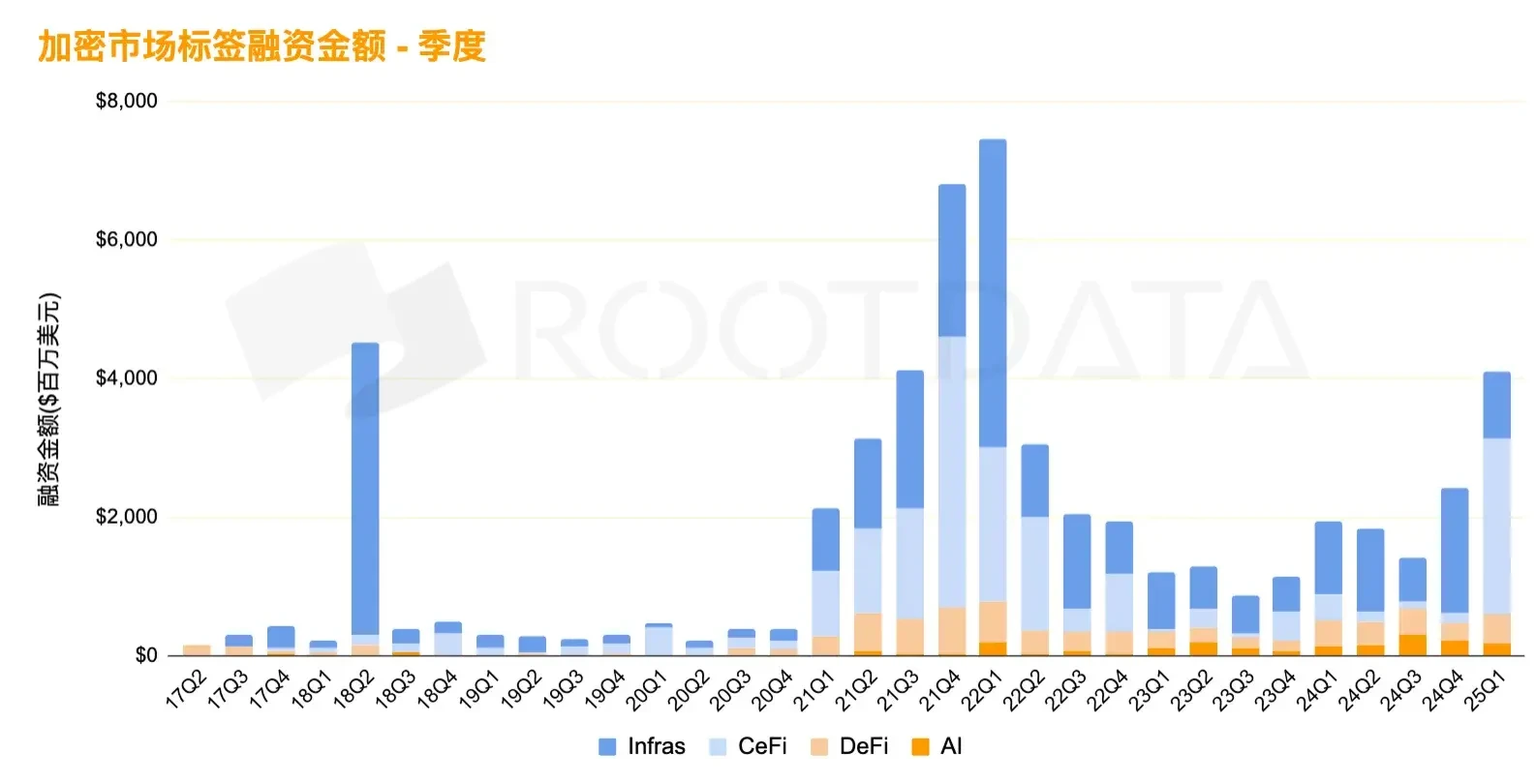

Q1 2025 data shows that while the cryptocurrency community remains enamored with the myth of AI MEMES, eagerly imitating ELIZA, the first chatbot in AI history, and becoming the decentralized ELIZA in cryptocurrency history, institutional investment in the cryptocurrency sector shows a clear divergence: the financing share of CEX and custodial projects has shrunk from a peak of 90% during the DeFi summer and the collapse of FTX to 45%, while AI, DeFi, and infrastructure projects have grown against the trend, accounting for 58% of total financing during the same period.

