This Week's Preview (4.14-4.20): TRUMP Welcomes 40 Million Tokens Unlocking, BTC ETF Underperforms Gold

Table of Contents:

- This week's large token unlocking data;

- Overview of the crypto market, quick read on the weekly performance of popular coins/sector fund flows;

- Spot ETF dynamics;

- BTC liquidation map data;

- Key macro events and crypto market highlights for the week.

1. This week's large token unlocking data;

This week, multiple tokens will undergo a one-time unlocking. The unlocking values are sorted as follows:

The official meme coin of U.S. President Trump will unlock tokens worth $321 million on April 18. Data shows that 40 million Trump tokens will be released via a cliff unlock, meaning these tokens will be fully available all at once. Given that these tokens are currently trading at around $8, this unlocking means that approximately $321 million in supply will flood the market at once.

Fasttoken (FTN) will unlock about 20 million tokens at 8 AM on April 18, representing 4.65% of the current circulating supply, valued at approximately $81 million;

Connex (CONX) will unlock about 4.33 million tokens at 8 AM on April 15, representing 376.3% of the current circulating supply, valued at approximately $77 million;

QuantixAI (QAI) will unlock about 566,000 tokens at 8 AM on April 18, representing 3960.24% of the current circulating supply, valued at approximately $49.9 million;

Polyhedra Network (ZKJ) will unlock about 15.53 million tokens at 8 AM on April 19, representing 25.72% of the current circulating supply, valued at approximately $35.25 million;

Arbitrum (ARB) will unlock about 9.265 million tokens at 9 PM on April 16, representing 2.01% of the current circulating supply, valued at approximately $28.5 million;

deBridge (DBR) will unlock about 1.14 billion tokens at 8 AM on April 17, representing 63.24% of the current circulating supply, valued at approximately $26.5 million;

Starknet (STRK) will unlock about 127 million tokens at 8 AM on April 15, representing 4.37% of the current circulating supply, valued at approximately $1,670;

Omni Network (OMNI) will unlock about 8.21 million tokens at 8 AM on April 17, representing 42.89% of the current circulating supply, valued at approximately $1,630;

Melania Meme (MELANIA) will unlock about 26.25 million tokens at 8 AM on April 18, representing 17.5% of the current circulating supply, valued at approximately $1,310;

Immutable (IMX) will unlock about 24.52 million tokens at 8 AM on April 18, representing 1.37% of the current circulating supply, valued at approximately $1,060;

Sei (SEI) will unlock about 55.56 million tokens at 8 PM on April 15, representing 1.14% of the current circulating supply, valued at approximately $990;

ApeCoin (APE) will unlock about 15.6 million tokens at 8:30 PM on April 17, representing 1.95% of the current circulating supply, valued at approximately $680;

Onyxcoin (XCN) will unlock about 29,600 tokens at 8 AM on April 15, representing 0.89% of the current circulating supply, valued at approximately $580.

The unlocking situations of these projects may have varying degrees of impact on the related markets. The above times are in UTC+8. This week, pay attention to the negative effects brought by the unlocking of these tokens, avoid spot trading, and seek shorting opportunities in contracts. The data is from CoinAnk.

We believe that the one-time unlocking events of multiple projects this week will have a significant impact on market liquidity and price trends, especially focusing on the potential selling pressure caused by high circulation ratios and project backgrounds. Here are the key points:

High-value unlocks dominate market sentiment: The official meme coin of Trump (TRUMP) ranks first with a unlocking amount of $321 million, accounting for 20% of the circulating supply. Although the current price is stable at $8, historical data shows that its price has fluctuated wildly (having shrunk by 83% from its peak), and the number of holders has sharply decreased (from 817,000 to 637,000), with most tokens concentrated in a few addresses. If the team chooses to sell, the imbalance between the surge in supply and insufficient liquidity may exacerbate downward price pressure. Additionally, the RTR token previously launched by the Trump family plummeted 90% due to rumors, indicating the market's high sensitivity to politically associated projects.

High circulation ratio projects pose significant risks: The unlocking circulation ratios for Connex (CONX) and QuantixAI (QAI) reach 376.3% and 3960%, respectively, far exceeding the market's normal levels. Such high ratio releases are usually accompanied by flaws in the token's economic model, which may trigger panic selling. Especially for QAI, its circulating supply has surged nearly 40 times; without strong fundamental support, the price may face a cliff-like drop.

