Buybacks are becoming a popular model for distributing profits in crypto projects.

Written by: Saurabh Deshpande

Translated by: Luffy, Foresight News

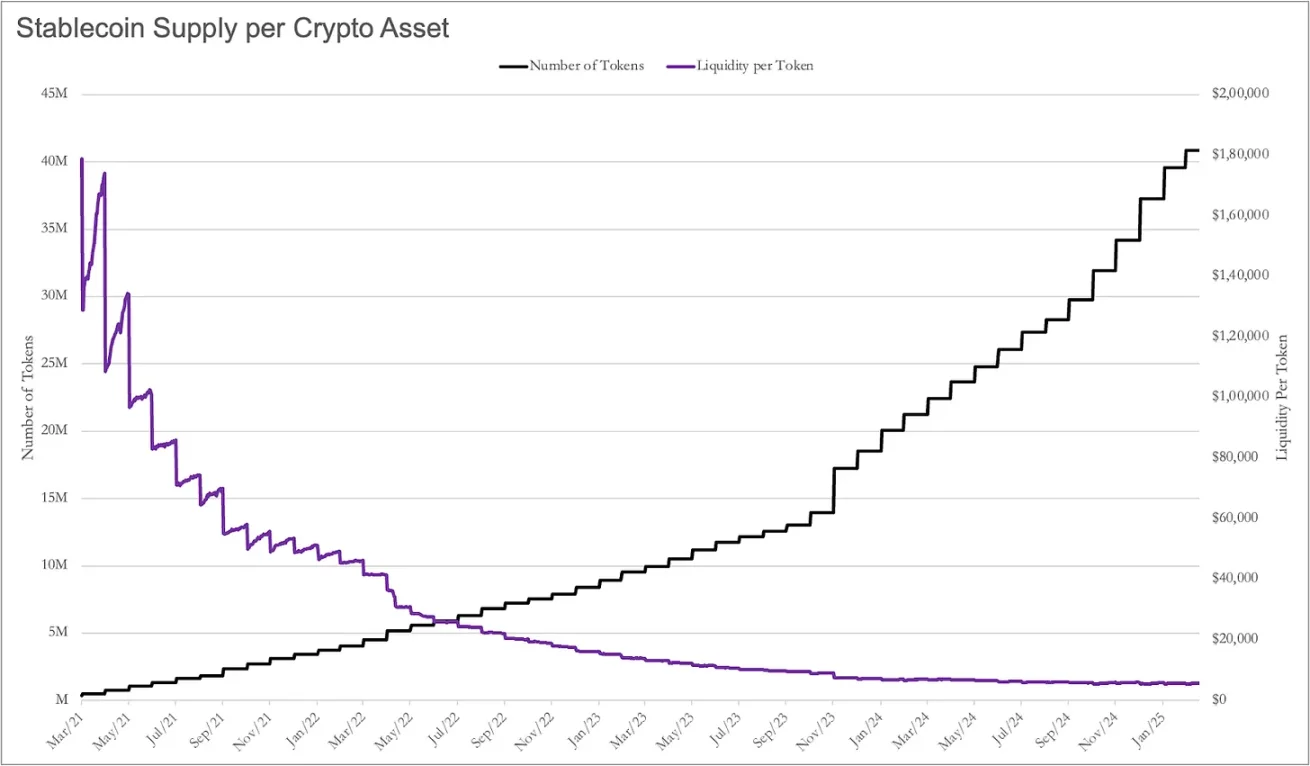

Recently, I used the supply of stablecoins as a measure of liquidity, combined with the number of tokens in the market, to calculate the liquidity of each asset. Unsurprisingly, liquidity ultimately approaches zero, and the chart drawn based on the analysis results can be considered a "work of art."

In March 2021, each cryptocurrency enjoyed approximately $1.8 million in stablecoin liquidity, while by March 2025, this figure was only $5,500.

As a project, you have to compete for the attention of users and investors against 40 million other tokens, a number that was only 5 million three years ago. So, how do you retain token holders? You can try to build a community, have members say "GM" on Discord, and then organize some airdrop activities.

But then what? Once they get the tokens, they will move on to the next Discord group to say "GM."

Community members won't stick around for no reason; you have to give them a reason. In my view, a high-quality product with actual cash flow is that reason, or making the project data look good.

Russ Hanneman Syndrome

In the TV show "Silicon Valley," Russ Hanneman boasted about becoming a billionaire by "moving radio to the internet." In the crypto space, everyone wants to be Russ, chasing overnight wealth while ignoring the "boring" yet practical issues of business fundamentals, building moats, and obtaining sustainable income.

Joel's recent articles "Death to Stagnation" (Death to Stagnation) and "Make Revenue Great Again" (Make Revenue Great Again) emphasize the urgent need for crypto projects to focus on sustainable value creation. Just like the impressive scene in the show where Russ Hanneman dismisses Richard Hendricks' concerns about building a sustainable revenue model, many crypto projects similarly rely on speculative narratives and investor enthusiasm. This strategy clearly seems unsustainable today.

But unlike Russ, founders cannot simply shout "Tres Comas" (the term Russ uses to flaunt his wealth) to make their projects successful. Most projects need sustainable income, and to achieve this, we must first understand how current revenue-generating projects are doing it.

https://youtu.be/BzAdXyPYKQo

The Zero-Sum Game of Attention

In traditional markets, regulators maintain the liquidity of publicly traded stocks by setting high thresholds for listed companies. There are 359 million companies globally, with only about 55,000 publicly listed, accounting for only about 0.01%. The benefit of this is that most available funds are concentrated within a limited scope. But it also means that investors have fewer opportunities to place early bets on companies and chase high returns.

The dispersion of attention and liquidity is the price of having all tokens easily traded publicly. I am not judging which model is better; I am simply illustrating the differences between the two worlds.

The question is, how do you stand out in what seems like an endless ocean of tokens? One way is to demonstrate that the project you are building has demand and to involve token holders in the project's growth. Don't get me wrong; not every project needs to be equally obsessed with maximizing revenue and profits.

Revenue is not the goal; it is a means to achieve long-term viability.

For example, an L1 that hosts enough applications only needs to earn enough fees to offset token inflation. Ethereum's validator yield is about 3.5%, which means its annual token supply will increase by 3.5%. Any holder staking ETH for yield will see their tokens diluted. But if Ethereum burns an equivalent amount of tokens through a fee-burning mechanism, then the ETH of ordinary holders will not be diluted.