At the same time, the financing scale of AI-related cryptocurrency projects has shown dramatic fluctuations. Although there was a surge of $2.3 billion in a single quarter in Q3 2024, by Q1 2025, this number fell back to $780 million, a decrease of 66%. This exposes the inherent contradictions of the "AI + blockchain" narrative: most current projects remain at the conceptual integration level and have not addressed core pain points such as AI model training and data rights confirmation. Meanwhile, traditional AI primary investment has entered its four-year technology cycle since the advent of GPT-3, with total investment amounts rising from an average of $400 billion per year from 2017 to 2020 to over $800 billion per year. In contrast, the growth of AI-related cryptocurrency financing has not reached 1% of the aforementioned traditional AI funding increase. How blockchain can cleverly combine with AI technology to ensure that cryptocurrency believers can share in the overflow of AI funds is worth pondering, and the acceleration of total AI cryptocurrency financing also indicates that native cryptocurrency funds are willing to increase their bets in search of this rare golden goose. In summary, founders of cryptocurrency projects should consider how to integrate AI and infrastructure solutions to address the current issues of rights confirmation and trust that CeFi or traditional AI cannot solve.

The Dual Dilemma of Liquidity

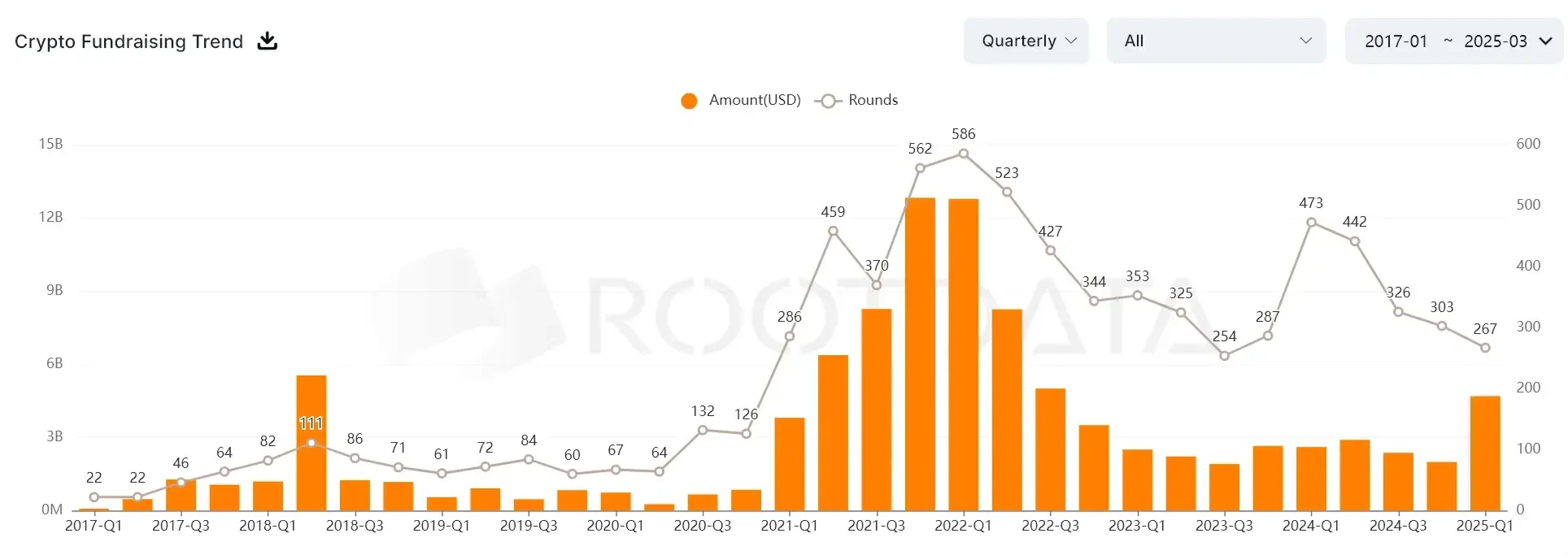

The divergence between quantitative tightening policies and the issuance of on-chain stablecoins has exacerbated market distortions. In March 2025, the on-chain circulation of USDC surpassed $98 billion, but during the same period, cryptocurrency venture capital only attracted $4.6 billion. This liquidity dam phenomenon reveals a deeper contradiction—institutional funds are more inclined to allocate BTC spot through compliant channels like ETFs rather than support early-stage innovative projects. In fact, the financing amount in the cryptocurrency primary market has fallen from a peak of $31 billion in 2021 to a total of $9.8 billion in 2024, a decrease of 68%, while the number of financings has dropped from 1,880 in 2021 and 2022 to 1,544 in 2024, with the average financing amount falling from $15.7 million in 2022 to $6.4 million, a decrease of 59%. The liquidity of institutional investment in cryptocurrency startups has nearly vanished due to the explosion of programmable blockchain technology and the benefits brought by the pandemic and quantitative easing in 2020.

