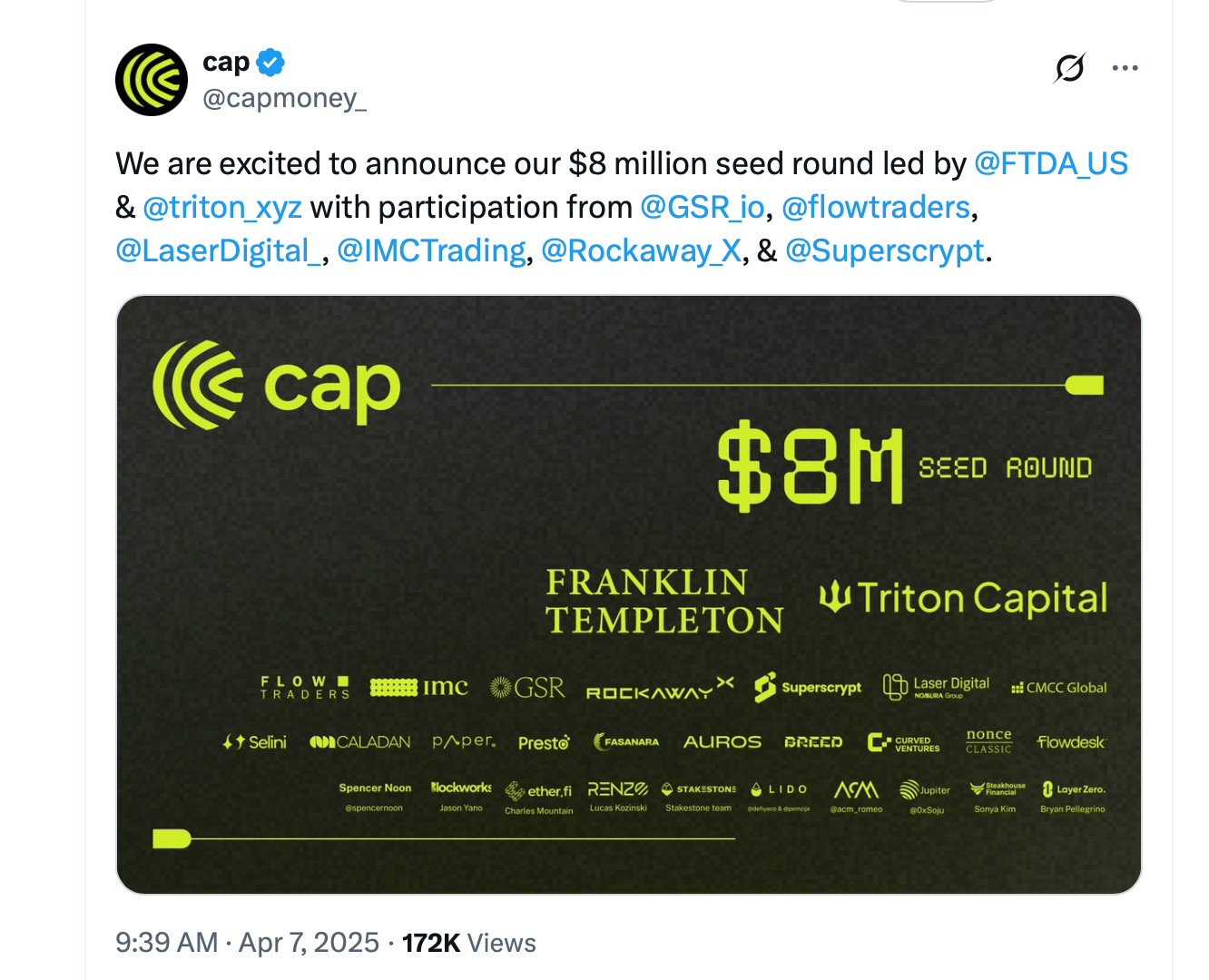

Stablecoin company Cap has raised $11 million in a seed funding round led by Triton Capital, Franklin Templeton, and Susquehanna International Group. Participants included crypto-native firms like Superscript and Rockaway X, alongside market makers GSR, IMC Trading, Nomura’s Laser Digital, and Flow Traders.

The funding follows a $1.1 million community round executed partially on Echodot, involving groups such as Omega, Patrons, and Crab Notes. Founders and teams from projects affiliated with the “Mega Mafia” ecosystem—including MegaETH Labs, Hop Network, and Euphoria Finance—also contributed.

Cap aims to address challenges in stablecoin sustainability, particularly the lack of safe yield options. Over $240 billion in stablecoins circulate globally, but generating risk-managed returns remains a hurdle. The company claims existing models, including endogenous designs or hedge-fund-like strategies, require reinvention.

Its proposed solution involves outsourcing yield generation programmatically via shared security markets, similar to Eigenlayer and Symbiotic. Just recently, Cap Labs revealed its new Type III stablecoin concept, touting it as a clever leap forward in yield generation—entirely automated and free from human meddling.

This approach allows institutions to produce yield without directly exposing users to operational risks. Cap plans to deploy its protocol on Ethereum-based shared security marketplaces, with a focus on integration into MegaETH, a real-time blockchain developed by MegaETH Labs.

The company credited MegaETH’s community for support during its development phase. The team noted on X that the funding will accelerate Cap’s mission to bridge traditional finance and crypto through compliant yield mechanisms. The firm did not disclose valuation or specific rollout timelines.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。