Author: Zuo Ye

- The non-dollarization of YBS native yield, such as opting for more purely on-chain assets like BTC/ETH/SOL for staking;

- The YBS "Lego" combination, Pendle is just the beginning, and more DeFi protocols need to support YBS until the emergence of on-chain USDT;

- Payment products, technically not difficult, and earning interest is conducive to customer acquisition, but the main challenge lies in compliance and the expansion of business scale. Even for USDT/USDC, payments often play more of a "middleware" role in backend clearing, with direct use as a transaction medium being less common.

In 100 days, a triple whammy of stocks, bonds, and currencies, accelerating the collapse of fiat currency order.

The 2008 financial crisis gave rise to the earliest believers in Bitcoin, and the "suicide" of the fiat currency system in 2025 will also promote the growth of on-chain stablecoins, especially non-dollar, non-full-reserve interest-bearing stablecoins (YBS, Yield-Bearing Stablecoins).

However, non-full-reserve stablecoins are still in theoretical conception, and the aftershocks of the Luna-UST collapse in 2022 are still present. Yet, under the pressure of capital efficiency, some reserve-backed stablecoins will undoubtedly become mainstream in the market.

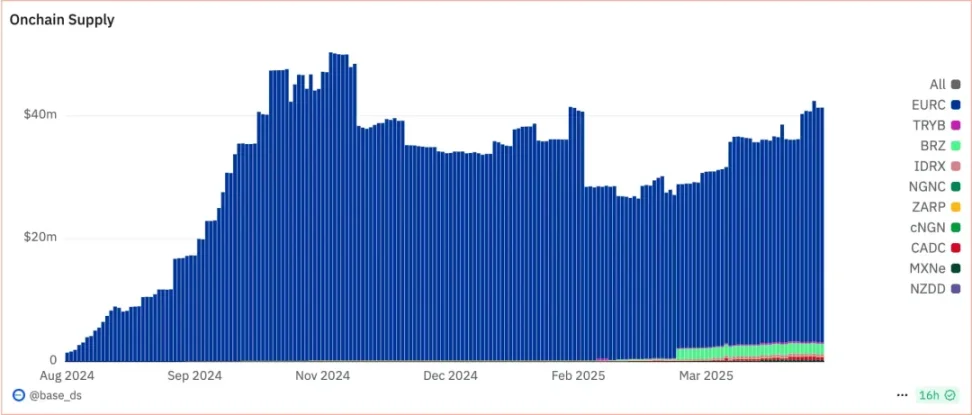

Non-dollar stablecoins are still in the experimental stage, and the global currency status of the dollar is still widely recognized. To maintain industrial capacity and employment, the renminbi will not actively internationalize on a large scale, and the replacement of the dollar will be a very long process.

Image caption: Non-dollar stablecoins, image source: https://dune.com/base_ds/international-stablecoins

Based on the above two points, this article mainly examines the latest stage of existing stablecoins, namely the overall picture of YBS, based on dollar-backed, full-reserve on-chain stablecoin systems, which contain the basic characteristics of post-dollar, non-full-reserve stablecoins.

Seigniorage manifests internally as inflation, commonly referred to as internal debt not being debt, and externally as the dollar tidal cycle.

