Author: Frank, PANews

In the Solana ecosystem, a "civil war" concerning hundreds of millions of dollars in trading volume is unfolding. Pump.fun and Raydium, two platforms that once depended on each other, are now in a competitive standoff.

Through an in-depth analysis of Raydium's pool data, PANews has discovered that Pump.fun's impact on Raydium may far exceed market expectations. Over the past year, thanks to the popularity of Pump.fun, Raydium has essentially been coasting. The launch of Pump.fun's own decentralized exchange, PumpSwap, undoubtedly cuts off Raydium's largest revenue stream.

Against the backdrop of a general cooling in the MEME market, is this "civil war" merely a pointless internal struggle? PANews will reveal the essence of this conflict through data analysis and explore its impact on the Solana ecosystem and the entire MEME market.

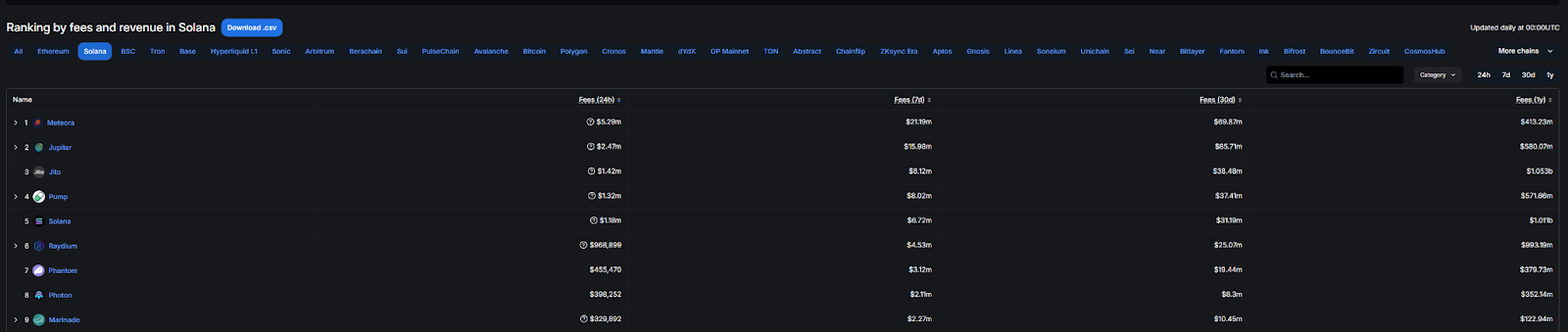

Data Insight: Pump.fun Tokens Occupy Half of Raydium's Territory

When Pump.fun announced the launch of its own DEX—PumpSwap—in early March, the market generally believed this would have a certain impact on Raydium, but few realized the severity of this impact. PANews analyzed approximately 250,000 trading pairs from Raydium's AMM and CLMM pools, which may provide insight into the true relationship between Pump.fun and Raydium and what the future may hold.

In Raydium's AMM pools, tokens generated by Pump.fun account for as much as 43.96%. Specifically, out of 216,000 AMM pools, 95,000 contain Pump.fun tokens. The total TVL of these Pump.fun token pools reaches $726 million, accounting for 50.79% of the total AMM TVL. Even when including CLMM pools, Pump.fun tokens still represent 43.68% of all pools in Raydium.

This means that Pump.fun contributes nearly half of Raydium's trading volume and revenue. PANews estimates that Pump.fun brings in annual revenue of around tens of millions of dollars for Raydium. After Pump.fun announced the launch of PumpSwap, the price of the RAY token plummeted by 15% within 24 hours, confirming Pump.fun's importance to Raydium.

The launch of PumpSwap poses a direct threat to Raydium, primarily in three aspects: first, zero migration fees (compared to Raydium's 6 SOL) significantly reduce the cost of user migration; second, the instant migration feature simplifies the process of moving tokens from launch to trading; finally, the improved liquidity and creator revenue-sharing model is more favorable to token creators. These advantages may lead to a large number of users migrating from Raydium to PumpSwap, further exacerbating Raydium's revenue losses.

Raydium's Counterattack: Can LaunchLab Turn the Tide?

In the face of the threat from PumpSwap, Raydium is not sitting idly by. In mid-March, Raydium announced it was developing a token launch platform called LaunchLab, as a direct competition to Pump.fun. Interestingly, Raydium had actually been developing LaunchLab for several months but had previously shelved the project, perhaps to avoid making the team feel that Raydium was directly competing with Pump.fun. Clearly, the launch of PumpSwap has broken this concern. On March 26, Raydium stated that LaunchLab would officially launch within a week.

According to reports, LaunchLab plans to offer several innovative features, including linear, exponential, and logarithmic bonding curves to adjust token prices based on demand; allowing third-party UIs to set their own fees; supporting multiple quote tokens besides SOL; and integrating with Raydium's liquidity provider locker. These features aim to provide token creators with more flexibility and control, thereby competing with Pump.fun.

However, whether LaunchLab can save Raydium from the significant revenue losses it faces remains uncertain. First, Pump.fun has already established strong brand recognition and a user base in the meme coin launch space; second, PumpSwap's zero migration fees and instant migration features have already provided users with significant cost and convenience advantages; finally, Raydium needs to complete the development and promotion of LaunchLab in a short time, which is itself a huge challenge.

From a strategic perspective, Raydium emphasizes that LaunchLab is not intended to replace Pump.fun, but rather to provide an alternative for teams that do not want to develop their own programs from scratch. This statement may be aimed at avoiding direct confrontation with Pump.fun, but in reality, the launch of LaunchLab is undoubtedly a strategic response to the threat posed by PumpSwap.

