The world is bustling, all for profit; the world is in turmoil, all for profit! Hello everyone, I am your friend Lao Cui talking about coins, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. Welcome to all coin friends for your attention and likes, and reject any market smoke screens!

With such a deep pullback, I will analyze it again today. The bearish trend is so obvious, yet there are still users thinking about going against the tide. The tariffs have come so swiftly, a bit unexpected; the only fortunate thing is that Lao Cui has been primarily shorting. Under the continuous pressure of tariffs, even if interest rate cuts come, or even increase in frequency and magnitude, the bull market that everyone expects will not appear. This time, the angle of the tariffs is something that finance cannot clearly explain. The political impact may be even more severe; everyone just needs to remember one logic: as long as tariffs remain at such high pressure, the bears will continue to reach new lows, and the thought of new lows will persist. As of now, all financial markets are in a free fall. Lao Cui has also seen everyone's viewpoints; many friends even think that when tariffs come, it is a good thing for the coin circle. Holding onto whimsical thinking, looking at what many so-called financial bloggers say, Trump's tariffs are forcing a settlement method, and the increase in tariffs will lead to Bitcoin settlements being accepted by more and more foreign trade. Those who can propose such logic definitely have no foreign trade experience; tariffs are calculated based on goods arriving at the port, and have nothing to do with your settlement method. As long as the products you sell in the U.S. are not domestically produced, tariffs will be charged, regardless of whether you settle in dollars, gold, or cryptocurrency.

