This strategic breakthrough is both a "shock therapy" for the market and a proactive move by Binance to redefine the competitive landscape of the bull market.

Written by: Oliver, Mars Finance

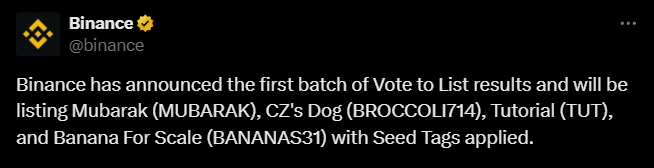

On March 27, 2025, Binance made a significant move: through community voting, it launched four new coins at once—MUBARAK, BROCCOLI714, TUT, and BANANAS31—accelerating the pace like stepping on the gas. This is not just a simple coin listing announcement, but a strategic breakthrough for Binance in the quagmire of the bull market.

The Bull Market's Dilemma: Liquidity Crisis and VC Harvesting Feast

This round of the bull market appears to be thriving, with Bitcoin hovering at high levels, and retail investors shouting "all in" as they rush in. But underneath lies dry sand, with liquidity as parched as a sunbaked riverbed; funds come in quickly but leave even faster. The market acts like a giant vacuum cleaner, sucking retail investors' wallets dry before they can even warm them up. Who is to blame? VC (Venture Capital) coins bear the brunt. Over the past few years, relying on flashy narratives and team halos, these projects have raised sky-high valuations, launching with market caps of 300 million to 500 million, and FDV (Fully Diluted Valuation) easily soaring to 1 billion or even 3 billion. It is not uncommon for new coins to be halved immediately after launch; before retail investors can shout "to the moon," their account balances have already "to the floor," with project teams and VCs cashing out and leaving a mess behind.

This "launching at peak" harvesting model not only extinguished the enthusiasm of the bull market but also dragged the reputation of exchanges into the abyss. Retail investors began to doubt: is this bull market a wealth party or a slaughterhouse for cutting leeks? Market sentiment is low, funds are scattered, and hot spots are fleeting; beneath the halo of the bull market lies deep fatigue. Binance clearly could not stand by, and this "four-coin launch" is a clear signal to throw a big stone into this stagnant water to stir up some waves.

Breaking the Bull Market: Painful Yet Joyful "Shock Therapy"

What does this "four-coin launch" mean for the bull market? In the short term, it brings growing pains, with funds being diverted, and retail investors complaining: "The market is severely fragmented; who can still rise?" Project teams must also sweat, as valuations are slashed, KOL quotes must be compressed to 25%-35%, and even the listing fees for exchanges must be renegotiated. Retail investors on X are venting: "Voting has lost its meaning; Binance is just playing with us." While this statement is exaggerated, it reflects the confusion in the market.

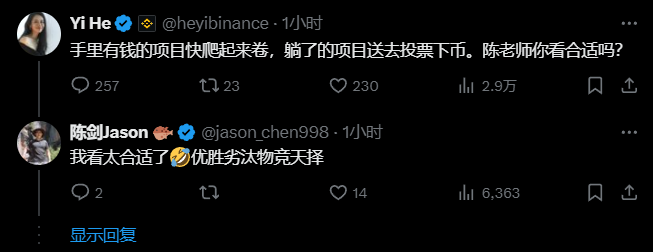

However, in the long run, this is a necessary path for the bull market to "remove the false and retain the true." Binance is using high-frequency coin listings to numb the market; the listing effect is gone, the premium is gone, leaving only free competition. Projects that rely on hype and VC cliques will be squeezed out like pus; only those with real communities and scenarios can break through. He Yi bluntly stated: "Projects with money should quickly get up and roll; those lying down should go vote for delisting." This, combined with Binance's early launch of the "voting delisting mechanism," serves as a double warning—if you don't roll, you will be eliminated. Poorly performing projects will be kicked out, giving retail investors more room for growth, which is much healthier than "high premium listings immediately breaking."

Binance seized the window of opportunity when the market was numb, accelerating the squeezing of the pus without leaving any breathing space. Some analysts on X noted: "The market cap limit of on-chain memes will be heavily impacted, and the likelihood of altcoins rising on CEX is even smaller." Isn't this exactly what Binance wants? To squeeze out the bubbles and bring the market back to rationality, allowing quality projects to surface. Retail investors may suffer in the short term, but in the long term, they may welcome a fairer opportunity for wealth creation.