Trump Abandons Dollar Hegemony

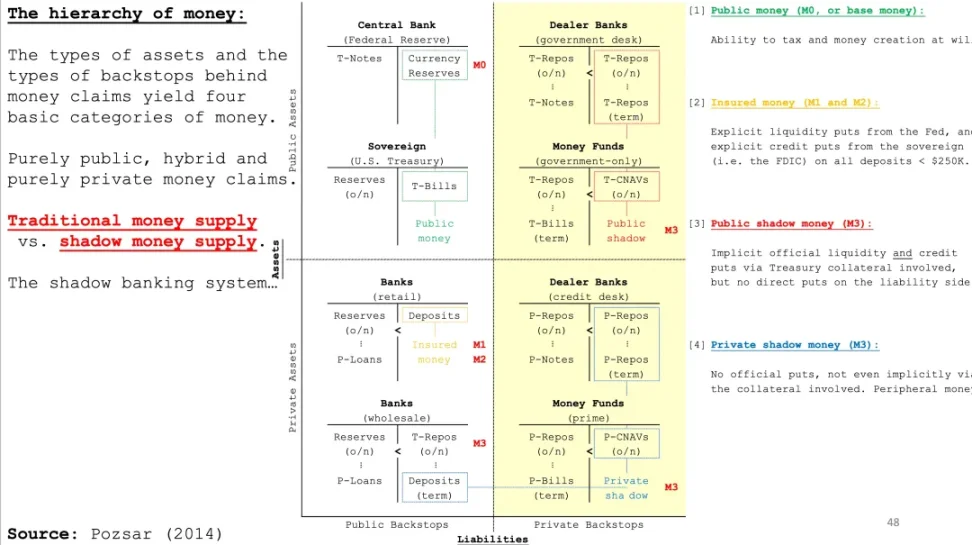

From a technical perspective, the issuance of the dollar is a back-and-forth between the Federal Reserve and the Treasury, which then uses the credit relationships of commercial banks to amplify the money multiplier, creating different statistical levels of money circulation such as M0/M1/M2/M3…

In this issuance model, U.S. Treasury bonds (T-Bills, T-Notes, T-Bonds) are divided into long and short terms, maintaining the slow inflation of the dollar and short-term currency stability. U.S. Treasury bond rates become the pricing foundation for the entire financial world, and the dollar becomes the world currency, at the cost of the U.S. external deficit and countries' dependence on the dollar.

The cost has always been two-way. The only product the U.S. actually has is the dollar itself, while countries around the world need to obtain dollars and realize the purchasing power of dollars.

The purchasing power of the dollar will depreciate in the long term, regardless of Trump's will, while countries must obtain dollars to minimize transaction intermediary costs. Bartering is not unfeasible, but using dollars directly is more cost-effective.

The hard-earned dollars must be quickly spent on production or financial arbitrage to preserve purchasing power and maintain competitiveness in the next phase of exports to the U.S.

This cyclical process is currently being disrupted by Trump's Schrödinger-style tariff system. Trump is raising tariffs and pressuring Powell to cut interest rates. Countries no longer want to continue holding dollars and are fleeing the U.S. Treasury bond market, turning the dollar/Treasury bonds into a risk asset.

Image caption: Dollar operation process, image source: Pozsar

The slow inflation of the dollar is the seigniorage that harvests from various countries, and only under the condition that countries must hold and partially invest in U.S. Treasury bonds can the damage to the dollar itself be reduced.

Assume the following scenario:

- Alice is a textile worker, laboring hard in a sweatshop, earning $1,000 in cash;

- Bob is a U.S. Treasury bond salesman. Alice invests $100/$200/$200 in short, medium, and long-term Treasury bonds, with the remaining $500 invested in expanding production;

- Bob uses the bonds purchased by Alice as collateral, leveraging 100x to borrow $50,000 from bank Cindy;

- Bob spends $25,000 to buy real estate, $20,000 to buy Mag7 stocks, and the remaining $5,000 to buy Alice a new handbag.

In this cycle, Alice's motivation is to exchange labor for dollars and use reinvestment and Treasury bonds to hedge against depreciation. Bob's motivation is to recover dollars and amplify the asset value of Treasury bonds, while Cindy's motivation is to collect risk-free Treasury bonds and earn fees.

The danger lies in two points: if Alice invests all $1,000 in Treasury bonds, then Bob and Cindy will have nothing to wear, and $500,000 won't buy a loaf of bread; secondly, if the Treasury bonds in Bob's hands cannot be used as risk-free collateral to borrow dollars, then Cindy will be unemployed, and Bob will also be unable to buy Alice's handbag, only able to buy underwear, and Alice will face losses from not being able to recover her expanded production.

Once the arrow is shot, there is no turning back. After Trump abandons dollar hegemony, the seigniorage collected from the dollar will also face a death spiral like Luna-UST, only it will take longer.

The fragmented world trade and financial system will instead act as a catalyst for the "globalization" of cryptocurrencies. Embracing power centers will create single points of failure. The dollarization of cryptocurrencies will not harm Bitcoin, but the dollarization of cryptocurrencies will lead to their disappearance.

