U.S. equities climbed marginally on Wednesday, with market participants speculating that a potential floor has been established, though persistent turbulence continues to characterize broader markets. The rift between China and the U.S. appears to be intensifying, as President Xi Jinping demonstrates no inclination to retreat from ongoing trade hostilities.

Beijing declared its intention to elevate tariffs on American imports to 84%, effective April 10, condemning U.S. measures as blatant “unilateralism, protectionism, and economic bullying.” Echoing the pattern observed in equities, bitcoin ( BTC) has traded within a defined corridor, maintaining relative stability as market observers posit that a price floor may have concurrently emerged.

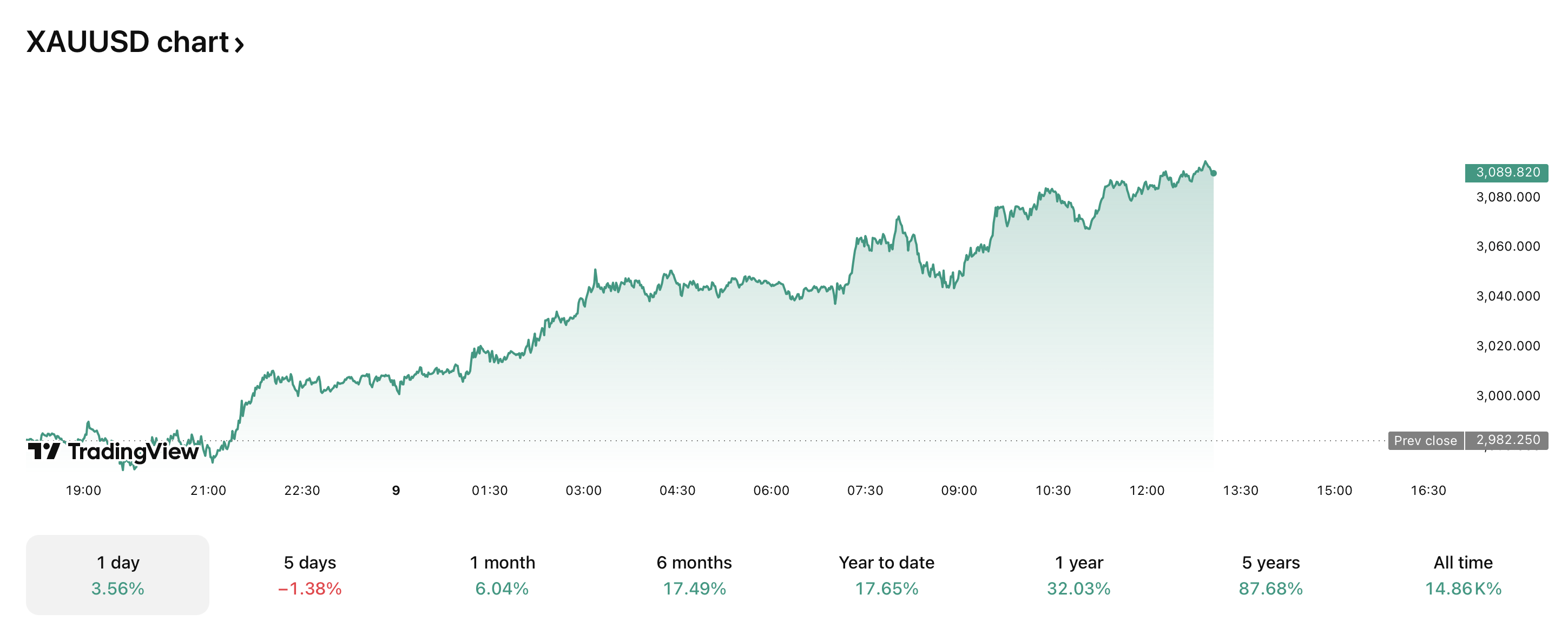

Precious metals, conversely, have advanced, with the price of one troy ounce of gold climbing 3.56% over the past 24 hours. Silver has likewise appreciated, rising 2.08% versus the U.S. dollar. As of 1 p.m. ET on Wednesday, gold traded at $3,090 per ounce, while silver fetched $30.44. Enthusiasts of precious metals anticipate sustained momentum, citing investor inflows into Treasury bonds, bullion, and liquid assets as evidence of shifting risk appetites.

Gold’s recent climb—surpassing $3,000 per ounce for the first time in recorded history—marks a notable milestone, though its percentage growth over time trails prior records. The current advance stems from geopolitical friction, aggressive central bank acquisitions, and macroeconomic uncertainty, propelling prices to an all-time peak of $3,167 on April 2, 2025.

Historical context, however, highlights a more dramatic chapter: between November 1978 and January 1980, gold prices leapt over 300% amid hyperinflation and energy turmoil. In comparison, 2025’s 17.65% year-to-date rise follows a 27% gain in 2024. Advocates argue that parallels to the late 1970s volatility could foreshadow even steeper appreciation, positioning gold for outsized returns in turbulent times.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。