Cooling MEME Market: Is the Civil War Just Pointless Infighting?

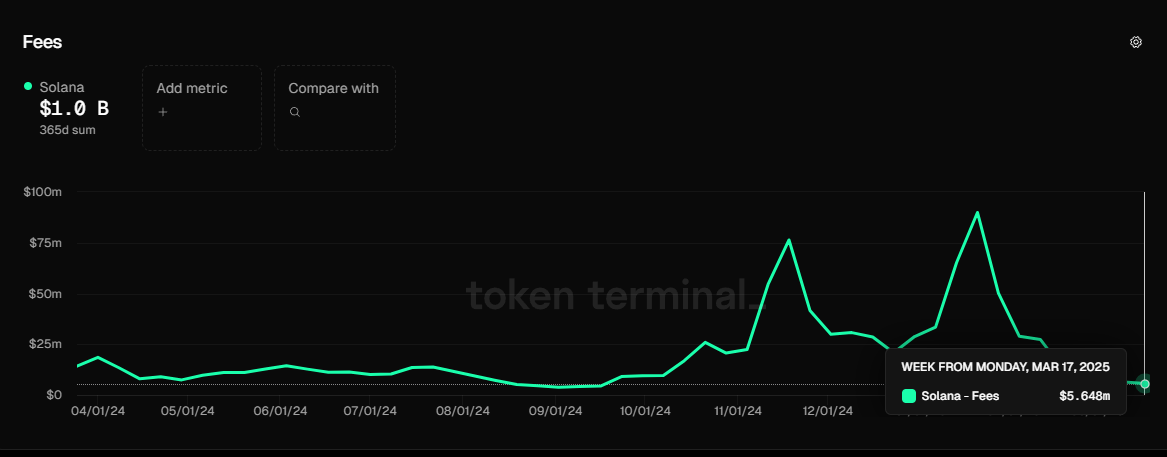

Behind the "civil war" between Pump.fun and Raydium lies a larger backdrop of the overall cooling trend in the MEME market. At the beginning of 2025, the meme coin market shifted from being dominated by Solana to multi-chain competition, but market enthusiasm has clearly declined.

Solana's on-chain fees dropped from a weekly high of $89.91 million in January 2025 to $5.64 million on March 17, a decrease of about 93.7%.

Additionally, DEX trading volume has also seen a dramatic decline, with Solana's DEX trading volume around $1.38 billion on March 27, compared to a peak of $35.8 billion in January, representing only 3.8% of that peak. From a broader perspective, current trading volumes seem to have returned to levels seen in the same period in 2024.

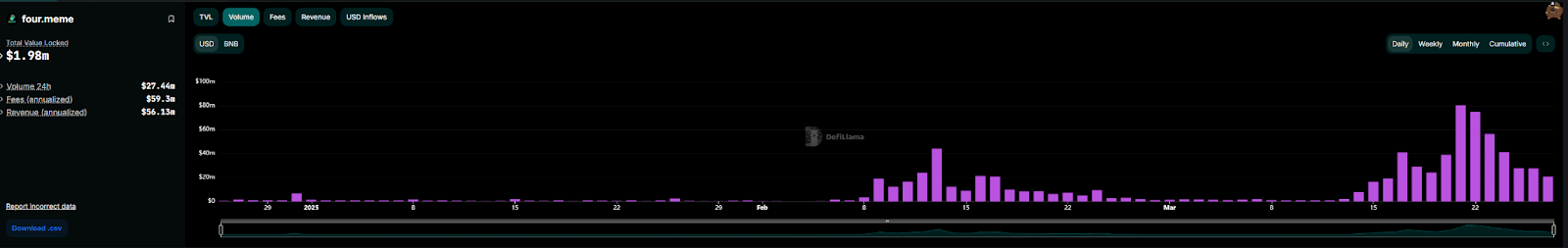

Other competing public chains have also experienced downturns, with Base chain's daily trading volume currently dropping to $369 million, an 86% decrease from January. The BSC chain, buoyed by endorsements from top influencers like CZ, created a brief spike, although its current daily trading volume remains above $1 billion, it is still significantly lower than the $8.4 billion peak in January.

The highly sought-after Four.meme on the BSC chain, after experiencing a brief peak, has also recently seen a noticeable decline. On March 27, Four.meme's trading volume was only $20 million, down 75% from its high of $80 million on March 21.

According to PANews observations, several professional Rug bots on Pump.fun have also been inactive recently. When even the scammers have nothing to gain, it seems that this market has truly entered a winter period.

In this context, the "civil war" between Pump.fun and Raydium is likely just a pointless internal struggle. Both sides are competing for a shrinking market rather than a continuously growing blue ocean. Without genuine innovation and practical value, this competition may only accelerate the cooling of the market and the fragmentation of the Solana ecosystem.

The shift in the relationship between Pump.fun and Raydium from cooperation to competition reveals deep-seated contradictions within the Solana ecosystem. Although data analysis indicates that the launch of PumpSwap may lead to Raydium losing nearly half of its new token market in the future, it is important to note that data can only reflect history and cannot truly predict the future. As the market shrinks, Pump.fun may not have the capacity to continue providing support to Raydium. The launch of PumpSwap seems more like a desperate self-preservation act.

For investors, while paying attention to the competition between Pump.fun, Raydium, or Four.meme, it is more important to be wary of the overall cooling trend in the MEME market to avoid becoming the "last leek" in this "civil war." The future market trend remains unclear, but maintaining patience is always the core skill to navigate through cycles.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。