Author: Frank, PANews

Since the beginning of 2024, the global stablecoin market has surged at a rate of 80.7%, surpassing $235 billion, with the dual giants USDT and USDC contributing 86% of the growth and continuing to dominate the market. However, it is perplexing that the hundreds of billions of dollars in incremental funds settled on the Ethereum and Tron chains have not spurred a simultaneous explosion in the altcoin market as seen in previous cycles. Data shows that this time, every additional $1 of stablecoin has only leveraged a $1.5 increase in altcoin market value, a decrease of 82% compared to the last bull market.

In this article, PANews will analyze comprehensive data on stablecoins to interpret the ultimate question in crypto brought about by their growth: Where has the money gone? As exchange balances soar and DeFi protocol staking volumes rise, the penetration of traditional financial institutions in over-the-counter trading and cross-border payment scenarios, along with the demand for currency substitution in emerging markets, is quietly reshaping the flow of funds in the cryptocurrency world.

Stablecoin Market Value Increases by $100 Billion, Ethereum and Tron Contribute 80% of Growth

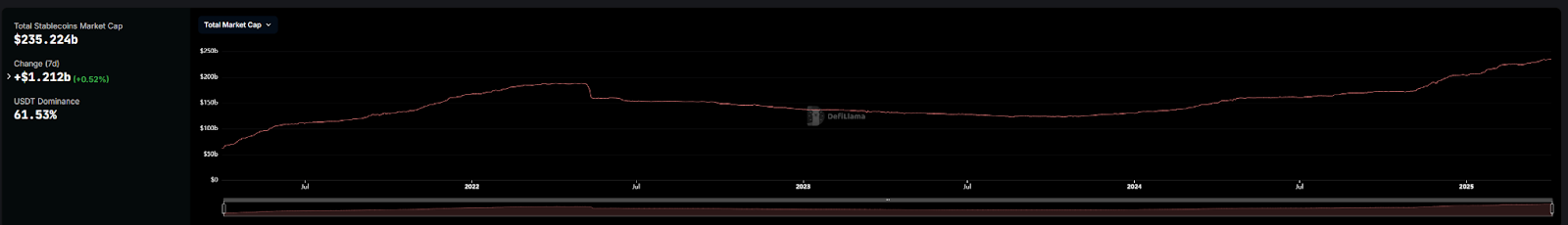

According to data from Defillama, overall, from the beginning of 2024 to the present, the issuance of stablecoins has grown from $130 billion to $235 billion, an overall increase of 80.7%. The primary growth still comes from the two stablecoins, USDT and USDC.

On January 1, 2024, the issuance of USDT was $91 billion, and by March 31, 2025, it had increased to $144.6 billion, a growth of approximately $53.6 billion, contributing 51% to the overall growth. During the same period, USDC's issuance rose from $23.8 billion to $60.6 billion, accounting for about 35% of the growth. These two stablecoins not only hold 87% of the market share but also contribute 86% of the growth.

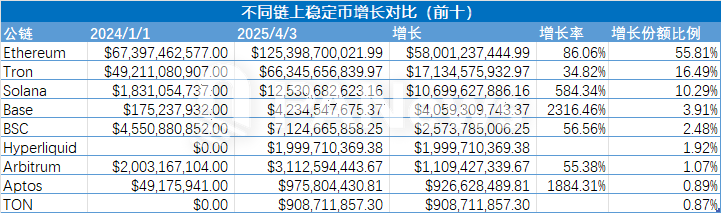

When breaking down the on-chain data, Ethereum and Tron remain the two public chains with the largest stablecoin issuance. Ethereum's stablecoin issuance accounts for 53.62%, while Tron accounts for about 28.37%, totaling 81.99%.

From January 1, 2024, to April 3, 2025, Ethereum's stablecoin increment was approximately $58 billion, with a growth rate of 86%, closely matching the issuance growth rates of USDT and USDC. Tron’s growth rate was about 34%, which is lower than the overall growth rate of stablecoins.

The third-ranked public chain is Solana, which saw an increase of $12.5 billion in issuance, with a growth rate of 584.34%. Fourth is Base, with a $4 billion increase in issuance, achieving a growth rate of 2316.46%.

