This stretch has proven arduous for bitcoin miners, with earnings contracting sharply. On April 2, coinciding with former President Donald Trump’s unveiling of expansive trade tariffs, hashprice hovered at $48.45 before cascading to its current $40 per PH/s.

Compounding the strain, the mining complexity metric vaulted 6.81% just four days prior at block 891,072, settling at an unmatched difficulty of 121.51 trillion. Conventional logic suggests such a trifecta— BTC’s depreciating value, dwindling miner income, and heightened operational demands—would erode global computational output.

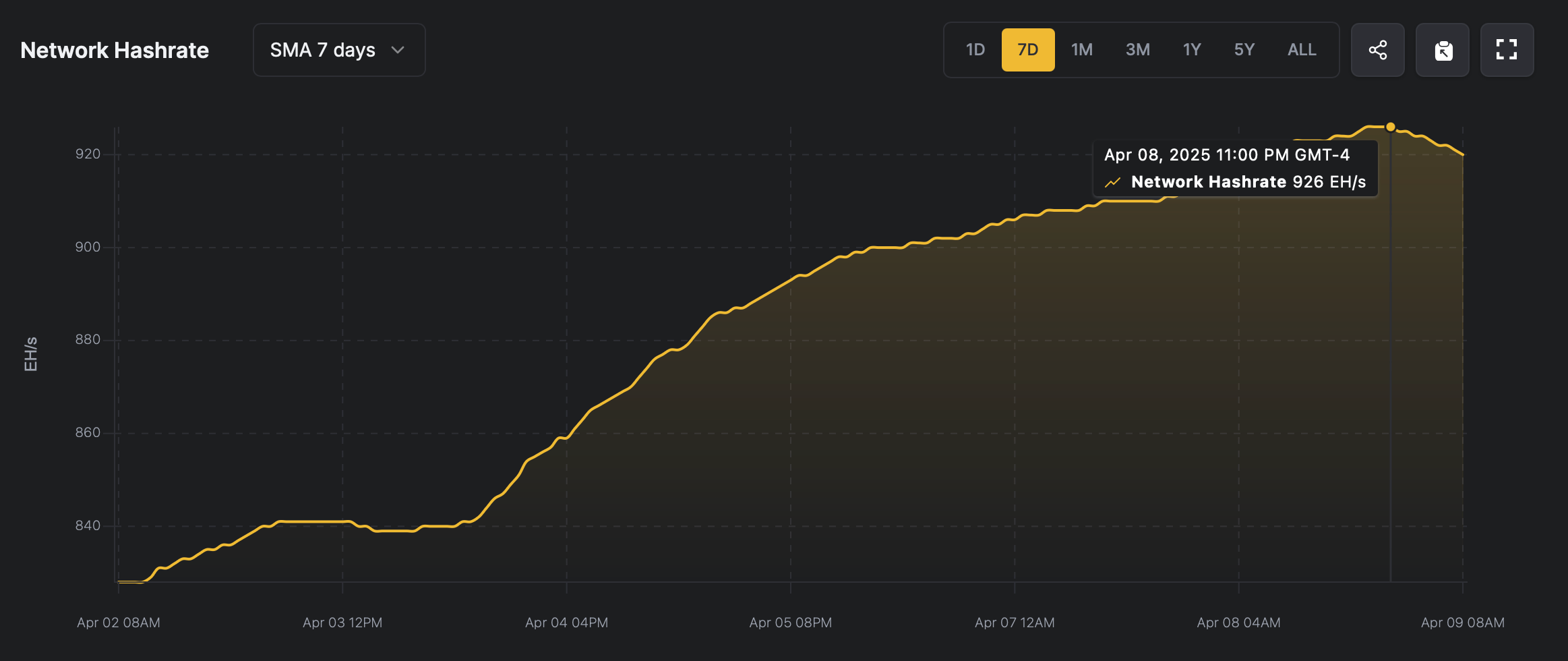

Yet the inverse unfolded: Bitcoin’s hashrate defied gravity, scaling to an unparalleled apex on Tuesday, April 8, 2025, per hashrateindex.com’s seven-day simple moving average (SMA). The metric briefly flirted with 926 exahashes per second (EH/s), inching within 74 EH/s of the elusive 1 zettahash (ZH/s) threshold.

By 9:30 a.m. ET on Wednesday, April 9, it moderated slightly to 921.06 EH/s, lingering near its stratospheric peak. Block intervals have mirrored the anticipated ten-minute norm, and while the impending difficulty recalibration on April 19 appears marginal, volatility still remains highly plausible.

Meanwhile, transactional lethargy across Bitcoin’s blockchain has sparked a curious stretch of underutilized blocks and diminished fee pressure. Presently, a premium transaction commands a modest 2 satoshis per virtual byte (sat/vB)—translating to a mere $0.22 per transfer—as demand wanes.

Over the past day, fee-derived income accounted for a paltry 1.32% of miners’ total rewards, exposing the ecosystem’s thinning profit margins. Yet, in a display of algorithmic defiance, the network’s computational might persists in scaling stratospheric heights.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。