Original Author: YBB Capital Researcher Ac-Core

I. Trade War Escalates, 24-Hour Cross-Market Flash Crash Relay

Image Source: Forbes

1.1 Global Financial Market Crash!

On the morning of April 7, global financial markets crashed across the board amid panic over escalating trade friction involving "reciprocal tariffs." Stocks, crude oil, precious metals, and even cryptocurrencies all plummeted. During the Asian trading session, U.S. stock index futures continued last week's downward trend, with Nasdaq 100 futures plunging 5%, and S&P 500 and Dow futures both dropping over 4%. The European market was similarly gloomy, with German DAX futures falling nearly 5%, and European STOXX 50 and UK FTSE index futures both breaching the 4% decline mark.

The Asian market opened with a stampede: South Korea's KOSPI 200 futures plummeted 5% in the morning session, triggering a trading halt; Australia's stock index saw its decline widen from 2.75% to 6% within two hours of opening; Singapore's Straits Times Index suffered a record drop of 7.29% in a single day. The Middle Eastern market experienced an early "Black Sunday," with Saudi Tadawul Index crashing 6.1% in one day, and stock indices in oil-producing countries like Qatar and Kuwait dropping over 5.5%.

The commodities market was filled with despair: WTI crude oil fell below the psychological threshold of $60, hitting a two-year low with a daily drop of 4%; gold unexpectedly fell below the $3010 support level, and silver's weekly decline expanded to 13%; in the cryptocurrency realm, Bitcoin fell below a key support level, and Ethereum plummeted 10% in a single day, shattering the myth of digital assets as a safe haven.

1.2 Impact on the Cryptocurrency Market

Short-term Market Shock

Recent policies from the Trump administration have had a significant impact on the cryptocurrency market. In January, when Trump signed an executive order to establish a regulatory framework for cryptocurrencies and study a national cryptocurrency reserve, the market reacted positively, pushing the total market capitalization of cryptocurrencies to $3.65 trillion by the end of the month, achieving a cumulative increase of 9.14%. However, the introduction of tariffs in February quickly reversed the previous market trend. Particularly after the announcement on February 3 of long-term import tariffs on China, Canada, and Mexico, the cryptocurrency market experienced a significant decline correlated with the stock market: Bitcoin dropped 8% within 24 hours, Ethereum fell over 10%, leading to $900 million in liquidations across the network and 310,000 investors being forcibly liquidated.

From a transmission mechanism perspective, tariff policies affect the cryptocurrency market through multiple pathways: first, the intensification of trade friction exacerbates global market volatility, strengthening the dollar as a safe-haven asset and prompting capital to flow back to the U.S. market; second, institutional investors may liquidate cryptocurrency assets to offset losses in other investment portfolios to manage risk; inflationary pressures triggered by tariffs may weaken consumer purchasing power, thereby reducing market risk appetite, especially in the highly volatile cryptocurrency market.

Long-term Potential Opportunities

Despite the significant short-term shocks, tariff policies may create structural opportunities for the cryptocurrency market in the following ways:

Expectations of Liquidity Expansion

The Trump administration may implement expansionary fiscal policies through tax cuts and infrastructure investments, which will increase market liquidity to compensate for fiscal deficits or debt monetization measures. Historical experience shows that during the $3 trillion expansion of the Federal Reserve's balance sheet in 2020, Bitcoin's price rose over 300%, indicating that a new round of liquidity injection may support cryptocurrency assets.Strengthened Anti-Inflation Properties

Eugene Epstein, head of trading and structured products at Moneycorp, pointed out that if the trade war leads to a depreciation of the dollar, Bitcoin may become a hedging tool due to its fixed supply characteristics. Competitive currency devaluation triggered by tariff policies may encourage more investors to use cryptocurrencies as an alternative channel for cross-border capital flow.

