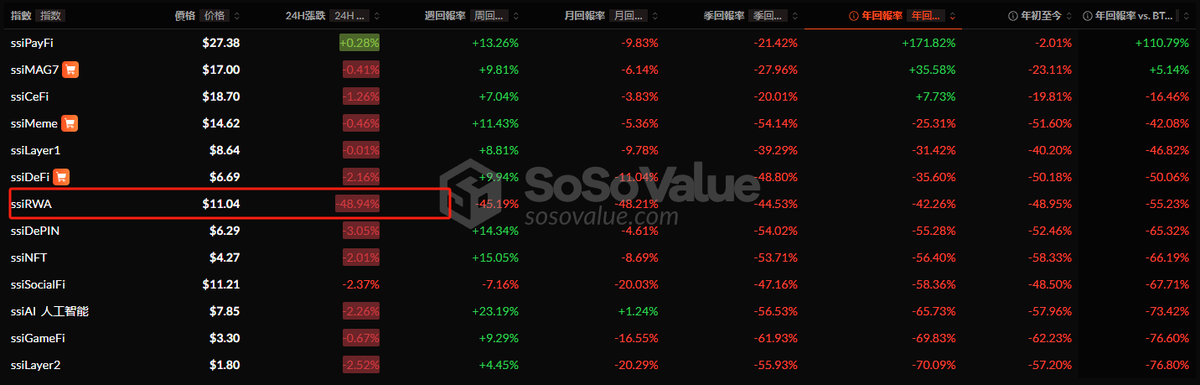

🚨Review of the $OM Crash Event丨Single-handedly Causing the Collapse of the Entire RWA Sector——

After spending half a day on Twitter, I finally understand the entire sequence of events before and after the crash. This drop is not just a single event, but a microcosm of the structural contradiction between the "ideal of decentralization" and the "reality of centralization."

🔊MANTRA is a DeFi platform based on the Cosmos SDK, focusing on the tokenization of real-world assets (RWA), with its native token $OM experiencing a 500-fold increase over the year.

1⃣Timeline of the Crash:

- On March 20, community users detected that a large OM holder was withdrawing coins and transferring them to an exchange, with rumors that OM had completed several large discounted OTC transactions.

- Subsequently, multiple large OM holders began to sell off, causing the price to continue to drop. Many OTC buyers were trapped, and panic spread throughout the community, leading to a rush to exit.

- In the early hours of April 14, the price of $OM plummeted from $6.2 to $0.4, a drop of over 90%, with a market cap evaporating by $5.5 billion in 2 hours.

- On-chain data shows that at least 17 addresses transferred a total of 43.6 million OM to exchanges before the crash, with 2 addresses linked to strategic investor Laser Digital. (Speculated to be related to the sell-off)

- The MANTRA team denied any "exit," stating that the crash was triggered by "improper forced liquidations by other (CEX) during low liquidity periods (Asian early morning)" and suspected negligence or market manipulation by the exchanges.

They also emphasized that the tokens remain locked and that there was no involvement from the team or core investors in the sell-off.

On-chain data also indicates that there were a large number of liquidation orders during the crash, leading to a chain reaction of sell-offs, with insufficient market depth exacerbating the decline.

2⃣What Issues Are Reflected in the OM Incident?

1) There is a Power Struggle Between the Project Team and CEX

A deep-seated contradiction is that CEXs are both liquidity providers and potential conflict of interest parties. For example, exchanges may earn transaction fees through liquidations without being accountable to the project ecosystem.

MANTRA has repeatedly hinted that the project team lacks actual leverage over CEXs, accusing them of abusing their discretion.

CEXs allowing liquidations during inactive periods essentially shifts the risk onto retail investors.

It's like suddenly closing all emergency lanes on a highway at 3 AM; any car breaking down could trigger a multi-car pileup.

2) The "Valuation Trap" of High FDV and Low Circulation Projects

OM's FDV/TVL ratio reached as high as 730 times, far exceeding the healthy industry level (usually below 50 times).

This extremely unhealthy metric indicates that OM's market cap far exceeds its actual value support, making it vulnerable to short-selling or liquidation. The previously questioned smart money may have positioned itself for bearish bets + short-selling + liquidation counterattacks, waiting for emotional triggers, which indeed aligns with on-chain data.

Creating an illusion of scarcity through lock-ups attracts speculative funds to inflate market cap, ultimately leaving retail investors to take the fall.

3) What Should We Be Cautious About?

🔺In the wake of the crash, the project team, CEXs, and market makers all attempt to absolve themselves of responsibility, but all three share the benefits of listing coins, with potential collusion lurking in the profit chain. Is there a possibility of joint control to squeeze out retail investors?

The diffusion of responsibility is, in itself, the best breeding ground for market manipulation.

🔺CEXs, by controlling liquidity and liquidation rules, effectively hold the power to price tokens. Liquidity equals power; should there be improvements in risk control mechanisms (such as dynamically adjusting liquidation thresholds) to avoid regulatory vacuums to the greatest extent?

In this situation, retail investors inherently face an information disadvantage. The project team should also consider how to avoid excessive reliance on centralized liquidity.

🔺Projects with high valuations supported by "unlock expectations" and "ecological blueprints" can collapse much faster than traditional financial assets when faced with black swan events.

Narrative bubbles will eventually burst, and there are only two points to consider from within—

Stay vigilant against the "FDV myth" and return to fundamental analysis. True value should be based on protocol revenue and user growth, not paper valuations.

Do not hold high-leverage positions during low liquidity periods; the demise will be slower.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。