Interestingly, in the near future, the shocks to the global economic system will lead to ongoing attacks and defenses between stablecoins. An increasingly fragmented world will always require glue languages and cross-chain bridges. The era of global arbitrage will undoubtedly exist in the form of on-chain stablecoins.

Sad frogs entertain the masses, and fun people change the world. Let us explain why this is so.

The Tail Wags the Dog: Stablecoins Expel Volatile Coins

The market capitalization of cryptocurrencies is "fake," while the issuance of stablecoins is "real."

The $2.7 trillion cryptocurrency market cap is merely a feeling of the "capacity" of the crypto market, while the $230 billion in stablecoins is at least supported by real reserves, although the 60% share of USDT reserves is questionable.

With the USDC-ification of DAI or USDS, the full or over-reserve stablecoins based on on-chain assets are effectively disappearing. The other side of real reserves is capital efficiency, or a significant reduction in the money multiplier. For every $1 issued, $1 of stablecoin is created, and off-chain, it goes to buy $1 Treasury bonds, while on-chain, it is lent out, with a maximum re-issuance of 4 times.

In contrast, BTC and ETH have value "created from nothing," valued at $84,000 and $1,600, respectively. Compared to the dollar, the M0 of cryptocurrencies should be BTC + ETH, which is 19.85 million BTC and 120.68 million ETH. M1 should add the $230 billion of stablecoins, while the re-issuance volume of YBS based on staking and lending relationships and the DeFi ecosystem constitutes M2 or M3, depending on the statistical caliber.

This representation will better reflect the current state of the crypto market than market cap and TVL. Calculating the market cap of BTC lacks practical significance; you cannot fully exchange it for USDT or USD, and the market lacks sufficient liquidity.

The crypto market is an "inverted" market, where volatile cryptocurrencies do not have corresponding full-reserve stablecoins.

Only under this structure does YBS have practical significance, as it can convert the volatility of cryptocurrencies into stablecoins, but this is merely theoretical; in reality, it has never come true, and even the $230 billion in stablecoins must provide liquidity and entry/exit channels for the $2.7 trillion market.

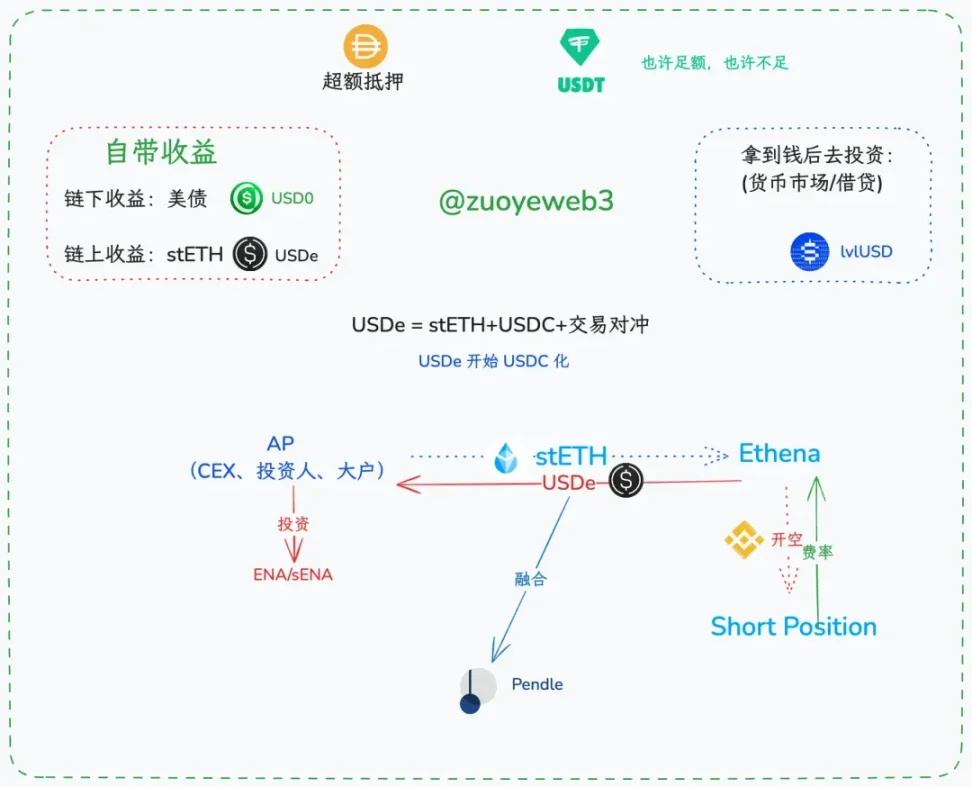

Ethena's compromise, an unsuccessful replication of the U.S. Treasury and dollar system.

