Original Author: Pzai, Foresight News

On April 14, the ETH/BTC exchange rate fell to 0.01924, setting a new low since January 2020. As a mainstream asset in the last bull market, Ethereum's performance in this cycle has led to considerable criticism from investors. In the face of Bitcoin's strong performance during this cycle, Ethereum seems to be undergoing a dual test of confidence and value. Some community members have remarked, "Although OM plummeted 90% today, its performance this year is still better than ETH." In the past week, some dormant whales on-chain have also begun to stir. This article will summarize the on-chain and exchange data from the past week, providing a panoramic view of token trading.

On-chain Data: "Retreat" Signals Emerge

In the past week, some whales have been "pouring" into the market. According to Arkham data, an OG address that purchased 100,000 ETH in early 2015 has cumulatively sold 4,180 ETH on Kraken since April, worth about $7.05 million. Another address, 0x62A, sold 4,482 ETH on April 12 at an average price of $1,572, also worth $7.05 million. Such a price decline has triggered numerous on-chain liquidations; for instance, a whale reduced its position by 35,881 ETH at an average price of $1,562 on April 10 and subsequently sold the remaining 2,000 ETH at $1,575 after unwinding leverage. This address still holds 688 ETH.

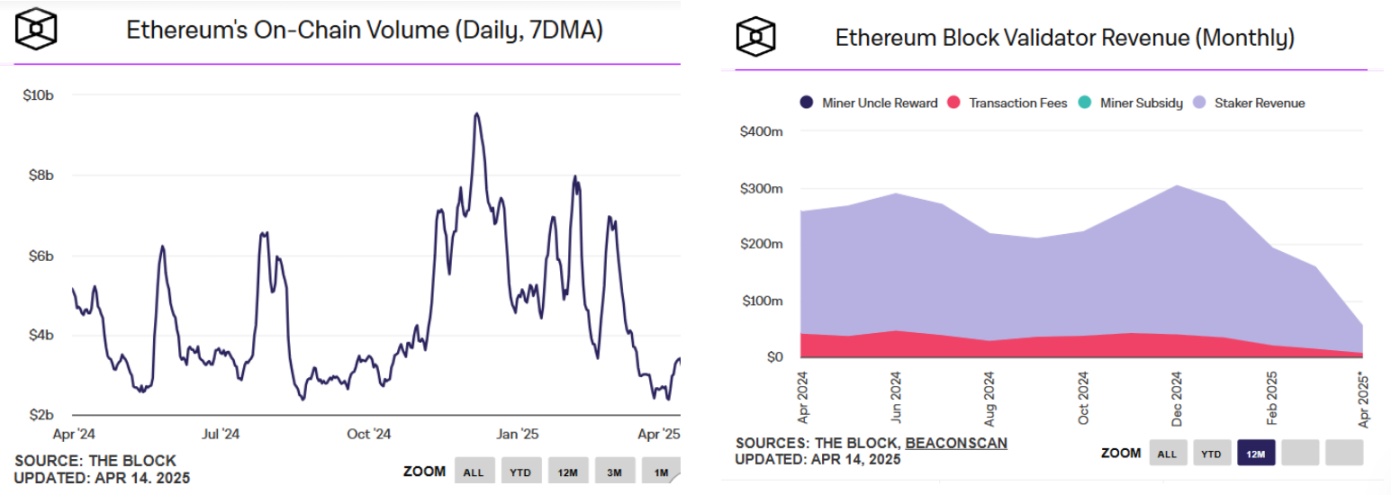

Since the Bitcoin halving in 2024, Ethereum has fallen 40% relative to Bitcoin, marking the first time it has shown sustained weakness within a year of a halving. In contrast, the SOL/ETH exchange rate has risen 49% this year to 0.0817. This indicates that in 2025, SOL's performance is still significantly better than Ethereum's. According to DeFillama data, Ethereum's on-chain DEX revenue in the past 24 hours was only $1.1 million, and its TVL has dropped from nearly $80 billion to $46.9 billion, a decline of nearly half. In the previous cycle, Ethereum successfully became the second-largest asset due to several new assets (such as NFTs and DeFi) and application advantages, but now, as the MEME trading frenzy shifts to chains like Solana, the on-chain circulation of its assets has relatively slowed.

