Billionaire Bill Ackman, founder of Pershing Square, has issued a warning to world leaders: "Don't wait until war breaks out to negotiate; call the president now."

Ackman's warning is not just an exaggeration—it feels more like a plea.

A few days ago, President Trump's tariff plan hit the global markets like a bomb, causing chaos. The U.S. stock market lost $6 trillion in value within a week, and the Dow Jones index experienced its largest intraday swing in history, dropping 2,595 points on Monday. Oil prices fell, interest rates were cut, and inflation concerns lingered. Trump confidently declared on Truth Social that "tariffs are a wonderful thing," but Wall Street titans were restless, speaking out and creating a symphony of tariff dissent.

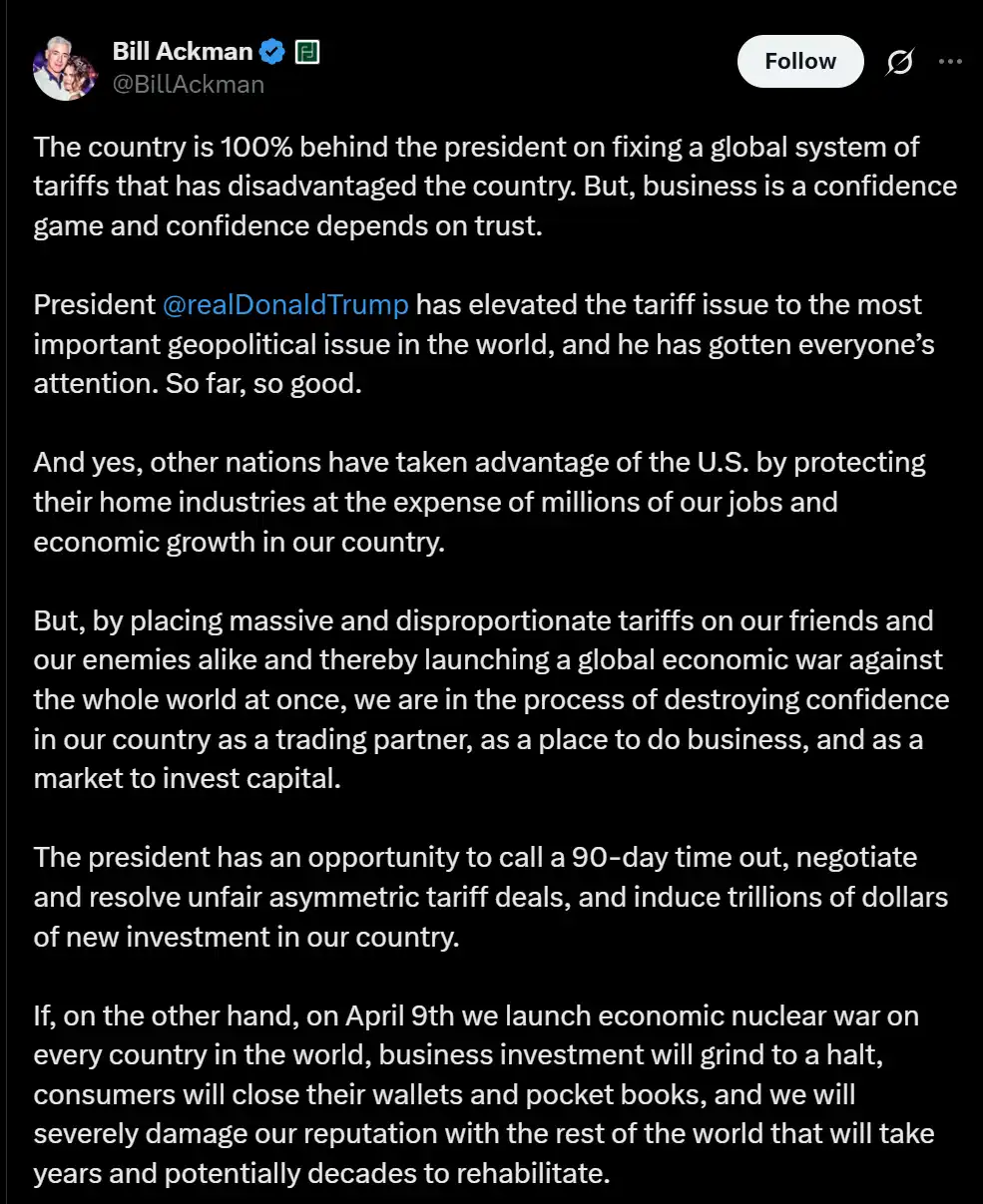

On April 6, 2025, Ackman tweeted: "By imposing massive and disproportionate tariffs on our friends and enemies, we are simultaneously launching a global economic war against the world. We are heading towards a self-induced economic nuclear winter."

