Just yesterday, Binance announced the upcoming launch of a new reward-based margin asset called LDUSDT. This is another "stablecoin" financial product that can be used as margin for contract trading, following the introduction of BFUSD in November 2024. What is it, and how does it differ from BFUSD?

Not a Stablecoin "Stablecoin"

LDUSDT is a "yield-bearing margin asset" specifically designed for futures trading, launched by Binance. The official note emphasizes that it is not a stablecoin. Users can exchange their USDT for LDUSDT, which is a simple yield elastic product asset.

LDUSDT has two functions: it can serve as trading margin while also earning yields. Binance allows users to use LDUSDT as margin for perpetual contracts (U-based contracts), while holders of LDUSDT can continue to earn real-time annualized returns from Binance's "capital preservation earning" product.

In simple terms, like the previously launched BFUSD, LDUSDT allows users' assets to simultaneously have "low-risk returns" and "liquidity." For Binance, this is also highly beneficial, as it can earn more lending interest while also generating more contract funding fees. The founder of the well-established crypto community, Benmo Community, suggested that "if Binance chooses to use FDUSD to rebuild liquidity for lending and perpetual contracts, the underlying USD can also earn U.S. Treasury bonds." According to the reserve report presented by First Digital Labs on February 28, 85% of the underlying USD in FDUSD consists of U.S. Treasury bills. Essentially, LDUSDT is a product through which Binance shares these returns with users.

How Does It Differ from BFUSD?

After Binance launched BFUSD on November 27, 2024, similar products appeared on platforms like Dex Backpack and HUOBI, but none had the same impact as Binance's BFUSD. However, after the launch of BFUSD, although the model was innovative and participants generally believed it could enhance liquidity, some issues with the product also emerged.

