特朗普要建“加密大富翁”?(相关阅读:《大富翁游戏“老粉”特朗普进军链游,加密赛道再下一棋》)

虽然特朗普上台之后搅得全世界不得安宁,但不得不承认,对于个人而言,特朗普无疑是历届以来最会搞钱的总统。除了早已闻名的地产产业、旗下媒体科技公司升以及让市场极度怀疑的暗箱股票操作外,他还开辟了全新的牟利渠道——加密货币,并从中至少获利10亿美元。

时至今日,特朗普的加密版图已经不断扩大,从最初的NFT到Defi,从MEME再到稳定币,最后延伸到挖矿,一个以特朗普为名的新加密帝国似乎正在冉冉升起。而就在最近,据财富报道,特朗普家族疑似又瞄准了链游领域。

回顾特朗普的加密之路,最早还要从数字卡说起。2021年6月,当时的特朗普还力主“伟大美元论”,痛斥加密货币是影响美元价值的“骗局”,还表示应该对加密货币进行严密监管。但仅仅不到1年半,特朗普就现真香定律。

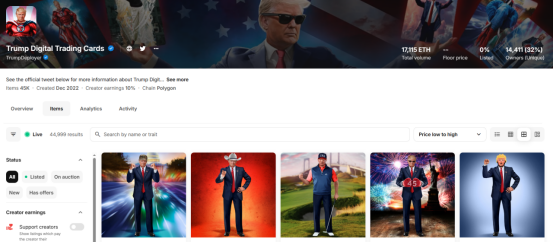

2022年12月15日,特朗普通过他创立的社交媒体网站TruthSocial宣布发行特朗普数字交易卡NFT,该系列在Polygon区块链上铸造,初始创建了总共4.5万个NFT,起始价格为每件99美元,购买45张数字交易卡,将获得一张与特朗普共进晚餐的门票。该系列NFT可支持信用卡和WETH购买,需要KYC和邮箱,尽管在当时引发群嘲,但在前总统的流量加持与号召下,这一系列仍然在推出后不到一天就宣告售罄。从opensea的交易量来看,这一系列交易总量达到17,115ETH,目前有14411个持有者。

简单而言,第一次尝试就让特朗普大赚445万美元,尝到甜头后,2023年4月18日,特朗普很快发布了他的第二系列NFT——Trump Digital Trading Cards Series 2。同样的营销方法,只不过系列总数增加至47,000张,据其称是表达担任47届总统的信心,售价仍为99美元,虽然同样在发行5小时内售罄,但后续第二日却迅速暴跌,可看出市场对连番的销售已有疲态。

但特朗普不管市场脸色,只在乎实际利益。就在之后不久,特朗普发布了第三系列MugShot Edition NFT,这一次更为离谱,总数达到了10万张,加量不加价,并推出了特色权益,花费1万美元可以受邀参加招待会,还附送一张限量200张的独特Ordinal数字交易卡。也正是因该系列,才有了后续特朗普的“让NFT再次火热”。简单计算,仅仅三套NFT的组合拳,特朗普团队就吸金1900万美元,而根据其财务披露,NFT实际获利已达数百万美元。

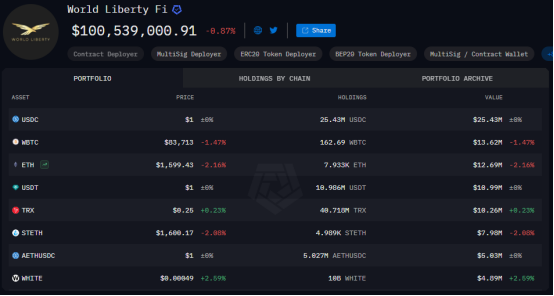

NFT只是一个开始,既是为赚取政治献金也是为了号召拉票,2024年9月,特朗普家族宣布推出加密货币项目“世界自由金融”(World Liberty Financial)。这家以Defi为名的企业上市以来在Defi上未见过多起色,反而是持续不断的买币建仓惹人关注,目前持仓总额达到了10亿美元,亏损0.87%。更为直接的是治理代币的销售,在明确代币不会二级转卖以及存在市场权益的背景下,今年3月,WLFI仍然宣布完成了5.5亿美元的WLFI治理代币销售,币圈OG孙宇晨也在其中贡献了7500万美元。

