The era of broad altcoin rallies may be fading as 2025 shapes up to favor strategic picks over market-wide surges, according to a March 2025 report by Kaiko Research in collaboration with Blockhead Research. The analysis highlights shifting liquidity trends, regulatory pressures, and bitcoin’s expanding institutional footprint as key forces redefining crypto capital allocation.

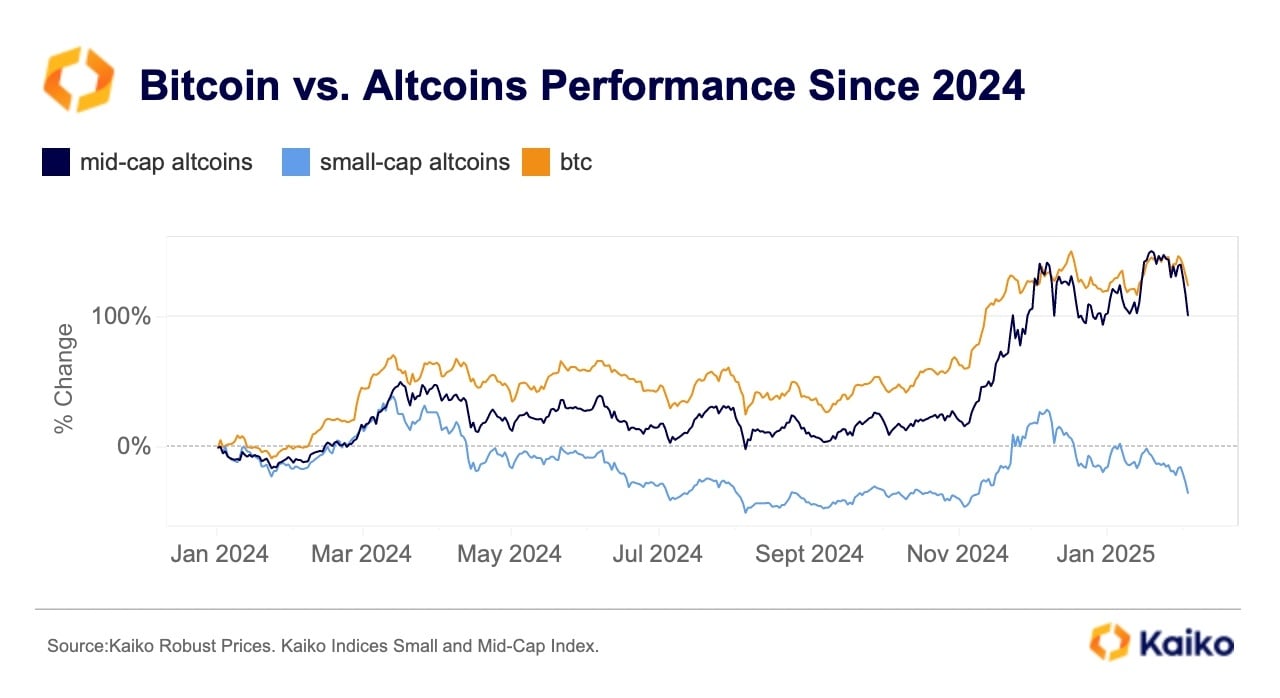

Altcoin trading volume dominance relative to bitcoin has climbed to levels unseen since 2021, yet concentration is at record highs. The top 10 altcoins now account for 64% of total volume, up from 32% in late 2021, with post-U.S. election momentum accelerating this trend. Large caps like solana ( SOL) and XRP have rallied, but small and mid-cap tokens tracked by Kaiko’s indices lagged, dropping over 30% year-to-date.

Macroeconomic headwinds further complicate the landscape. Rising global interest rates and reduced central bank liquidity have dampened risk appetite, contrasting sharply with the loose monetary policies that fueled the 2021 bull run. While bitcoin has thrived amid U.S. spot exchange-traded fund (ETF) approvals—attracting $1 billion in first-day trading volume—altcoins face steeper competition for capital.

The U.S. Policy Uncertainty Index, now at Covid-19-era highs, has also driven investors toward bitcoin’s perceived stability. The report concludes that altseason—a period of uniform altcoin gains—may be supplanted by a “strategic picking” phase. Success will hinge on liquidity depth, institutional backing, and measurable adoption, sidelining weaker projects. This signals a pivot for investors from diversification to precision in crypto portfolios.

Additionally, this weekend, blockchaincenter.net’s Altcoin Season Index sits at a paltry 20—nowhere near the 75 required to declare an altcoin season. The benchmark is clear: when 75% of the top 50 coins outpace Bitcoin over a 90-day stretch (stablecoins and wrapped assets aside), the market flips into altcoin mode. Yet right now, just ten tokens have managed to eclipse BTC’s performance in the past three months.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。