As a project, Ethereum does not actually need to be profitable because it already has a thriving ecosystem. As long as validators can earn enough to maintain node operations, Ethereum can function without additional income. However, this is not the case for projects with a circulation rate (the proportion of circulating tokens) of around 20%; these projects are more like traditional companies and may take time to reach a state where there are enough volunteers to keep the project running.

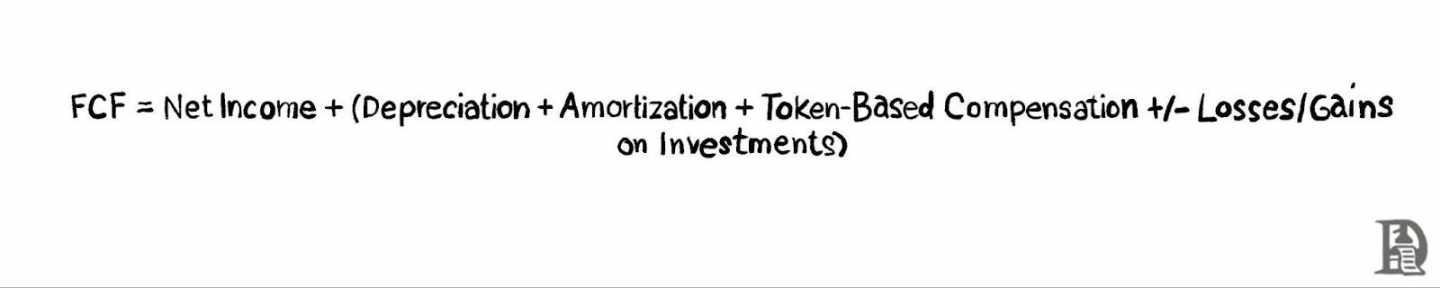

Founders must face the reality that Russ Hanneman ignores: generating real, sustainable income is crucial. It should be noted that whenever "revenue" is mentioned in this article, I am actually referring to free cash flow (FCF), as the data behind revenue is often difficult to obtain for most crypto projects.

Understanding how to allocate FCF, when to reinvest it to promote growth, when to share it with token holders, and the best distribution methods (such as buybacks or dividends) are decisions that will likely determine the success or failure of founders aiming to create lasting value.

Looking to the equity market can be helpful for making these decisions effectively. Traditional companies often distribute FCF through dividends and buybacks. Factors such as company maturity, industry, profitability, growth potential, market conditions, and shareholder expectations all influence these decisions.

Different crypto projects naturally have different opportunities and limitations in value redistribution based on their lifecycle stage. I will describe these in detail below.

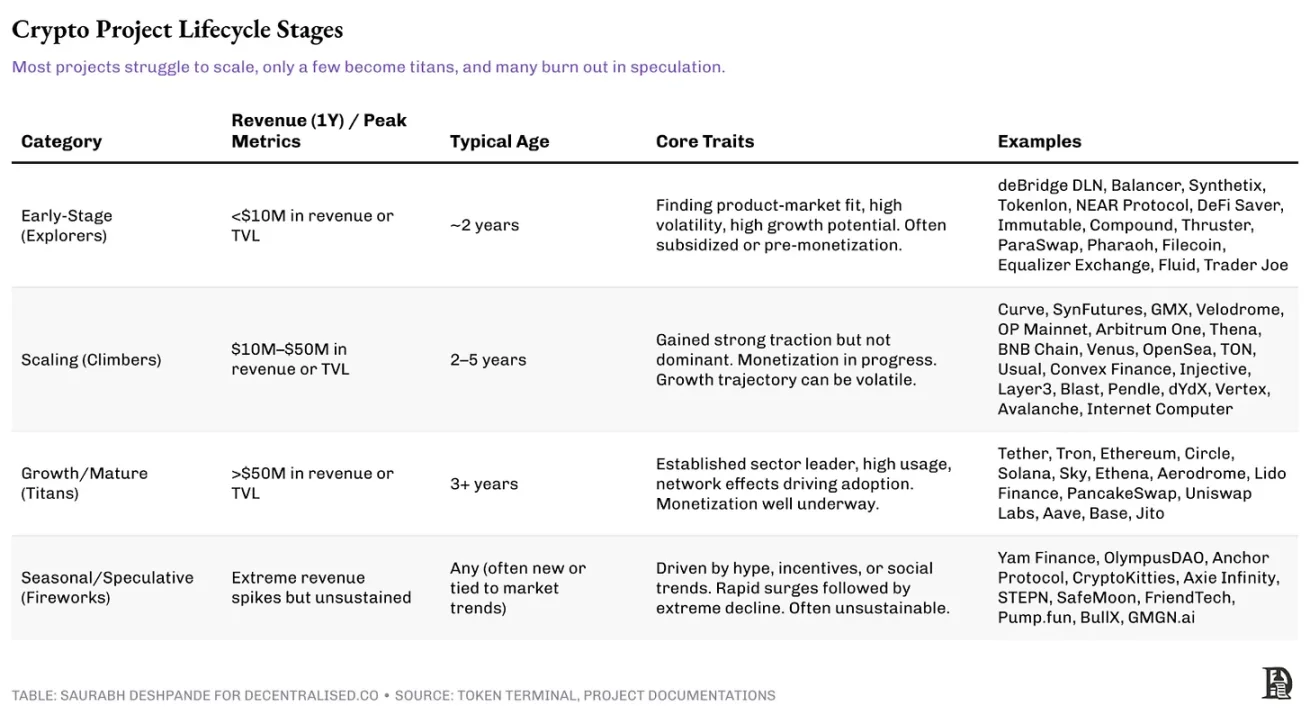

Crypto Project Lifecycle

(1) Explorer Stage

Early crypto projects are typically in the experimental phase, focusing on attracting users and refining their core products rather than aggressively pursuing profitability. The product-market fit is not yet clear, and ideally, these projects prioritize reinvestment to maximize long-term growth rather than revenue-sharing plans.

Governance in these projects is usually more centralized, controlled by the founding team, which makes upgrade and strategic decisions. The ecosystem is still in its infancy, network effects are weak, and user retention is a significant challenge. Many of these projects rely on token incentives, venture capital, or grants to maintain initial user guidance rather than stemming from natural demand.

While some projects may achieve early success in niche markets, they still need to prove that their model can be sustainable. Most crypto startups fall into this category, with only a small fraction able to break through.