Among the top ten, Hyperliquid, TON, and Berachain have only started issuing stablecoins in the past year. These three have added approximately $3.8 billion in stablecoin issuance, contributing 3.6% to the stablecoin growth. Overall, Ethereum and Tron remain the main markets for stablecoins.

Every $1 of New Funds Only Leverages $1.5 in Altcoin Market Value

Although the on-chain growth of stablecoins is rapid, the growth of altcoin market value during the same period has not been ideal.

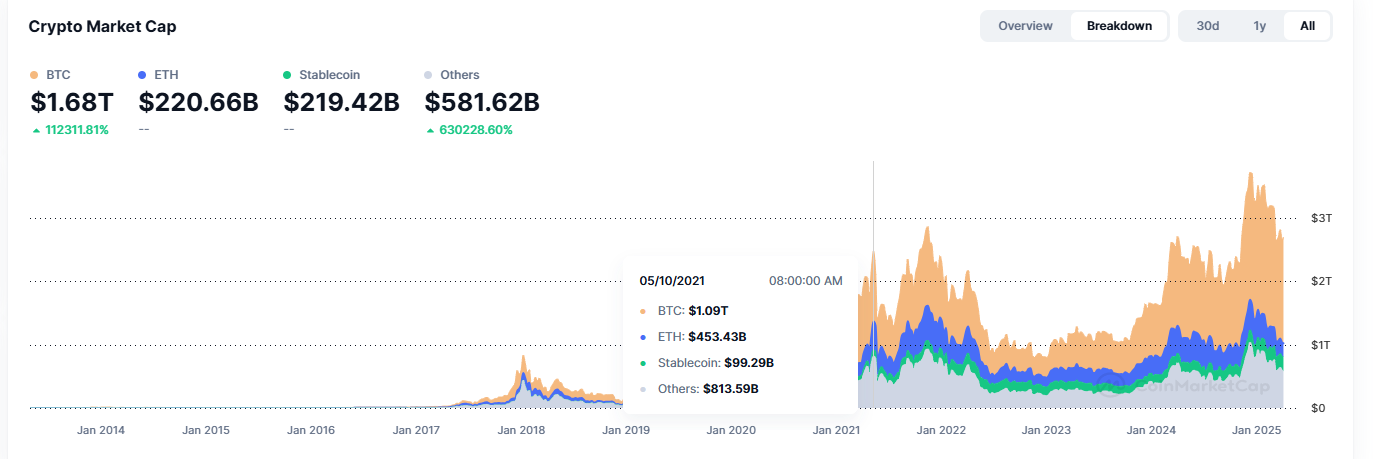

For comparison, in March 2020, the overall altcoin market value was about $39.8 billion (excluding BTC and ETH), and by May 2021, it had risen to $813.5 billion, an increase of approximately 19.43 times. During the same period, stablecoin data grew from $6.14 billion to $99.2 billion, an increase of about 15 times, essentially synchronized.

In this bull market phase, the overall increase in stablecoin market value has reached 80%, but the overall market value increase of altcoins during the same period is only 38.3%, with a growth of about $159.9 billion.

Looking back at the 2020-2021 cycle, for every $1 increase in stablecoins, the overall market value of altcoins rose by $8.3. However, in the 2024-2025 cycle, for every $1 increase in stablecoins, the market value of altcoins only increased by $1.5. This significant reduction in ratio indicates that the newly added stablecoins do not seem to have been used to purchase altcoins.

Where has the money gone? This is a key question.

Public Chain Landscape Reshuffled: Ethereum and Tron Hold Their Ground, Solana and Base Break Through Growth

Intuitively, during this cycle, the MEME craze on Solana has consistently led this bull market. However, the speculation around MEME primarily uses SOL trading pairs, leaving little room for stablecoin participation. Moreover, as analyzed earlier, the growth of stablecoins still mainly remains on Ethereum.

Therefore, to discover where the growth of stablecoins has gone, it seems necessary to analyze the trends of major stablecoins like Ethereum, USDT, and USDC.

Before analysis, it may be helpful to outline several possible directions, which are common speculations in the market regarding the destination of stablecoins. For instance, stablecoins may be more used in payment scenarios, staking yields, value storage, etc.

