Outflows Persist With Significant Withdrawals on Bitcoin ETFs and Further Dips for Ether ETFs

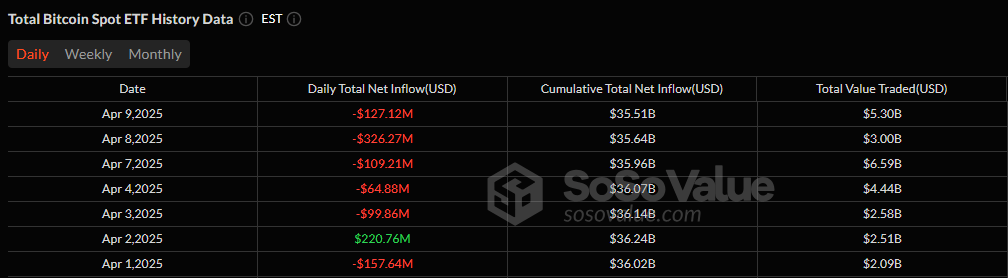

The red tide isn’t letting up on crypto exchange-traded funds (ETFs). Bitcoin ETFs recorded their 5th consecutive day of outflows, bleeding $127 million, as concerns over macro volatility continue to weigh on the market.

Blackrock’s IBIT once again shouldered the bulk of the retreat, seeing $89.71 million walk out the door. Grayscale’s GBTC followed with $33.80 million in outflows, while Wisdomtree’s BTCW and Vaneck’s HODL lost $5.67 million and $4.65 million, respectively.

However, it wasn’t entirely one-sided. Bitwise’s BITB posted a $6.71 million inflow, the first glimmer of green for any bitcoin ETF this week. Trading activity also bounced back, with total value traded hitting $5.3 billion, a sharp rise from Tuesday’s $3 billion. Encouragingly, net assets recovered to $91.79 billion, climbing above the $90 billion threshold.

Source: Sosovalue

In the ether ETF arena, the funds’ exit continued. Outflows totaled $11.19 million, led by Fidelity’s FETH ($5.73M) and Blackrock’s ETHA ($5.45M). The rest of the funds remained stagnant, showing no net movements.

Trading activity in ether ETFs was relatively strong at $823.68 million, but total net assets slid to $5.56 billion, well below the symbolic $6 billion mark.

As the week approaches its close, the persistence of these outflows signals a jittery market still grappling with inflation expectations, rate policy, and broader risk sentiment. However, the 90-day pause on tariffs by President Donald Trump could spark life back into the markets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。