In the long run, the most successful cryptocurrencies will be those that provide the most practical value through trusted neutrality, thereby achieving social scalability.

Written by: Nick Tomaino, Founding Partner of 1confirmation

Translated by: Luffy, Foresight News

Social scalability refers to an institution's ability to involve as many people as possible and allow them to profit. This characteristic is the core driving factor behind cryptocurrencies becoming an asset class with a total market capitalization of $2.9 trillion today. In this article, I will explain what it is and why it is so important.

In 2017, Nick Szabo published an article titled "Money, Blockchains, and Social Scalability" describing Bitcoin as a social breakthrough. Most people view cryptocurrencies purely as technology and focus on technical scalability, but I align more with Szabo's perspective. Technical scalability plays a role in social scalability, but it is not the main factor. In the long run, the most successful cryptocurrencies will be those that provide the most practical value through trusted neutrality, thereby achieving social scalability.

1. Social Scalability of Bitcoin

Bitcoin is the first trusted neutral, internet-based native store of value. The term "trusted neutrality" refers to fairness, impartiality, and being unaffected by small groups. Trusted neutrality is a social construct that, while often based on technology, ultimately relies on many dynamic factors that influence people's trust.

This trusted neutrality has been gradually earned by the Bitcoin protocol over time, initiated by grassroots efforts from the very beginning. Bitcoin was launched as open-source software, allowing anyone to read, run, write, and own it in a fair competitive environment. Its launch was fair, with no insider trading and no involvement from celebrities, companies, or governments. The rules were established from the start and have never changed. The community openly discusses everything about Bitcoin on forums like Bitcointalk. To understand its spirit, one can read Hal Finney's early remarks.

The trusted neutrality and practicality of Bitcoin are the main reasons for the growth of the crypto industry. Initially, Bitcoin was just a grassroots movement initiated by the pseudonymous founder Satoshi Nakamoto, with no insiders holding shares and no clear origin jurisdiction, serving as a new product for anyone in the world to use. Today, it has transformed into a $1.7 trillion asset, with some of the largest governments and companies in the world actively using it as a store of value. The rules of the Bitcoin system remain difficult to change, which is also a significant reason for its continued adoption.

The development of Bitcoin is remarkable, but the cultural decisions made by the community early on, focusing solely on its monetary function, have limited new Bitcoin developers and companies from applying it in more areas beyond currency. Although Bitcoin maximalists have claimed for the past 15 years that Bitcoin's potential is limitless, decentralized systems indeed have vast opportunities to bring more freedom and progress to the world beyond the monetary realm.

2. Is Social Scalability Really Important?

Social scalability is a crucial factor in Bitcoin's success, but by 2025, any investor must ask the question: Is social scalability really important? Today, among the top nine cryptocurrencies by market capitalization, four are essentially "company tokens" (XRP, BNB, SOL, TRON). The total market capitalization of these four tokens exceeds $31.2 billion.

These tokens have strong narratives but have not achieved trusted neutrality. They were launched by small teams in known jurisdictions (Silicon Valley in the U.S. and China) and allocated over 50% of the tokens to insiders (founding teams and venture capital firms). They have conducted highly coordinated marketing campaigns, with insiders participating in government lobbying and engaging in many corporate-style top-down activities. These protocols have yet to prove their resilience, security, and resistance to single points of failure. They have made radical trade-offs for performance, sacrificing decentralization.

Now, let's discuss their practicality. Some people find these four protocols useful, but they have not spawned new use cases or gained broader adoption. Regardless, these four tokens have achieved remarkable success, leading people to believe that what I call social scalability is irrelevant. If you can build a narrative and get enough people to believe in it, that seems to be what truly matters.

However, I believe that in the long run, social scalability is crucial and will bring over $2 trillion in value accumulation over the next decade. That is why we focus on it. If you are concerned with shorter time frames, I can understand why you might disagree. But I encourage you to look at it from a more macro perspective.

Time will prove everything, and circumstances may change. If you agree that social scalability is vital and examine the facts, you will clearly see that only two cryptocurrencies possess both trusted neutrality and sufficient practicality to achieve long-term social scalability: Bitcoin and Ethereum.

Bitcoin dominates the crypto space, but Ethereum may have greater social scalability than Bitcoin. The reasons are as follows:

3. Trusted Neutrality of Ethereum

Like Bitcoin, Ethereum's trusted neutrality has existed from the very beginning. Ethereum does not have the legendary "fair launch" story like Bitcoin, but in its initial phase, only 9.9% of its token supply was allocated to insiders, and anyone in the world could easily acquire Ethereum tokens by sending Bitcoin to the initial coin offering (ICO) address, with no behind-the-scenes deals for venture capital firms and no involvement from celebrities, companies, or governments.