In the face of the Trump administration's escalating tariff policies, Ackman is not the only one sounding the alarm. Many Wall Street heavyweights have publicly opposed the expansionary tariff policies, even those who previously supported him or hoped for deregulation and economic growth under his administration.

Former Goldman Sachs CEO Lloyd Blankfein also raised a question: "Why not give them a chance?" suggesting that Trump should allow countries to negotiate "reciprocal" tariff rates.

Others, including Boaz Weinstein, Gerber Kawasaki CEO and President Ross Gerber, and JPMorgan CEO Jamie Dimon, also spoke out.

Boaz Weinstein predicted, "The avalanche has really just begun." Dimon stated bluntly, "The sooner this issue is resolved, the better, because some negative impacts will accumulate over time and be hard to reverse," warning that the long-term economic alliance of the U.S. could face catastrophic division. Gerber called President Donald Trump's tariff policy "destructive," stating that it could lead to an economic recession.

It is evident that even those financial giants accustomed to market volatility, and who once supported Trump, are now beginning to worry that this tariff war could trigger uncontrollable chain reactions.

Increasing criticism has arisen as Trump has not provided any indication that he is prepared to retract the punitive trade reforms set to begin on April 9. Markets can tolerate uncertainty, but they cannot accept "policy speculation" based on power. The collective voice from Wall Street this time clearly indicates that capital is unwilling to pay the price for political gambles.

Howard Marks, co-chairman of Oaktree Capital, pointed out in an interview with Bloomberg that the tariff policy has altered the existing patterns of global trade and economics, making the market environment more complex. Investors need to consider a range of unknown variables, such as inflation triggered by tariffs, supply chain disruptions, retaliatory measures from trade partners, and the potential impacts of these factors on economic growth and asset prices.

Marks' warning reveals the anxiety within the entire professional investment community. When policy dominance overrides market rules, traditional analytical frameworks become ineffective, and even the most seasoned fund managers must relearn how to place bets in a global economic game.

