The Bitcoin circular economy is spreading across the globe.

Written by: Aaron Wood, CoinTelegraph

Translated by: Deng Tong, Jinse Finance

With the United States establishing a strategic Bitcoin reserve, Bitcoin is experiencing unprecedented adoption, but some prominent Bitcoin advocates believe the project is straying from its roots.

Earlier this year, Bitcoin supporter and Twitter founder Jack Dorsey stated that he believes if Bitcoin is only a "digital gold," then the project has failed. He said that national Bitcoin reserves might "benefit nation-states, but I don't necessarily know if it benefits Bitcoin."

Dorsey believes that for Bitcoin to succeed, it needs to return to its white paper and strive to become a form of peer-to-peer cash that can be traded globally.

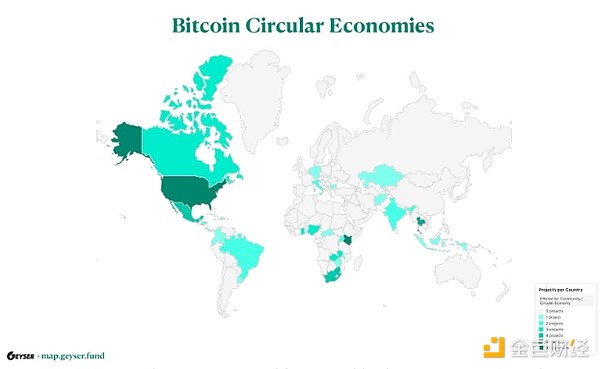

Around the world, many "circular Bitcoin economies" have been working towards this goal: developing local economies that use Bitcoin as currency, attempting to demonstrate the viability of Bitcoin and its future prospects.

The Bitcoin white paper proposed a cash system. Source: Bitcoin.org

Bitcoin Circular Economy and Wall Street

The Bitcoin Alliance refers to the Bitcoin circular economy as "a local economic ecosystem in which Bitcoin (BTC) is increasingly used as a medium of exchange, unit of account, and store of value"—that is, a place where Bitcoin fulfills the three roles of money.

There are various Bitcoin communities and circular economies around the world, but their goals are similar, as they all believe Bitcoin is a superior form of currency and should be used as a "means of payment for goods and services as well as a means of settling other financial obligations."

This practice of using Bitcoin as currency is in stark contrast to the mainstream attitude in the United States, where cryptocurrency advocates view Bitcoin as a reserve asset that can be hoarded—similar to digital gold. President Donald Trump stated at the Nashville Bitcoin Conference in July 2024: "Never sell your Bitcoin."

In a speech at the Bitcoin Policy Institute on March 17, Strategy CEO and Bitcoin extremist Michael Saylor compared digital currency to an investment asset. According to Saylor, a large amount of shares would allow holders (such as the U.S. government) to exert control over the digital economy in another "manifest destiny."

When asked whether the large-scale adoption of Bitcoin by countries like the U.S. would stray from its founding principles, Isa Santos, founder of the Bitcoin Island project in Mexico, said: "Yes, but that's the charm of Bitcoin. It's also meant for your enemies."

Stelios Rammos, founder of the Bitcoin crowdfunding project Geyserfund, stated that government adoption of Bitcoin is "inevitable, for better or worse."

"Bitcoin is for everyone, and its truest founding principle is permissionless money. Government adoption of Bitcoin is inevitable, and if we could press a button and say 'the government bans the use of Bitcoin,' then it would no longer be Bitcoin," he told Cointelegraph.

However, he believes the Bitcoin community has a set of core values that can promote grassroots adoption of Bitcoin rather than government welfare, adding that Bitcoin is at a stage where Bitcoin users should care more about how it is adopted rather than whether it is adopted.

Rammos stated: "The circular economy will play a significant role in achieving a future where Bitcoin is held and used by ordinary people, not just as a pure asset in the digital vaults of large banks and governments."

Both stated that government adoption of Bitcoin has tangible benefits. Santos noted that adoption from a major power like the U.S. could still be a positive factor, as many view the U.S. as a leader in finance.

Rammos mentioned that U.S. adoption of Bitcoin would raise awareness of this groundbreaking cryptocurrency, benefiting the entire network and creating a ripple effect on the global circular economy.

What Role Does Bitcoin Play in These Communities?

The Bitcoin circular economy is thriving worldwide. They are particularly popular in developing economies, where local currencies are not reliable as a store of value.

In Cuba, where inflation is out of control and wages are unbearably low, Bitcoin and the Bitcoin circular economy allow locals to protect their savings.

In rural Peru, most people do not have bank accounts—meaning they lack access to banking or financial services—Bitcoin provides locals with a way to save and pay for school and daily expenses.

However, challenges also exist. Valentin Popescu, co-founder of the Bitcoin education and advocacy organization Motiv in Peru, stated that Bitcoin's notorious volatility makes it difficult to sell as a savings tool to rural communities.

The Bitcoin community also faces challenges in growing beyond the existing expatriate and enthusiast groups. Bitcoin advocates flocked to El Salvador, where Bitcoin Beach provided the first prototype for a Bitcoin circular economy. However, this does not mean that locals are genuinely using Bitcoin.

The Bitcoin circular economy is thriving globally. Source: Geyser Fund

In addition to the victories and challenges faced by these communities, many of them also offer financial education programs and community-building initiatives.

Santos said: "Each circular economy has its unique characteristics. They must meet the needs of the community." She noted that a common factor among these communities is volunteerism.

The Bitcoin circular economy in South Africa, Bitcoin Ekasi, supports local Surfer Kids community projects by paying coaches' salaries in Bitcoin while enabling local shops and vendors to accept Bitcoin payments.

Rammos stated that these communities can put lesser-known locations on the map, attracting tourism through "Bitcoin expatriates" who want to spend Bitcoin and develop the local economy.

"Ultimately, local residents benefit from the Bitcoin circular economy, and the Bitcoin network benefits as well; it’s a truly symbiotic relationship," Rammos said.

Whether driven by Wall Street or the general public, the ultimate goal of the organizers operating these communities is to fully integrate Bitcoin into the financial world.

Rammos concluded: "Hopefully, in the near future, we won't need the term 'circular economy' anymore; it will just be the Bitcoin economy or simply the economy."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。