On April 14, 2025, the cryptocurrency market experienced another upheaval. On the Binance platform, the native token OM of the MANTRA project plummeted over 80% in just one hour (from 0:30 to 2:55 Beijing time), dropping from around $6 to less than $1, resulting in a market cap evaporation of several billion dollars.

The Rise and Fall of OM Token

According to AiCoin data, the OM token began to show abnormal fluctuations on the evening of April 13, and by the early hours of the 14th, the decline rapidly expanded, hitting a low of $0.37, down about 93% from its intraday high. Although the price later rebounded to above $0.6, it still shrank nearly 90% from its historical high of $9. This incident has been referred to by the community as another "black swan" event following the collapses of LUNA and FTX.

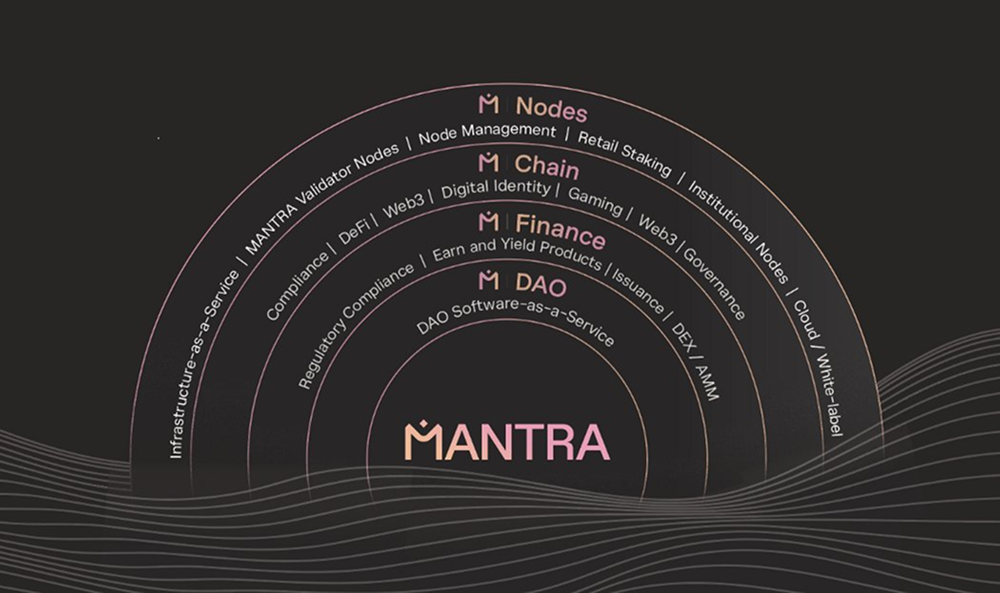

The MANTRA project is a Layer 1 blockchain focused on the tokenization of real-world assets (RWA) and has garnered market attention in recent years due to high-profile collaborations with Google Cloud and Dubai's DAMAC Group. OM, as the core token of its ecosystem, is used to incentivize user participation, governance, and airdrops. However, the significant gap between the project's high valuation and its low total value locked (TVL, only about $13 million) has long raised concerns among some analysts about its sustainability.

In response to the crash, the MANTRA team quickly issued a statement through their official X account, denying any internal issues within the project and stating that the price anomaly was caused by "disorderly liquidation," rather than team sell-offs or "scalping" behavior. Co-founder John Patrick Mullin further stated that preliminary investigations indicated that a large holder of OM faced "massive forced liquidation" on a centralized exchange (CEX), and that the liquidation occurred during a low liquidity period over the weekend, amplifying market impact. He emphasized that the team's tokens are still under custody and publicly shared relevant wallet addresses for community verification. Nevertheless, some investors expressed skepticism about this explanation, accusing the team of having a high concentration of holdings and potentially manipulating prices.

Market Background and Chain Reaction

The crash of the OM token is not an isolated incident. Recently, several tokens on the Binance platform, such as ACT, TST, MASK, and LEVER, have also seen significant declines, some related to adjustments in leverage and margin requirements by the exchange. Industry insiders revealed that Binance has tightened the liquidation rules for high-leverage positions, which may have led to some investors being forcibly liquidated during market fluctuations, triggering a chain sell-off. Following the OM incident, community members pointed out on the X platform that in the days leading up to the crash, multiple wallets transferred approximately 43.6 million OM (about 4.5% of the circulating supply) to Binance and OKX, with a total value exceeding $200 million, raising speculation about "strategic selling."

Additionally, on-chain data analysis platform Insomniac disclosed that since March 21, one address received about $36 million worth of OM from Binance and transferred 4.3 million tokens to OKX on April 12. These unusual fund flows are believed to be related to the liquidation event, but the specific reasons remain to be confirmed by official sources.

Zhao Changpeng's Statement and Industry Reflection

After the incident, Binance founder Zhao Changpeng (CZ) posted on the X platform in the early hours, advising investors to "not chase narratives" but to focus on projects with "users, revenue, and profits." He further stated that centralized exchanges should no longer set cumbersome listing review processes, and investors should decide for themselves which trading pairs to engage with. This statement elicited polarized reactions. On one hand, some agreed with his decentralization philosophy, believing that the market should be freely chosen by investors; on the other hand, critics questioned whether Binance had conducted sufficient due diligence on high-risk projects like OM, especially in light of recent token crash incidents that have brought the exchange's responsibilities into the spotlight.

Market Impact and Future Outlook

The crash of the OM token not only severely undermined investor confidence in the MANTRA ecosystem but also served as a wake-up call for the cryptocurrency market. In recent years, RWA tokenization has been viewed as an important application of blockchain technology, but issues such as high valuations, low liquidity, and concentrated holdings have frequently surfaced. Analysts pointed out that the MANTRA project previously claimed to have reached a $1 billion tokenization partnership with DAMAC and obtained a crypto license from Dubai's VARA, which temporarily boosted OM's price but failed to mask its fundamental shortcomings.

As of the time of writing, the OM price has stabilized around $0.8, but market sentiment remains fragile. In the future, whether MANTRA can restore its reputation through transparent communication and tangible progress remains to be seen.

This article represents the author's personal views and does not reflect the stance or views of this platform. This article is for informational sharing only and does not constitute any investment advice to anyone.

AiCoin official website: aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group chat: Customer Service Yingying, Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。