Bitcoin ETF Outflows Stretch to Day Three as Ether Funds Go Silent

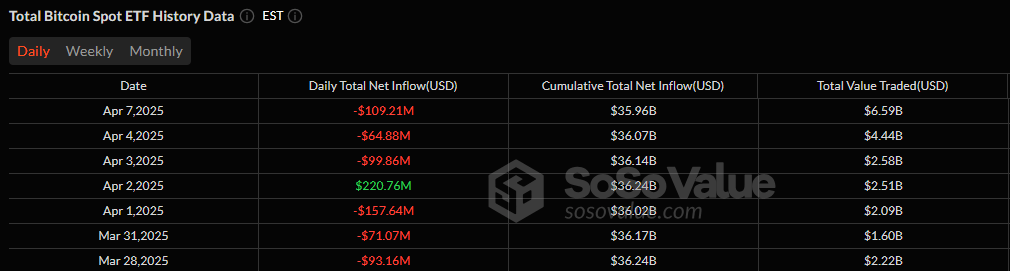

The new week began with more red ink for bitcoin ETFs, as outflows surged to $109.21 million, dragging the U.S. spot ETFs into a 3rd consecutive day of losses. Investor sentiment remained cautious, with capital continuing to exit even amid rising trading volumes.

Grayscale’s GBTC bore the brunt, shedding a hefty $74.01 million. Invesco’s BTCO followed distantly with a $12.86 million outflow. The rest of the day’s exits came in small drips: Wisdomtree’s BTCW saw $6.23 million leave, Vaneck’s HODL saw a $6.10 million exit, Valkyrie’s BRRR dropped $5.32 million, and Ark 21shares’ ARKB lost $4.69 million.

Source: Sosovalue

The remaining six ETFs, including heavyweights like Blackrock’s IBIT and Fidelity’s FBTC, stayed flat with no inflow or outflow activity. Despite the downward flows, trading volume was robust.

Total value traded reached $6.59 billion, a strong bump from Friday’s $4.43 billion. However, total net assets for bitcoin ETFs dropped below the psychological $90 billion mark, closing at $87.86 billion.

As for ether ETFs, it was a quiet day across the board. All nine registered zero net flows, with not a single dollar moving in or out. After weeks of sustained outflows, the stillness could signal hesitation or just the calm before another inflow/outflow storm.

With markets now reacting more closely to macroeconomic and geopolitical uncertainty, including trade-related jitters, ETF flows may remain volatile through the week.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。