Ethereum was initially a proof-of-work (PoW) chain and used the PoW mechanism for the first seven years, ensuring a more balanced token distribution before transitioning to a proof-of-stake (PoS) mechanism. At the beginning, you did not need to own or purchase Ethereum to participate in consensus and earn rewards; you only needed to contribute computing resources. Native proof-of-stake chains often face the issue of early large holders dominating token rewards. This helped Ethereum have a large and diverse stakeholder base early on, allowing a broader group of people to participate in consensus and earn Ethereum rewards.

Ethereum's founder is Vitalik Buterin. Critics of Ethereum may point to Vitalik's leadership and argue that having such a powerful and well-known founder undermines Ethereum's trusted neutrality. However, those who have observed Vitalik leading in a transparent and sincere manner from the beginning know that he has established a culture that emphasizes trusted neutrality.

You won't see Vitalik promoting investment narratives on social media like many prominent figures in the crypto space, chasing money, attention, and power. Over the past decade, he has been one of the easiest people in the industry to achieve all of that, but he has not done so. Instead, he has acted in his own way, emphasizing values such as anti-censorship, inclusivity, and transparency, and primarily focusing on setting the best technical architecture and long-term values for developers.

In fact, the governance of Bitcoin and Ethereum is similar. Modifications to the protocols of Bitcoin and Ethereum require a rough consensus among miners, users, and developers, which is why Ethereum's upgrade speed is much slower than many venture capital firms would like. But in the long run, this helps enhance its trusted neutrality and is a conscious trade-off made by Ethereum's leadership.

The Ethereum mainnet now has four execution clients (Geth, Nethermind, Besu, and Erigon) and five consensus clients (Prysm, Lighthouse, Teku, Nimbus, and Lodestar) actively maintained. The diversity of clients and avoidance of single points of failure have always been a focus. Additionally, the Ethereum mainnet and L2 have become the most trusted building platforms for developers and companies.

Today, the proportion of Bitcoin owned by Michael Saylor's company in the total Bitcoin supply is far higher than the proportion of Ethereum tokens owned by Vitalik and the Ethereum Foundation in the total Ethereum supply. Bitcoin's leaders have allied with the government more quickly by supporting politicians and lobbying. This may be because Bitcoin has matured more and attracted a broader stakeholder group than Ethereum.

However, the risk that Saylor and government lobbying could undermine Bitcoin's trusted neutrality is real, and it is encouraging to see Vitalik and the Ethereum Foundation resist the impulse to chase investment narratives in response to market conditions. Ethereum's leadership focuses on developers, and Ethereum has now far exceeded the scope of any individual or group. The most important people for Ethereum's future are likely the developers who are still relatively unknown today.

4. Practicality of Ethereum

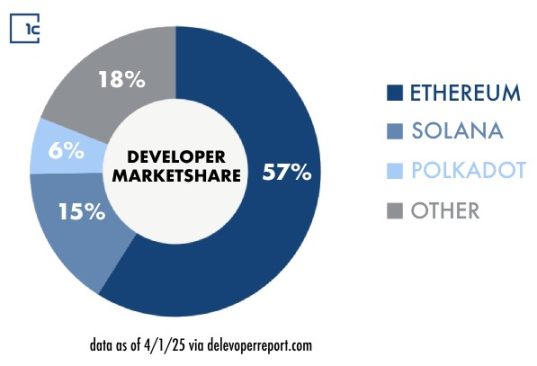

The Ethereum Virtual Machine (EVM) dominates market share and has strong network effects: since Bitcoin introduced the world to a trusted neutral, internet-based native store of value, Ethereum has captured a significant share of mind among the developer community and has become the birthplace of every innovation that brings a large number of new users into the crypto space beyond currency. Ethereum is the birthplace of decentralized finance, non-fungible tokens (NFTs), prediction markets, decentralized social networks, decentralized identity, real-world assets (RWA), stablecoins, and more. All these new use cases promote EVM wallets and Ethereum as a trusted neutral, internet-based native store of value.

Some of these use cases initially started on the Ethereum mainnet and are now transitioning to L2 blockchains built on Ethereum. Many excellent companies and developers working in the crypto space prefer a trusted developer environment that offers them more control and better economic benefits compared to working on L1 blockchains, which is what Ethereum's L2 architecture provides. Those developing on L2 or L3 not only gain more benefits but also enjoy Ethereum's security, the network effects of the EVM, and promote Ethereum as a trusted neutral, internet-based native store of value. Some L2s will thrive, while others may not. For certain use cases, developers may realize that they can achieve significant liquidity advantages on the mainnet that L2s do not offer. Regardless of the outcome, it is beneficial for Ethereum.