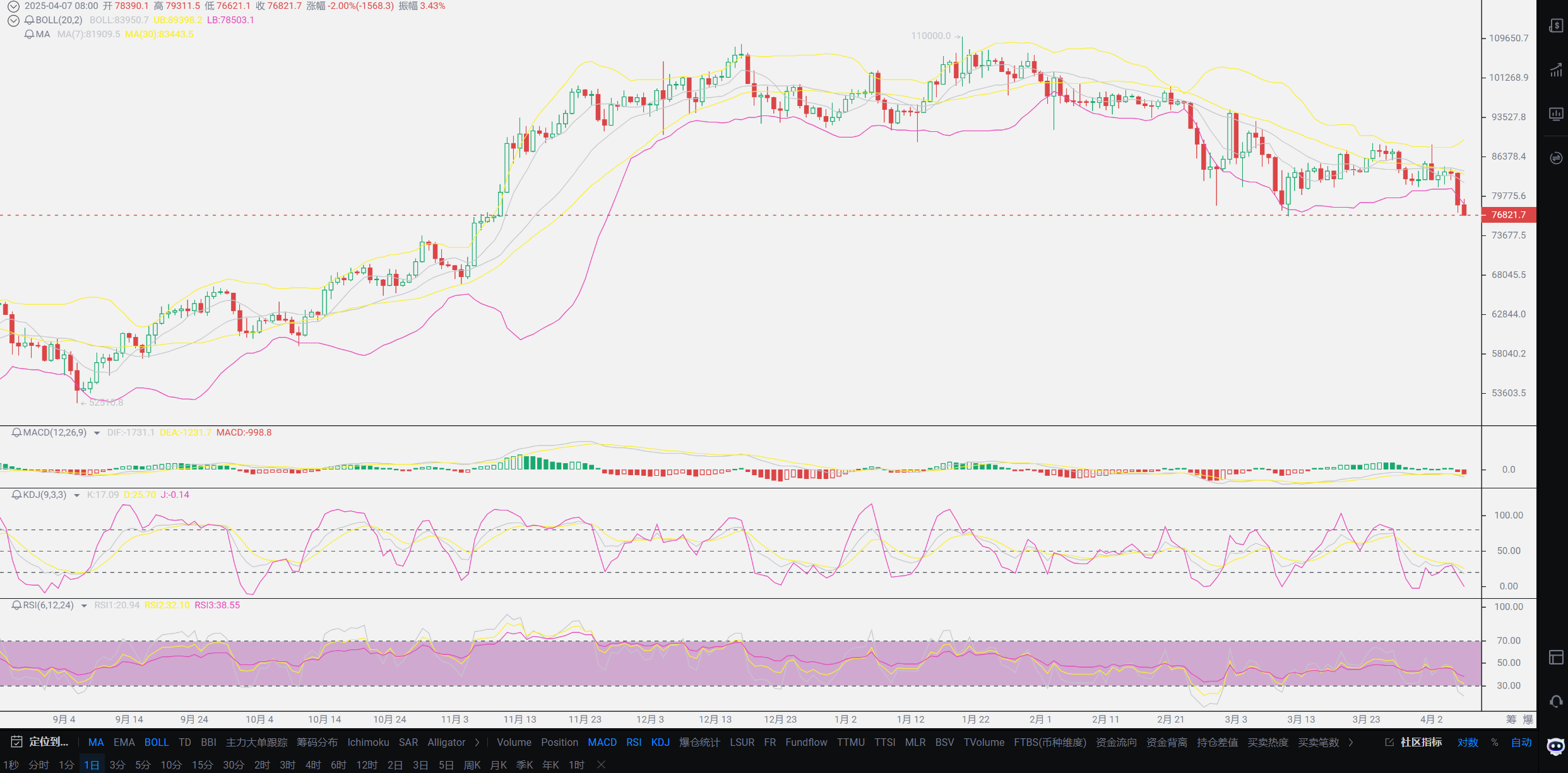

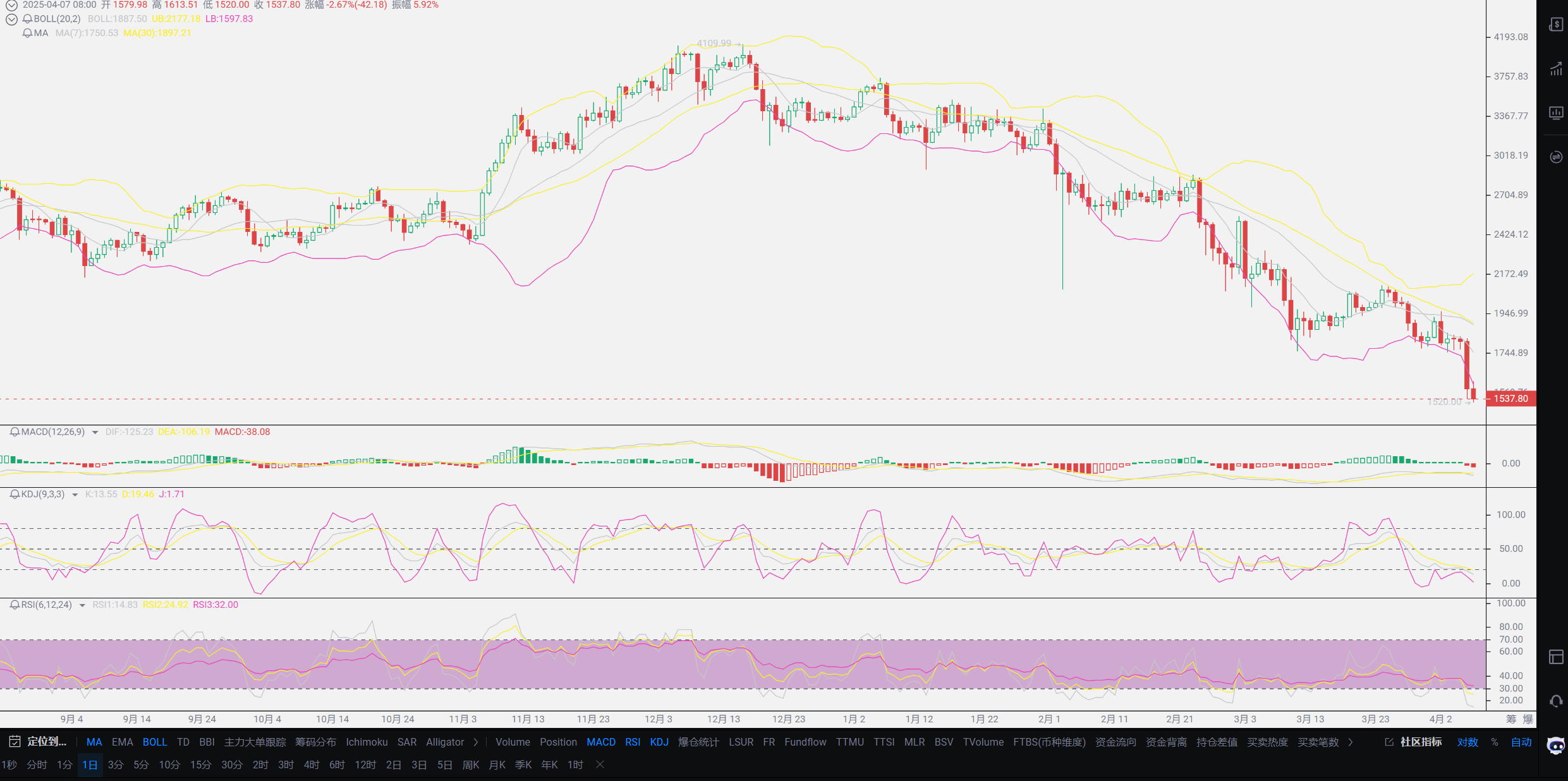

If it weren't for this wave of tariff pressure, according to previous analysis, around 1500 would be the bottom space for Ethereum. With the impact of tariffs, the bottom space will become deeper. The previous estimate for Bitcoin's bottom was also around 75000, but this current speculation must be cautious. The most unstable factor is the U.S. increasing tariffs; if we counter, will they continue to escalate? If they continue to escalate, then new lows will come again. If they abandon the escalation, the impact of tariffs will not be eliminated immediately, but the strategy of cutting interest rates can at least give the financial environment a breather. Everyone needs to be clear that this wave of tariffs is not an ordinary financial adjustment; an increase of about ten percent is already the peak of finance. Since Trump took office, the overall increase in tariffs has reached about sixty percent; this increase is purely a political issue. A cost of 100 dollars now requires 160, and these cost issues are meant to force the manufacturing industry to return. Clearly, the manufacturing industry returning is what Trump needs, all high-end manufacturing, but his restrictions are targeting low-end phenomena. Those who can sanction us are basically low-end manufacturers; currently, high-end products are only from the Cook Group, and Nvidia has already left our market; we have nothing in chips. The most affected by sanctions are necessities, so foreign trade is basically unmanageable. More funds will need to pay tariffs, and in the short term, there will be no large capital outflow. To save the coin circle, everyone must clear the concept of bulls.

Many friends also feel that the increase in tariffs is merely giving up the U.S. market and think it won't have such a big impact. This sensitivity to finance really needs to be exercised. The U.S. is the world's largest economy, and we are second, but their consumption capacity is three to four times ours. The current world pattern is one superpower and many strong ones; we are strong, but they are super. If you can understand this concept, you can measure it by the standards of the world's richest; basically, all the world's richest come from the U.S. market, not other countries. This is the charm of the U.S. market; as long as you can conquer the U.S. market, it basically