On-chain Activity Indicators

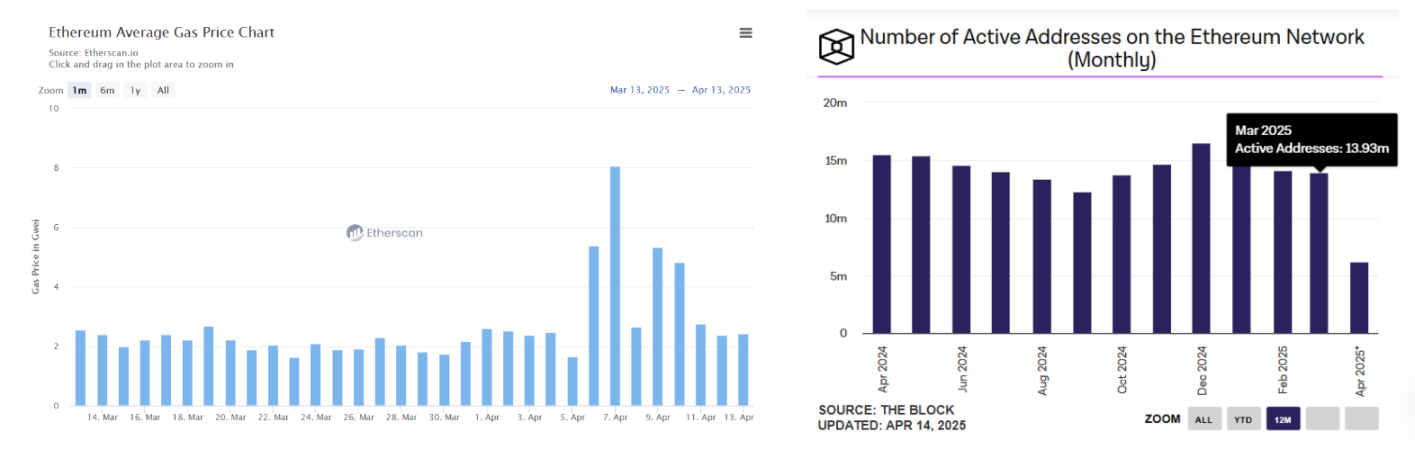

In the past month, aside from the market crash on April 7, Ethereum's mainnet Gas has long maintained a level of 2 Gwei, reflecting a decline in on-chain activity. Additionally, the monthly active addresses on Ethereum's mainnet have shown a fluctuating trend, with active addresses in March falling below 15 million.

According to The Block data, Ethereum's daily average transaction volume is below $3 billion, and combined with the impact of coin prices, the monthly earnings of mainnet validators in March fell below $200 million. From the perspective of investor sentiment, the lower on-chain opportunities have led some investors to adopt a wait-and-see attitude regarding Ethereum's growth potential in the short term.

