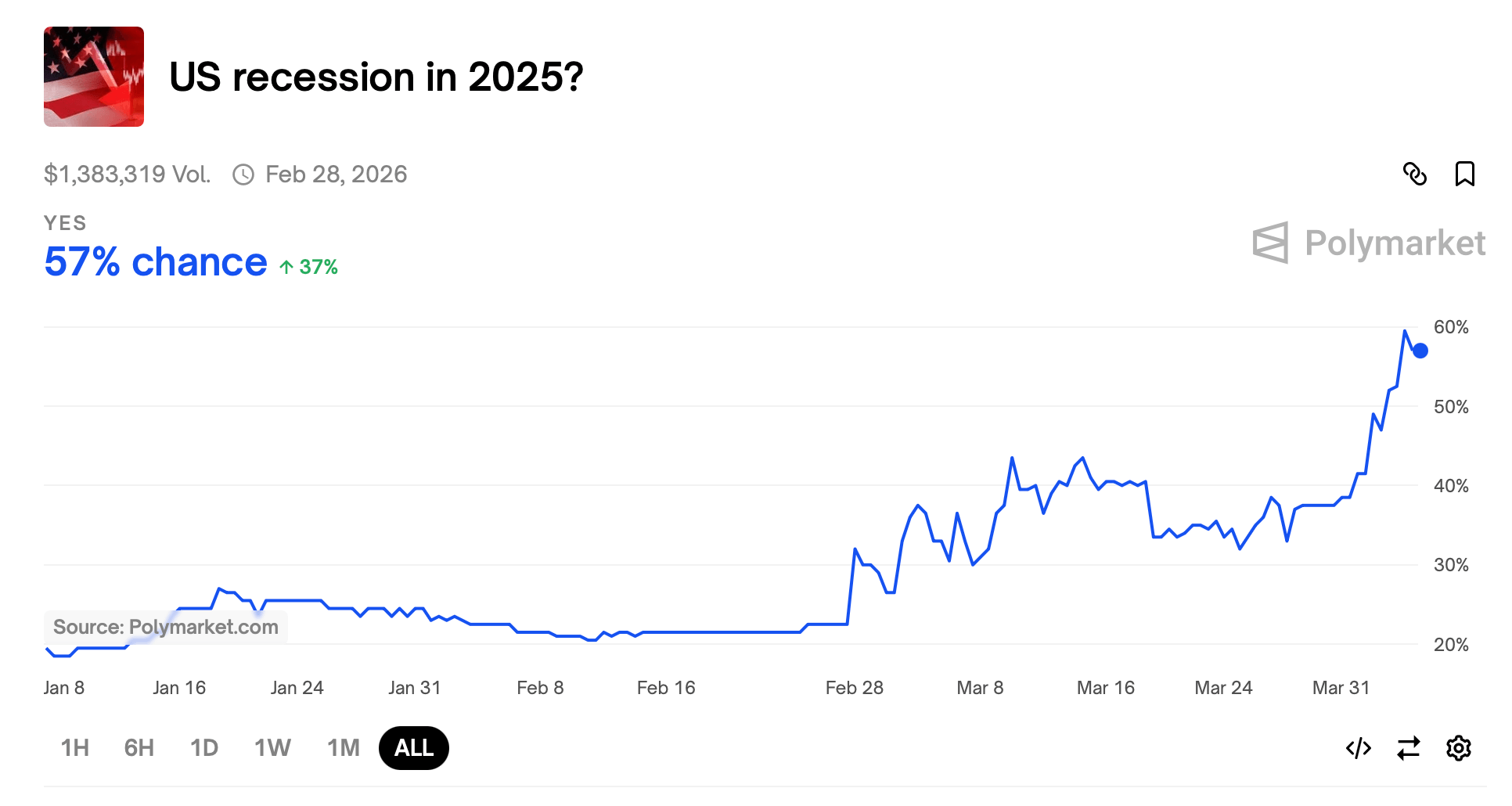

Based on the activity on Polymarket, the blockchain-powered predictions platform, expectations of a recession have grown since our previous update on the wager. Just two days ago, following Trump’s announcement of the “Liberation Day” tariff initiative, the probability of a 2025 recession was pegged at 49%. At that point, trading volume hovered near $1.1 million; today, it has climbed to $1.38 million. The likelihood of a recession has also moved higher, now reaching 57%.

Polymarket recession bet on April 5, 2025.

The probability reflected on Polymarket now closely aligns with JPMorgan Chase’s latest projection, as the financial institution formally increased its estimate for a U.S. recession—placing the odds at 60% in light of the economic consequences tied to Trump’s newly imposed tariffs. This makes JPMorgan the first major Wall Street firm to issue a direct recession forecast for 2025, citing the forceful nature of the trade measures.

The bank anticipates a 0.3% contraction in the U.S. economy throughout 2025, with GDP expected to decline by 1% in Q3 and another 0.5% in Q4. The most recent economic calamity has thrown expectations for the upcoming May 7 U.S. Federal Reserve meeting into uncertainty. At present, there’s a 66.7% probability that interest rates will hold steady, while a 33.3% chance remains for a potential quarter-point cut. Polymarket reflects nearly identical probabilities, though with subtle variations in its figures.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。