means your product is guaranteed. To solve the issue of tariffs, it can only rely on communication from the upper levels; at this stage, there are no communication channels, and it is likely to continue for a while. Regardless of Trump's intentions, whether to stimulate interest rate cuts or seize currency issuance rights, this can be seen from USD1, reflecting Trump's ambitions. These methods currently bring endless bearish trends; everyone just needs to short to profit, even if we have already reached new lows, there will be even lower positions. The issue that bulls need to pay attention to is interest rate cuts; with the implementation of tariffs, the performance of U.S. stocks and the gold market can greatly increase the probability of interest rate cuts.

Previously, Lao Cui's estimates were all after June; now June has also been included in the consideration for interest rate cuts, especially recent data from March in the U.S. will indicate some issues. Interest rate cuts mainly observe two data points: inflation and unemployment rate. The data from March may be okay, but the data from April will definitely not look good; the estimate is that May may start to hype interest rate cuts, leading to signs of market rebound, but April will definitely be a tough month. From the perspective of tariffs, the U.S.-China trade deficit has two data points: one is a trillion-dollar deficit by 2025, and the other is 540 billion. Our tariffs are far greater than those of other countries, which is due to this trade deficit. Comparing these two, based on sixty percent tariffs, we will indeed pay more tariffs. The reason for the deficit is very simple: due to sanctions, we cannot buy high-end products from the U.S., causing significant issues for domestic output manufacturing. At the same time, our response method is also very simple; if we cannot purchase high-end industries, then we are also bypassing the U.S. on energy and agricultural issues, trying to reduce transactions with them. After all, losing the world's largest market will definitely have a greater impact on us, with the first being a cliff-like drop in domestic tech stocks. Similarly, as costs increase, the U.S. will also struggle; the first impact will also be on tech stocks. So everyone should not expect to interpret this crisis from a financial perspective; finance cannot resolve it, and continuing will only lead to mutual destruction.