文件显示,在扣除运营成本后,特朗普及其商业伙伴将获得项目净收入的75%,包括WLFI代币销售。从WLFI销售中筹集的资金中,3000万美元已被指定用于支付公司费用、赔偿和义务。项目文件还显示,特朗普及其在DT Marks DEFI LLC的合作伙伴将获得剩余金额的75%,即3.9亿美元,作为特朗普“不时”推广项目并允许使用其姓名和形象的营销费用。

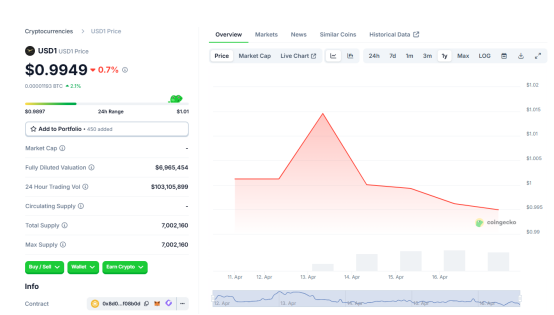

前脚特朗普刚在首届白宫加密峰会上畅聊稳定币的未来,后脚家族企业就开始了行动。3月25日,WLFI宣布推出名为USD1的稳定币,该稳定币与美元挂钩,并由美国政府短期国债、美元存款和其他现金等价物100%支持。USD1 将在ETH 和 BSC 区块链上铸造,并计划在未来扩展到其他协议,USD1储备将由BitGo托管。截止到如今,据CoinGecko数据,USD1 成交额已超4491万美元。

再往后就是挖矿,总统明确表示要确保剩余比特币是美国制造,特朗普家族自然是要抢占先机。3月底,特朗普次子Eric Trump与矿企 Hut 8 Mining 宣布联合成立比特币挖矿新公司 American Bitcoin。Hut 8 将大部分 ASIC 矿机注入由 Eric Trump与Donald Trump Jr. 参与投资的 American Data Centers,交易完成后更名为 American Bitcoin,Hut 8 持有80%股权。

若说挖矿和稳定币似乎仅仅是刚刚成型,还谈不上大获利,让全球震撼的,必然要唯Trump MEME莫属了。在1月,特朗普推出的个人MEME Trump开启了总统发币的先河,成功使其在谩骂声中赚了个盆满钵满。但从最高峰的70美元到如今的7.89美元,从暴涨125倍,到从高点跌去90%,投资者冰火两重天,也埋下了后续币圈流动性进一步紧缩的祸根。

由于存在解锁问题,实际获利并未有想象中庞大。从代币分发来看,TRUMP总供应量为10亿枚,但最初流通仅为2亿枚,剩下8亿预计将在3年内线性解锁。特朗普集团的两家附属公司占据绝对份额,特朗普旗下企业CIC Digital LLC及Fight Fight Fight LLC将坐拥80%的TRUMP代币,锁定期为3-12个月,未来24个月内解锁,目前账面金额获利大约为63.44亿美元。

整体而言,一个庞大得特朗普加密帝国正在兴起,其布局已然非常广泛,在NFT小试牛刀后,挖矿业务即将成型,还囊括了利润现金牛稳定币与Defi,甚至有MEME提供血包,虽有分散,但产业链条已然逐渐形成,基础设施与应用均有涉足,并预计将围绕“核心应用”扩展持续延伸。彭博社报道称,截至目前,特朗普家族已从加密领域吸金超10亿美元,而从当前来看,加密市场并不处于景气周期,在立足点之后进入牛市,显而易见特朗普家族的获利将极为可观。

