Source: Cointelegraph Original: "{title}"

The value of Bitcoin in hedging financial risks is regaining attention—during the historic $5 trillion drop in the S&P 500 index, Bitcoin's price remained relatively stable.

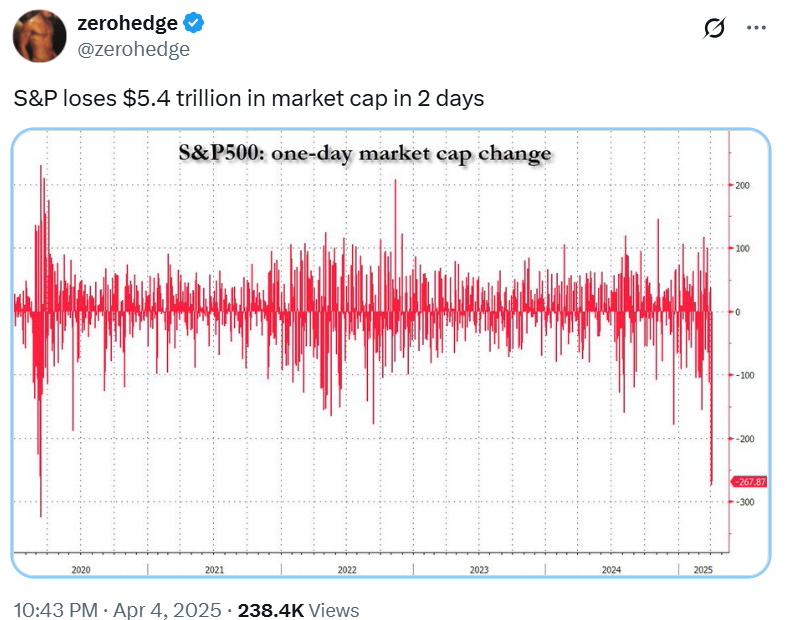

According to a Reuters report on April 5, the S&P 500 index saw a market value evaporate by $5 trillion in just two days, marking the largest recorded drop, far exceeding the $3.3 trillion drop during the early days of the COVID-19 pandemic in March 2020.

This epic sell-off was triggered by U.S. President Trump's announcement of retaliatory import tariffs on April 2. The policy aims to reduce the U.S. trade deficit of approximately $1.2 trillion and boost domestic manufacturing.

S&P 500 index $5.4 trillion market value evaporated Source: Zerohedge

Marcin Kazmierczak, co-founder of blockchain oracle company RedStone, pointed out that Bitcoin's decline was much smaller than that of traditional markets following the announcement of the tariff policy, confirming the maturity of Bitcoin as a global asset.

"We may be witnessing an evolution in Bitcoin's market positioning," he told Cointelegraph.

"Historically, Bitcoin has been highly correlated with risk assets during macro shocks, but this divergence may indicate a shift in investor perception."

He added, "Bitcoin's fixed supply mechanism stands in natural opposition to fiat currencies that may face inflationary pressures under tariff economics."

According to TradingView data, Bitcoin only dropped 3.7% during the stock market crash, with a price of approximately $83,600 on April 5.

BTC/USD 1-hour chart Source: Cointelegraph/TradingView

Nexo's resident analyst Iliya Kalchev emphasized to Cointelegraph, "Despite the $5 trillion sell-off in traditional markets, BTC has held firm at the key support level of $82,000, indicating that structural demand remains solid even in a forced liquidation and high volatility environment."

Bitcoin may become the "digital gold" in the tariff game. James Wo, founder of venture capital firm DFG, believes that although Bitcoin has decoupled from traditional stocks, its initial price plunge still shows that some investors view it as a risk asset.

"As Bitcoin ETFs bring more institutional exposure, it is now more susceptible to macroeconomic trends," Wo told Cointelegraph.

"However, if Bitcoin maintains resilience amid ongoing uncertainty, its fixed supply and decentralized nature will not only strengthen the 'digital gold' narrative but may also establish it as a more reliable store of value."

Despite the current lack of upward momentum, analysts are confident in Bitcoin's upside potential for the remainder of 2025.

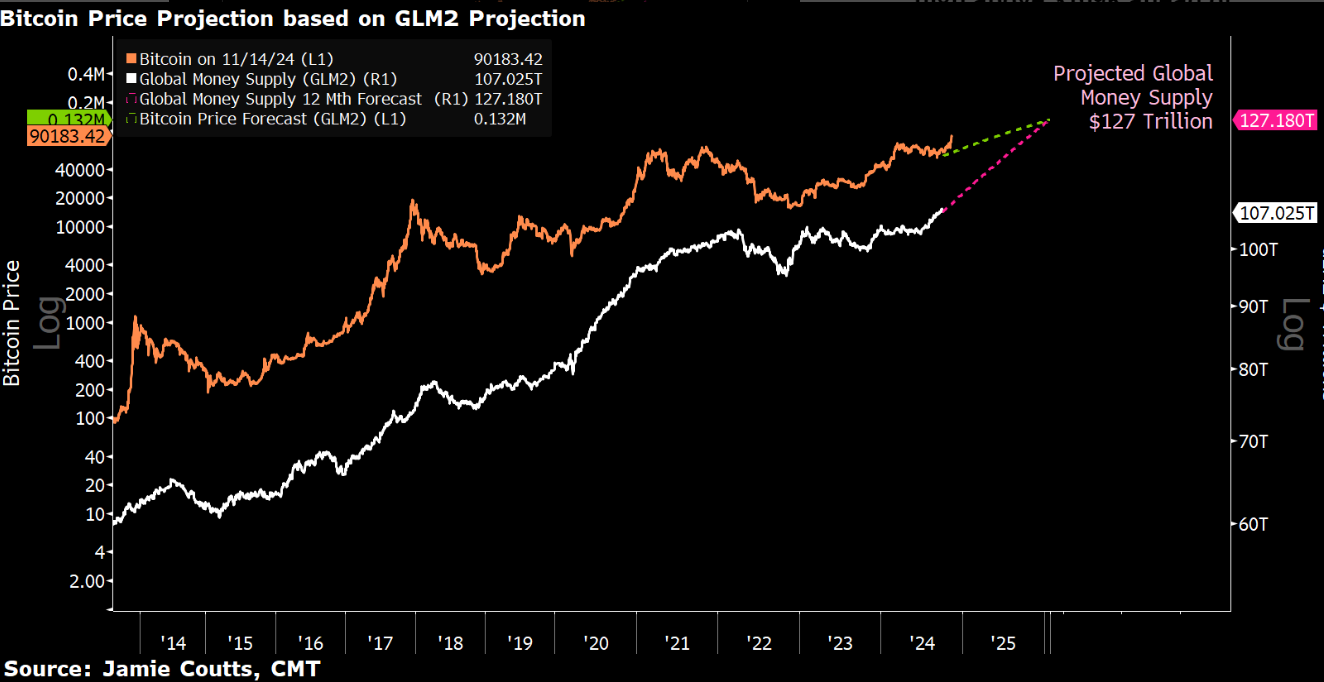

BTC price prediction based on M2 money supply growth Source: Jamie Coutts

Jamie Coutts, chief crypto analyst at Real Vision, estimates that the growing money supply could push Bitcoin's price above $132,000 by the end of 2025.

Related articles: Trump declares "national emergency," tariff policy impacts cryptocurrency prices

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。