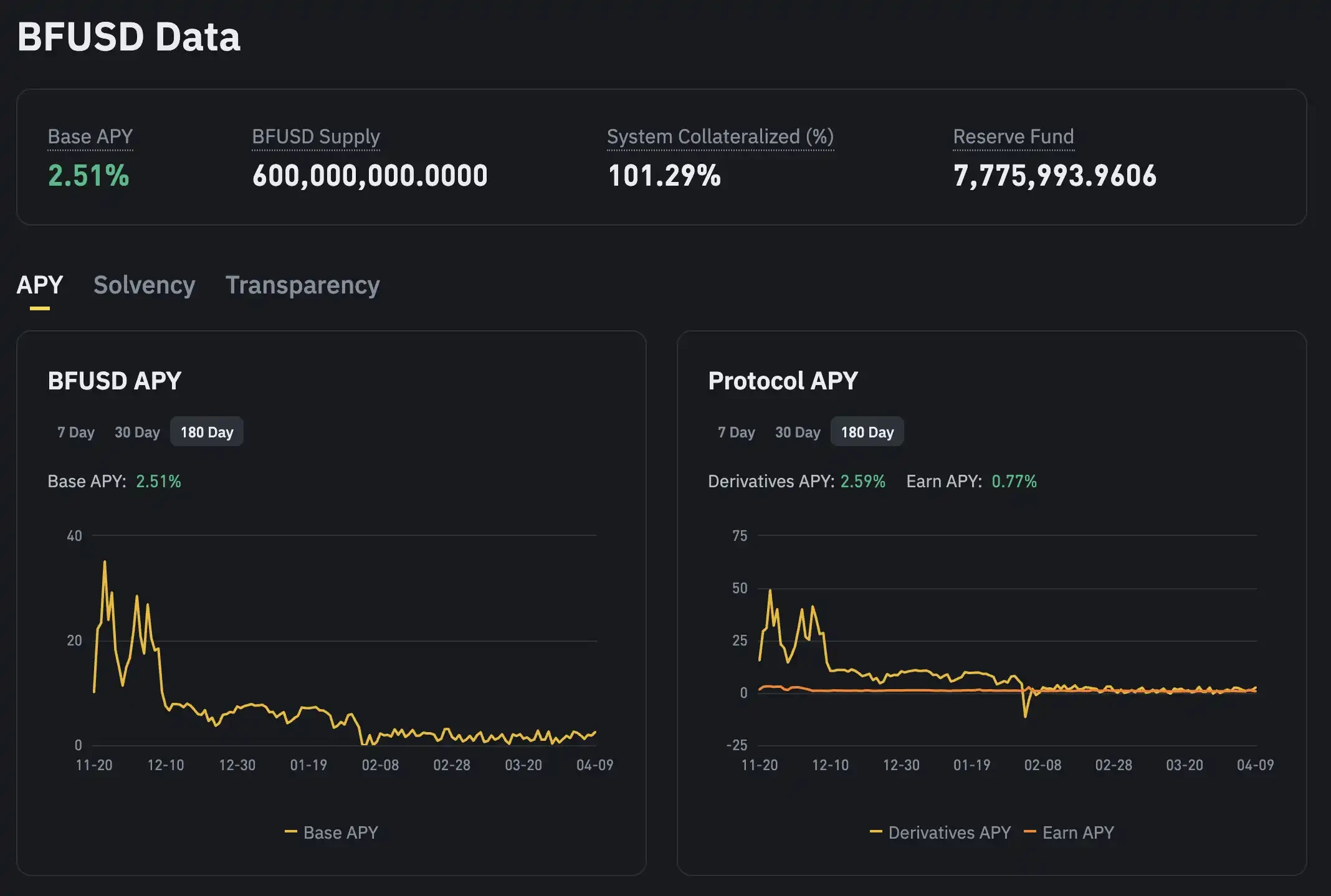

The yield volatility is significant; BFUSD's yield consists of a base interest rate and trading bonuses, with holding limits tied to VIP levels. This model highly depends on market conditions and the user's own trading activities. Although it can reach an extremely high APY of 38% during peak periods, if the market is one-sided or trading volume is insufficient, actual yields may fall short of expectations, even approaching the minimum value of the base interest rate. During the high liquidity period at the end of last year, it could maintain around 20-30%, but starting from February to March this year, the APY has often been close to 0%.

Retail and Professional Traders Have Different Rates; BFUSD's additional rewards are linked to users' futures trading volume. High-frequency traders or large accounts can significantly boost their yields, while ordinary users with low trading volumes may only receive the base interest rate, making it less cost-effective. This design makes BFUSD more suited for professional traders rather than ordinary retail investors.

LDUSDT, while similar in usage to BFUSD, has a different yield structure. BFUSD is based on hedging strategies and staking, while LDUSDT's income comes from Binance sharing the annualized returns of the capital preservation earning "Simple Earn" product, which includes part of the platform fees, lending income, or returns from some low-risk investments.

For these two reasons, BFUSD is currently unpopular in the market. Unlike BFUSD, which can fluctuate significantly due to funding rate volatility, LDUSDT's advantage is its relative stability, but the trade-off is that the yield will not be as high. While these yields may seem insignificant in a bull market, in the current environment of relatively depleted liquidity, it is a good choice for those wanting to maintain stable returns and liquidity. Additionally, it simplifies participation for more retail investors without relying on their own trading strategies.

What Does Binance Aim to Achieve by Continuously Launching Yield Stablecoins?

Overall, BFUSD is more like an investment tool that creates additional value for users through Binance's proactive actions, serving as an extra "buff" for traders who frequently trade during a bull market. In contrast, LDUSDT acts as a gateway, connecting Simple Earn and futures trading, incentivizing conservative users to engage in trading during a bear market.

KOL "Loki_Zeng" remarked, "Binance is too competitive; I thought the separation of stablecoin yield and circulation would be an inevitable outcome, but I didn't expect that the revolution would come from Binance itself." Whether it's BFUSD or LDUSDT, what Binance aims to do is activate a large amount of idle stablecoins on the exchange, leverage them, and keep them within the Binance ecosystem to continuously provide vitality for actual business.

Can the water in this liquidity towel be squeezed by a larger hand to help us get through the dry times before "watering"? Currently, Binance has not released more detailed information about LDUSDT, and Rhythm BlockBeats will continue to monitor this matter.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。