In April 2025, Lido announced the launch of the Unichain liquidity incentive program, involving multiple mainstream asset pools, aimed at consolidating the DeFi currency status of stETH and promoting it as a core asset for cross-chain trading.

Written by: Lawrence

Introduction: A Delayed Liquidity Feast

On April 12, 2025, the liquidity staking protocol Lido tweeted on platform X "Incentives: Soon™," announcing the launch of a 3-month Unichain liquidity incentive program, involving 12 mainstream asset pools (including wstETH/ETH, WBTC, stablecoins, and UNI/COMP, etc.). This marks the first time in 5 years that the UNI token has been included in the official incentive system since the initial liquidity mining of Uniswap V2 was launched in 2020. Previously, the price of UNI fell from $19 to a low of $4.5 after a 3-month decline, nearing the historical low of $3.3 after the LUNA crash in 2022.

This move reflects Lido's continued dominance in the Ethereum staking market and represents a key breakthrough attempt for Uniswap in its Layer2 strategy, becoming a window to observe the turning point of the DeFi market cycle.

Lido's "Liquidity Siege": From Staking Monopoly to Cross-Chain Expansion

1.1 Lido's Strategic Intent: Consolidating stETH's DeFi Currency Status

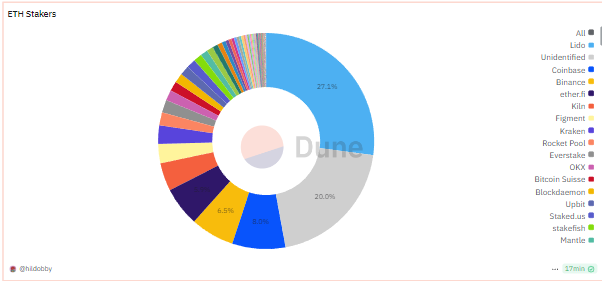

As the absolute leader with a 27.1% share of the Ethereum staking market (data as of April 14, 2025, source: Dune Analytics), Lido's core goal has shifted from merely expanding staking scale to enhancing the on-chain application scenarios of stETH.

Previously, the main use cases for stETH were concentrated in lending collateral (AAVE, MakerDAO accounting for 40%) and passive holding (55%), with its function as a trading medium only accounting for 3%. By choosing Unichain as the main battlefield for incentives, the aim is to embed stETH into the core liquidity pools of Layer2, promoting it to become a "universal Gas asset" for cross-chain trading.

Technical Mechanism Innovations:

- Merkle Reward Distribution: Utilizing an off-chain computation and on-chain verification model with zero Gas fees, lowering the participation threshold for users;

- Multi-Asset Pool Design: Covering ETH, LST, WBTC, stablecoins, and UNI/COMP, forming a cross-chain asset exchange matrix;

- Collaboration with Gauntlet: Preventing "short-term arbitrage traps" in liquidity mining through dynamic adjustment of incentive weights.

1.2 Data Insights: Lido's "Centralization Anxiety" and Breakthrough Attempts

Although Lido's node operators have increased to 37 (targeting 58), its protocol-level market share (78%) still far exceeds the 15% safety threshold proposed by Vitalik.

Guiding liquidity through Unichain essentially disperses risk through "inter-protocol collaboration": shifting the liquidity dependence of stETH from the Ethereum mainnet to the Rollup ecosystem, reducing the impact of single points of failure on staking security.

From on-chain data, the cross-chain scale of stETH to Arbitrum and Optimism grew by 320% year-on-year in Q1 2025, validating the initial effectiveness of this strategy.

Uniswap's "Self-Redemption": Can Unichain Turn the Layer2 Predicament?

2.1 Unichain's Mission: From Liquidity Fragmentation to Aggregation

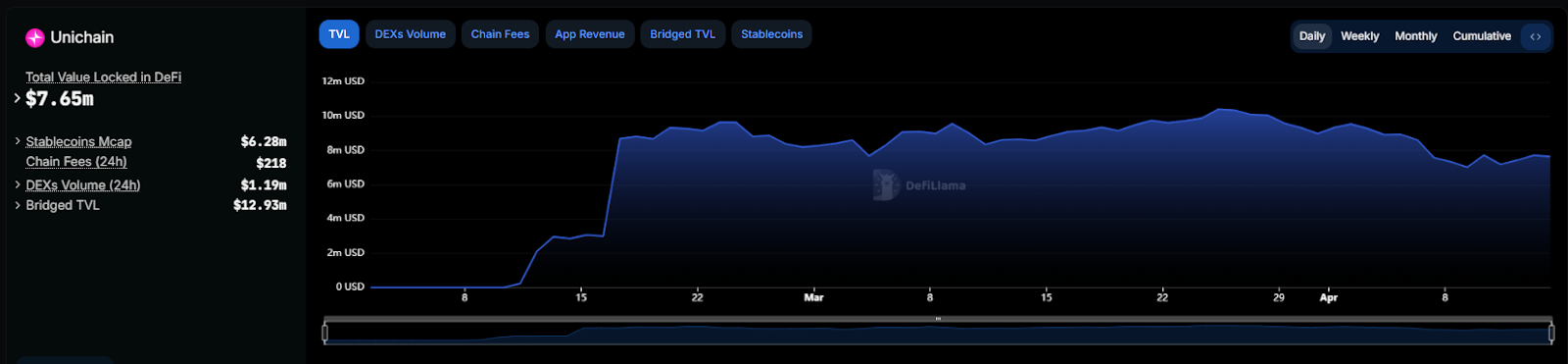

Uniswap's Unichain, launched in 2024, is a universal Rollup based on OP Stack, aimed at solving the liquidity fragmentation issue in a multi-chain ecosystem. However, its initial performance fell short of expectations:

Cross-Chain Experience Bottleneck: Users must first bridge assets to Unichain, leading to transaction delays and increased costs;

TVL Growth Weakness: As of April 2025, Unichain's locked value was only $7.65 million, far below other chains.

