Author: taetaehoho, Eclipse CSO

Compiled by: Tim, PANews

The tweet in the image suggests: People are concerned that L2 will shift from being a scaling solution to an L1 launcher, so what exactly is the difference between L2 and L1?

The tweet in the image suggests: The generational division of chains in 2025 is outdated; there is no need to distinguish between L1 and L2. The real difference lies in the users and the ecosystem.

You should read these tweets 100 times.

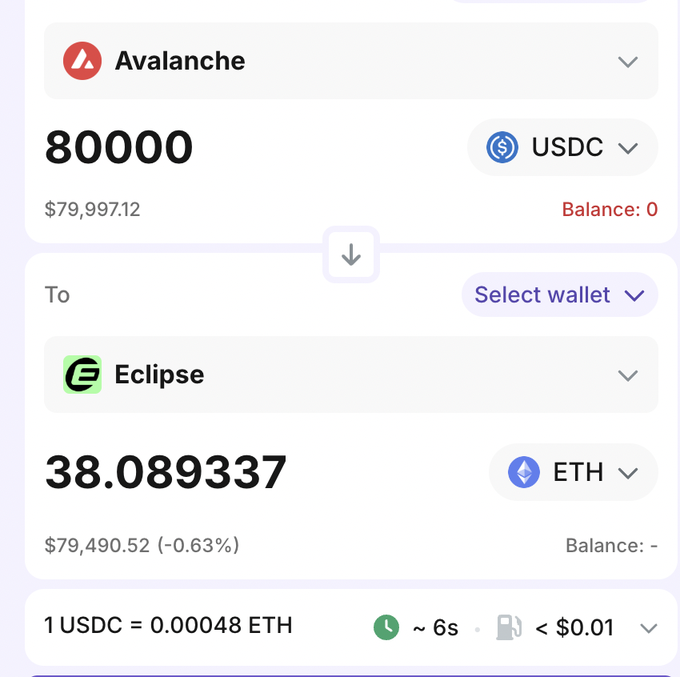

From the perspective of end-user perception, there is no product difference between L1 and L2. There is also no fundamental difference in liquidity between L1 and L2. A new L1 must launch by bridging the liquidity of stablecoins or non-native assets to its chain. Similarly, an L2 also needs to launch by bridging the liquidity of stablecoins or non-native assets to its chain. The difference for L2 is that it receives a trust-minimized bridge from L1, while Alt-L1 does not have this mechanism and must rely on cross-chain message bridges. It is evident that some large whales are very sensitive to these trust assumptions, but many ordinary users do not care.

A viewpoint from the middle-ground group (mainly from Alt-L1 teams) argues that "L2 will lead to liquidity fragmentation."

An L2 only allows for trust-minimized bridging from L1, but every L2 launched today will connect with Alt-L1 and other L2s.

Every legitimate L2 deploys cross-chain message bridges at launch. Any user connected to the underlying chain (such as Ethereum, Solana) can use this as a relay for large asset transfers between Alt-L1 and L2. If an Alt-L1 does not have its own L2, this could make it difficult for liquidity to flow outward, but if it also integrates cross-chain messaging bridges, it creates a paradox.

The essence of an L2 product is not defined by its association with L1. It is merely an execution layer, just like other execution layers with different characteristics.

So, why is L1 more valuable than L2?

Look at it from two perspectives.

1. Perspective One: Differences in Valuation Logic between L1 and L2 in Primary and Secondary Markets

a. In the secondary market, the valuation logic is the same

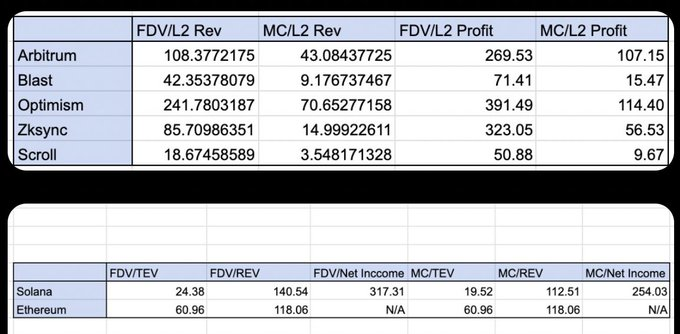

L1 has higher network activity. The valuation of Solana/ETH is about 100 times annualized revenue, while the valuation range for mature L2s is similar (10-200 times). Data from October 2024, but the argument still holds.

As indicated by the fundamental valuation multiples, the trading valuation multiples of mature L1s and mature L2s are currently relatively close (Arbitrum/Optimism vs. Solana/Ethereum).

b. In the primary market, the valuation logic is different

Compared to the secondary market, the primary market has more unexplained extreme valuation multiple outliers. In other words, there are projects with valuations reaching billions of dollars despite low trading activity, and these phenomena are more common in the primary market than in the secondary market.

Representative Projects

- L1: Sui, Mantra, Pi, ICP, IP (and many older projects from different periods)

- L2: MOVE

In my view, this is a misconception in the initial framework setting of L2 projects. Arbitrum and Optimism positioned themselves as Ethereum's scaling networks, serving as execution layers to help ETH scale. This positioning, combined with Ethereum's "rollup-centric roadmap," indeed provided an excellent cold start approach.

However, the downside of this method is that it limits the entire target market to the Ethereum user base, thereby constraining the overall liquidity, industry awareness, and revenue scale that these chains (like Arbitrum/OP) can capture. Although Arbitrum and Optimism are fully capable of attracting entirely new decentralized applications and ecosystem participants (including those who have never engaged with Ethereum), their initial go-to-market strategy (GTM) overly emphasized their identity as "Ethereum's scaling networks." This positioning led the market to always view them as subordinate ecosystems to Ethereum (thus their valuations are only seen as a percentage of Ethereum's value). To be fair, when these teams launched, Ethereum was indeed the only mainstream ecosystem present in the market.

2. Perspective Two: Token Models

An L1 token model has a fundamental network flywheel effect. As activity on the L1 chain increases, it directly drives demand for the token from two independent participant types: on-chain speculators and stakers.

The more frequent the on-chain activity, the higher the fees that on-chain speculators are willing to pay to include transactions in blocks. The uncertainty brought by diversified activities actually increases the probability, frequency, and scale of wealth opportunities, prompting people to compete for these opportunities. In terms of staking, the more fees a blockchain earns, the more people are willing to stake its native tokens to gain exposure to this economic benefit. Additionally, on-chain activity is often related to the issuance of net new assets, which are typically traded in pairs with the native token, requiring people to purchase these native tokens to participate in related trading activities (e.g., minting NFTs with ETH, buying meme coins with SOL).

How should L2 address these issues?

Shift in Thinking

L2 needs to clearly decide whether to focus on ecological synergy or to attract users from any source. The construction of L2 should fully leverage its unique second-layer technological advantages (trustworthy/customizable block construction, performance optimization, profit-sharing).

Optimize Token Economic Models

L2 should optimize its token economic model to create a flywheel effect where growth in network activity stimulates token demand on both the supply and demand sides. The current approach of using custom gas tokens in L2, while addressing the incentive issues in the on-chain speculation segment, fails to allow stakers to share in this revenue. Theoretically, since most L2s allocate sequencer profits to the DAO treasury, and the tokens control the DAO treasury, this is equivalent to distributing expected profits fairly to token holders. However, to achieve the same effect in the cognitive realm of token holders, it is necessary to grant them more comprehensive governance rights.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。