Financing Dilemma: The Great Escape Game for Founders

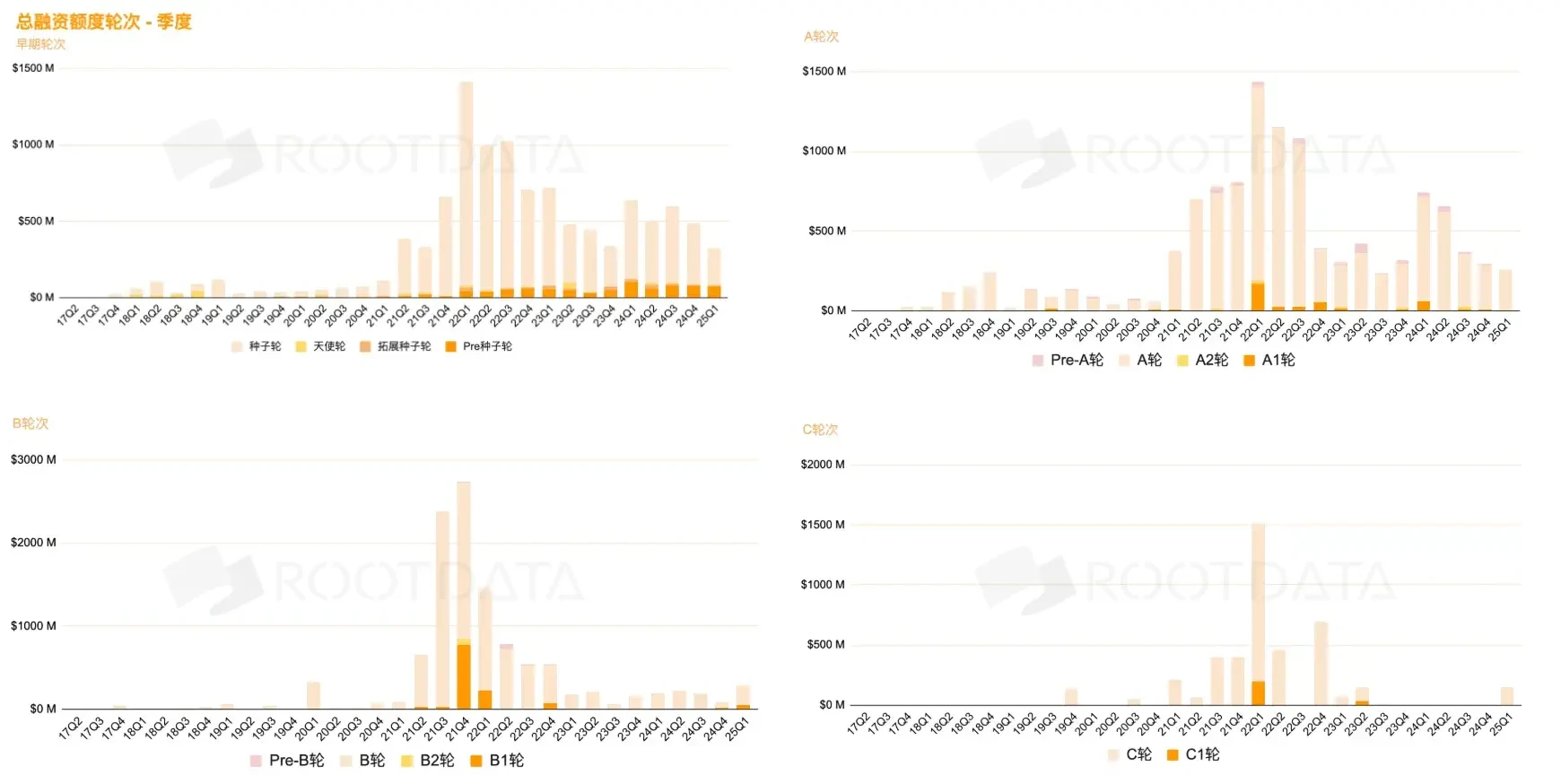

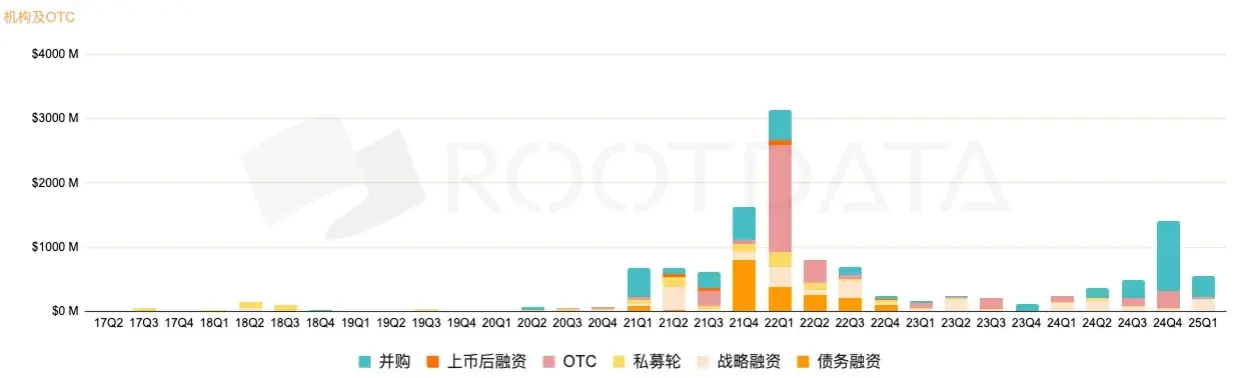

RootData shows that the later-stage financing amounts for cryptocurrency projects have significantly contracted; the cycle of 2021 led to overvaluation, and now founders' project valuations are being squeezed in Series A and even seed rounds, with no institutions willing to publicly invest in Series C from Q3 2023 to Q4 2024. Strategic financing remains stable, while mergers and acquisitions and OTC transactions show that institutional funds are more willing to reach off-market agreements in a liquidity-scarce market.

