Treasury Secretary Scott Bessent addressed the market’s stumble Friday, tracing the slump chiefly to declines among the “Magnificent 7” (Mag 7)—Amazon, Tesla, Microsoft, Meta, Nvidia, and peers—rather than Trump’s trade measures. He noted the Nasdaq’s all-time high coincided with Chinese AI firm Deepseek’s launch of advanced language models, sparking unease over the competitiveness of American tech investments in artificial intelligence (AI).

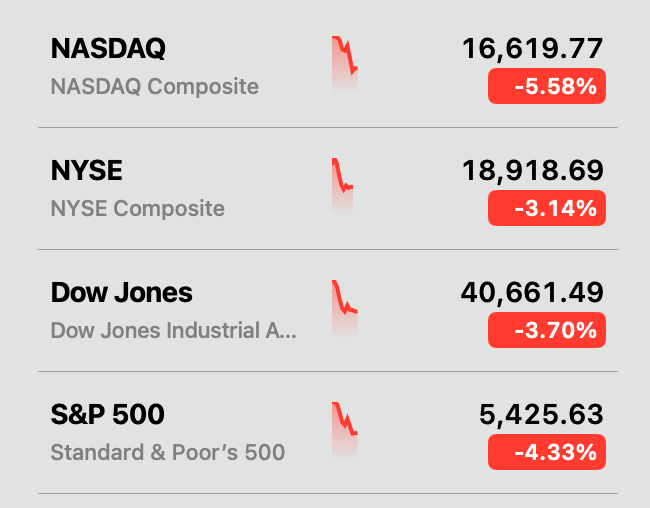

Top Wall Street indices at 11:00 a.m. ET on April 3, 2025.

Bessent asserted, “That’s a Mag 7 issue rather than a MAGA issue,” framing the decline as specific to tech equities, not wider tariff shifts. Observers suggest Trump’s circle may be intentionally engineering a downturn to facilitate restructuring the nation’s towering debt obligations. The strategy, which the research firm The Kobeissi Letter claims was solidified before Trump’s January inauguration, has already erased over trillions from U.S. stock valuations and driven investors toward safe-haven assets like gold, which has been tapping new lifetime highs.

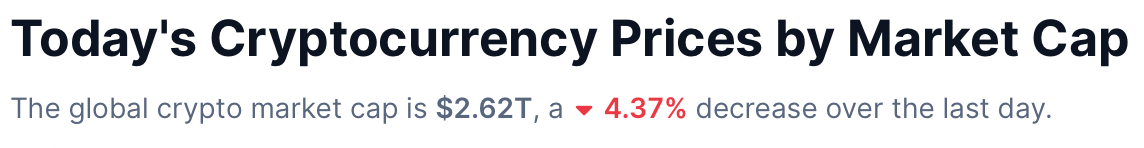

Crypto economy total valuation at 11:00 a.m. ET on April 3, 2025.

Cryptocurrencies and equities have suffered steep losses. The Kobeissi Letter asserts that Trump’s team views a recession as the fastest path to lower rates ahead of the 2025 debt refinancing cliff. February’s $1.15 trillion year-to-date deficit—38% higher than 2024—has intensified pressure to curb spending. Key tactics include slashing oil prices (down 20% since inauguration), trimming government jobs (2 million added since 2020), and escalating global tariffs. A substantial cohort of observers concur with this assessment.

“Does everyone saying we have a ‘great economy’ realize we are $37 trillion in debt and it costs over $1 trillion to service the debt?” Jacob Canfield wrote on X. “The only way out is by refinancing our debt at lower interest rates. And the only way to get lower rates? Crash the market. Force the Fed’s hand. Make them cut rates. When rates drop, the U.S. can roll over debt more cheaply. When you get cheap debt, everything will go up.”

Canfield added:

Short term: crash for real estate, stocks, and crypto and boom for gold and precious metals. Long term: new all time highs across the board.

Bitmex co-founder Arthur Hayes appears to echo this thesis, positing that the Fed will inevitably bow to pressure. “Trump’s tariff formula is further evidence he is laser focused on reversing these imbalances,” Hayes wrote on April 3. “The problem for treasuries is that without $ exports foreigners can’t buy bonds. The Fed and banking system must step up to ensure a well functioning treasury [market], which means Brrrr.”

Administration officials have openly endorsed the strategy. Commerce Secretary Lutnick stated on March 6 that the “stock market [is] not driving outcomes,” while Treasury Secretary Bessent, at the time, dismissed concerns over “a little volatility.” The Kobeissi Letter’s post highlights Trump’s March 9 remark acknowledging a “period of transition” as evidence of his tolerance for asset price declines. Analysts warn the approach risks a self-fulfilling downturn, particularly as consumer spending cools.

One certainty emerges: Thursday’s synchronized retreat across Wall Street and digital asset markets, ignited by Trump’s newly imposed trade measures, reflects an enduring climate of doubt.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。