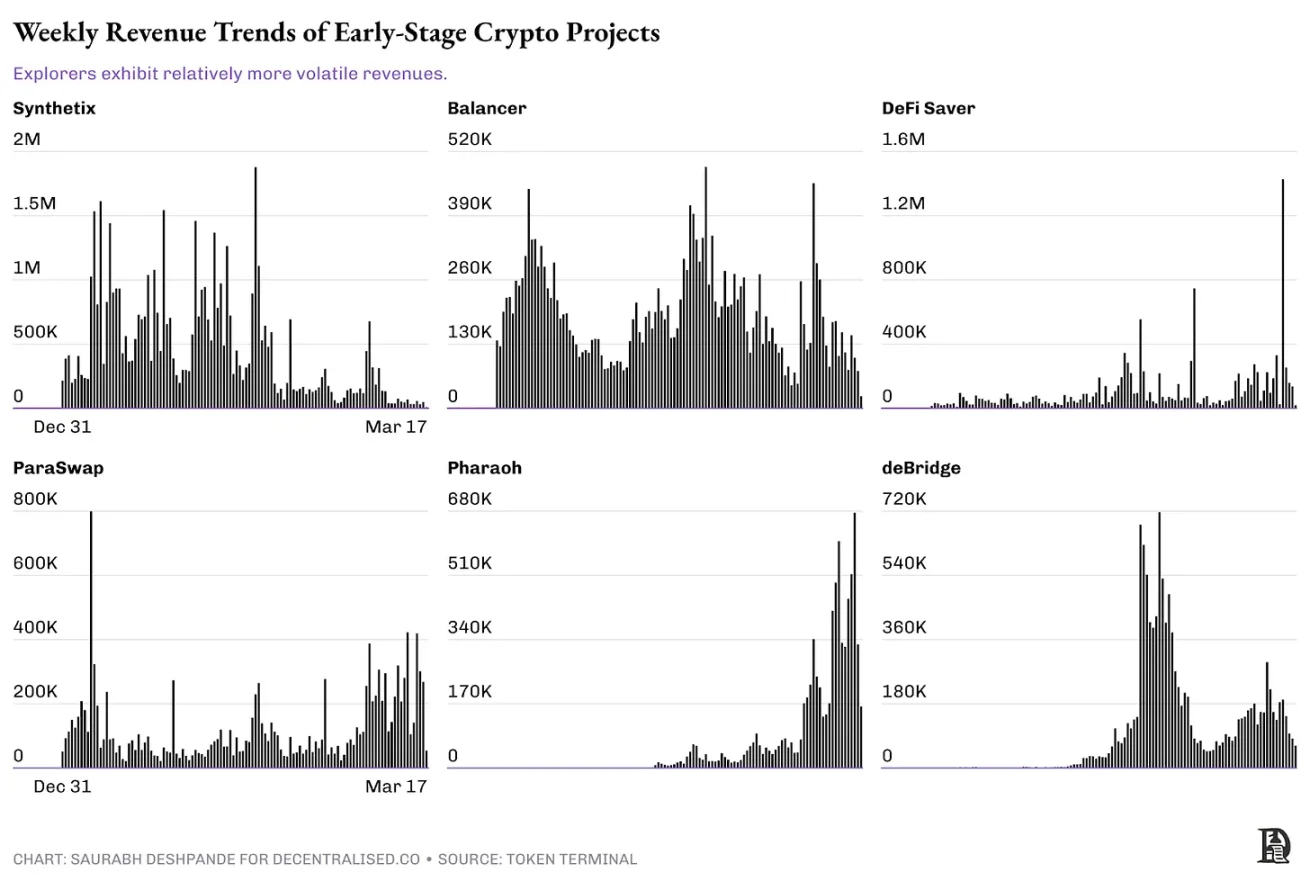

These projects are still searching for product-market fit, and their revenue models highlight the difficulties they face in maintaining sustained growth. Projects like Synthetix and Balancer show significant spikes in revenue followed by sharp declines, indicating that they experience speculative activity periods rather than steady market acceptance.

(2) Climber Stage

Projects that have moved past the early stage but have not yet established dominance fall into the growth category. These protocols can generate substantial revenue, ranging from $10 million to $50 million annually. However, they are still in a growth phase, with governance structures evolving, and reinvestment remains a priority. While some projects consider revenue-sharing mechanisms, they must find a balance between profit distribution and continued expansion.