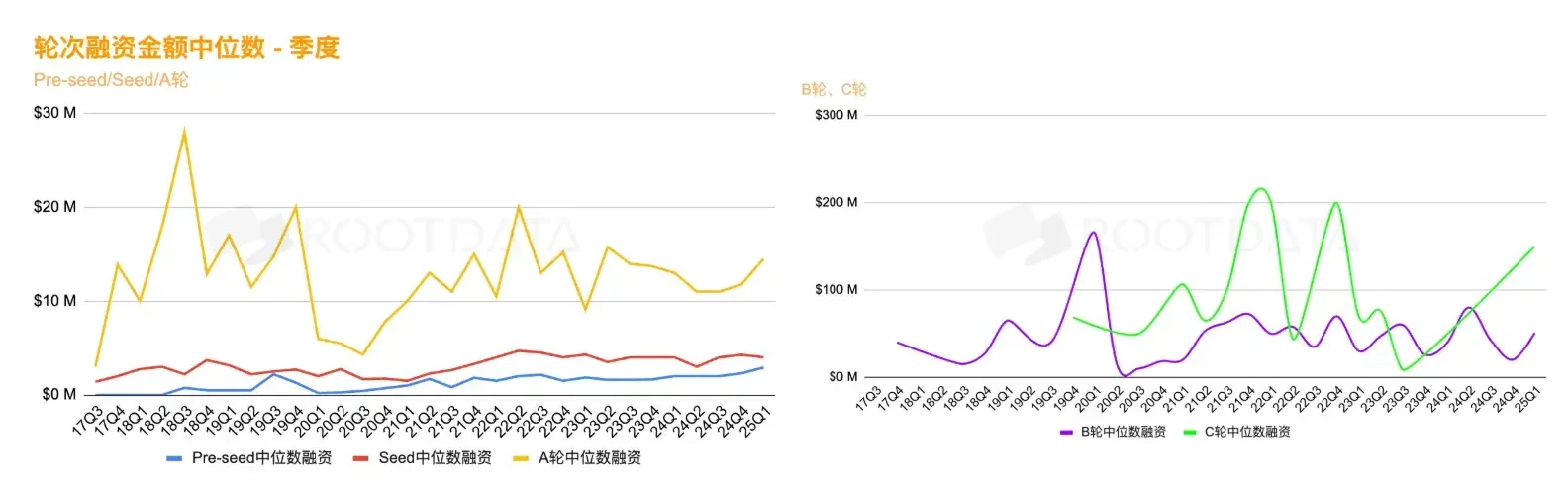

It is noteworthy that the median financing across all rounds has steadily increased, indicating that funds are more willing to reduce investment frequency and increase investment amounts in the context of declining total financing. Like a battle royale game, excellent capital reserves and bullets are fully bet on founders' projects with better fundamentals and cash flow. At a time of explosive growth in AI technology and cryptocurrency technology, the competition among early cryptocurrency founders and startups for the gold coins in investors' hands has become intense. Among the 2,681 projects that received seed round financing from 2017 to now, only 281 have entered Series A (a progression rate of 10.5%), and fewer than 30 projects have reached Series C. This "one in ten" survival game reflects the systemic flaws of early-stage projects in the industry:

From Valuation Bubble to Value Return:

In the 2021 cycle, the median amount of seed round financing reached $4.7 million, while by Q1 2025, it had fallen to $400,000. With total financing shrinking, its proportion continues to decline, indicating that investment institutions' interest in cryptocurrency seed projects is waning.

The median amount for pre-seed rounds was $2 million, which increased to $2.91 million by Q1 2025. The total financing amount for pre-seed rounds has increased, and the rising median financing amount, while riskier, has attracted more interest from cryptocurrency institutions due to favorable pricing.

With the total amount of Series A financing shrinking, the financing amount has increased from $10 million to $14.5 million during the same period. This indicates that cryptocurrency projects that have achieved PMF and cash flow have received more funding, while projects that have not successfully turned a profit have struggled to secure additional funding in the seed round.

Token Economics Failure:

Series B projects face liquidity pressure from token unlocks, and the secondary market's inability to absorb this leads to a vicious cycle. According to RootData, most projects experience significant selling pressure with each unlock of token funds without new liquidity injections.

Technological Iteration Gap:

The financing bubble of 2021 concentrated failed projects in popular tracks from the previous cycle, such as cross-chain bridges and NFT platforms, failing to keep up with new trends like ZK-Rollup, modular blockchains, and AI. LPs in fund structures that have not achieved positive profitability are seeking drastic measures for survival, leading to a continuous increase in institutional activities (such as OTC and mergers).

