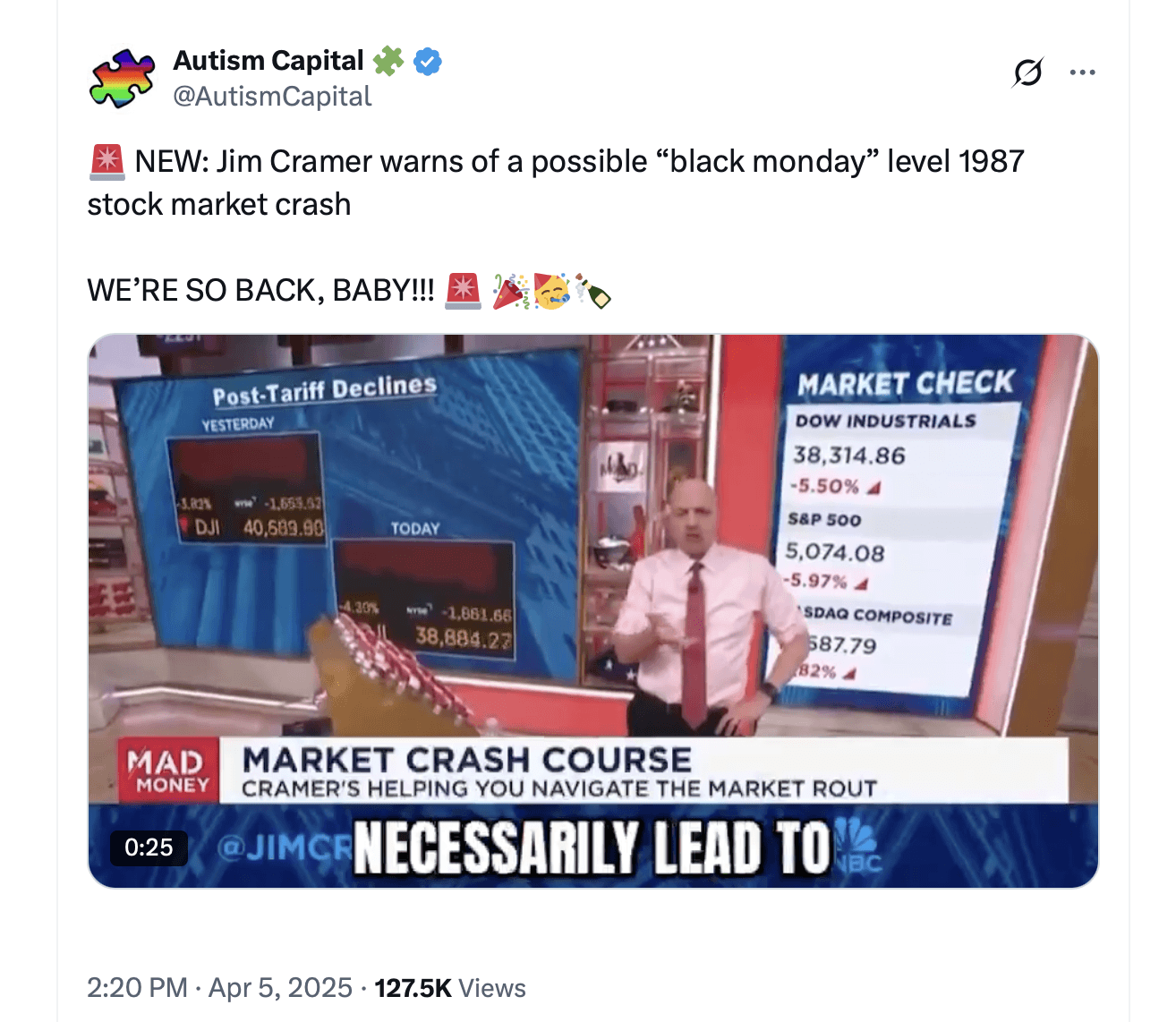

Jim Cramer, the volatile host of CNBC’s “Mad Money,” has sparked alarm with his prediction of a market crash reminiscent of 1987’s Black Monday, when the Dow Jones Industrial Average (DJIA) plummeted 22% in a single day. His warnings follow a brutal two-day sell-off on April 3–4, 2025, which saw the Dow plunge 2,231 points amid fears that Trump’s tariffs on imports could exacerbate inflation and stall economic growth.

Cramer, a former hedge fund manager turned media personality, attributed the recent downturn to President Trump’s refusal to scale back tariffs targeting foreign goods, particularly Mexican beer and auto parts. He singled out companies like Constellation Brands—the distributor of Grupo Modelo’s Corona beer—as vulnerable to tariff-driven cost spikes, noting, “The last thing it needs is tariffs. This dog played my child trust until we finally jettisoned it at a big loss.” Cramer also criticized Trump’s inaction, arguing that without intervention, markets could face a “man-made obliteration” akin to Black Monday.

Cramer said:

We could be in for the rips of a quick bear market, following the Covid-2020 model. We could be in for a 2000-style bear market where tech was laid to waste for a very long time, or it might be the Big Kahuna—the one in October 1987.

The host’s dire outlook has reignited debate over his stock-picking track record. Critics often label Cramer a contrarian indicator, citing data showing that betting against his recommendations—via strategies like the Inverse Cramer ETF (SJIM)—has historically outperformed the market. The SJIM ETF, launched in 2023, reportedly delivered a 48% return in 2024 by shorting Cramer’s picks. Analysts argue his tendency to hype overvalued, media-driven stocks creates short-term volatility ripe for exploitation.