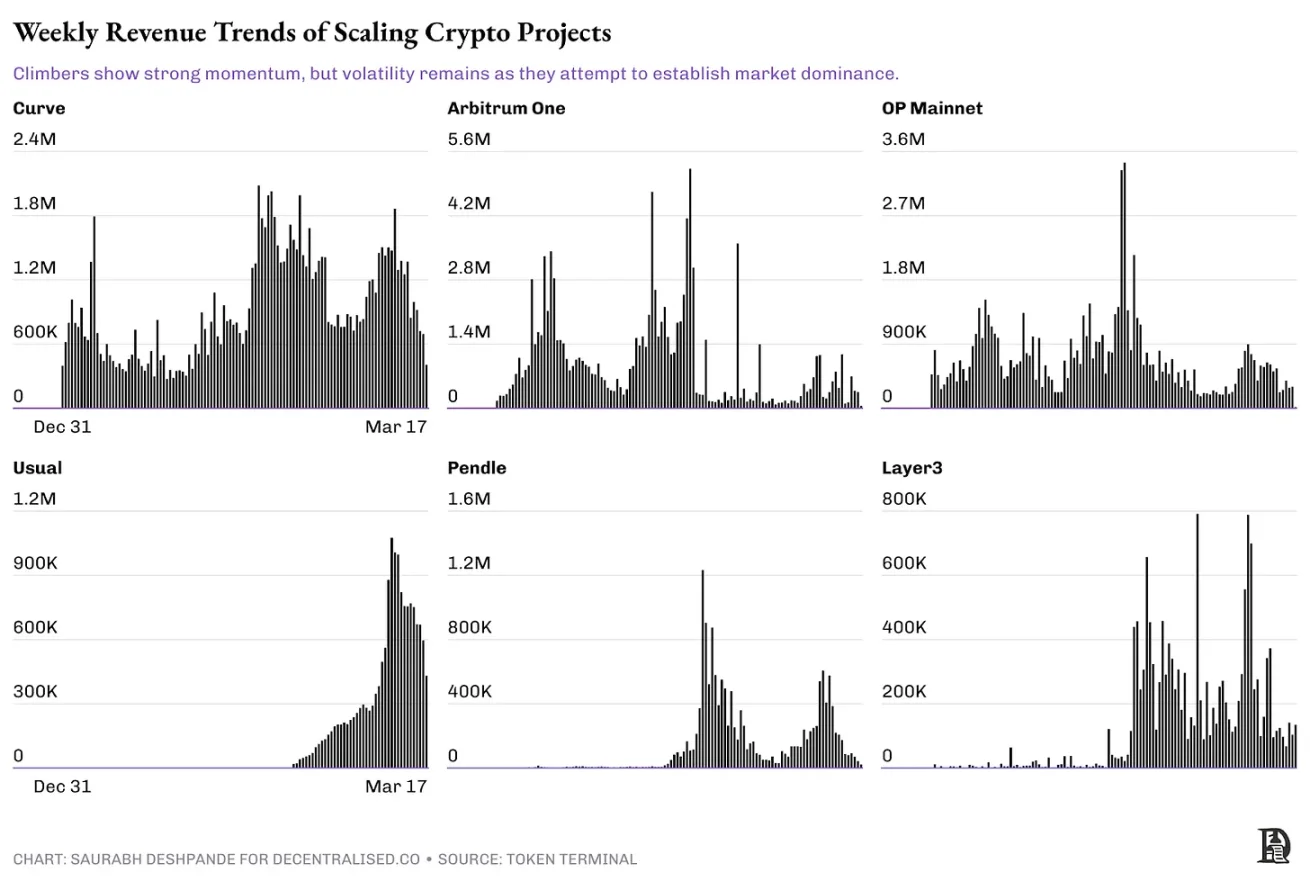

The chart above records the weekly revenue of crypto projects in the climber stage. These protocols have a certain level of attractiveness but are still in the process of solidifying their long-term positions. Unlike the early explorer stage, these projects have noticeable revenue, but their growth trajectories remain unstable.

Projects like Curve and Arbitrum One show relatively stable revenue flows with clear peaks and troughs, indicating fluctuations influenced by market cycles and incentive measures. OP Mainnet also exhibits a similar trend, with spikes indicating periods of high demand followed by slowdowns. Meanwhile, Usual's revenue shows exponential growth, indicating rapid adoption but lacking historical data to confirm whether this growth is sustainable. Pendle and Layer3 have seen significant spikes in activity, indicating a current high level of user engagement, but also revealing the challenges of maintaining growth momentum in the long term.

Many L2 scaling solutions (like Optimism and Arbitrum), decentralized finance platforms (like GMX and Lido), and emerging L1s (like Avalanche and Sui) fall into this category. According to Token Terminal data, currently, only 29 projects have annual revenues exceeding $10 million, though the actual number may be slightly higher. These projects are at a turning point, with those solidifying network effects and user retention moving into the next stage, while others may stagnate or decline.

For climbers, the path forward lies in reducing reliance on incentives, strengthening network effects, and proving that revenue growth can be sustained without sudden reversals.

(3) Giant Stage

Mature protocols like Uniswap, Aave, and Hyperliquid are in the growth and maturity stage, having achieved product-market fit and generating significant cash flow. These projects are in a position to implement structured buybacks or dividends, enhancing token holder trust and ensuring long-term sustainability. Their governance is relatively decentralized, with active community participation in upgrades and treasury decisions.

The network effect creates a competitive moat, making it difficult to be replaced. Currently, only a few dozen projects can reach this level of revenue, which means very few protocols have truly matured. Unlike early or growth-stage projects, these protocols do not rely on inflationary token incentives but earn sustainable income through transaction fees, lending interest, or staking commissions. Their ability to withstand market cycles further distinguishes them from speculative projects.

In contrast to early or growth-stage projects, these protocols exhibit strong network effects, a solid user base, and deeper market foundations.