II. "Businessman + Dictator = Market Manipulation"

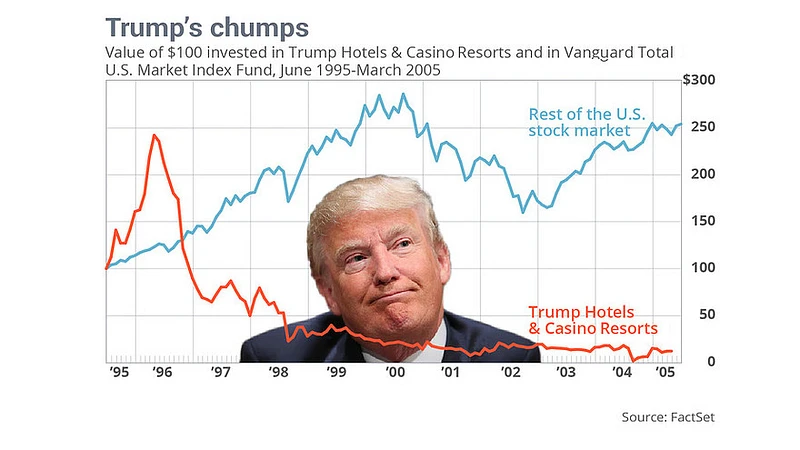

Image Source: MarketWatch

2.1 Starting from the Tariff War of Trade Deficits

In Trump's businessman mindset, the so-called "trade deficit" is not a complex economic concept but rather an unequal price relationship between buyers and suppliers in a procurement negotiation. Economist Fu Peng's explanation is insightful: the buyer calls all potential suppliers to the table and says, "We need to renegotiate the terms of cooperation." Doesn't this sound a bit like centralized bidding in the pharmaceutical industry? Indeed, Trump's approach is a typical bidding tactic.

If tariffs are viewed as a form of "price restriction," then the high tariffs set by Trump are essentially a psychological price point predetermined by the buyer in a bidding process—those who want to win the bid must compete below this price. This setting may sound crude, even somewhat arbitrary, but it is very common in many actual procurement negotiations, especially in large centralized procurement projects led by the government.

Some may question whether Trump made these decisions on a whim using an Excel spreadsheet; however, that is not the case. His strategy is not complicated; it essentially involves artificially setting a "threshold price" to force suppliers to come to the negotiating table. The most direct effect of this tactic is that those who do not come to negotiate are automatically excluded, because if you do not accept this "maximum bid," you will be taxed under the worst conditions, essentially forfeiting your market access.

At this point, countries wishing to participate in this "bidding" must sit down and negotiate with the U.S.—how to lower tariffs, how to allocate products, how to change rules. It appears to be a trade confrontation, but it is more like a commercial negotiation driven by rounds of games. For this reason, the report by Citibank's head of Asian trading strategy, Mohammed Apabai, makes it very clear: Trump is currently using a typical negotiation tactic.

For small and medium-sized suppliers, the space is actually quite limited, as they find it difficult to negotiate with the buyer on their own. Thus, the buyer (the U.S.) uses the concessions of these small suppliers to further pressure larger suppliers. This strategy of first breaking the periphery and then surrounding the center is essentially using concessions from the periphery to force core players to compromise.

So, in a sense, Trump's so-called "tariff war" is not entirely about starting a war but rather about creating a situation where "negotiation is unavoidable." It is about forcing you to negotiate or forcing you out; that is the real game he wants to play.

2.2 "Dictator"

Although the U.S. has a strong constitutional system and democratic tradition, during Trump's presidency, many of his actions and behaviors have been widely criticized as having "dictatorial" tendencies. This assessment is not unfounded but is based on his repeated assaults on institutional norms, democratic mechanisms, public opinion environments, and power structures. While Trump did not completely break the institutional framework of the U.S., his actions reflect typical dictatorial characteristics—breaking institutional boundaries, suppressing dissent, and reinforcing personal authority.

Undermining Institutional Checks and Balances, Concentrating Power by Bypassing Congress

During Trump's presidency, he frequently used executive orders to advance policies, including building the U.S.-Mexico border wall, issuing the "Muslim ban," and rolling back environmental regulations. He even declared a "national emergency" to access military funds when Congress refused to allocate money for the border wall, circumventing the constraints of the legislative branch. Such actions undermine the principle of separation of powers enshrined in the U.S. Constitution, leading to an unprecedented expansion of executive power, which is seen as having a clear tendency toward centralization.

Attacking Press Freedom, Creating an "Enemy" Style Public Opinion Environment

Trump often referred to media outlets that criticized him as "fake news," even labeling traditional news organizations like CNN and The New York Times as "enemies of the people." He repeatedly attacked journalists, television hosts, and commentators on Twitter, inciting hostility toward the media among his supporters. In political communication studies, this method of "delegitimizing" the media is one of the common strategies of dictatorial leadership to control public opinion, aimed at weakening public trust in diverse information sources and establishing an "information monopoly."

Interfering with Judicial Independence, Emphasizing "Loyalty over Expertise"

Trump has repeatedly attacked the judicial system in public, especially when courts ruled against his policies, even directly criticizing judges by name. For example, he referred to a judge who opposed his immigration policy as a "Mexican," implying that the ruling was unfair. Additionally, in high-level appointments, he often prioritized loyalty over professional competence, frequently changing key positions such as Attorney General and FBI Director, severely impacting judicial independence.

Refusing Election Results, Undermining the Tradition of Peaceful Power Transition

After the 2020 presidential election, Trump adamantly refused to acknowledge his defeat, claiming the election was "stolen," and repeatedly demanded states to "recount" or "overturn results." More seriously, his rhetoric ultimately led to the Capitol riot on January 6, 2021, where a large number of supporters stormed the Capitol in an attempt to prevent the certification of Biden's election. This event has been widely referred to in international discourse as "the dark day of American democracy" and is a clear attempt to interfere with the peaceful transfer of power, exhibiting characteristics of authoritarianism.

