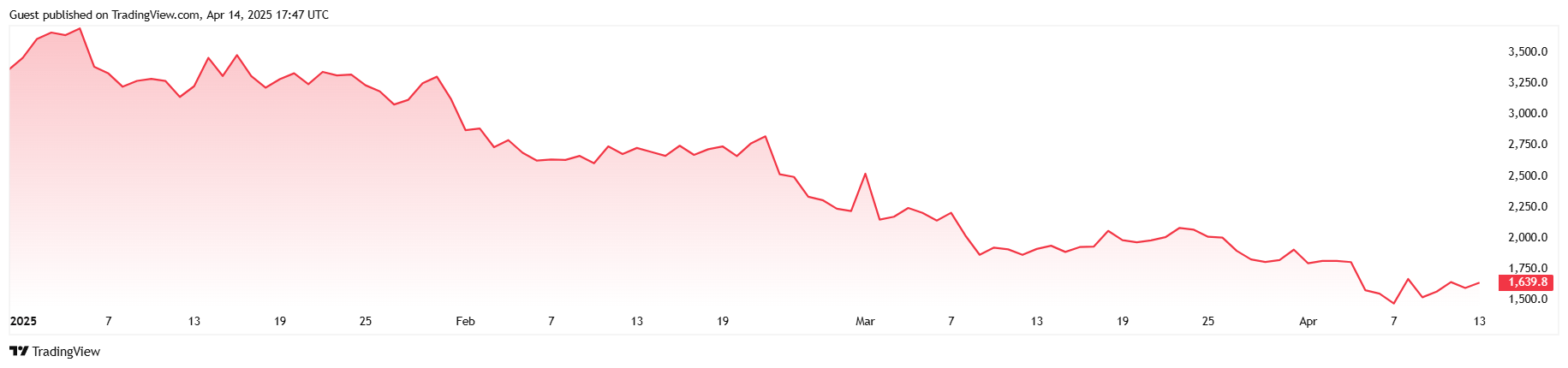

Ethereum’s ether ( ETH) has had a rough year, nosediving almost 51% since January. Savvy investors have taken advantage of the cryptocurrency’s demise, investing in the Proshares Ultrashort Ether ETF (ETHD) and reaping a year-to-date (YTD) return of almost 250%, according to Bloomberg ETF analyst Eric Balchunas.

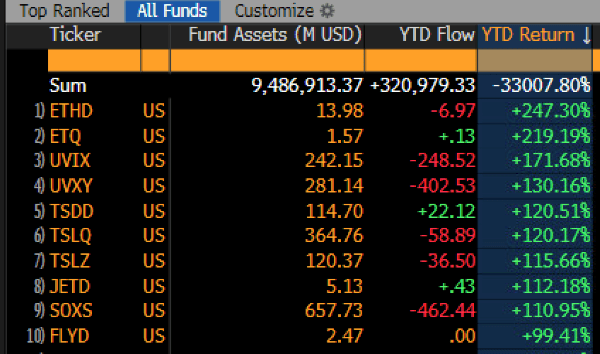

(A list of the best-performing ETFs so far in 2025 / Eric Balchunas on X)

The fund belongs to a class of high-risk investment vehicles that make leveraged bets on the price of an underlying asset. The Proshares ETHD is designed to return double the inverse performance of Bloomberg’s Ethereum Index on a daily basis. This year, that strategy has meant that as ether tanks, ETHD rises at twice the rate of the cryptocurrency’s depreciation.

(The price of ETH from the beginning of 2025 to present / Trading View)

To add insult to injury, another leveraged ETF, the T-REX 2X Inverse Ether Daily Target ETF from Rex Shares, which operates in a similar manner to ETHD except that it goes short on spot ether instead of the Bloomberg index, has also seen its YTD returns go through the roof at roughly 220%, making it the second best performing ETF in the U.S. so far this year. In other words, shorting ETH has been a winning strategy for American ETFs, at least for now.

“The best performing ETF this year is the -2x Ether ETF ETHD, up 247%,” Balchunas explained in a Friday post on X. “Number two is the other -2x Ether ETF,” he added. “Brutal.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。