After President Donald Trump slapped a 104% tariff on China, what one analyst characterized as “doubling down on dumb,” the communist state retaliated with a reciprocal 84% levy on all incoming U.S. imports, but bitcoin barely reacted.

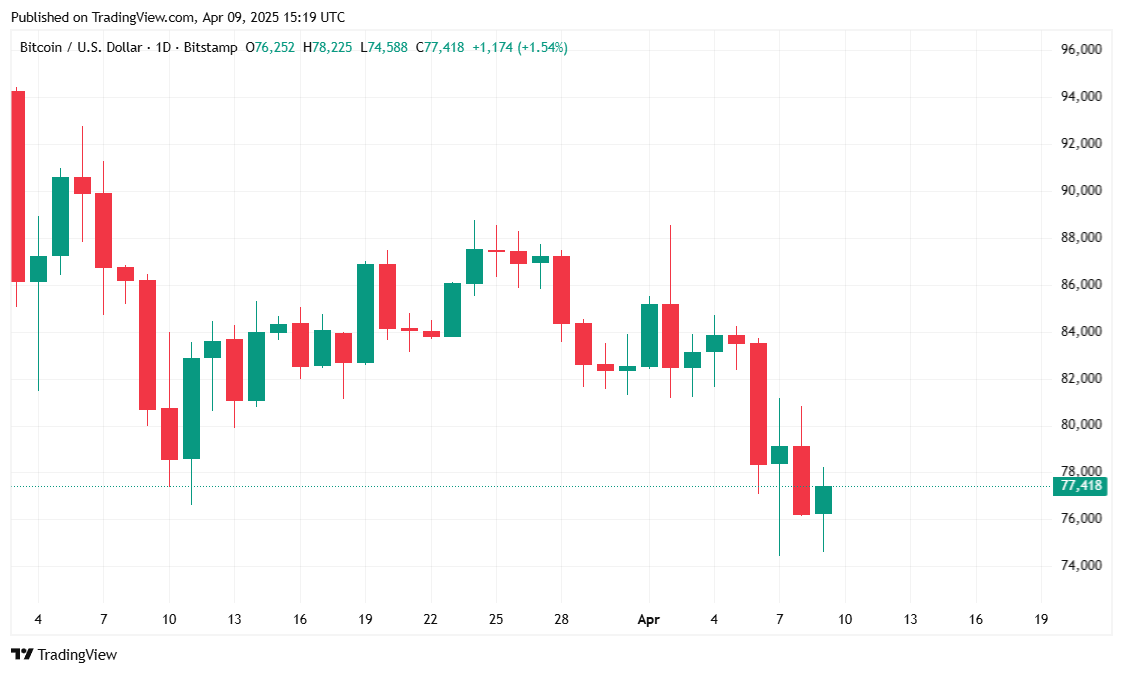

The digital asset is currently trading at $77,411.52, marking a 1.37% drop over the past 24 hours and extending its weekly losses to 10.47%, according to Coinmarketcap. Prices fluctuated between $74,589.67 and $78,486.21 in the past day, showing some signs of volatility as investors reacted to market uncertainty.

( BTC price / Trading View)

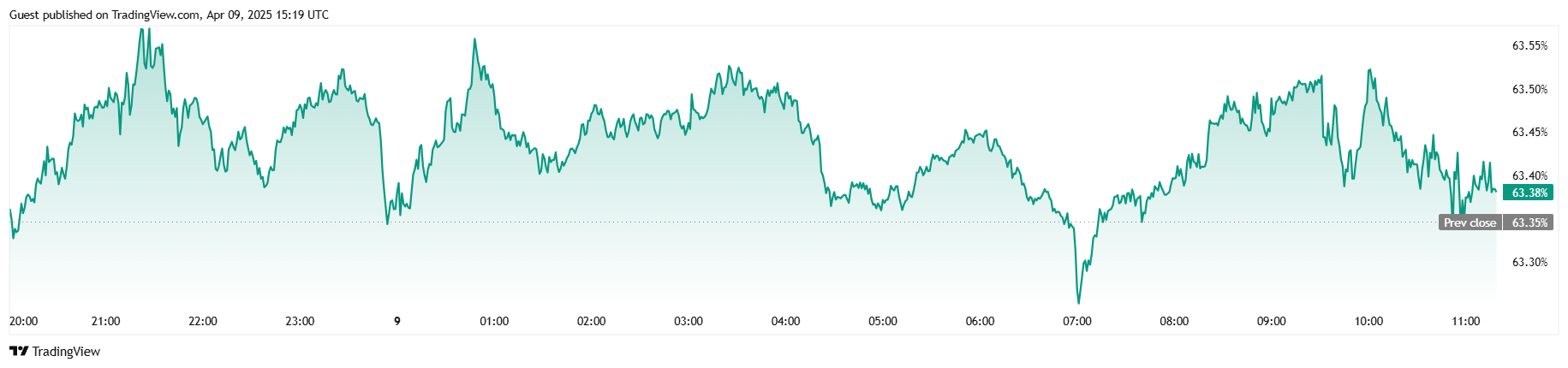

Despite the small price decline, trading volume surged by 22.90% over the last 24 hours to $62.60 billion, signaling renewed interest among traders, potentially driven by bargain hunting or short-term positioning. However, the increased activity did not translate into bullish momentum, as bitcoin’s market capitalization dipped by 1.19% to $1.53 trillion. BTC’s market dominance remained steady, inching up 0.01% to 63.35%, reflecting the ongoing weakness across the broader crypto market.

