Even before U.S. markets stirred, Dow Jones Industrial Average futures telegraphed unease, projecting a 3% downturn in pre-bell trading.

This financial tremor followed Wednesday’s tectonic policy shift: The White House introduced a sweeping 10% baseline tariff on select nations, effective Apr. 5, a maneuver that sparked immediate consternation across global exchanges.

By dawn Thursday, Wall Street’s premarket indices plunged into crimson territory, mirroring the digital asset sector’s 3.92% contraction over 24 hours. Bitcoin, after briefly stabilizing above $83,000 at 7:30 a.m. ET, slipped beneath $82,000 just 90 minutes later—a harbinger of broader volatility preceding equities’ opening act.

Leading cryptocurrencies faced a cascading rout: Bitcoin retreated 3.5%, Ethereum tumbled 5.6%, and XRP relinquished 6.5%, while BNB and SOL eroded 2.3% and 10.3%, respectively.

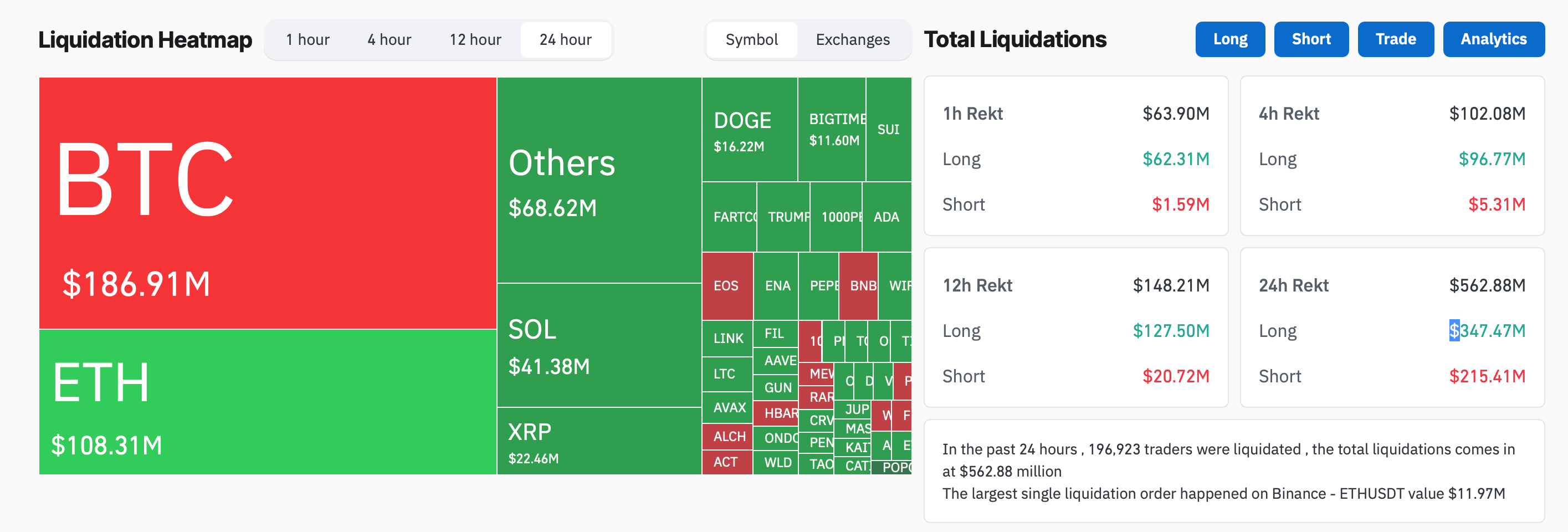

Meme tokens bore sharper wounds, with DOGE and ADA shedding 8.5% and 9%, as TRX slid 2.9%. Derivatives markets witnessed $562.82 million in positions forcibly closed Thursday, leaving 196,887 traders navigating margin calls.

Of this carnage, $347.65 million stemmed from bullish bets gone awry, contrasting with $215.17 million in profitable short maneuvers. Bitcoin derivatives alone accounted for $186.91 million of the bloodletting—a stark testament to its gravitational pull in speculative arenas.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。