During dinner tonight, we were discussing how relaxed this weekend has been, with no running around and not much market fluctuation. Even $BTC showed an independent trend. However, by the afternoon in the U.S., things started to go awry, with Bitcoin dropping 5.5% and $ETH falling over 10%. Although I didn't go to Hong Kong, I still contributed to the activities there.

I analyzed many reasons for the decline tonight, but they all seemed a bit forced. There isn't a very clear reason linking the drop to any specific content. Saying it's due to the implementation of reciprocal tariffs isn't accurate either, as after Lutnik indicated that the tariffs would be implemented on schedule, several countries and regions expressed their willingness to make adjustments. This is a good thing. After all, the reciprocal tariffs announced on the 2nd were the worst-case scenario, and anything better than that is a plus for the market.

Additionally, we noticed that although Bitcoin temporarily fell below $79,000, the trading volume wasn't high. This indicates that the selling wasn't primarily from large institutions or so-called "whales," but rather seemed to be a risk-averse move. Moreover, considering the timing, it was during the main trading hours in Europe and the U.S., so it could be a reaction to the risk-averse sentiment regarding the European tariff countermeasures expected on Monday.

In fact, I'm more concerned about the opening of U.S. stock futures a few hours later and entering the main trading hours in Asia. If U.S. stock index futures continue the downward trend from Friday, will Asian investors react with more panic to the declines in both the stock market and cryptocurrencies? It's hard to say right now. However, I personally believe that as long as the economy doesn't go into recession, around $70,000 should be a decent bottom range.

Of course, I may not be right. I will start to accumulate again, but not only considering the price, but also the timing. If the price of $BTC falls below the previous low of $77,000 after the announcement of reciprocal tariffs, I might consider starting to build a small position in Bitcoin. This is mainly due to concerns about the GDP data to be released at the end of the month, so I don't want to increase my speculative positions, and this thought might need further refinement.

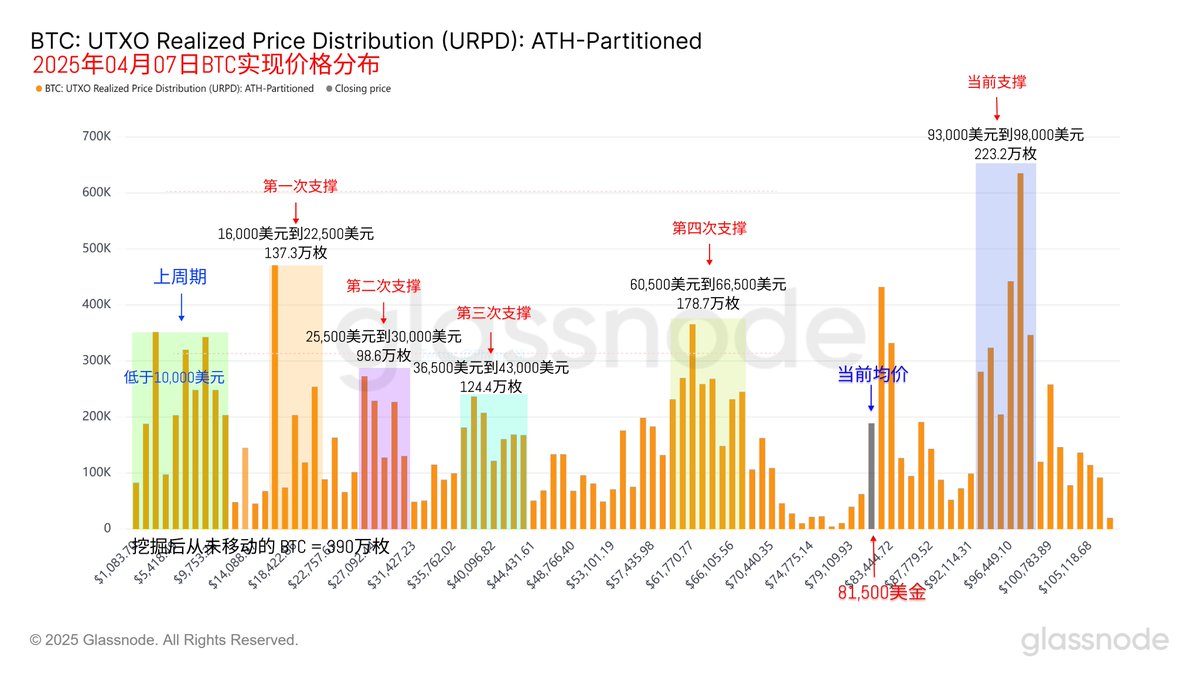

Looking back at Bitcoin's data itself, as expected, there hasn't been much turnover. It remains short-term investors, especially those who bought in the last two days, who are now exiting. I wondered if the panic among some investors was due to the official implementation of the 10% tariff starting Monday. After all, the average tariff in the U.S. for 2024 is only 2.5%, and now it's at 10%.

This also indicates that, at least currently, there are no significant signs of panic on-chain. The selling is more likely coming from the existing Bitcoin on exchanges. Let's see how the market reacts on Monday.

Since the on-chain liquidity isn't large, there hasn't been any fundamental change in the current support structure.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。