Original | Odaily Planet Daily (@OdailyChina)

Author | Azuma (@azuma_eth)

This column aims to cover low-risk yield strategies primarily based on stablecoins (and their derivative tokens) in the current market (Odaily Note: systemic risks can never be completely eliminated), to help users who wish to gradually increase their capital through U-based financial management find more ideal earning opportunities.

Past Records

Lazy Financial Strategy | Focus on Berachain, raise expectations for Reslov airdrop (March 31)

New Opportunities

Aave to Support Pendle PT

Aave has begun to advance a proposal to support Pendle PT assets, with the first phase expected to support sUSDE PT maturing on May 29.

This is undoubtedly great news for fixed-rate players, as using Pendle PT for circular lending has always been an effective strategy to amplify fixed income. Previously, some players executed this strategy using smaller lending markets like Morpho. If Aave opens support for PT assets, it will significantly improve the execution efficiency and operational capacity of this strategy.

OpenEden Launches Pendle

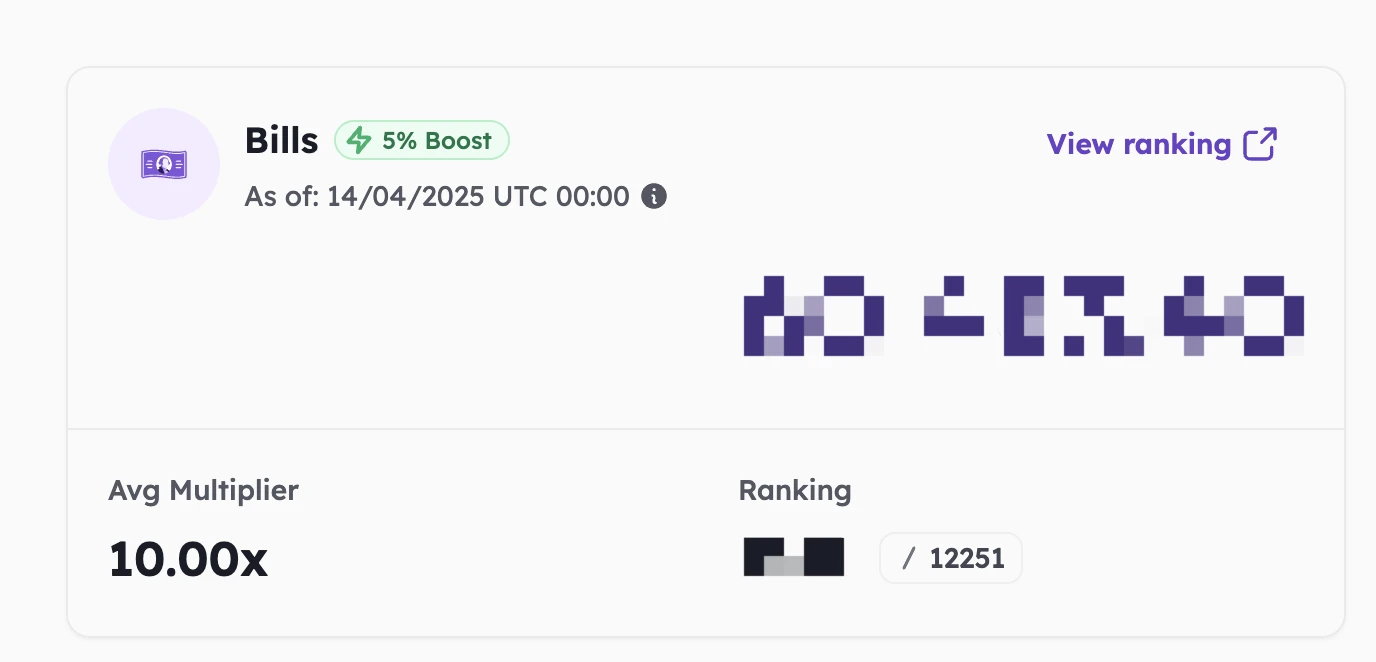

The RWA project OpenEden, invested by YZi Labs (Binance Labs), Ripple, etc., has launched Pendle, with the current real-time annualized yield for cUSDO LP at 6.384%, while also earning 10 times the points (Bills) bonus.

Currently, the total number of participants in the OpenEden points program is reported to be 12,251, with relatively low competition compared to other yield-generating stablecoin projects like Level.