CEX and ETF Data

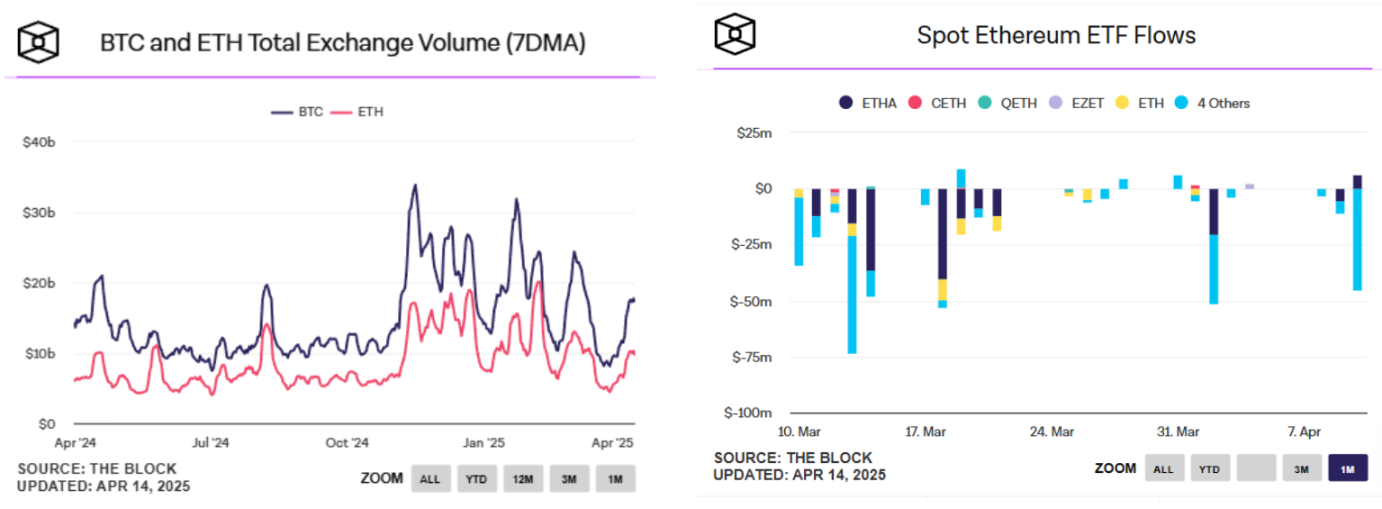

From the exchange data, it is evident that Bitcoin's peak trading volume is significantly larger and more volatile, indicating that more market funds are flowing into Bitcoin spot and derivatives trading. In terms of ETF data, Ethereum's spot ETF has recorded multiple days of outflows in the past month, with a single-day outflow reaching as high as $75 million. The differences in market performance further reveal a significant divergence in risk appetite for crypto assets, with the outflow of Ethereum's spot ETF exposing market concerns about the slowing pace of the crypto ecosystem, especially against the backdrop of intensified Layer 2 competition and new public chains diverting developer resources, leading some institutional investors to shift their focus.

Macroeconomic Environment: Bitcoin Dominates, Ethereum Awaits Opportunities

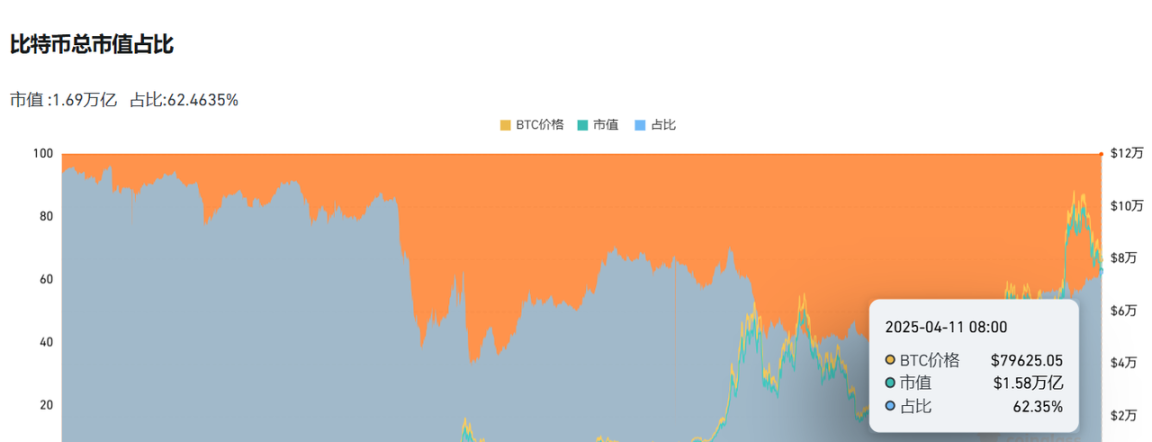

In the market environment where Bitcoin acts as the "Beta" of U.S. stocks, Bitcoin's total market capitalization is gradually exceeding 60%, reaching 62.46% today. This indicates a clear "Bitcoin season" in the current market, with high capital concentration and altcoins generally underperforming Bitcoin. Additionally, the crypto fear and greed index remains in the "fear zone," reflecting investors' preference for "risk aversion," with Bitcoin becoming the asset of choice. Furthermore, in the future strategic reserve plans in the U.S., most proposals from states only reference Bitcoin, further solidifying Bitcoin's status as a mainstream crypto asset. If the ETH/BTC exchange rate falls below 0.018 in Q2 2025, it could trigger more leveraged position liquidations, further suppressing prices.

In the Ethereum ecosystem, the potential "Trump liquidity" is also a focal point of market attention. On March 25, the Trump family launched the USD1 stablecoin pegged to the dollar through "World Liberty Finance" (WLFI), with the first batch to be issued on Ethereum and Binance Smart Chain. As one of the stablecoins specifically for institutional liquidity, this liquidity window is expected to provide sufficient inflow to Ethereum. The current new low of the ETH/BTC exchange rate is a result of the market's weighing of short-term risks (halving siphoning, regulatory uncertainty) against long-term value (ecosystem innovation, market expectations). With Ethereum's upcoming Pectra upgrade and key advancements like account abstraction, in a future where Vitalik exclaims to "build Ethereum L1 as the core of the 'world computer'," can we witness a resurgence of Ethereum? Let us wait and see.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。