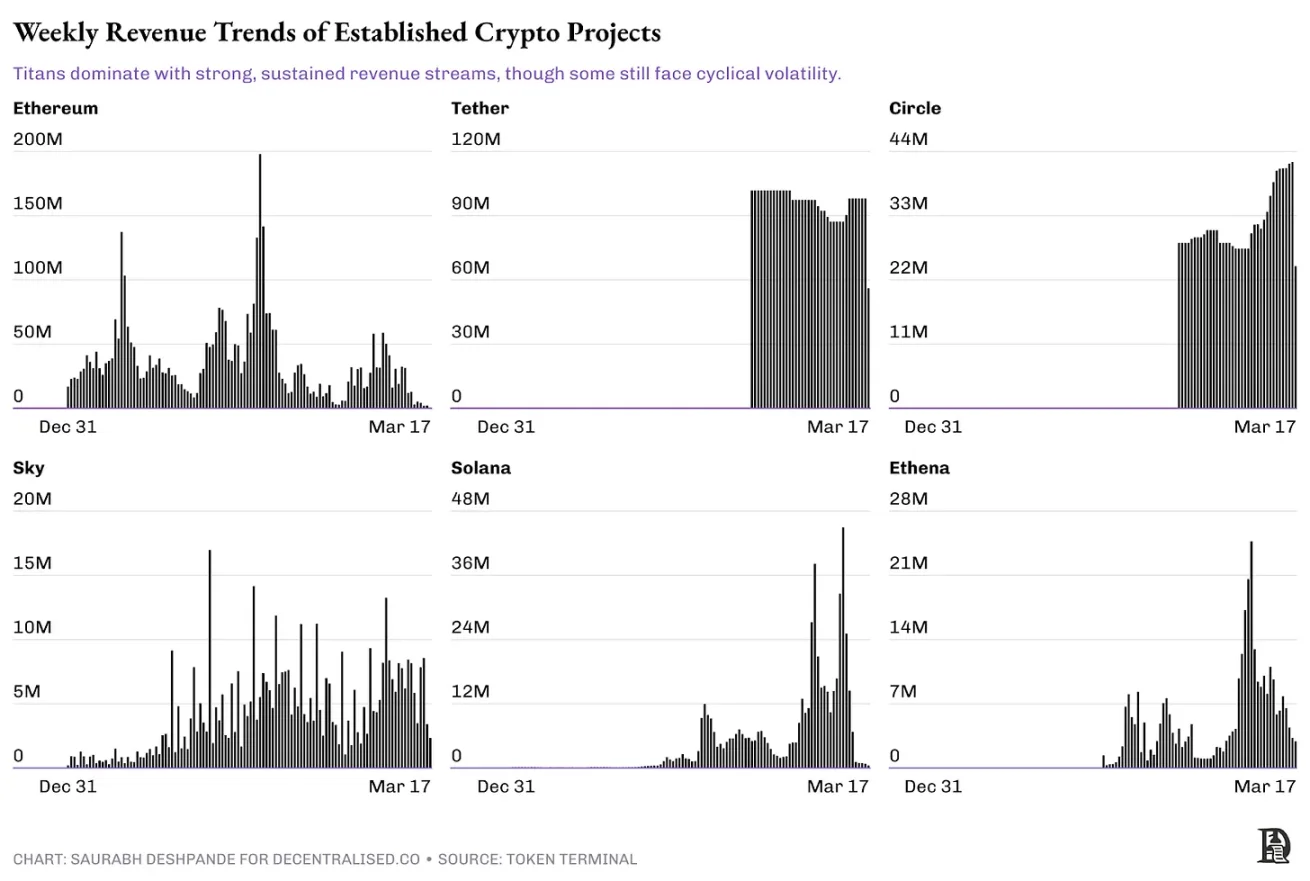

Ethereum leads in decentralized income generation, showing periodic peaks that align with high network activity periods. The revenue situations of the two major stablecoin giants, Tether and Circle, differ, with revenue streams being more stable and structured rather than experiencing significant fluctuations. While Solana and Ethena have considerable revenue, they still exhibit noticeable cycles of growth and decline, reflecting their changing adoption status.

Meanwhile, Sky's revenue is relatively unstable, indicating significant demand fluctuations rather than sustained dominance.

While the giants stand out in scale, they are not immune to volatility. The difference lies in their ability to navigate downturns and maintain revenue over the long term.

(4) Seasonal Projects

Some projects experience rapid but unsustainable growth due to hype, incentives, or social trends. Projects like FriendTech and memecoins may generate substantial revenue during peak cycles but struggle to retain users in the long term. Premature revenue-sharing plans can exacerbate volatility, as speculative capital quickly withdraws once incentives dry up. Their governance is often weak or centralized, ecosystems are thin, and the adoption of decentralized applications is limited or lacks long-term viability.

While these projects may temporarily achieve extremely high valuations, they are prone to collapse when market sentiment shifts, leaving investors disappointed. Many speculative platforms rely on unsustainable token issuance, fake trading, or inflated yields to create artificial demand. While some projects can escape this phase, most fail to establish a lasting business model, essentially categorizing them as high-risk investments.

Profit Sharing Models of Public Companies

Observing how publicly traded companies handle surplus profits can teach us more.

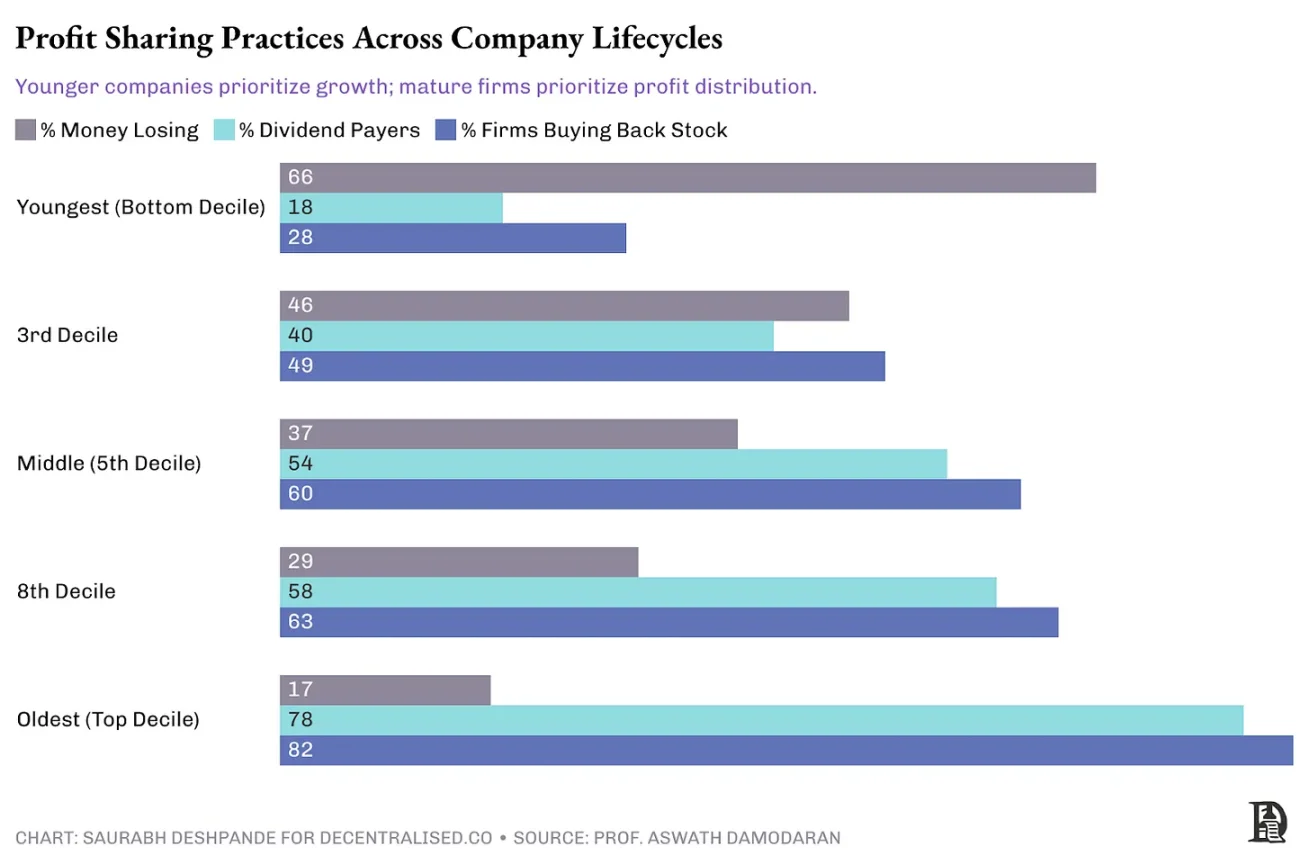

The chart illustrates how profit-sharing behavior evolves as traditional companies mature. Young companies face significant financial losses (66%), leading them to retain profits for reinvestment rather than distributing dividends (18%) or conducting stock buybacks (28%). As companies mature, profitability typically stabilizes, and dividend payments and buybacks increase accordingly. Mature companies frequently distribute profits, with dividends (78%) and buybacks (82%) becoming common.

These trends resonate with the lifecycle of crypto projects. Just like young traditional companies, early crypto "explorers" typically focus on reinvestment to find product-market fit. In contrast, mature crypto "giants," like established traditional companies, have the capacity to distribute income through token buybacks or dividends, enhancing investor confidence and the long-term viability of the project.