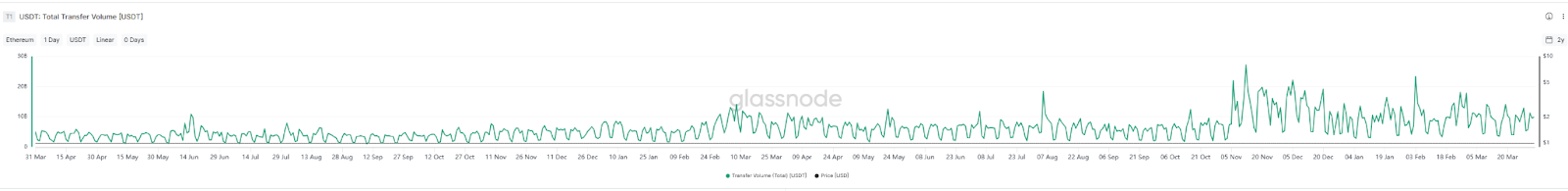

Let’s first look at the trading situation of stablecoins on Ethereum. From the chart below, we can see that the trading volume of stablecoins exhibits a rhythmic fluctuation resembling a heartbeat. This fluctuation may hide the usage patterns of stablecoins.

When the cycle is shortened, we can significantly observe that this fluctuation follows a 5+2 pattern, meaning 2 days of low activity followed by 5 days of peak activity. Observations show that the low periods are always on weekends, while the peak periods generally rise from Monday to Wednesday and gradually decline on Thursday and Friday. This clear volatility pattern suggests that the initiators of these stablecoin transactions mainly come from institutions or enterprises; after all, if consumer payment scenarios were dominant, such volatility would likely not be present.

Additionally, from the perspective of daily transaction frequency, the peak daily transfer count of USDT on Ethereum does not exceed 300,000 transfers, and typically, the transfer frequency and average transfer amount on weekends are far lower than on weekdays. This further corroborates the above inference.

USDT Flows into Exchanges, USDC Settles in DeFi Protocols

From the distribution of holdings, over the past year, USDT's exchange balance has seen a significant increase. On January 1, 2024, the exchange balance was 15.2 billion tokens, and by April 2, 2025, this number had grown to 40.9 billion tokens, an increase of $25.7 billion, with a growth rate of 169%. This increase far exceeds the overall issuance growth of stablecoins at 80.7% and accounts for 48% of the growth in USDT's issuance during the same period.

In other words, in the past year, about half of the newly issued USDT has flowed into exchanges.

However, the situation for USDC during the same period is quite different. On January 1, 2024, the exchange holdings of USDC were about 2.06 billion tokens, and by April 2, 2025, this number had increased to 4.98 billion tokens. During the same period, USDC's issuance increased by 36.8 billion tokens, with only 7.9% of the new issuance flowing into exchanges. The overall balance on exchanges also only accounts for 8.5%, which is significantly lower than USDT's 28.4%.

Most of the newly issued USDT has flowed into exchanges, while the new trading volume of USDC has not entered exchanges.

So where has the new flow of USDC gone? This may help explain the question of where the funds in the market are flowing.

From the perspective of holding addresses, the top addresses holding USDC mainly come from DeFi protocols. Taking Ethereum as an example, the largest holding address for USDC is Sky (MakerDAO), with a holding quantity of 4.8 billion tokens, accounting for about 11.9%. In July 2024, this address held only 20 million tokens, increasing 229 times in less than a year. The purpose of Sky's USDC is primarily to serve as collateral for its stablecoins DAI and USDS. The growth of USDC at this address still represents the demand for stablecoins driven by the growth of DeFi protocol TVL.

AAVE is the fourth-largest holding address for USDC on Ethereum. On January 1, 2024, AAVE held about 45 million USDC, and by the peak on March 12, 2025, this address's USDC holdings increased to 1.32 billion tokens, an increase of about $1.275 billion, accounting for 7.5% of the new issuance of USDC on Ethereum.

From this perspective, the new issuance of USDC on Ethereum is primarily due to the growth of staking products. At the beginning of 2024, the total TVL on Ethereum was about $29.7 billion. Although it has recently experienced a decline, there is still a stock of $49 billion (the peak TVL reached $76 billion). Based on the $49 billion figure, the growth rate of TVL on Ethereum can also reach 64.9%, which is much larger than the growth of altcoins last year and is close to the overall growth rate of stablecoins.