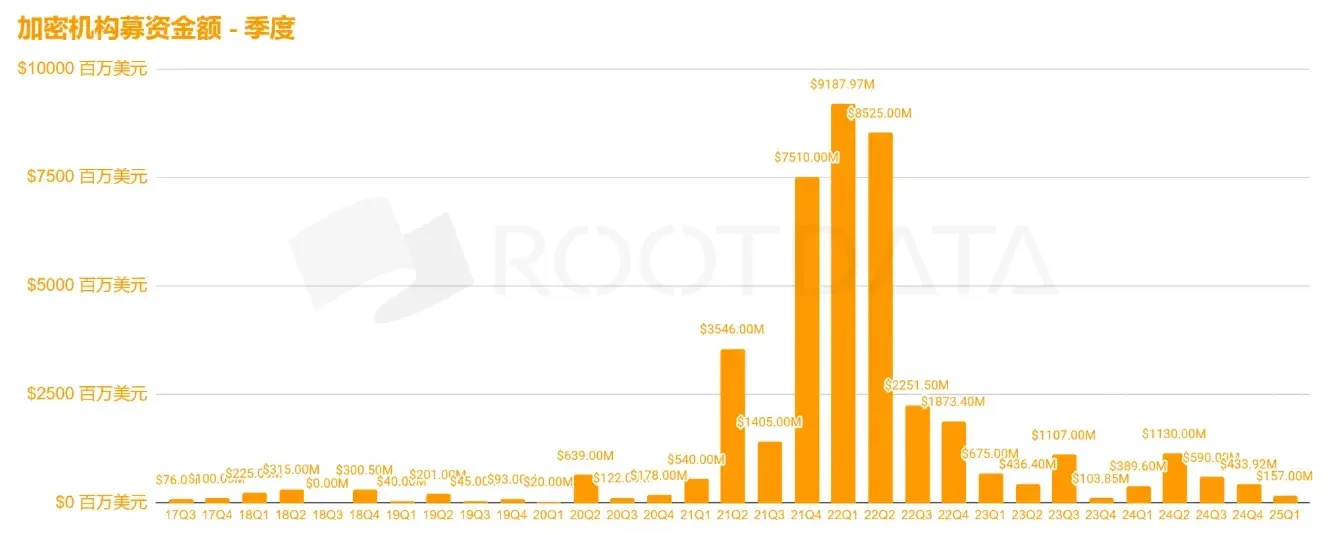

Fundraising Dilemma: A Cliff-like Decline in Scale

According to RootData, the total amount raised by cryptocurrency institutions plummeted from a peak of $22 billion in 2022 to $2 billion in 2024, a staggering decline of 91%. This rate of shrinkage far exceeds the decline in financing scale for Nasdaq tech stocks during the same period (35%). A lack of macro liquidity, the "century-old" cryptocurrency token issuance, and a decline in institutional IRR have led to a sharp drop in interest from institutional LPs and independent investors in financing cryptocurrency projects. This may indirectly reflect the insufficient AI innovation in the cryptocurrency industry during this cycle, which has failed to attract attention from incremental funds outside the industry.

Quarterly Data Confirms the Downtrend: After Q2 2024 (the BTC halving cycle), the fundraising amount fell back to $420 million, comparable to levels before the rise of DeFi in 2020, indicating that the current bull market has not brought incremental funds to cryptocurrency institutions.

Top Institutions Encounter Setbacks: A16Z faced a setback after successfully raising funds for three consecutive years from 2020 to 2022, while Paradigm's new fund in 2024 shrank by 72% compared to its historical peak in 2021.

After the cooling of the public financing market for cryptocurrencies, private rounds and OTC trading volumes have increased by 35%. In Q4 2024 and Q1 2025, financing completed through off-market transactions reached $1.9 billion, with mergers and OTC accounting for 75% of the total during that period. This prevalence of "under-the-table transactions" reflects institutional investors' anxiety about liquidity—by customizing token unlock terms and repurchase agreements, they aim to minimize the impact of market volatility on their portfolios.