Promoting Cult of Personality, Forming a "Leader-Only" Narrative

Trump has implemented a highly personalized style of governance within the party and government, demanding absolute loyalty. He frequently boasts about himself at rallies, portraying himself as "the greatest president in history," and implying that without him, the country would decline. This political discourse creates a "messianic" personal myth, weakening the presence of collective governance and institutional norms, and easily sliding into cult of personality and populism.

2.3 Trump's Double Game: Not a President but a "Stock God"

Donald Trump, the billionaire from a real estate empire, surprised many when he successfully became the President of the United States in 2016, as he was seen as a "non-typical political figure" ascending to the world's most powerful position. Looking at his governing style and political behavior, combined with the hypothetical positioning of Trump as a "businessman" and "dictator" discussed above, I personally believe that Trump is not a true "president" in the conventional sense but rather a "super trader" who treats power, public opinion, and financial markets as tools: a "stock god" who turns the White House into a trading room on Wall Street to profit from market volatility. Thus, from the perspective of a "trader," reinterpreting Trump's unconventional actions seems to make all his non-conventional operations reasonable.

Businessman Nature: Viewing the Presidency as a "Super Trading Platform"

Trump is a typical businessman-type political figure. He has spent decades in the business world, adept at creating topics, controlling public opinion, and speculating for profit. He does not govern the country according to political logic but views American and global affairs from a "business perspective." His governance is not aimed at institutional improvement or global leadership but rather at pursuing "transaction results," emphasizing "America First," which essentially prioritizes "profit."

Moreover, Trump also exhibits strong "dictatorial" characteristics, particularly in the way he guides public opinion and concentrates power. He controls the rhythm of information, eagerly using Twitter to release market-shocking statements such as "We are about to reach a major agreement with China" or "The Federal Reserve should cut interest rates," often causing severe fluctuations in the financial markets. For an ordinary president, these statements might be seen as diplomatic postures; but for a leader who operates with a "market manipulation mindset," these are precise tools for controlling market trends.

Dictatorial Rhetoric: Using Information to Intervene in Market Sentiment

If a core characteristic of a dictator is "control and utilization of information," then Trump is a master at "shaking the market" through information in modern society. He does not need a censorship system or to shut down the media; instead, he becomes the strongest source of information for the market by creating uncertainty and confrontational emotions.

In the Twitter era, he almost daily releases "market-impacting statements" like a financial news anchor:

"China will sign a huge trade agreement";

"If the Federal Reserve does not cut interest rates, the U.S. will lose its competitiveness";

"Oil prices are too high; it's OPEC's fault";

"The border wall will be built; the market should feel reassured".

These statements do not constitute formal policy but frequently lead to dramatic fluctuations in the Dow Jones Index, S&P 500, gold, and oil markets. The timing, wording, and even the choice of when to release information all bear the marks of manipulation.

Even more striking is his repeated "turning" at different times—praising the progress of U.S.-China negotiations one day and announcing tariff increases the next; stating in the morning that the Federal Reserve should cut interest rates and then saying in the afternoon that the dollar is too weak. This back-and-forth is not political oscillation but rather precise control of market sentiment, turning volatility into manageable harvesting opportunities.

Family Capital Network: An Arbitrage Channel Built on Power and Information

Trump's business network did not cease after he was elected president; rather, it was endowed with more "legitimacy" and influence. His family members, such as Jared Kushner and Ivanka Trump, continue to be widely involved in political and business affairs, having direct influence in various fields such as Middle Eastern policy, technology investment, and real estate. Reports have frequently surfaced about his family trust funds and close friends' investment groups utilizing policy foresight for financial arbitrage:

Before Trump's large-scale tax cuts were announced, some funds closely related to him heavily invested in U.S. stocks;

Whenever Trump hinted at possibly releasing strategic oil reserves or launching military actions, suspicious trading always appeared in the energy market ahead of time;

During the trade war with China, the market reacted highly sensitively to Trump's statements about "reaching an agreement," often resulting in short-term spikes.

While it is impossible to directly substantiate insider trading, his control over information and the concentration of policy decision-making power give the "arbitrage channel" substantial practical value. The president is no longer a representative of the system but rather a "trader" with unlimited prior information and discourse power.