However, in terms of scale, although the TVL on Ethereum has grown by $19.3 billion, it still has a significant gap compared to the $58 billion growth of stablecoins on Ethereum. Excluding the portion of new issuance contributed by exchanges, staking protocols have not fully absorbed the incremental stablecoins.

New Scenarios Rise: From Cross-Border Payments to Institutional Trading Paradigm Shift

In addition to the demand for stablecoins driven by the growth of DeFi, consumer payments, cross-border remittances, and over-the-counter trading by financial institutions may also represent new demand for stablecoins.

According to multiple official documents from Circle, the scenarios for stablecoins are gradually revealing their potential in cross-border remittances and consumer payments. A report from Rise indicates that approximately 30% of global remittances are achieved through stablecoins. This proportion is particularly significant in Latin America and Sub-Saharan Africa, where retail and professional-grade stablecoin transfers in these regions grew by over 40% year-on-year from July 2023 to June 2024.

A report released by Circle shows that in 2024, the net issuance of USDC by Zodia Markets, a subsidiary of Standard Chartered Bank, has reached $4 billion (Zodia Markets is an institutional digital asset brokerage that provides services including over-the-counter trading and on-chain foreign exchange to global clients).

Another Latin American retail payment company, Lemon, has clients holding over $137 million in USDC, with users primarily utilizing stablecoins for retail payments.

In addition to the new demand arising from differences in scenarios, the varying ecological structures of different chains also create different demands for stablecoins. For example, the MEME craze on the Solana chain has stimulated trading demand on DEXs. According to incomplete statistics from PANews, the TVL of USDC trading pairs (top 100) on the Solana chain is approximately $2.2 billion, and based on the rule that USDC accounts for half of this volume, the amount of settled funds is about 1.1 billion USDC, which accounts for 8.8% of USDC's issuance on the Solana chain.

The Crypto Market Shifts from "Speculative Bubble" to "Wealth Management Products"

After dissecting and analyzing stablecoins, PANews finds it challenging to identify a single direction as the main driving force behind the growth of stablecoins. This makes it difficult to explain where the money in the market has gone. However, upon reflection, we may arrive at a series of complex conclusions.

The market value of stablecoins is continuously growing, but clearly, these funds have not significantly flowed into the altcoin market, becoming the initial driving force for the arrival of the altcoin season.

From the perspective of the Ethereum market, a significant portion of the growth in the main stablecoin USDT is still flowing into exchanges, but it seems more likely that this is being used to purchase BTC (as the altcoin and Ethereum markets have not seen significant increases) or for wealth management products within exchanges. The remaining growth demand may be absorbed by DeFi protocols. Overall, the funds flowing into Ethereum seem to prioritize stable returns from staking and lending protocols. The appeal of the crypto market to traditional funds may no longer be about wild fluctuations but rather a new type of wealth management product.

Changes in new scenarios, such as traditional financial institutions like Standard Chartered entering the crypto market, have also become one of the new demands for stablecoins. Additionally, the increasing adoption of stablecoins in underdeveloped regions due to factors like lagging infrastructure and unstable domestic currency exchange rates is also on the rise. However, the data for this part has not yet been fully compiled, and we do not know the specific share.

Stablecoins have different narrative demands on different chains. For instance, the growth demand on Solana may stem from the trading enthusiasm generated by the rise of MEME. New public chains like Hyperliquid, Berachain, and TON also bring certain funding demands due to their growth momentum.

Overall, the undercurrents of this capital migration reveal that the crypto market is undergoing a paradigm shift. Stablecoins have transcended the boundaries of being mere trading mediums and have become value conduits connecting traditional finance with the crypto world. On one hand, altcoins have not received a massive influx of funds due to the growth of stablecoins. On the other hand, the wealth management needs of institutional funds, the essential payment needs of emerging markets, and the maturity of on-chain financial infrastructure are pushing stablecoins toward a broader stage for value carrying. This may signal that the cryptocurrency market is quietly moving toward a historic turning point from "speculative-driven" to "value accumulation."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。