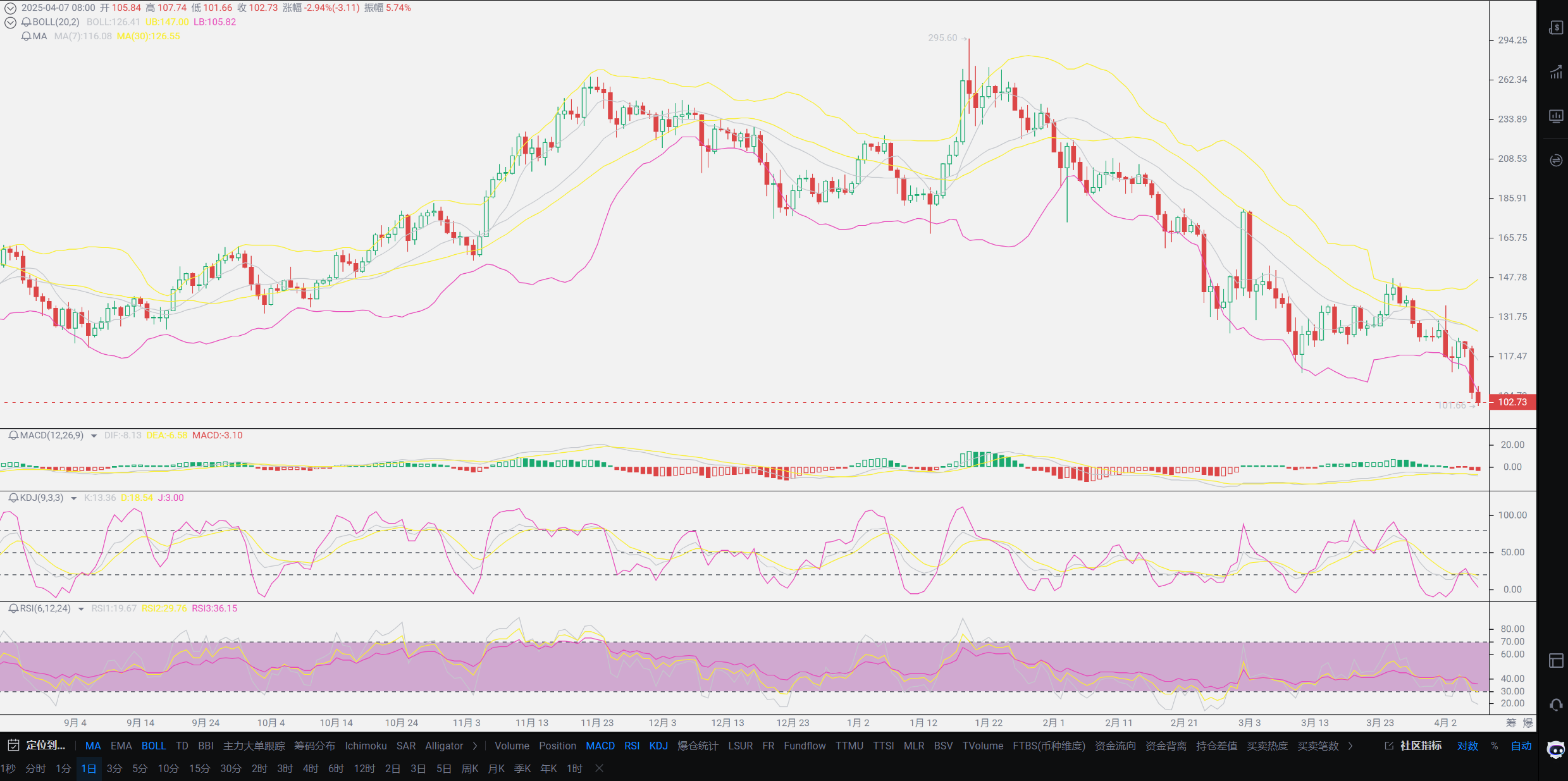

Lao Cui summarizes: looking at the coin circle in conjunction with the entire financial market, Bitcoin has actually become the best-performing market recently. Small coins can be said to be linked to all markets, experiencing declines, while Bitcoin has remained strong until today, showing a significant drop. In comparison, it seems that Bitcoin has investment attributes that resist risk. Meanwhile, in the same period, the larger investors in the coin circle have significant investments in U.S. stocks or other markets. They themselves are struggling to survive, causing a large outflow of funds to save their own companies; as Lao Cui mentioned before, blockchain belongs to future technology attributes, so this financial crisis will definitely affect the growth of the coin circle. If the performance of the financial market continues like this, the bearish space in the coin circle may further increase. At least Bitcoin will reach around 70K or even lower, and Ethereum will also reach around 1000. These two depend on whether interest rate cuts can happen in June; if interest rate cuts do not come in June, the bottom space will definitely reach this position, which is still a conservative estimate. Regarding the third listed coin, there has been no news; the future of small coins is becoming increasingly unclear. Lao Cui's current users have already cleared out small coins since the decline began; if there are users still holding such coins, they must reduce losses through contracts. Remember, contracts are a legitimate means; losses must be minimized as much as possible. Finally, Lao Cui's spot trading is still continuously buying, waiting for this year's interest rate cuts. Once there is a rebound, Lao Cui will also clear out some coins. Currently, the average holding price of SOL is around 130, and Ethereum is around 2000; I will continue to buy on the way down. There is currently no spot for Bitcoin, only short contracts averaging out the losses of the spot; everyone can refer to this. Regarding the price points, you can directly ask Lao Cui; it is estimated that there will not be a heavy update on the article in the short term, and more focus will return to the users themselves. The estimated new lows have basically been reached; friends who want to buy spot can keep in sync with Lao Cui. It will be a tough two months, but June may bring surprises.

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation, strategizes the big picture, and does not focus on one piece or one area, aiming for the ultimate victory. The novice, however, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trade at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。