The U.S. stock-market slide prompted by President Donald Trump's global tariff announcement on Wednesday sent the Nasdaq Composite Index into one of its biggest funks since the start of the century.

The tech-heavy index lost 5.5% on Thursday, just outside the top 20 worst single-day drawdowns since 2000, according to Investing.com. Most of the largest drawdowns occurred during the dot-com crash of 2000-2001 and the 2008 global financial crisis. Other equity measures also suffered, with the S&P 500 index falling almost 5%.

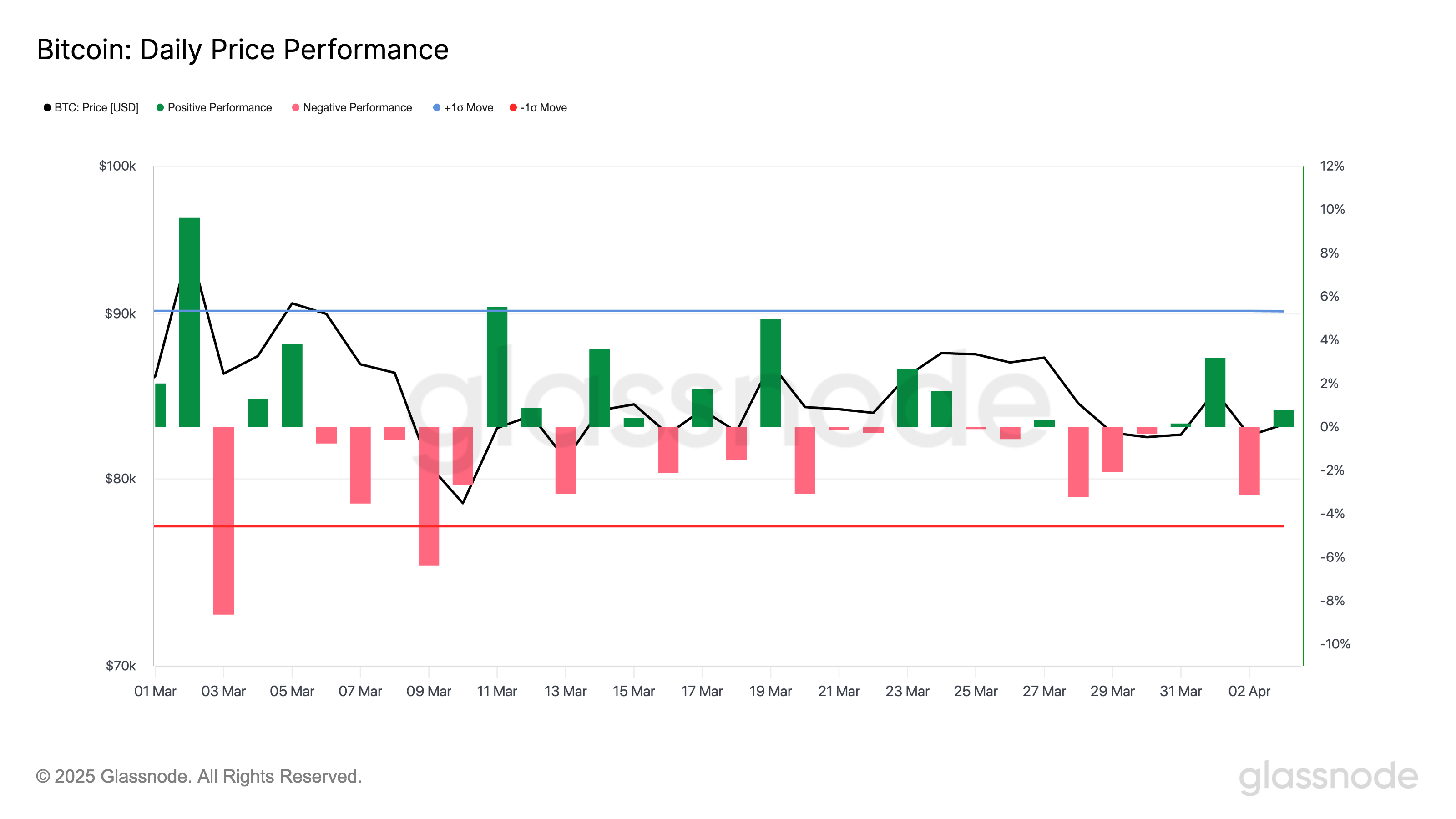

In contrast, the bitcoin (BTC) price, which is typically correlated with U.S. equities over short timeframes, bucked the trend. The largest cryptocurrency, which tumbled immediately after the announcement while stock markets were closed, rose 0.7% the following day, with momentum carrying into Friday, according to Glassnode data.

Bitcoin is now trading above $84,000 compared with about $87,000 before Trump started speaking. Nasdaq futures, meanwhile, are lower ahead of the U.S. jobs report due later in the day.

Bitcoin made its 2025 low in mid-March at around $76,000, whereas the Nasdaq hit a low on Thursday. Year-to-date, bitcoin is outperforming the Nasdaq, losing 10% against the index's 11%.

Analyst Caleb Franzen highlighted bitcoin's relative strength compared with the S&P 500 in this risk-off environment, noting its resilience around the 200-day moving average.

"It's pretty remarkable to see that bitcoin is up +3.4% today relative to the S&P 500, particularly in a risk-off environment. As I've recently pointed out, BTC/SPY continues to hold above its 200-day moving average cloud," Franzen said in a post on X.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。