Recently, Forbes reported on CertiK's alarming data regarding security incidents in the cryptocurrency industry for 2024—760 security vulnerabilities, $2.36 billion in losses, and a 31% year-on-year surge. This set of numbers not only reflects the industry's pain points but also poses a question to every builder: as the market nurtures innovation amid volatility, how can we ensure that technological breakthroughs and user trust truly go hand in hand?

Over the past decade, blockchain technology has transitioned from a geek experiment to mainstream visibility, but security has always been a sword of Damocles. Whether it’s the $1.4 billion attack on Bybit or the endless stream of vulnerabilities, they repeatedly validate a truth: innovation without a safety net will ultimately become a house of cards. As quoted in the article, CertiK co-founder Professor Gu Ronghui stated, "Security is not a competitive advantage, but a shared responsibility." When the pace of hacker technology iteration surpasses the upgrade of protective systems, single-point defenses are insufficient to address systemic risks. Only comprehensive security construction can usher in significant development for Web 3.0.

The following is the full report:

Market Turbulence Accelerates Innovation in the Web 3.0 Industry

As the risk of a U.S. economic recession rises, JPMorgan has increased its probability from 30% at the beginning of the year to 40%, while Goldman Sachs has raised its estimate from 15% to 20%. Since the beginning of 2025, with the U.S. stock market showing weak performance, the "Trump rally" has noticeably weakened.

After U.S. President Trump announced new tariffs on American imports on "Liberation Day" (on April 2, he declared this day as "Liberation Day"), the market immediately plummeted, with the tech-heavy Nasdaq index down 17% year-to-date, and many economists predicting an upward trend in U.S. inflation levels.

Trump stated that although his high tariff policy would reach the highest level in over a century and could impact financial markets, it would ultimately lead to a "strong economic recovery."

Last month, U.S. Treasury Secretary Scott Bessent remarked that the market decline caused by tariff issues was "a healthy adjustment." Kevin Hassett, chairman of the U.S. National Economic Council, also stated, "Despite some fluctuations in this quarter's data, we remain very optimistic about the long-term economic outlook."

The Web 3.0 market, which is highly correlated with tech stocks, has seen over a trillion dollars in market value evaporate in recent weeks. Experienced Web 3.0 practitioners understand that volatility is a fundamental characteristic of market operations. In such a rapidly changing market, seasoned Web 3.0 investors and developers will return to the trenches, focusing on driving industry innovation. In fact, prolonged market turbulence often provides good opportunities for investment and the creation of the next generation of products.

Building Truly Useful and Secure Products for General Investors

Beyond Bitcoin and Ethereum, many projects in the Web 3.0 ecosystem lack a solid value foundation, with liquidity often revolving around hot narratives. The industry has yet to fully establish a profit model driven by fundamentals, and capital flows often hinder sustainable development.

The total market value of the meme coin market shrank from $125 billion in December 2024 to $53 billion in March 2025, a decline of over 57%. In February of this year, investors moved $485 million from Solana to Ethereum, Arbitrum, and BNB Chain, with capital rotation being the main theme of the market.

Byron Gilliam, a market strategist and senior industry observer at Blockworks, stated, "Meme coins are certainly not stocks; they are more like lottery tickets—some people do hit the jackpot." He pointed out that the meme coin issuance platform pump.fun generated $600 million in revenue in just 14 months, but offered little return to users: of the 8.7 million tokens launched on the platform, only 4 now have a market value exceeding $100 million.

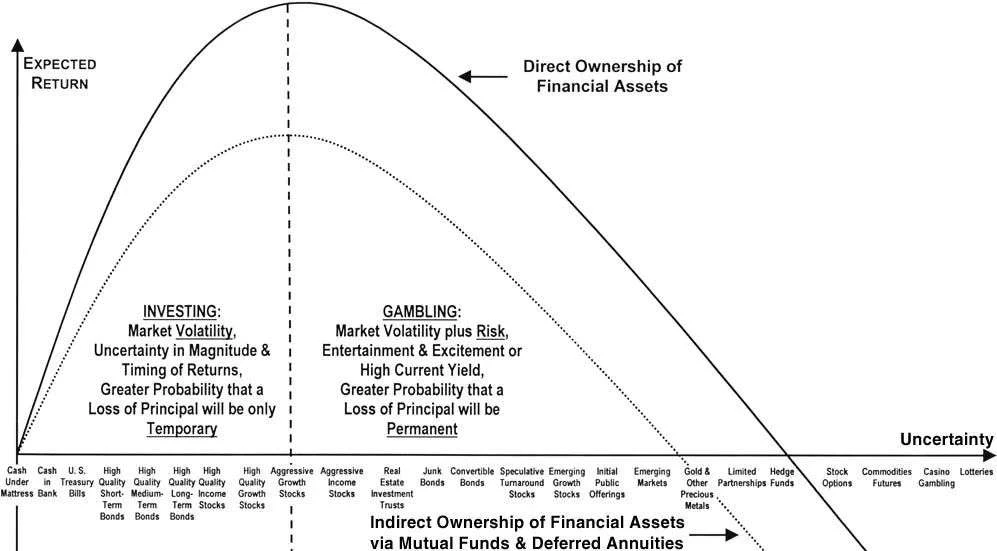

The main participants in the meme coin market are retail investors. The famous "Dow Jones Index Investment vs. Gambling Comparison Chart" clearly illustrates the continuum between expected returns and uncertainty, with most serious financial practitioners emphasizing that Web 3.0 assets need to move away from "lottery thinking."

