Creators can quickly obtain funding, while users can share profits and participate in cultural asset investments. Its innovative model has attracted the attention of institutions like Grayscale.

Written by: Luke, Mars Finance

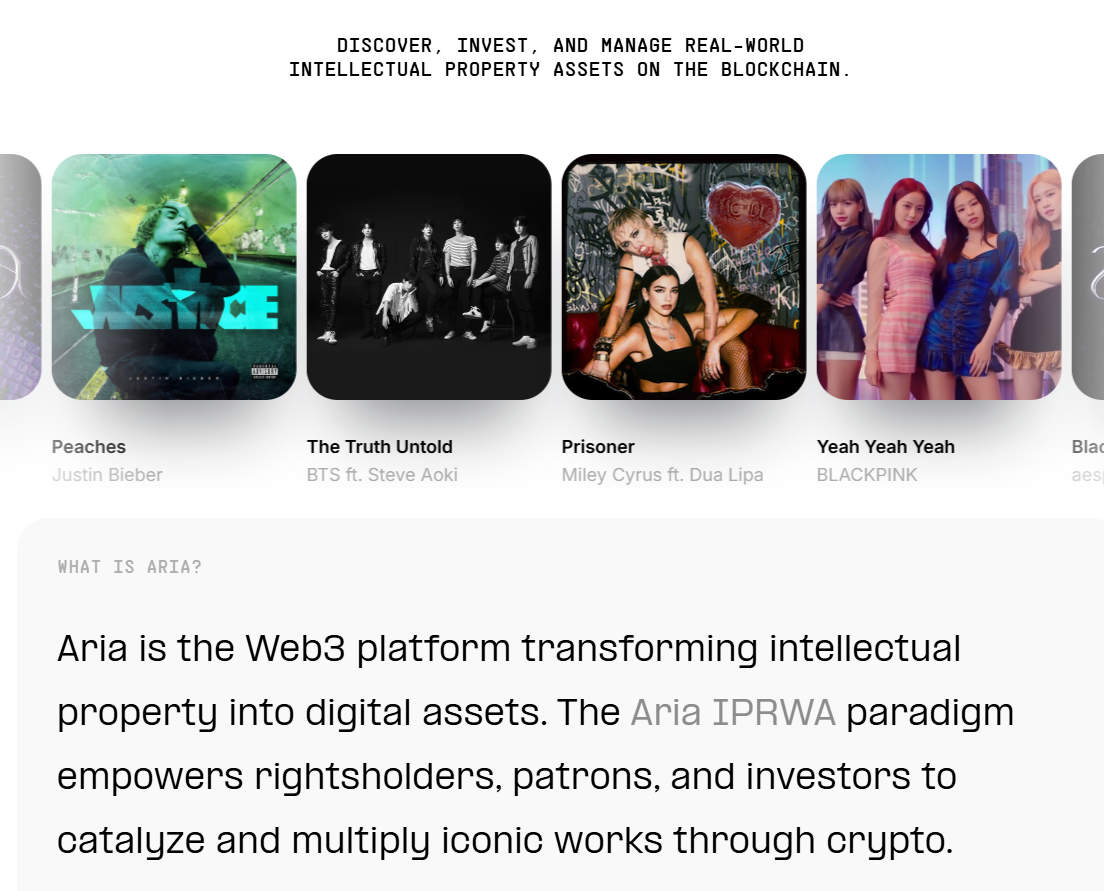

In the past month, Story Protocol has made a remarkable impact in the crypto market, making headlines almost daily. As a Layer 1 blockchain project focused on intellectual property (IP) management, Story Protocol has introduced some of the world's most influential cultural assets—such as Justin Bieber's "Peaches," BTS's "Like It's Christmas," and the movie "Balisty x"—to the blockchain through its core protocols Aria and STR8FIRE, sparking a wave of tokenization. This has not only caught the eye of institutions like Grayscale but has also sparked widespread discussion: What is the operational mechanism of the Story ecosystem? How does it achieve profitability? What returns can creators and ordinary users expect? This article will delve into its model, explore how Web3 can bring revolutionary changes to the IP industry, and look ahead to its future potential.

I. The Operational Model of Story Protocol: From Technology to Ecosystem

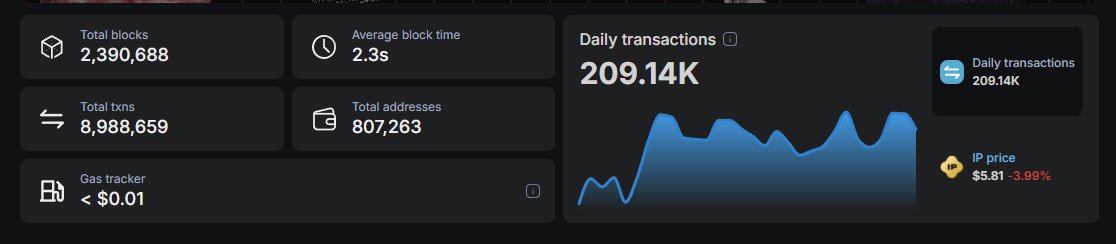

Story Protocol is a Layer 1 blockchain specifically designed for IP management, aiming to transform real-world intellectual property (such as music, movies, and artworks) into tradable digital assets and provide them with liquidity. As of March 27, 2025, the Story mainnet has reached 2.39 million blocks, with an average block time of 2.35 seconds, a daily transaction volume of 209,000, and a total transaction volume nearing 9 million, with over 800,000 participating wallets, demonstrating its strong technological and community momentum.