There has been much discussion about whether L2 contributes to Ethereum's value or will erode the mainnet's fees and reduce Ethereum's value. Standard Chartered recently lowered Ethereum's target price from $10,000 to $4,000, citing that Coinbase's L2 (Base) would erode the mainnet's fees. This viewpoint only sees the trees and not the forest.

The main benefit of L2 is not to contribute fees to the mainnet, but to promote EVM wallets to new users and to advocate for Ethereum as a trusted neutral, internet-based native store of value. The usage of the Ethereum ecosystem (including the mainnet and L2) can reduce the supply of Ethereum, which is a great feature that has made Ethereum more deflationary than Bitcoin. However, fees are not the primary benefit of applications and L2.

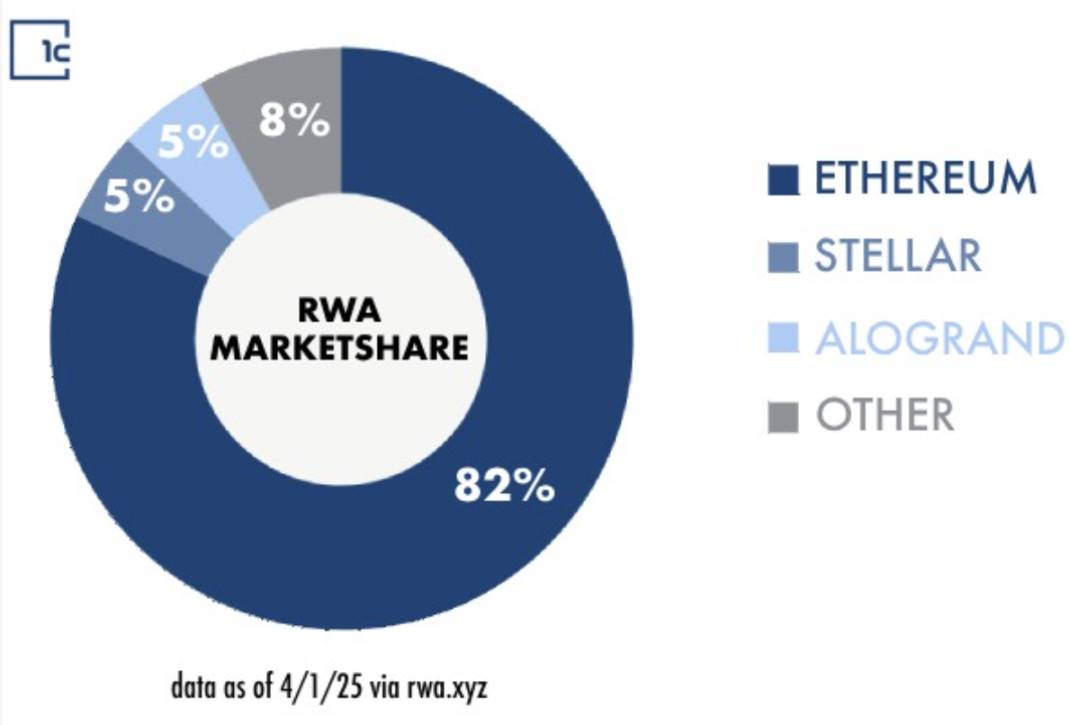

Ethereum dominates the market share in stablecoins, real-world assets, and NFTs: Ethereum is now the primary ecosystem for new developers and large companies like JPMorgan, BlackRock, Coinbase, and Robinhood to tokenize assets. This trend began with crypto-native assets like fungible tokens and NFTs, but is now increasingly touching areas such as dollars, government bonds, stocks, bonds, private credit, and real estate. Whether these activities occur on the mainnet or L2, and how much L2 ultimately pays to the mainnet, will affect the amount of Ethereum burned. However, even if all these activities occur on L2 and L2 pays very little to the mainnet, the popularity of these use cases will still promote Ethereum as a trusted neutral, internet-based native store of value.

5. Opportunities Worth Over $100 Trillion

A trusted neutral, internet-based native store of value represents the largest market opportunity in today's world. The total market capitalization of gold is about $20 trillion, and the global broad money supply (M2) is approximately $100 trillion, so it can be said that this is a market opportunity worth over $100 trillion.

Cryptocurrencies that achieve social scalability through trusted neutrality and practicality have the best chance to seize this opportunity. Currently, there is not a strong narrative surrounding this, but from my experience in life and the crypto space, I have learned that often the stronger the narrative, the further it may be from the truth. Those who focus on core objectives and resist the impulse to chase short-term gains will be rewarded.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。