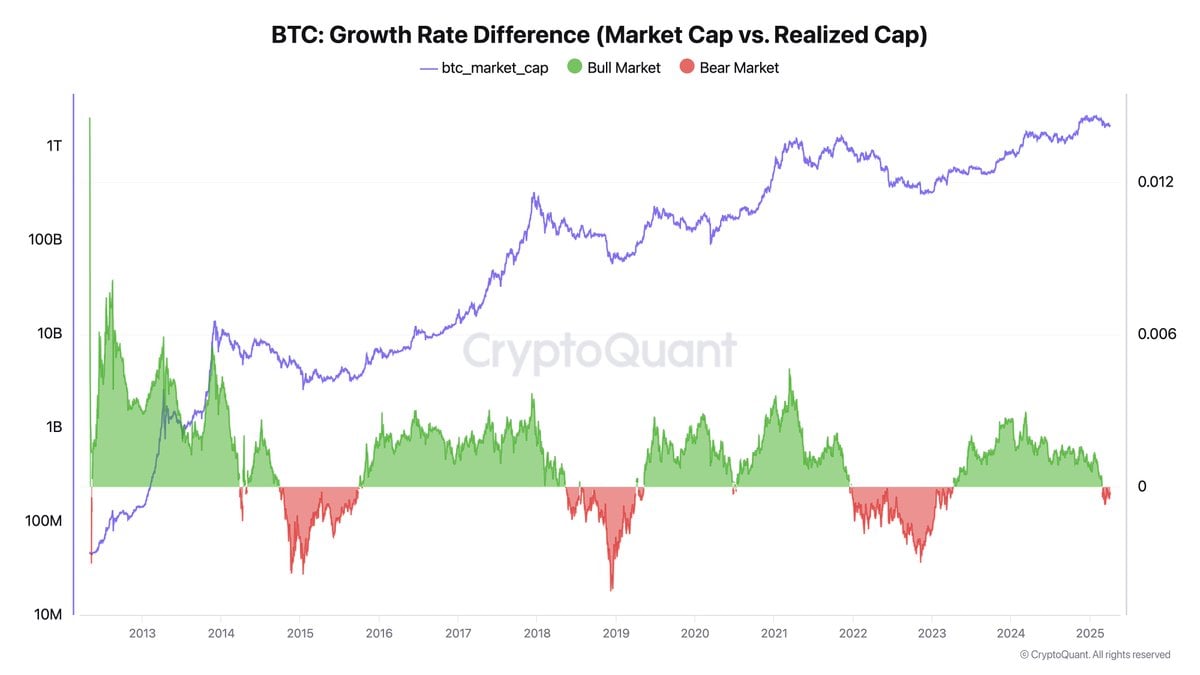

Realized cap, an onchain metric tracking the average cost basis of BTC holdings, reflects actual capital inflows. Market cap, based on BTC’s last traded price, measures perceived value. Cryptoquant‘s CEO Ki Young Ju explained that when realized cap rises while market cap stagnates, it signals capital entering the market without price appreciation—a bearish trend.

The image captures bitcoin’s growth trajectory from 2013 to 2025 through two distinct lenses: market cap, a reflection of price-based valuation, and realized cap, a metric grounded in aggregate cost basis. It maps this divergence across bull and bear cycles, offering a visual narrative of shifting momentum. By framing these historical phases alongside the Cryptoquant CEO’s assessment of present stagnation, the chart lends weight to his viewpoint—while subtly hinting at the possibility of a cyclical rebound, echoing bitcoin’s tendency to recover following such valuation gaps.

Conversely, a surging market cap with a flat realized cap indicates bullish momentum driven by speculative buying. He noted that current data shows realized cap increasing as investors accumulate BTC, but prices remain stagnant due to high selling pressure. Ju referenced Strategy’s (MSTR) convertible bond-driven BTC purchases, which amplified paper gains during low sell periods.

“But when sell pressure is high, even large purchases fail to move the price,” the Cryptoquant CEO remarked. “There are simply too many sellers. For example, when bitcoin was trading near $100K, the market saw massive volumes, but the price barely moved.”

The Cryptoquant executive noted, however, that critics argue onchain data may miss off-exchange activity, but Ju countered that major capital flows—including exchange transactions, custodial movements, and exchange-traded fund (ETF)-related trades—are visible onchain. Historically, Ju noted, bear market reversals take at least six months, making short-term rallies unlikely.

While current metrics signal caution, bitcoin’s history of defying expectations leaves room for optimism. Institutional adoption, regulatory clarity from Trump’s administration, or positive macroeconomic shifts could reignite bullish momentum, bypassing short-term sell pressure. A surprise and bullish advancement could attract fresh capital, potentially realigning Realized and Market Caps.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。