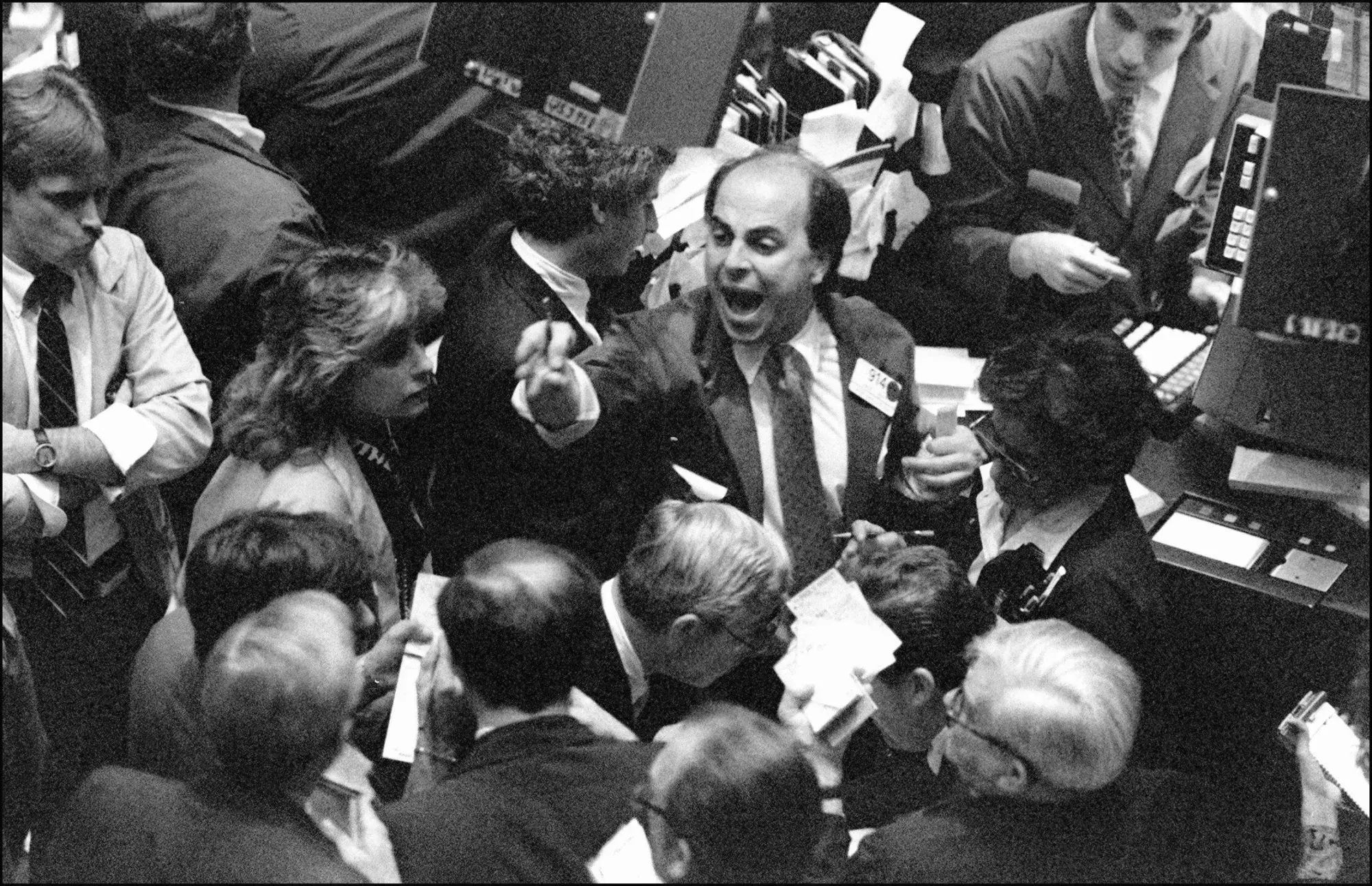

Oct. 19, 1987, otherwise known as ‘Black Monday.’ Photo source: Bloomberg.

Cramer’s Black Monday comparison references the Oct. 19, 1987, crash, triggered by program trading, overvaluation, and global contagion. While swift central bank action averted a depression, the crash exposed risks of automated trading and herd mentality—factors Cramer claims are resurfacing. “It feels like one of those pre-crash moments in October ’87,” he said, recalling his decision to sell holdings before the collapse.

Despite his polarizing reputation, Cramer urged investors to avoid panic, noting that post-1987 markets rebounded within a year. He advised focusing on recession-resistant sectors like auto parts and discounted financial stocks, though he cautioned, “In a recession, you don’t wanna own anything connected to autos.”

The Inverse Cramer movement, amplified by social media trackers like @Cramertracker, showcases deepening skepticism toward his advice. Yet Cramer’s latest warnings highlight tangible risks: Trump’s tariffs have already disrupted supply chains, while sticky inflation complicates the Federal Reserve’s ability to cut rates.

Whether Cramer’s prediction proves prescient or merely hyperbolic, his commentary reflects broader anxieties over policy-driven market instability—a lesson Black Monday taught all too well.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。