Significance of Lido's Incentives:

By introducing core trading pairs like stETH/ETH, Unichain can quickly establish deep liquidity leveraging Lido's staking traffic.

For example, the initial APR design for the wstETH/ETH pool is set at 180%-250%, significantly higher than the 45% of similar pools on the mainnet, potentially attracting arbitrage capital to migrate cross-chain.

2.2 UNI Token Economics: "Hidden Risks and Glimmers of Hope"

The core contradiction behind the current low price of UNI is:

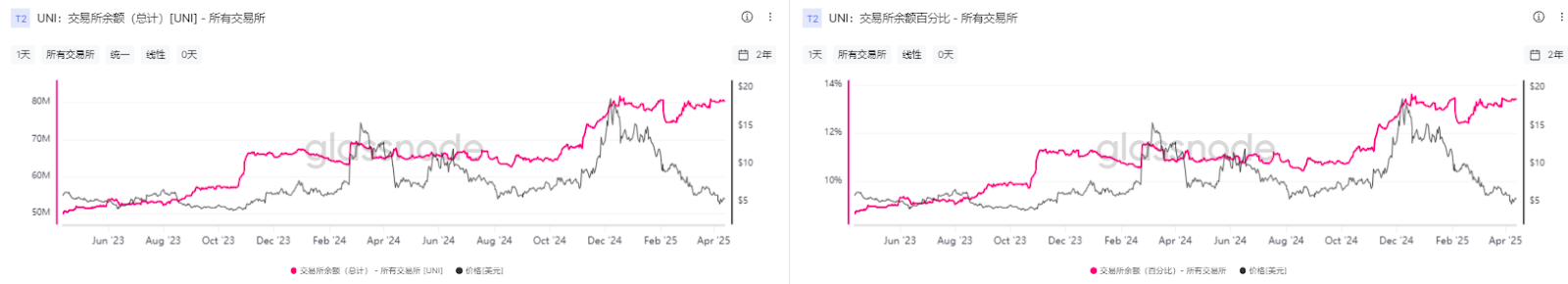

- Unlocking Selling Pressure: In 2024, the total unlocking amount for team and investor tokens reached over 65 million, accounting for 6.5% of the circulating supply;

- Governance Stalemate: The "fee switch" proposal was rejected again in March 2025, preventing protocol revenue from benefiting token holders.

Bottom Signal Analysis:

- Exchange Balances at All-Time High: Glassnode data shows that the amount of UNI held on exchanges has reached an all-time high; any reversal signal may indicate a price recovery.

- On-Chain Chip Distribution: Glassnode data shows that the proportion of whale addresses holding over 10,000 UNI has decreased from 62% in 2024 to 47%, suggesting a potential retail accumulation;

- Valuation Anchoring: The current price-to-sales ratio (PS) of UNI is 8.2, below the industry average of 15.4, sitting at the historical 10th percentile;

- Technical Support: The weekly RSI (14) has dropped to 28.6, nearing the extreme oversold area of 2022.

Market Impact: The "Game of Ice and Fire" in the DeFi Ecosystem

3.1 The "Siphon Effect" of Liquidity Migration

Lido's incentives may trigger two major chain reactions:

- Layer2 Liquidity Redistribution: The TVL of stablecoin pools on emerging chains like Solana and Sui may decline by 15%-20%, with funds shifting towards Unichain;

- Interest Rate Wars in Lending Protocols: The borrowing rate for wstETH collateral on AAVE has dropped from 5.2% to 3.8%, potentially forcing the introduction of subsidy programs.

3.2 The "Unexpected Rise" of COMP and Risks

The inclusion of COMP in this incentive pool has sparked controversy. The underlying logic may be:

- Liquidation Safety Net: Compound's on-chain lending liquidation lines are generally lower than Aave's, making it suitable as collateral in high-volatility markets;

- Governance Token Reuse: A recent proposal from MakerDAO allows COMP to be used as collateral for DAI minting, enhancing its utility scenarios.

Conclusion: Seeking "Asymmetry" Amid Uncertainty

Lido's liquidity incentives are not only a tactical collaboration of DeFi protocols but also a strategic experiment in the value capture logic of the Layer2 era. For UNI, the price of $5.4 reflects both a pessimistic pricing based on historical path dependence and an implied option premium for the successful breakthrough of Unichain. Under the dual catalysts of macroeconomic shifts and the formation of regulatory frameworks, 2025 may become a key turning point for UNI's transition from a "governance token" to a "cash flow asset." Investors should be wary of the short-term volatility brought by liquidity siphoning but should pay more attention to the long-term value of leading protocols rebuilding their moats under the narrative of cross-chain interoperability.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。