Roshan Dharia, CEO of Echo Base, candidly stated, "Undeniably, meme coins have played a role in attracting Web 3.0 curious individuals. But if we want to build a sustainable financial market, the Web 3.0 industry must focus on creating products with real economic value that can solve real problems. Meme coins are suitable for media hype, but what truly attracts the attention of traditional financial institutions is the efficiency and transparency brought by blockchain—these new values, which were once hard to reach, are now changing everything thanks to blockchain infrastructure."

"Practicality" is key to attracting users into the Web 3.0 space and opening new revenue channels for on-chain projects. Another crucial factor is how to ensure the safety of ordinary users' funds, especially after Bybit experienced a $1.4 billion attack.

According to a report released by CertiK, there were 760 security incidents in 2024, with total losses reaching $2.36 billion, a year-on-year increase of 31%. These vulnerabilities not only expose industry risks but also further highlight the urgency of building high-security products.

Professor Gu Ronghui, co-founder and CEO of CertiK, pointed out, "Hackers are adopting increasingly sophisticated attack methods, and there is a greater need than ever for on-chain projects to actively invest in security construction. The Bybit incident serves as a wake-up call for the entire industry—security is not a competitive advantage, but a shared responsibility."

Mooly Sagiv, co-founder and CEO of Certora, also stated, "As the Web 3.0 industry continues to mature, hackers are simultaneously upgrading their methods. Companies have a responsibility to create safer products for users. The Bybit incident has weakened investor confidence, and all participants must take action to rebuild trust together."

As the market speculation frenzy temporarily cools, it is an opportune time for project teams to focus on creating secure and genuinely valuable products. Venture capital firms (VCs) have been doing this for years, continuing to move forward even during market turbulence.

VCs Focus on Creating Value in Future Technologies

NFTs and the metaverse have not become part of the mainstream Web 3.0 narrative in 2024; they are remnants of the previous Web 3.0 bull market cycle, forgotten amid the frenzy of meme coins and AI tokens. However, according to a report by Galaxy, in the fourth quarter of 2024, VC investments in areas such as NFTs, the metaverse, and gaming have instead taken the lead.

This is not hard to understand—people naturally love games, lotteries, and entertainment. In the U.S., the annual revenues of these industries reach $65 billion, $100 billion, and over $100 billion, respectively, and continue to grow (globally). Now, these massive traditional industries are being transformed by Web 3.0 technology, with gaming being one of the current focuses of VC innovation.

VCs typically do not chase "public opinion heat," but rather dig into tracks with long-term potential in advance, positioning themselves before the industry matures to seek future returns. For example, in the fourth quarter of 2024, most of the funding in areas like NFTs, DAOs, and the metaverse flowed into early-stage projects.

Ronald Yung of RaveDAO stated, "NFTs were once seen as symbols of the last bull market or digital collectibles, but their true value lies in their evolving practicality. At RaveDAO, we are expanding NFTs beyond art to areas such as event tickets and participation credentials."

"Although market sentiment has shifted, the technology behind NFTs remains a powerful tool for identity verification, access control, and community interaction. This solution will not disappear; it is simply adapting to real-world applications."

Similarly, VCs recognized the disruptive potential of AI long before ChatGPT became popular, and AI tokens have dominated investor interest. Funding in the AI sector grew from $670 million in 2011 to $36 billion in 2020, showing a long-term upward trend.

The influx of capital into emerging technology sectors remains strong. In the first quarter of 2025, total funding in the AI sector significantly surpassed Web 3.0 venture capital, continuing the past preference for AI investments. However, it is worth noting that blockchain-driven AI startups are also beginning to attract capital interest.

Rowan Stone, CEO of Sapien, stated, "While traditional AI still holds a funding advantage, combining AI with blockchain technology to create new user-oriented tech products is expected to drive revenue growth and attract more new capital."

"As long as we continue to refine products in the AI + Web 3.0 subfields, we have the potential to build a truly intelligent, user-centered global ecosystem."

From an investment perspective, VCs have identified more "future-oriented" sectors and are strategically allocating resources to support long-term market growth. The Trump administration's statement about "the U.S. economy entering a transitional period" is based on the strong support of the technology and information industries.

The technology and information industry is the third-largest service sector in the U.S., accounting for about 10% of GDP (approximately $2.4 trillion), second only to healthcare and social services (18%) and financial services (20%)—and the U.S. is the core of the global capital market.

Larry Fink, chairman and CEO of BlackRock, pointed out in his annual report that the prosperity of the U.S. financial services industry is just beginning. History shows that market changes often give rise to innovation opportunities. The current market turbulence is also a reminder: focusing on innovation is more important than closely monitoring daily stock market fluctuations.

Warren Buffett, known as the "Oracle of Omaha," once said, "Remember that the stock market is a manic depressive." In a recent CNBC interview, he stated, "When valuations are highly volatile, it is even more important to focus on the intrinsic quality of the assets—amid chaos lies opportunity."

Always maintain rationality.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。