Top projects have limited short-term impact but should be wary of cumulative effects: Fasttoken (FTN) and Arbitrum (ARB) have lower unlocking ratios (4.65% and 2.01%), but due to FTN's recent stable market performance (price around $3.99, circulation rate 43.63%), short-term selling pressure may be manageable. As a leading Layer 2 project, even with an unlocking amount of $28.5 million, ARB's ecological application demand may partially offset the selling impact. However, the concentrated release of multiple projects may still lead to a dilution of market liquidity, creating a "bloodletting effect."

Structural risks in the market are emerging: The unlocking of meme tokens (like MELANIA) and low market cap projects (like deBridge unlocking 1.14 billion tokens) further highlights the speculative nature of the market. Combined with the fact that 80% of the TRUMP token's supply is controlled by the team and will be unlocked over three years, there is a long-term risk of "slow dilution." Additionally, historical cases show that after large-scale unlocks, the average token price drop can reach 10%-30%, and investors should be cautious of short-term volatility.

In this wave of unlocks, TRUMP's political attributes and the vulnerabilities of high circulation ratio projects constitute the main risk points. The market needs to pay attention to team movements and changes in on-chain token distribution. Investors are advised to prioritize assessing the project's fundamentals and the ownership of the unlocked tokens (such as team, institutions, or community) to avoid irrational volatility impacts.

2. Overview of the crypto market, quick read on the weekly performance of popular coins/sector fund flows

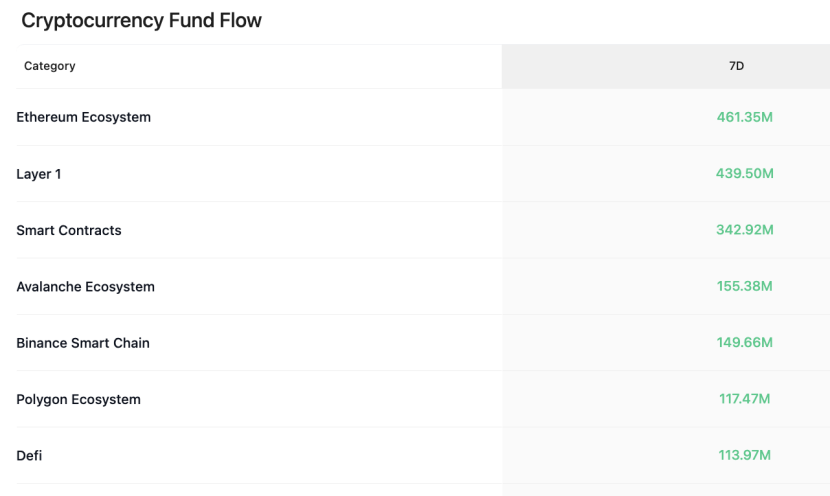

According to CoinAnk data, over the past 7 days, the crypto market has seen net inflows in five sectors categorized by concept: Ethereum ecosystem, L1, smart contracts, Avalanche ecosystem, #BSC, Polygon ecosystem, and DeFi. The following are the top gainers among the top 500 market cap coins over the past week: #aergo, #XCN, DOGINME, #GODS, and SWFTC, which have shown relatively strong gains and can continue to be prioritized for trading opportunities.

3. Spot ETF fund dynamics.

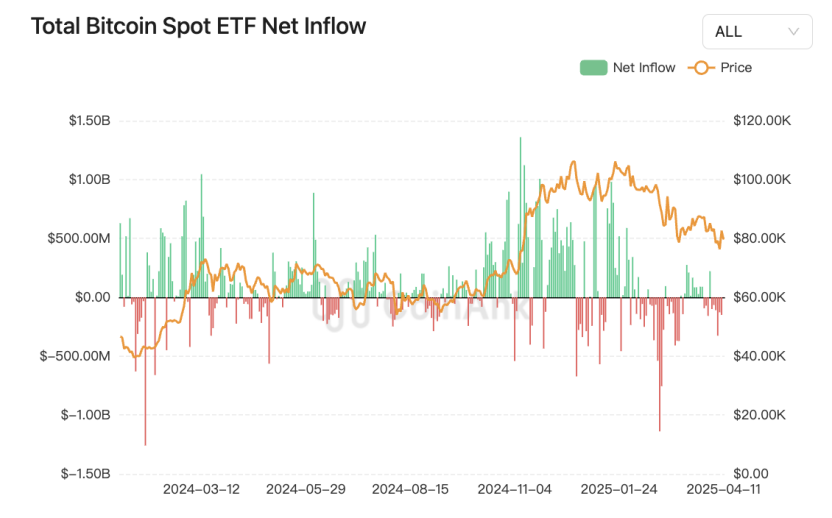

CoinAnk data shows that the total on-chain holdings of U.S. spot Bitcoin ETFs have surpassed 1.1 million BTC, currently reaching about 1.133 million BTC, accounting for 5.71% of the current BTC supply, with an on-chain holding value of approximately $96.5 billion.