Ethena's USDe has expanded from $620 million at its inception to $6.2 billion in February this year, at one point capturing 3% of the market share, second only to USDT and USDC. This is the most successful non-fiat reserve stablecoin since UST.

The hedging model of USDe is actually very simple. Authorized issuers (AP) deposit stETH and other interest-bearing assets, and Ethena opens short positions on Perp CEX. In historical backtesting data, in most cases, long positions provide funding for short positions, and funding rate arbitrage becomes Ethena's native protocol income.

As for why Hyperliquid does not take on the short positions, it is because Perp DEX is still a derivative of Spot CEX, and the core source of Hyperliquid's price oracle is Binance, so USDe simply goes to the most liquid CEX.

But that's not all; Ethena is also taking a further step in imitating the real dollar system.

Image caption: YBS classification and operation process, image source: @zuoyeweb3

On the surface, Ethena has four token systems: USDe and sUSDe, ENA and sENA, but the core of Ethena has always been just USDe. The most important scenario is the adoption rate of USDe beyond "staking and wealth management," such as trading and payments.

Recalling the dollar's operation process, dollars cannot be fully reinvested in Treasury bonds. The most reasonable situation is that a small portion of dollars flows back to the bond market, while most dollars remain in the hands of other countries. This way, the global currency status of the dollar can be preserved, and the purchasing power of the dollar can be maintained.

Earlier this year, USDe attracted about 60% of USDe to be staked as sUSDe at a 9% yield. Essentially, this is the protocol's liability. Theoretically, the remaining 40% of USDe must pay 9% yield to 60% of the holders, which is clearly unsustainable.

Therefore, the alliance of interests between ENA and CEX is incredibly important. For reference, Circle shares profits with Coinbase and Binance for holding USDC, and ENA essentially has to take on the "bribery" role for APs. If large holders do not sell, everything will be fine, and sENA serves as another guarantee for stabilizing large holders.

With layers of nesting, the best model to emulate is not the dollar or USDC, but USDT, where $14 billion in profits belong to Tether, while $160 billion in risks are shared by CEX and retail investors.

There is no other way; P2P transfers, spot trading pairs, U-based contracts, and assets of retail and institutional investors all require USDT as the most widely recognized transaction intermediary, while USDe does not even have a spot trading pair.

Of course, whether the cooperation between Ethena and Pendle can reshape the DeFi ecosystem, shifting it from a lending-centric model to a yield-centric model, still requires time. I will introduce this in a separate article later.

YBS is Essentially a Customer Acquisition Cost

In 2014, USDT initially explored the Bitcoin ecosystem, and later partnered with Bitfinex, establishing a foothold in CEX trading pair scenarios. Subsequently, in 2017/18, it settled on the Tron network, becoming the absolute leader in P2P scenarios.

The subsequent USDC/TUSD/BUSD/FDUSD have merely been imitations, never surpassing the original (a side note: Binance has a natural conflict with stablecoins and has already killed off several stablecoins).

Ethena, relying on a "bribery" mechanism, has captured part of the CEX market, but has hardly encroached on the compliant scenarios of USDC, nor has it squeezed into the trading and transfer scenarios dominated by USDT.

YBS cannot penetrate trading scenarios, nor can it enter payment scenarios, and it struggles off-chain as well. Relying solely on yield, it has only one path left: DeFi.

The existing YBS can be categorized as follows:

The yield of YBS is a liability of the protocol, essentially a customer acquisition cost. It requires more users to recognize its dollar equivalence standard and hold it themselves, rather than investing in the staking system, to sustain itself.