The relationship between company age and profit-sharing strategies naturally extends to practices within specific industries. While young companies typically prioritize reinvestment, mature companies adjust their strategies based on the characteristics of their industry. Industries with stable, abundant cash flows tend to favor predictable dividends, while those characterized by innovation and volatility prefer the flexibility of stock buybacks. Understanding these nuances helps crypto project founders effectively adjust income distribution strategies to align the project's lifecycle stage and industry characteristics with investor expectations.

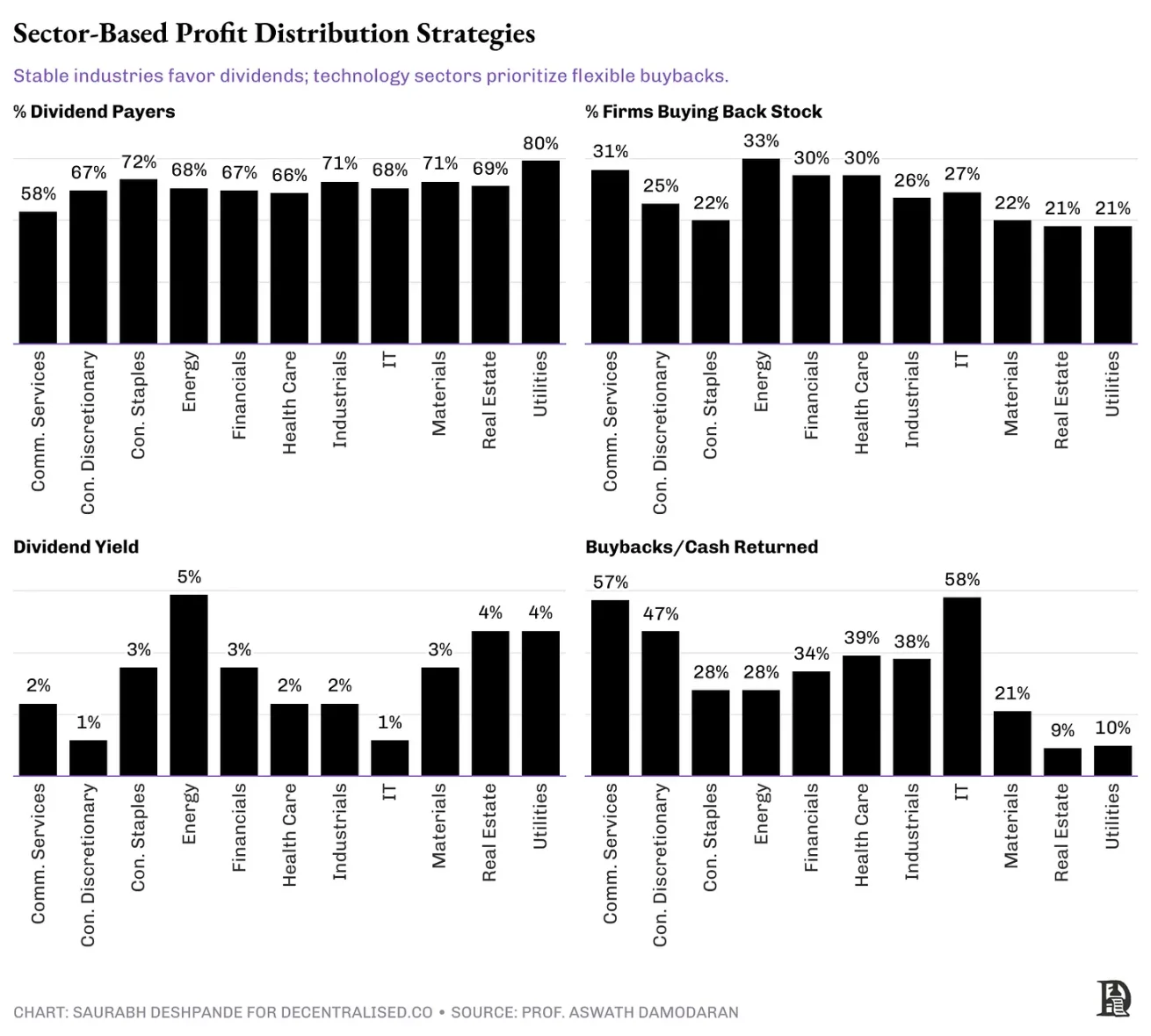

The following chart highlights the unique profit distribution strategies across different industries. Traditional, stable industries like utilities (80% of companies pay dividends, 21% conduct buybacks) and consumer staples (72% of companies pay dividends, 22% conduct buybacks) strongly favor dividends due to predictable revenue streams. In contrast, technology-focused industries like information technology (27% conduct buybacks, with the highest proportion returning cash through buybacks at 58%) lean towards buybacks to provide flexibility during revenue fluctuations.

These have direct implications for crypto projects. Protocols with stable, predictable revenue, such as stablecoin providers or mature DeFi platforms, may be best suited to adopt a continuous payment model similar to dividends. Conversely, high-growth, innovation-focused crypto projects, especially those in DeFi and infrastructure layers, can adopt flexible token buyback strategies, emulating traditional tech industry approaches to adapt to volatile and rapidly changing market conditions.