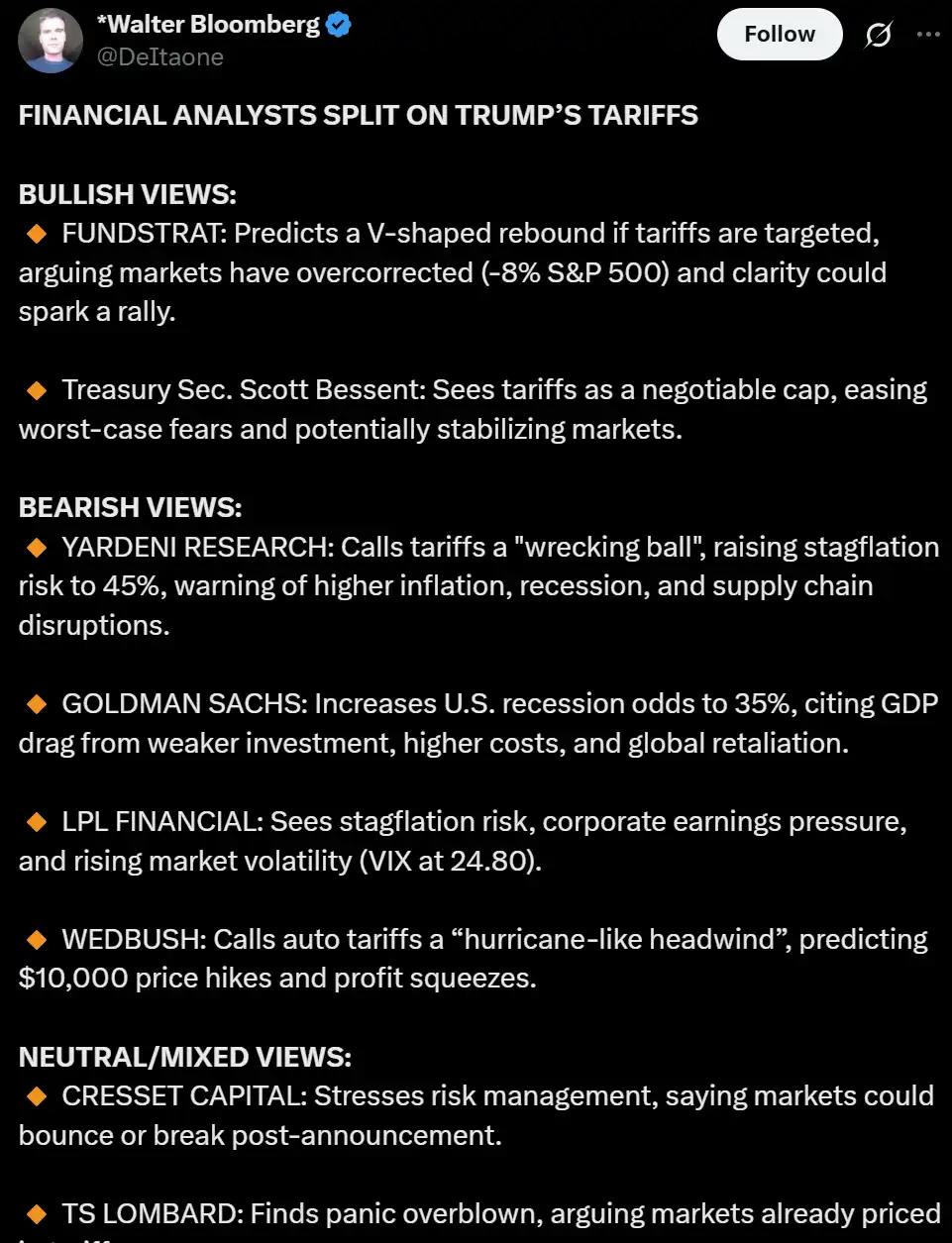

As of April 3, 2025, Wall Street's stance on Trump's tariff policy remains divided. The bullish camp, such as Fundstrat and Treasury Secretary Scott Bessent, believes that the market's previous adjustments were overdone, and once the policy direction becomes clear, it could trigger a "V-shaped rebound." Meanwhile, the bears warn of heightened risks, with Yardeni Research likening tariffs to a "wrecking ball," Goldman Sachs raising the probability of a U.S. recession to 35%, and LPL and Wedbush expressing concerns about stagflation, corporate earnings pressure, and severe impacts on the automotive industry.

At the same time, the neutral camp emphasizes risk management, noting that some negative factors have already been priced in by the market, and the subsequent trend will largely depend on the enforcement of tariffs and the actual resilience of the manufacturing sector. However, as market volatility intensifies and panic rises, voices that were previously cautious are beginning to shift, with a noticeable increase in questioning Trump's tariff policy.

Despite Ken Fisher's harsh criticism of Trump's tariff plan launched in early April as "stupid, wrong, and extremely arrogant," he maintains his usual optimistic outlook. He believes that "fear is often worse than reality," and this turmoil may just be a market correction similar to that of 1998, potentially leading to an annualized return of up to 26%.

Steve Eisman, known for shorting the subprime mortgage crisis and the inspiration for "The Big Short," warned that the market has not yet truly reflected the worst-case scenario of Trump's tariff policy, and it is not the time to "play the hero." He stated that Wall Street is overly reliant on the old paradigm of "free trade is beneficial," and in the face of a president who breaks with tradition, it is inevitable to feel at a loss.

He admitted that he has also suffered significant losses from being long, pointing out that the market is filled with "the grievances of losers." Eisman emphasized that current policies attempt to address the neglected groups under free trade, and Wall Street should not be surprised by this, as Trump "has long said he would do this; it’s just that no one took him seriously."

Amid the clamor, U.S. Treasury Secretary Scott Bessent emphasized that tariffs are essentially a negotiation tool for "maximizing leverage," rather than a long-term economic barrier. He questioned, "If tariffs are really that bad, why are our trading partners using them too? If they only harm American consumers, why are they so nervous?" In his view, this is a counterattack against China's "low-cost, slave labor, and subsidies" system.

However, in reality, Bessent seems not to play a key role in decision-making, appearing more like a "spokesperson" within the government to soothe the market. The severe fluctuations triggered by tariffs have already raised alarms within the White House.

This tariff turmoil has exposed the impact of policy uncertainty on market confidence, leading to a rare "collective complaint" from Wall Street. Regardless of their stance, most voices are questioning or even angrily criticizing the radical and hasty nature of the policies. Behind the divisions lies a general dissatisfaction with the logic and execution pace of the policies, and what truly needs to be discussed is perhaps how to rebuild confidence amid the chaos.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。