Loopscale Officially Launches

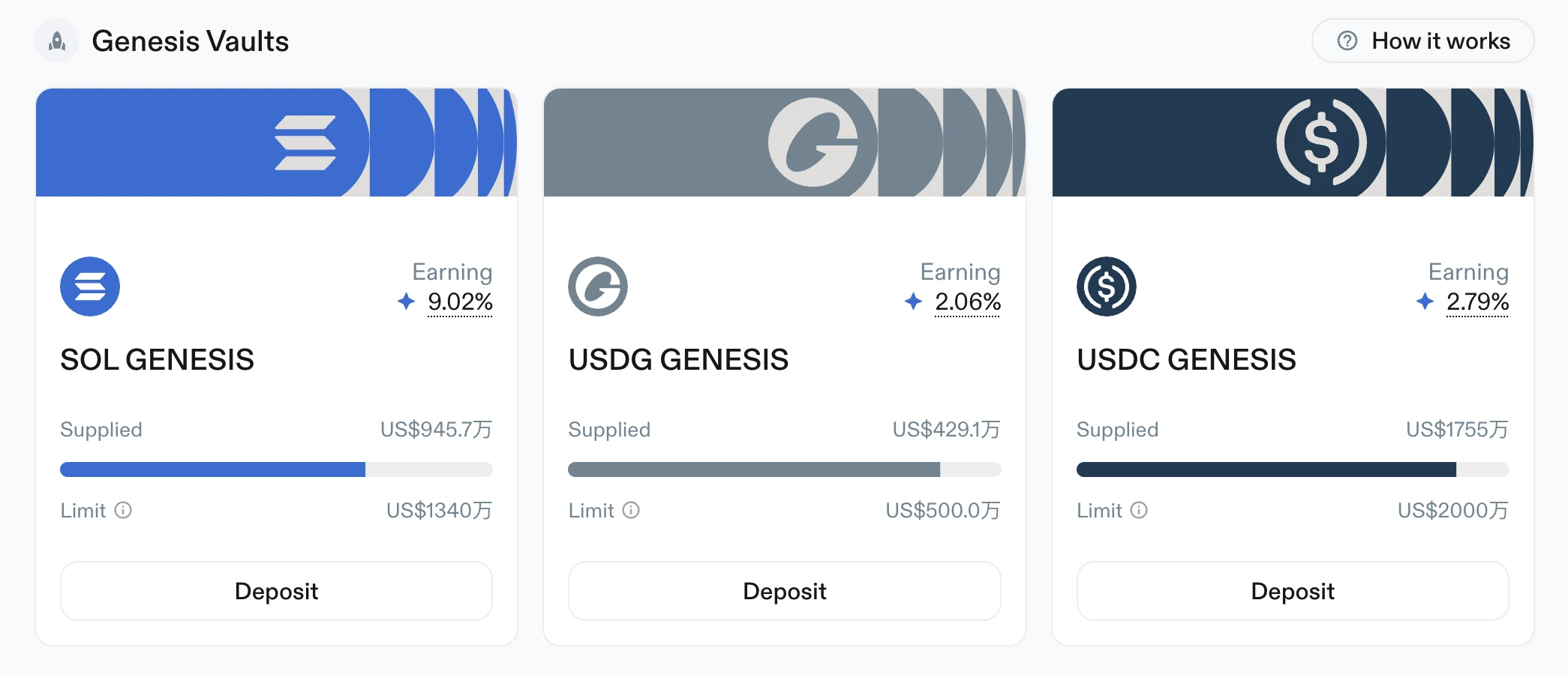

The Solana ecosystem order book lending protocol Loopscale announced the end of its closed testing last week and officially launched. At the same time, Loopscale disclosed that it has received investments from CoinFund, Solana Ventures, Coinbase Ventures, Jump, and Room40.

Loopscale also mentioned that it will provide a four-week points incentive for several Genesis pools. Although the current yield is not high (USDC 2.79%), it is temporarily possible to earn 6 times the points bonus, so it may be worth considering mining until the incentive period is complete.

StandX Launches Points Program

The decentralized contract exchange StandX officially launched its points program last week.

The co-founder of StandX was a founding member of the Binance contract team. The project has recently gained significant attention in the Chinese community, but some users have concerns due to the lack of financing backing. On April 11, StandX announced that it has received funding from the Solana Foundation, which has somewhat alleviated market concerns.

Currently, StandX supports multiple modes for accumulating points: minting and holding DUSD can earn 6.65% APY, but there is no points rate bonus; providing USDT/DUSD LP can earn 2.5 times the points rate bonus, but the USDT portion in the pool cannot earn interest (there will be some additional trading fee income).

Huma 2.0: Controversy Sparks Interest

The most discussed deposit project over the weekend was undoubtedly Huma.

Huma is positioned in the PayFi track and previously had $38 million in financing backing. Last week, the project launched version 2.0, allowing deposits to earn points, with a mining method similar to Noble's sub-pool model.

Classic Mode: Supports no lock-up, three-month lock-up, and six-month lock-up, corresponding to 1x, 3x, and 5x points increase, while also earning 10.5% APY;

Maxi Mode: A single six-month lock-up, corresponding to a 25x points increase, but does not earn basic income.

The sudden rise in interest is due to a heated discussion over the weekend between several KOLs and Huma team members regarding the project's business model. During this, a team member from Huma faced severe criticism from the community for making inappropriate remarks, leading Huma's founder Richard Liu to issue a public letter of apology. Interested readers can refer to that post for more details.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。