而就在日前,财富报道,特朗普最新加密项目将是一款房地产视频游戏,知情人士表示,这款游戏是对《MONOPOLY GO!》的改编,玩家通过在数字《大富翁》棋盘上移动棋子赚取游戏内现金,在数字城市中建造建筑,还透露特朗普的长期好友Bill Zanker是该项目的幕后推手。但Zanker发言人凯文·默库里 (Kevin Mercuri)对此进行了否认,只是表示Zanker的确在研发一款游戏,但并非大富翁。可以看出,后续特朗普家族的加密触手,极有可能伸向链游领域。

此前就曾提到过,特朗普的经营哲学秉持流量货币化的原则,素来以流量为先的币圈显然非常契合其经营特点,而在自身可控的政策加持下,特朗普可凭借释放利好不断抬高币市,也可直接利用影响力切入到利润最为丰厚也最具政策前景的领域中,这无疑是一种另类的政治贪腐与内幕交易。而纵观其在加密领域的布局,无不是政府释放出信号前后,家族团队迅速跟进,利益集团也随之组建。一个典型的例子,WLFI的联合创始人之一是扎克·威特科夫,也是特朗普政府中东问题特使史蒂夫·威特科夫的儿子。

对此,也并非所有人感到开心,民主党派与无党派的高层质疑声从未停歇。著名的加密反对者伊丽莎白沃伦就表示,SEC放弃执法活动,正是特朗普利用加密业务致富的一部分,无疑对监管立法产生了阻碍。无党派的竞选法律中心的总法律顾问兼道德高级主任凯德里克·佩恩也表示特朗普个人正在倡导法律来促进加密行业发展。

此言并非空穴来风。在特朗普上台后,不仅SEC彻底变为加密友好者,司法部也承诺会减少加密诉讼,甚至对此前深陷反洗钱的混币器管控也不再追诉,利益相关者更是能放即放。以孙宇晨为例,2023年其还被SEC以欺诈性市场纵和其他涉嫌不当行为被起诉,但在去年大额投资WFLI后,今年SEC停止了这一诉讼。

看似特朗普掌控的政策铁板一块,但随意的监管很容易诱发政治冲突,尤其是在美国当前复杂的政治局势下,存在监管反噬的可能。投行 TD Cowen就在今日表示,特朗普家族的加密业务(包括计划推出的稳定币)可能引发反弹并拖延美国监管进程,尽管立法者加速推进加密法规,但政治风险正在攀升。

实际上,利益冲突与内幕消息也不仅仅局限于币圈。在最近关税风暴席卷全球股市后,特朗普的密友们已经成功大捞一笔。根据国会信披文件,一位与特朗普关系密切的佐治亚州国会女议员 Marjorie Taylor Greene,成功在特朗普暂缓关税的前一天与当天,进行了21笔股票买入。更为可笑的是,也在同一天,特朗普个人账户的股票持仓暴涨22.67%,单日获利超过4.15亿美元。除了这位女议员外,宾夕法尼亚州的共和党众议员 Rob Bresnahan也在特朗普宣布加征钢铁和铝产品关税的当天,无比凑巧的提前出售了美国钢铁生产商Steel Dynamics的股票。尽管后续两位议员均出面澄清,表示投资合法合规,但还是引发了市场的一片猜忌之声。

家族在币圈捞金,盟友在股市获利,不论如何澄清,特朗普的操作难免有利益冲突之嫌,目前,民主党议员团已然联名致信SEC新任主席Paul Atkins,要求调查特朗普是否通过政策变动为盟友创造交易机会,是否涉嫌市场操纵。但考虑到主席是由特朗普一手推上的自己人,民主党的弹劾或许难以成功。

肉眼可见的是,特朗普家族牟利的脚步仍然还未停歇。上任不到半年,账面吸金已过数十亿美元,四年任满,捞金又有几何?执政能力的评价还未展开,美国最会赚钱的总统,似乎已经诞生。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。