( BTC dominance / Trading View)

In derivatives, bitcoin futures open interest rose 1.64% to $51.44 billion, suggesting that traders are still actively speculating despite the price drop. Liquidation data from Coinglass shows $2.43 million in total liquidations, with $1.80 million from long positions, indicating that a modest number of bullish traders were caught on the wrong side of the move. Meanwhile, short traders were liquidated to the tune of $633,170.

Despite China’s trade spat with the U.S., at the time of reporting, the S&P 500 is up slightly by 0.88%, the Dow has barely budged, increasing by 0.48%, and the Nasdaq had a decent uptick of 1.89%.

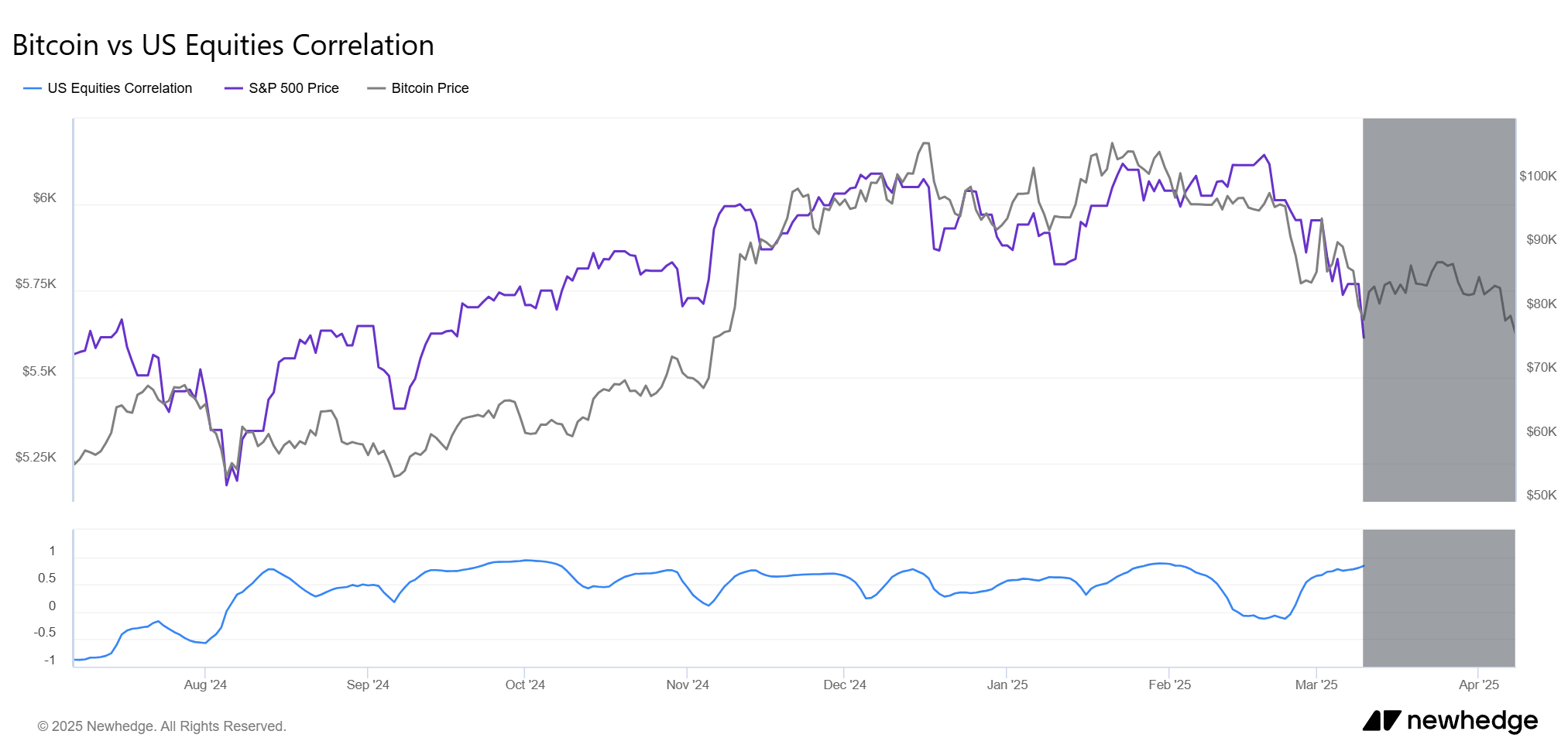

But crypto markets continue to bleed, down 2.21% over 24 hours to a market capitalization of $2.46 trillion. The sideways movement seen in traditional markets appears to have carried over to the price of bitcoin. After all, BTC has a 0.66 thirty-day rolling correlation with the stock market according to crypto research platform Newhedge.

(30-day rolling correlation of 0.66 between bitcoin price and the S&P 500 index / Newhedge)

Based on such a relationship, the cryptocurrency will likely react similarly to traditional assets, at least in the near term.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。