Blackrock’s IBIT Leads $326 Million Bitcoin ETF Exit, Ether ETFs Also Slip

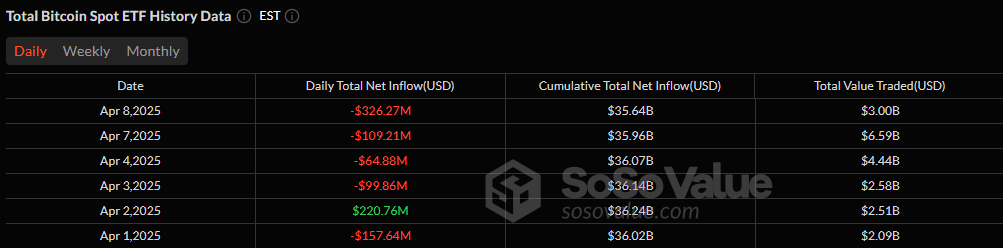

Bitcoin exchange-traded funds (ETFs) are deep in outflow territory, and Tuesday, April 8’s action only added to the pressure. A staggering $326.27 million left the market, marking the 4th consecutive session of redemptions and reinforcing the cautious stance investors are taking in early April.

The lion’s share of the retreat came from Blackrock’s iShares Bitcoin Trust (IBIT), which saw a massive $252.90 million exit. That alone accounted for over three-quarters of the day’s total outflow.

Bitwise’s BITB and Ark 21Shares’ ARKB followed with $21.71 million and $19.90 million in losses, respectively. Smaller outflows trickled from Franklin’s EZBC ($8.89 million), Grayscale’s GBTC ($8.49 million), Grayscale’s BTC ($7.48 million), and Invesco’s BTCO ($6.90 million).

Source: Sosovalue

Despite the heavy withdrawals, trading activity was more subdued compared to Monday, April 7. Total value traded dropped to $3 billion, down sharply from $6.59 billion. Total net assets for bitcoin ETFs took another hit, slipping to $85.76 billion by day’s end.

Ether ETFs didn’t buck the trend. After a quiet session the day before, the space saw renewed outflows, though on a much smaller scale. Fidelity’s FETH logged a $3.29 million exit, the only ether ETF to move for the day.

As capital continues to flow out of digital asset funds, the broader question remains: Are investors simply rotating or bracing for more turbulence ahead?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。