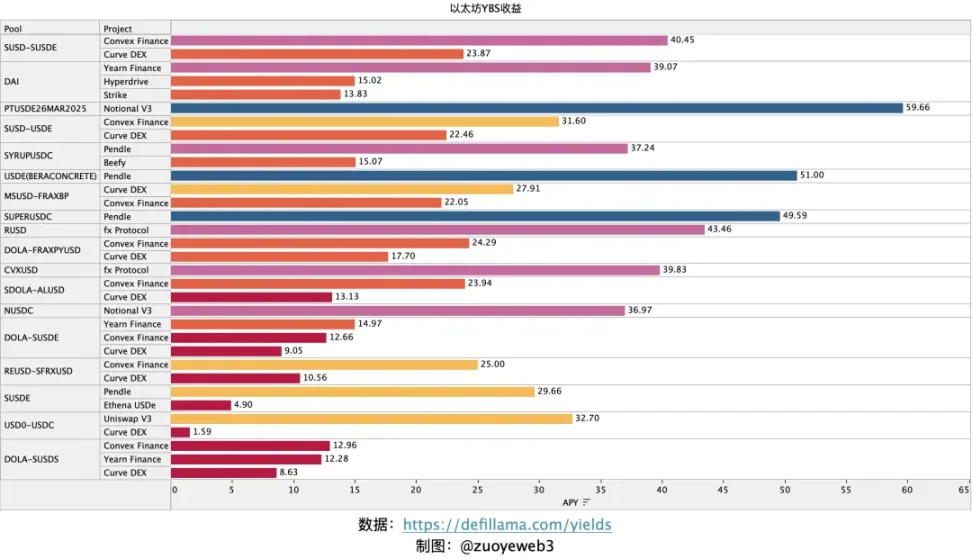

Among the top 50 stablecoins by market cap, there is a clear division at $50 million, and the APY list for YBS is as follows:

Image caption: Ethereum YBS yield, image source: @zuoyeweb3

According to data from DeFillama, the current YBS yield on Ethereum can be roughly attributed to Ethena and Pendle, which stands in stark contrast to the often thousands of times returns seen since DeFi Summer.

The era of exorbitant profits has ended, and the era of low-interest wealth management has arrived.

Profit and loss are two sides of the same coin. Nowadays, U.S. Treasury bonds have become the underlying yield pillar for most YBS, which is not safe. Furthermore, on-chain yields require extremely strong secondary liquidity support. Without sufficient user participation, yield guarantees will become a heavy burden that could crush YBS projects.

This is not surprising. Binance's investment in Usual manually adjusted the anchoring ratio, and Sun's USDD can still guarantee a 20% yield to this day. Kids, this is not funny. If the most successful USDe has a native yield of only 4.9%, then where does USDD's 20% come from? I can't figure it out.

Here, a distinction needs to be made. The yield rates in the above image are the rates of various pools, and they even include the yields inherent to LSD assets, which do not completely equate to the yields provided by each YBS natively. The yield sources for participating in DeFi are likely the participants themselves; this principle has always existed.

With more and more YBS emerging, there is no doubt that the focus of competition remains market share. Only when the vast majority of people want to use Stable, rather than pursue Yield, can YBS maintain high yields while encroaching on the usage space of USDT.

Otherwise, if 100% of users pursue yield, then the source of yield will disappear. Whether it is Ethena's fee arbitrage or U.S. Treasury bonds on-chain, there must be counterparties that incur losses in yield or principal. If everyone is making money, then the world is a giant Ponzi scheme.

Additional Minor Points for Discussion

- This article omits the introduction of Aave/Curve's GHO/crvUSD and other CDP mechanisms, as they seem unlikely to become market mainstream. MakerDAO has not successfully navigated the on-chain central bank route, and switching to other lending protocols will likely lead to the same dead end;

- Regarding stable calculations, such as UST and AMPL, the market is no longer focused on these outdated products; people prefer those based on real assets or mainstream on-chain assets;

- Pendle and Berachain: the former represents a new trend in DeFi, while the latter is a fusion mechanism of public chains + YBS. This part is too important, so I will dig a separate hole to write about it;

- This article does not cover institutional issuance or adoption, as well as off-chain payments, trading, and other uses, but focuses more on the sources of YBS yields and potential market opportunities.

- Additionally, I am currently working on a visualization tool for on-chain yield strategies. If any entrepreneurs/developers are interested, feel free to message me to discuss.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。