Binance's Strategic Shift: From Aristocrat to Fighter

In the past, Binance was the "aristocrat" of exchanges, with high barriers to entry for coin listings, requiring projects to have a pedigree, a story, and to pass through layers of screening before making it to the table. Back then, when a new coin was listed on Binance, it was like receiving a ticket to wealth freedom, attracting a swarm of retail investors and sending prices soaring. But now, the aristocrats have come down to earth. This "four-coin launch," along with the fast-paced Alpha channel, Launchpool, and Pancake IDO, presents a "wholesale market" approach.

Cutting Bubbles, Repricing.

Binance's recent high-frequency coin listings act like sharp scissors, cutting the inflated bubbles of the market into pieces. The FDV of VC coins has been slashed from 1 billion-3 billion to 300 million-500 million, and meme coins have shrunk to 50 million-100 million. This is the reality price after liquidity exhaustion; no matter how impressive your team or narrative was in previous years, there is only so much money in the market, and you are worth this price. Industry observers point out that this downward valuation is a natural continuation of the bear market cleanup, but Binance has actively accelerated this process, attempting to seize the high ground of pricing power.

Seizing Territory, Deepening Breakthroughs.

Small and medium exchanges have captured a lot of traffic with low barriers, and on-chain meme projects have piqued retail investors' interest. Binance cannot sit idly by; why should they eat meat while I only drink the northwest wind? From Alpha to contracts, to spot trading and new listings, Binance is launching a full-scale attack, covering the entire frequency spectrum from memes to small and medium projects. Some commented on X: "Binance is trying to regain market pricing power and change the system of 'once listed on Binance, it's the end point.'" This statement is not without merit; Binance not only wants to reclaim traffic but also to suppress the market cap limit of on-chain memes, firmly locking retail investors' attention within its own ecosystem.

Ecological Closed Loop, Comprehensive Layout.

Binance's ambitions do not stop there. It connects on-chain hot spots through Alpha, drives the ecosystem with the BNB chain, and binds users with wallets, constructing a closed loop from investment to trading. The status of BNB is being increasingly elevated; whether it's new listings, voting, or wealth management, it is indispensable, and the price remains stable. The BNB/BTC pair has not dropped. Retail investors holding BNB are like holding the "stabilizing needle" in the bull market; if BTC rises further, BNB is likely to become one of the coins with the strongest fundamentals.

However, while everyone is discussing Binance's strategic shift, CZ jumped out to pour cold water: "There are no betting clauses. There is no strategy (at least from my personal perspective)." This statement feels like a game of Tai Chi; the absence of betting clauses indicates it is not forced by capital, and the lack of strategy nonetheless stirs the market into chaos. This "no move is a move" flavor is intriguing. Perhaps every step Binance takes is not a deliberate design but a precise grasp of the market pulse.

Brainstorming: Binance's Next Move

The "four-coin launch" is just an appetizer. In the future, Binance may batch launch 10 or 20 coins, turning the market into a porridge, completely desensitizing it; or it may strengthen the delisting mechanism, forcing projects to reach new heights; or it may connect the BNB ecosystem to build a closed-loop empire from investment to trading. It seems increasingly difficult for small and medium exchanges to catch their breath. Some predict: "VC investments will lower valuations again, and Binance will once again control the entire market." This statement, while bold, is not without basis. The giant ship of Binance is navigating towards deeper blue seas with seemingly random routes.

Another interesting point: this time, Binance did not even give traffic exposure in the "new coin area," clearly showing it is not supporting them. Some voices joked: "Binance has become cheap." This statement sounds harsh but reflects Binance's transformation from a "selected supermarket" to a "wholesale market." Whether it is cheap or not is not important; what matters is that it seeks daily active users, trading volume, and ecological control.

Conclusion: Binance's Ambition and the Redemption of the Bull Market

Binance's gamble is both a helpless response to the liquidity dilemma and a proactive move to reshape market order. It has transformed from an aristocrat to a fighter, using high-frequency coin listings to cut bubbles and employing delisting mechanisms to pressure competition. For retail investors, it is painful in the short term but fair in the long term; for project teams, it is time to wake up and roll. CZ says "there is no strategy," while He Yi urges "get up and roll," this combination harmonizes to create a new play for Binance.

The rules of the bull market have changed, and after flipping the table, Binance smiles and says: "Come, let's reshuffle the deck." Who can laugh last depends on who runs faster. Are you ready?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。