"Creating Chaos—Guiding Direction—Harvesting Results": A Typical Tactic of Market Manipulators

Traditional presidents seek stability and continuity, while Trump seems to be constantly "creating chaos." He excels at inciting market panic and then guiding the market's recovery through "soothing" statements—this entire process resembles a wave operation:

"Fire at Iran"—market panic—release negotiation signals the next day—market rebounds;

Announce increased tariffs on China—tech stocks plummet—days later state "China's attitude is very good"—rebound;

During the pandemic, claim the outbreak is "under control"—stock market briefly rebounds—subsequent information reversal leads to another decline.

These seemingly random statements are backed by a high degree of coordination in emotional guidance and market rhythm. He understands the public's expected reactions, acting like a super market operator who leads the collective psychology of global investors.

Post-Trump Era: Personal Brand Continues to Influence the Market

Even after leaving office, Trump can still influence market rhythms. He casually announces "the possibility of running again," causing stocks related to energy, military, social media, and conservative technology to immediately react. For example, the Trump Media Group (Truth Social) went public through a shell company, and despite lacking substantial profitability, the stock surged significantly—capital markets treat "Trump" itself as a speculative target, reflecting his brand's financialization.

III. The Crypto Market Orchestrated by the U.S.: A Conspiracy of Capital and Power Control

Image Source: Al Jazeera

3.1 Power Restructuring: What Trump Wants is Not Bitcoin, but Bitcoin "Americanized"

Today's crypto market is no longer a haven for decentralized ideals but a new type of financial colony jointly manipulated by U.S. capital and power. Since the approval of Bitcoin spot ETFs, Wall Street giants like BlackRock, Fidelity, and MicroStrategy have rapidly built BTC spot positions, locking Bitcoin, which originally belonged to the tech community, into Wall Street's vaults. Financialization and politicization have become the dominant logic, with the prices of crypto assets no longer determined by spontaneous market behavior but reliant on the Federal Reserve's interest rate signals, SEC regulatory dynamics, and even a presidential candidate's verbal commitment to "support crypto."

The essence of this "Americanization" is to re-embed decentralized assets into a center—the U.S. financial hegemony system. ETFs cause the crypto market to rise and fall in tandem with U.S. stocks, and behind the candlestick charts are the pulses of U.S. bond market fluctuations and CPI data. Once seen as a symbol of freedom, Bitcoin is increasingly resembling an "alternative Nasdaq component stock that reflects the Federal Reserve's intentions with a delay."

3.2 Strategic Value of Bitcoin: A Non-Sovereign Reserve Asset, but a Gray Backup for Dollar Hegemony

The Trump era laid the groundwork for Bitcoin's national financial positioning. He did not directly declare support like traditional politicians; instead, he allowed for the migration of computing power, relaxed regulatory gray areas, and supported mining infrastructure, incorporating Bitcoin into the U.S. strategic financial resource pool. As expectations of a weakening traditional dollar credit system grow, Bitcoin is gradually taking on the role of a "non-sovereign reserve asset," being shaped into a safe-haven alternative amid financial turmoil.

This layout is very American: unannounced warfare, silently assimilating. The U.S. has dominated most of Bitcoin's financial infrastructure (Coinbase, CME, BlackRock ETF) and further mastered on-chain settlement capabilities through dollar-pegged stablecoins (USDC). When global turmoil, capital flight, and trust transfer occur, the U.S. has quietly acquired this "dollar alternative in de-dollarization."

Trump may see further: Bitcoin's faith has nothing to do with him; rather, it is about domesticating its financial attributes as another "currency sovereignty tool" for the U.S. In scenarios where the dollar is restricted, SWIFT is difficult to use, and fiat currencies are devalued, Bitcoin becomes a backup plan for maintaining power.

3.3 The Truth of Manipulation? Trump is Not Just a President, but a "Super Dealer" in the Financial Battlefield of Traffic

First, understand a fact: in any financial market, 90% of the time is dominated by fluctuations, and only "big fluctuations can make big money."

So, based on all the above points, while Trump appears to be a president on the surface, he is actually more like a super trader driven by traffic, with the sole purpose of: creating market volatility and controlling market fluctuations, all to profit from the volatility.

Trump is a speculator adept at influencing market direction through information, traffic, and influence, profiting from market fluctuations. On one hand, he supports Bitcoin as a "U.S. strategic reserve," while on the other, he introduces the meme token $TRUMP to siphon off market liquidity—this is a market manipulation strategy of "information intervention + liquidity extraction."

More brutally, the trends in the crypto market increasingly depend on U.S. political maneuvering: Federal Reserve statements, SEC dynamics, presidential candidates' remarks, congressional hearing sentiments… The decentralized crypto system, which should be independent, is now deeply embedded in the logic of dollar policy, U.S. stock structures, and large U.S. capital. The crypto market has become an "extended battlefield" of the American financial system.

We are also witnessing a harsh reality: the market appears free, yet it has long been orchestrated; prices seem volatile, but behind them are those controlling information and traffic setting the stage.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。