Dividends vs. Buybacks

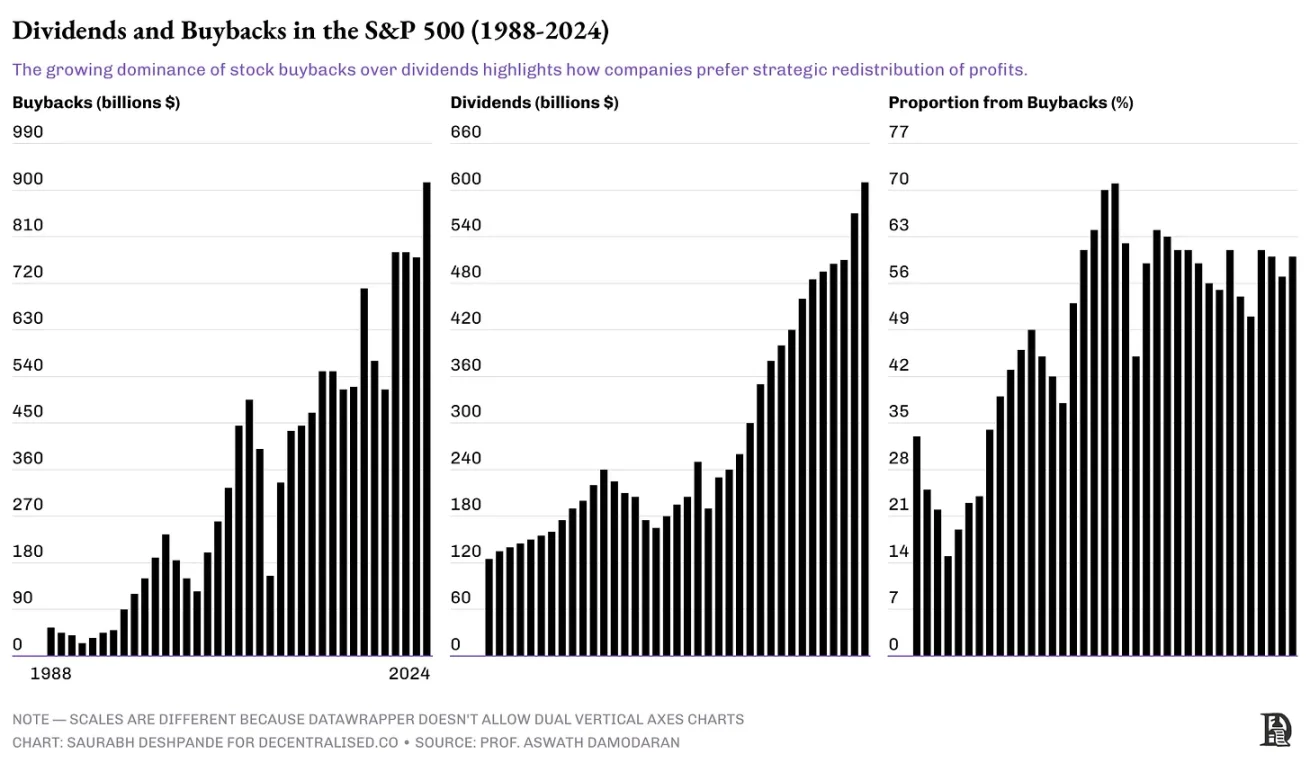

Both methods have their pros and cons, but buybacks have recently become more favored than dividend distributions. Buybacks are more flexible, while dividends are sticky. Once a dividend of X% is announced, investors expect it to be paid every quarter. Thus, buybacks provide companies with strategic leeway: not only in how much profit to return but also when to return it, allowing them to adapt to market cycles without being constrained by rigid dividend payment schedules. Buybacks do not set fixed expectations like dividends; they are seen as one-time attempts.

However, buybacks are a form of wealth transfer and a zero-sum game. Dividends create value for each shareholder, so both have their place.

Recent trends indicate that buybacks are becoming increasingly popular for the reasons mentioned above.

In the early 1990s, only about 20% of profits were distributed through buybacks. By 2024, approximately 60% of profit distributions will be conducted through buybacks. In dollar terms, buybacks surpassed dividend distributions in 1999 and have maintained that lead ever since.

From a governance perspective, buybacks require careful valuation assessments to avoid inadvertently transferring wealth from long-term shareholders to those who sell their shares at inflated valuations. When a company buys back its stock, it ideally believes the stock is undervalued. Conversely, investors choosing to sell their shares believe the stock price is overvalued. Both viewpoints cannot be correct simultaneously. It is generally believed that companies know their plans better than shareholders, so those who sell shares during buybacks may miss out on higher profit opportunities.

According to a paper from Harvard Law School, current disclosure practices often lack timeliness, making it difficult for shareholders to assess buyback progress and maintain their ownership stakes. Additionally, when compensation is tied to metrics like earnings per share, buybacks may influence executive compensation, potentially prompting executives to prioritize short-term stock performance over the company's long-term growth.

Despite these governance challenges, buybacks remain attractive to many companies, especially U.S. tech firms, due to the operational flexibility of buybacks, autonomy in investment decisions, and lower future expectations compared to dividends.