The Crisis of Launching at a Loss

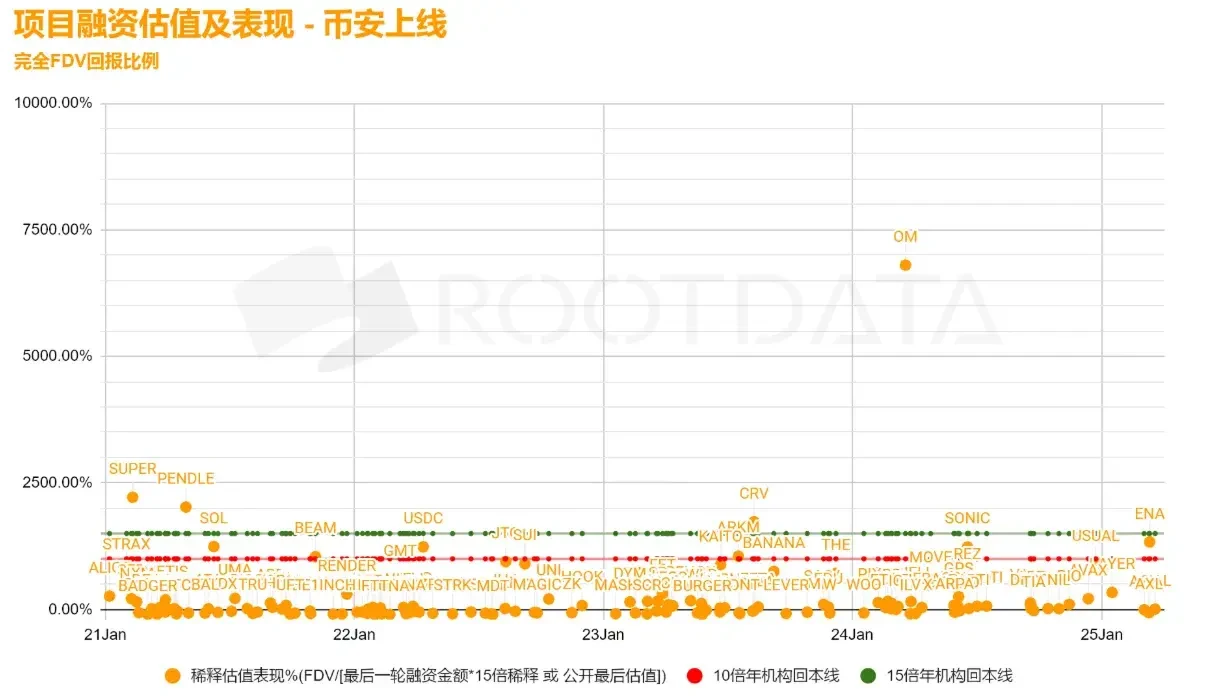

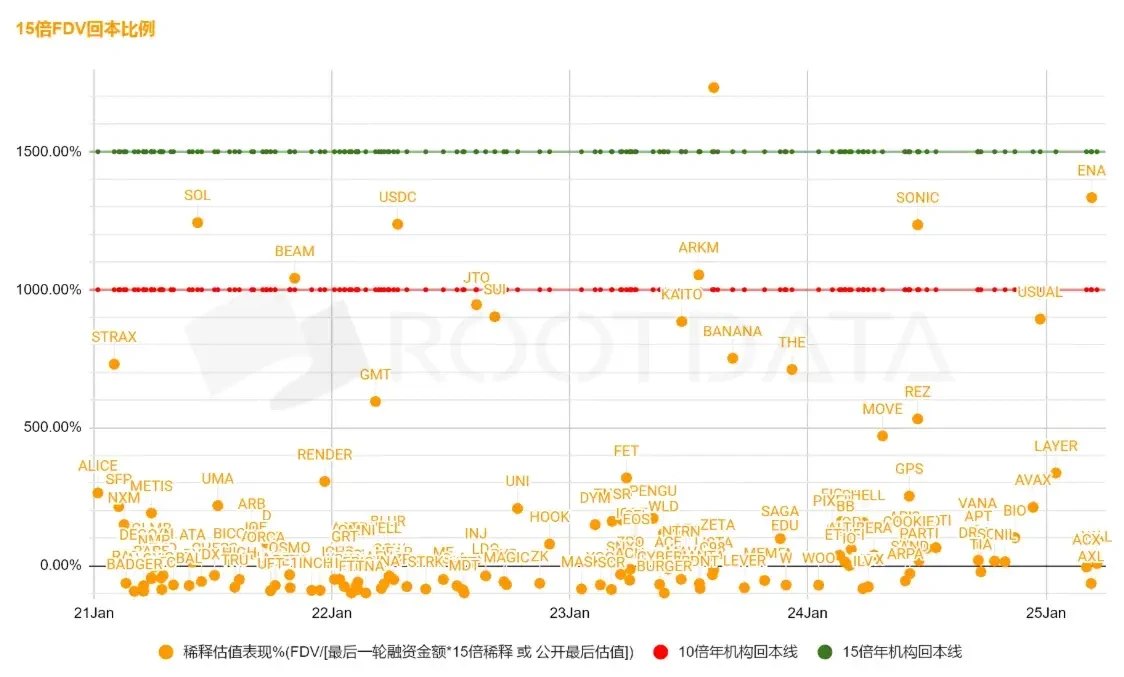

During this cycle, the cryptocurrency community has popularized the slogan "shorting tokens upon launch," which reflects the negative reactions and rejection of institutional projects by independent cryptocurrency investors. According to RootData's collection of the financing performance of cryptocurrency institutions' tokens launched on Binance, under the common "3+1" unlock rule, institutions face severe exit pressures:

a. The first unlock must achieve a 5-10x return to cover overall costs in the first phase.

b. Data shows that since the Arbitrum launch in 2021, there are very few projects in later financing rounds that are expected to recover costs without any hedging strategies.

c. Among the new tokens issued in 2024, more than half have an FDV below 5 times the last round of financing, directly leading to:

Institutions face a -50% actual paper loss with a 10% unlock in the first phase.

Subsequent unlocks trigger a chain reaction of selling pressure.

This also indirectly confirms the hidden reason behind the rise of institutional trading — the decline in token investment portfolio returns. In short, tokens launched on Binance are already facing this issue, and institutions are even more distressed by those tokens that can only be launched on liquidity-depleted T1 and T2 exchanges.