Gold ETF inflows have reached a three-year high, with PAXG and XAUT outperforming the broader cryptocurrency market.

We believe that the Bitcoin spot ETF holding of 1.13 million BTC (5.71% share) and the concurrent record high market capitalization of gold tokens (PAXG, XAUT) reveal a dual evolutionary path of the crypto market under macro uncertainty:

Deepening institutionalization and stratification of value storage. The holding value of Bitcoin ETFs has reached $96.5 billion, indicating that its role as "digital gold" in institutional allocation logic is still strengthening, but the 27% price drop this year highlights the decline in liquidity premium. Meanwhile, the 24% increase in gold tokens and the $1.4 billion market cap of the RWA sector reflect that traditional safe-haven assets are penetrating the crypto market through tokenization, forming a liquidity transmission chain of "physical gold → on-chain gold → Bitcoin," weakening Bitcoin's exclusive status as a safe haven.

Fund diversion and reconstruction of risk preferences. Gold ETFs saw inflows of 226.5 tons in the first quarter (with North America accounting for 60%), resonating with the $42.7 million net minting of gold tokens, suggesting that traditional asset management institutions are using compliant crypto tools to hedge geopolitical risks. This fund diversion has intensified the competition for liquidity within the crypto market—Bitcoin ETFs are attracting institutional funds, while gold tokens are capturing safe-haven demand, leading to a liquidity vacuum for altcoins (down 30% this year).

The rise of RWA narratives and qualitative changes in market structure. The explosion of gold tokens is just the prologue to the RWA revolution, successfully validating the feasibility of on-chain physical assets. If major asset classes like real estate and government bonds accelerate tokenization in the future, it could reshape the crypto market's valuation system: Bitcoin may retreat to the narrative of "digital scarcity," while RWA assets attract traditional capital through cash flow anchoring mechanisms. However, regulatory arbitrage risks should be noted, as the SEC may include gold tokens in the securities framework for review.

In the short term, the crypto market may continue the differentiated pattern of "core assets (BTC, RWA) resisting declines - altcoins under pressure." Bitcoin needs to break through the miner cost line to halt negative feedback. In the medium to long term, the depth of integration between RWA and traditional finance will determine whether the crypto market can break through its current size ceiling and form a true cross-market capital bridge.

4. BTC liquidation map data.

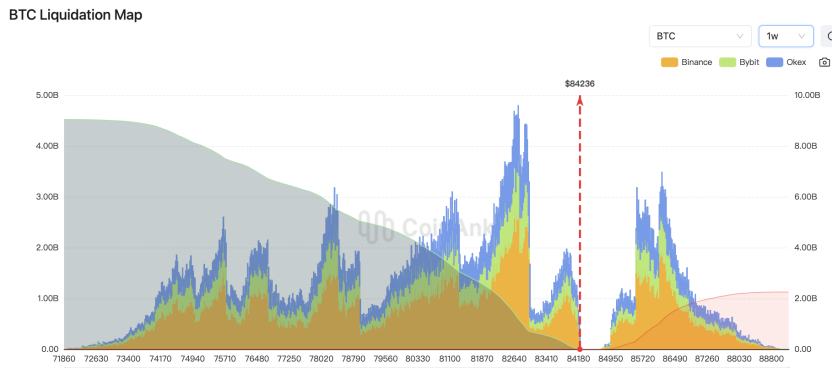

CoinAnk liquidation map data shows that if BTC breaks $88,800, the cumulative short liquidation intensity on major CEXs will reach $2.25 billion. Conversely, if Bitcoin falls below $80,000, the cumulative long liquidation intensity on major CEXs will reach $4.5 billion.

We believe that the current Bitcoin price is forming a key liquidation threshold in the range of $80,000 to $88,000, with both long and short positions engaged in fierce confrontation here. If Bitcoin breaks $88,000, it will trigger approximately $2.25 billion in forced liquidations of short positions, primarily due to the "short squeeze" effect triggered by the price breaking through key resistance levels—concentrated stop-loss orders may accelerate price increases, creating a positive feedback loop. Notably, this figure is significantly higher than the previously predicted $842 million, reflecting that market leverage levels have continued to rise with the price increase.