Income Generation and Distribution in Cryptocurrency

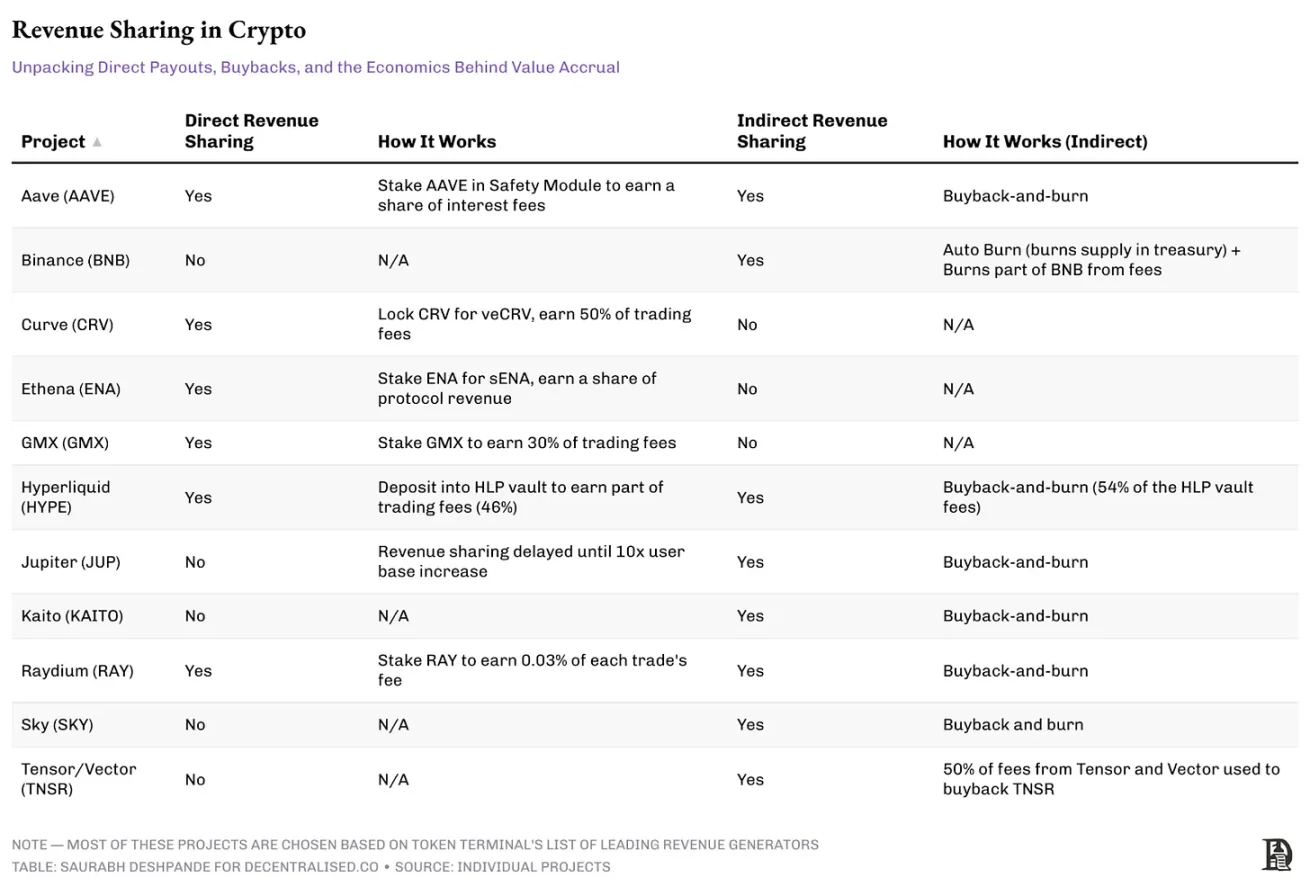

According to Token Terminal data, there are 27 projects in the crypto space that generate $1 million in revenue monthly. This is not comprehensive, as it misses projects like PumpFun and BullX. However, I believe it is close enough. I studied 10 of these projects to observe how they handle revenue. The key point is that most crypto projects should not even consider distributing income or profits to token holders. In this regard, I appreciate Jupiter. They clearly stated at the time of announcing their token that they had no intention of sharing direct profits (like dividends) at that stage. Only after the user base grew more than tenfold did Jupiter initiate a buyback-like mechanism to distribute value to token holders.

Profit Sharing in Crypto Projects

Crypto projects must rethink how to share value with token holders, drawing inspiration from traditional business practices while adopting unique methods to avoid regulatory scrutiny. Unlike stocks, tokens offer innovative opportunities to integrate directly into the product ecosystem. Projects do not simply distribute profits to token holders; they actively incentivize key ecosystem activities.

For example, before initiating buybacks, Aave rewards token stakers who provide critical liquidity. Similarly, Hyperliquid strategically shares 46% of its revenue with liquidity providers, akin to traditional consumer loyalty models in mature enterprises.

In addition to these strategies integrated with tokens, some projects adopt more direct profit-sharing methods reminiscent of traditional public equity practices. However, even direct profit-sharing models must be handled cautiously to avoid being classified as securities, balancing the rewards for token holders with compliance with regulatory requirements. Projects like Hyperliquid, which operate outside the U.S., often have greater operational flexibility when adopting profit-sharing practices.

Jupiter is a more creative example of value sharing. They do not conduct traditional buybacks but utilize a third-party entity, Litterbox Trust, which receives JUP tokens encoded to equal half of Jupiter protocol's revenue. As of March 26, it has accumulated approximately 18 million JUP, valued at about $9.7 million. This mechanism directly ties token holders to the project's success while avoiding regulatory issues associated with traditional buybacks.

It is important to note that Jupiter only embarked on the path of returning value to token holders after establishing a robust stablecoin treasury capable of supporting the project's operations for years.

The rationale for allocating 50% of revenue to this accumulation plan is straightforward. Jupiter follows a guiding principle of balancing ownership between the team and the community, promoting clear consistency and shared incentives. This approach also encourages token holders to actively promote the protocol, directly linking their financial interests to the growth and success of the product.

Aave recently initiated a token buyback after undergoing a structured governance process. The protocol has a healthy treasury of over $95 million (excluding its own token holdings) and launched the buyback plan after detailed governance proposals in early 2025. This plan, named "Buy and Allocate," allocates $1 million weekly for buybacks, following extensive community discussions around token economics, treasury management, and token price stability. Aave's treasury growth and financial strength enable it to initiate this move without impacting operational capabilities.

Hyperliquid uses 54% of its revenue to buy back HYPE tokens, with the remaining 46% used to incentivize liquidity on the exchange. Buybacks are conducted through the Hyperliquid Assistance Fund. Since the launch of this plan, the assistance fund has purchased over 18 million HYPE tokens, valued at over $250 million as of March 26.

Hyperliquid stands out as a unique case, with its team avoiding venture capital and likely self-funding its development, now allocating 100% of its revenue to reward liquidity providers or buy back tokens. It may not be easy for other teams to replicate this. However, both Jupiter and Aave exemplify a key aspect: they have robust financial conditions that allow for token buybacks without impacting core operations, reflecting rigorous financial management and strategic foresight. This is something every project can emulate. Before initiating buybacks or dividends, there should be sufficient capital reserves.

Tokens as a Product

Kyle presented a great point that crypto projects need to establish investor relations (IR) positions. For an industry built on transparency, it is ironic that crypto projects perform poorly in operational transparency. Most external communications are made through sporadic Discord announcements or Twitter posts, with financial metrics shared selectively and expense spending largely opaque.

When token prices continue to decline, users quickly lose interest in the underlying product unless it has established a strong moat. This creates a vicious cycle: falling prices lead to waning interest, which further depresses prices. Projects need to provide token holders with ample reasons to hold on and give non-holders reasons to buy.

Clear and continuous communication regarding development progress and fund usage can itself create a competitive advantage in today's market.

In traditional markets, investor relations (IR) departments bridge the communication gap between companies and investors by regularly releasing financial reports, holding analyst conference calls, and providing performance guidance. The crypto industry can adopt this model while leveraging its unique technological advantages. Regular quarterly reports on revenue, operating costs, and development milestones, combined with on-chain verification of treasury fund flows and buybacks, would greatly enhance stakeholder confidence.

The biggest transparency gap lies in spending. Publicly disclosing team salaries, expense details, and grant allocations can preemptively answer questions that only arise when a project collapses: "Where did the money from the initial coin offering (ICO) go?" and "How much salary do the founders pay themselves?"

Strong IR practices bring strategic advantages that extend beyond transparency. They reduce volatility by decreasing information asymmetry, expand the investor base by making it easier for institutional capital to enter, cultivate long-term holders who fully understand operational conditions and can hold through market cycle fluctuations, and build community trust that can help projects weather tough times.

Forward-thinking projects like Kaito, Uniswap Labs, and Sky (formerly MakerDAO) are already moving in this direction by regularly publishing transparent reports. As Joel pointed out in his article, the crypto industry must break free from speculative cycles. By adopting professional IR practices, projects can shed the "casino" reputation and become the "compound creators" envisioned by Kyle—assets that can sustainably create value over the long term.

In a market where capital is increasingly discerning, transparent communication will become a prerequisite for survival.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。