Cryptocurrency Investment Tends Towards Rationality

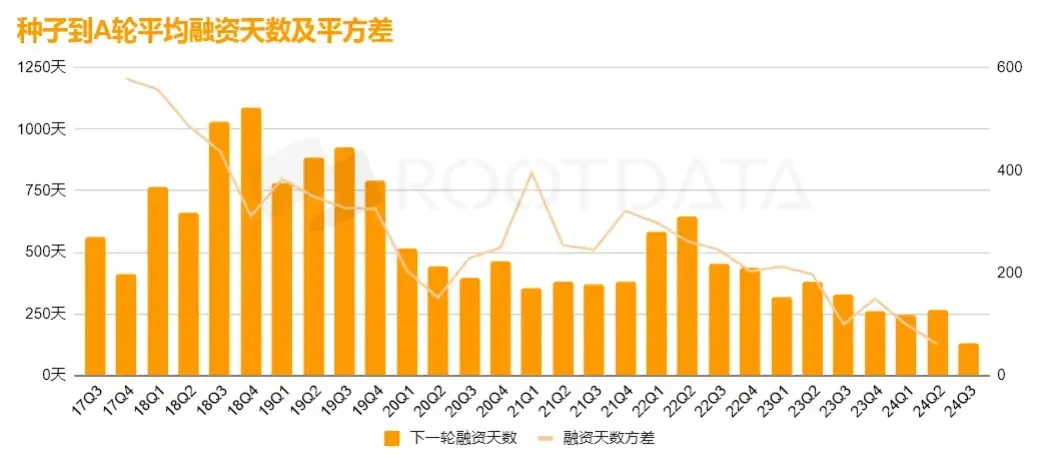

Based on RootData's data on the number of days from seed round to Series A financing and its squared variance in the cryptocurrency financing market, we find that from 2017 to 2020, the average number of days until the next round of financing gradually increased, peaking in Q4 2018 (1,087.75 days). This reflects the slow financing pace and low liquidity of early projects in the cryptocurrency industry. The variance was high between 2017 and 2020, peaking in Q4 2017 (578.63 days), indicating significant uncertainty in project financing timelines. During the ICO and DeFi waves from 2017 to 2019, the cryptocurrency industry was in an exploratory phase, with project quality varying widely. Some projects experienced prolonged financing cycles due to immature token economic models.

After 2021, the number of days until the next round of financing significantly decreased, dropping to 317.7 days in Q1 2023 and further shortening to 133 days in Q3 2024. This indicates that as the market matures, the financing efficiency of quality projects has improved, and capital allocation has become more concentrated. Since 2021, the variance has gradually decreased, suggesting that the market has entered a phase of rational development, with financing cycles among projects becoming more consistent. Since 2021, institutional investors have been more inclined to support leading projects. The concentration of funds in seed and Series A rounds has enabled quality projects to complete their next round of financing more quickly. At the same time, capital has gradually abandoned projects lacking innovation and profitability, accelerating the industry's survival of the fittest.

Summary

The cryptocurrency industry is undergoing a transformation from early chaos to rational development. Since 2021, both curves have shown a continuous downward trend; the decrease in the number of days until the next round of financing and variance not only reflects improved capital allocation efficiency but also highlights the industry's preference for quality projects. In the coming years, those projects that can quickly adapt to market demands, integrate emerging technologies like AI, and achieve commercial closed loops will become the focus of capital pursuit.

In summary, the current market has higher demands for profitability and product-market fit (PMF). Founders need to quickly validate their business models during the seed round to shorten subsequent financing cycles. Institutional investors should focus on high-potential projects that can complete multiple rounds of financing in a short time. Such projects typically have clear growth paths and strong execution capabilities.

The author believes that the liquidity tightening commonly perceived by the cryptocurrency community is not the main reason for the poor performance of the cryptocurrency financing market or cryptocurrency prices. The year 2024 marks the beginning of compliance for the cryptocurrency industry and a turning point for more mature institutions to enter the market. The failure of cryptocurrency founders to perfectly submit a closed-loop answer of AI and cryptocurrency technology to native cryptocurrency investors is a major reason for the poor performance of cryptocurrencies in this intertwined technological cycle of AI and cryptocurrency, or the primary reason for not gaining liquidity overflow from the AI application explosion.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。