Conversely, if the price falls below the $80,000 support level, it is expected to lead to liquidations of long positions amounting to as much as $4.5 billion, which is twice the intensity of short liquidations, indicating that current market sentiment leans towards risk aversion. This asymmetrical liquidation pressure suggests that the downside risk is more destructive: once it breaks through key support, programmatic trading and panic selling may create a negative spiral, leading to short-term liquidity exhaustion. From a technical perspective, the difference in liquidation intensity values stems from the liquidity distribution across different price ranges, with higher "liquidation columns" representing more high-leverage contracts concentrated at that price level, resulting in a stronger market reaction when prices reach that area.

This long-short game pattern highlights that the current market is in a period of high volatility sensitivity. Traders need to be cautious of the potential liquidity siphoning effect that may occur after price breaks through thresholds, while also monitoring changes in the open interest and funding rates on exchanges, as these indicators will provide early signals of market sentiment shifts to prevent market failures under extreme conditions.

5. Key macro events and crypto market highlights for the week.

April 14: Trump invites Salvadoran President Nayib Bukele to a White House meeting to discuss bilateral cooperation and diplomatic relations; KernelDAO plans to hold its TGE on April 14; the trial of Tornado Cash developer Roman Storm is scheduled for April 14, 2025.

April 15: U.S. crypto investors must submit their 2024 tax returns by April 15; "Vitalik: The Story of Ethereum" will be available on Apple TV and Prime Video; Shardeum mainnet will launch.

April 17: At 1:15 AM, Federal Reserve Chairman Powell will speak at the Chicago Economic Club; in addition, several Federal Reserve officials will be speaking intensively this week.

April 18: TRUMP will unlock 40 million tokens, valued at over $400 million.

We believe that this week's macro events and crypto market dynamics present a multidimensional intertwined impact pattern, requiring a comprehensive assessment of policies, technology, and market sentiment:

Political cooperation and regulatory games. Trump's invitation to the Salvadoran president to discuss bilateral cooperation may further promote El Salvador as a model sovereign Bitcoin nation, strengthening the strategic position of cryptocurrencies in cross-border payments. The Trump administration has previously signaled support for crypto assets multiple times, including proposals to establish a strategic Bitcoin reserve, which may boost market expectations for long-term policy friendliness. However, the advancement of the Tornado Cash developer's trial (April 14) highlights the ongoing regulatory pressure on privacy protocols, which may exacerbate market concerns about compliance risks for decentralized protocols in the short term.

Project progress and market liquidity. The TGE (Token Generation Event) of KernelDAO and the launch of the Shardeum mainnet (April 15) will introduce new funds and user traffic. As a critical node for project initiation, a successful TGE may attract speculative funds, but caution is needed regarding the risk of liquidity dilution after token unlocks. Additionally, the unlocking of 40 million TRUMP tokens on April 18 (valued at over $400 million) may trigger selling pressure from holders, especially since this token is highly tied to the Trump concept, necessitating attention to the market's absorption capacity.

Macroeconomic and monetary policy. Federal Reserve Chairman Powell and several officials will speak intensively (April 17), from which the market will interpret signals regarding the interest rate path. If the remarks are hawkish, it may suppress risk asset preferences; conversely, if they suggest rate cuts or delays in tapering, it may drive demand for Bitcoin as an "anti-stagflation asset." Recent analysts have pointed out that if the U.S. Treasury market becomes chaotic due to tariff policies (such as those implemented on April 2), it may prompt funds to shift towards Bitcoin. Furthermore, the U.S. tax deadline (April 15) may lead to a short-term selling wave, but historical data shows that such impacts are often temporary.

Narrative-driven and technical ecology. The release of the documentary "Vitalik: The Story of Ethereum" (April 15) will strengthen consensus within the Ethereum community, and combined with the Shardeum mainnet launch, it may boost the Layer 2 ecosystem's popularity. Recently, after Bitcoin broke through $85,000, market sentiment has turned optimistic; if the Ethereum ecosystem also gains momentum, it may create a "dual mainline" rotation pattern.

This week, the crypto market is expected to exhibit high volatility, with policy benefits (such as Trump's cooperation) and technological advancements providing support, but token unlocks, regulatory events, and macro uncertainties may trigger short-term pullbacks. In the medium to long term, if the Trump administration's crypto strategy continues to be implemented, it may inject institutional dividends into the market, while Federal Reserve policies and tariff effects remain key variables. Investors need to pay attention to whether Bitcoin can hold the critical level of $85,000 and how the market reacts after the TRUMP token unlock.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。