The project was founded in 2022 by Seung Yoon Lee and others, and has since secured several rounds of funding led by a16z, totaling over $134 million. Targeting the global $61 trillion IP market, even capturing just 1% would represent a $610 billion opportunity, and Story's ambition is to become the digital cornerstone of future IP management. Its ecosystem consists of multiple sub-protocols, with Aria and STR8FIRE focusing on music and film, respectively, together building a decentralized IP economic system.

1. Underlying Logic: The Programmability of IP

The core innovation of Story lies in achieving the programmability of IP through smart contracts. In traditional IP management, rights holders rely on complex legal contracts, intermediaries, and lengthy settlement processes, while Story migrates these steps to the blockchain. Smart contracts not only record IP ownership but can also automatically execute licensing agreements, track usage, and distribute profits. This decentralized design significantly reduces transaction costs and enhances transparency and efficiency. Story's native token, IP, serves as the lifeblood of the ecosystem, used for paying network fees, participating in staking, and governance voting, powering the entire system.

2. Aria: The Pioneer of Music IP Tokenization

Aria is the RWA (Real-World Asset) protocol within the Story ecosystem that focuses on music IP, operating in a clear and efficient manner, specifically divided into the following steps:

- Asset Acquisition: Aria acquires music copyrights through a community funding pool. For example, on February 18, 2025, Aria partnered with StakeStone to launch a deposit campaign, attracting 4,156 wallets to deposit a total of $10.95 million in stablecoins (such as USDC and USDT) to purchase partial copyrights of popular songs like Justin Bieber's "Peaches" and BTS's "Like It's Christmas." These funds are managed by smart contracts to ensure transparent distribution.

- Tokenization: The acquired copyrights are split into RWIP (Real-World IP) tokens, each representing a portion of the revenue rights for specific songs. These tokens are minted on the Story mainnet and can be freely traded on decentralized exchanges (DEX) like Uniswap, providing unprecedented liquidity to IP.

- Revenue Distribution: Streaming revenue generated by the songs (such as play counts on Spotify and Apple Music) is proportionally distributed to RWIP holders through smart contracts. For example, if "Peaches" generates $100 million in annual revenue, a user holding 1% of the tokens could receive $1 million in profits, with the distribution process fully automated and requiring no intermediaries.

- Staking and Rewards: Users can stake RWIP or Aria Points obtained from deposit activities on the Story mainnet to earn additional returns. The Aria Premiere Launch has promised an annual percentage yield (APY) of up to 30%, while some IP RWA has a stable yield of about 7%, attracting a large number of investors to participate.

Aria's success lies not only in technological innovation but also in its deep understanding of the music industry. It combines traditional royalty models with blockchain economics, opening new possibilities for creators and investors.

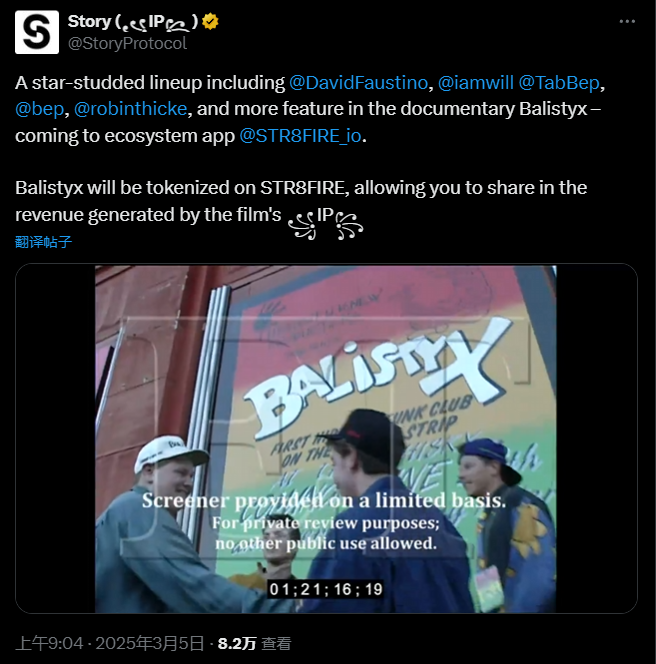

3. STR8FIRE: Exploration and Breakthroughs in Film IP

STR8FIRE is the sub-protocol within the Story ecosystem that targets film IP, operating similarly to Aria but with a focus on application scenarios:

- Asset Tokenization: On March 5, 2025, STR8FIRE announced the tokenization of partial copyrights for the movie "Balisty x," generating corresponding RWIP tokens. These tokens represent a portion of the revenue rights from box office sales, streaming platform subscription fees, or merchandise.

- Participation Mechanism: Users can purchase RWIP by depositing stablecoins, gaining the opportunity to share in movie-related profits. For example, if "Balisty x" achieves a global box office of $500 million, a user holding 0.1% of the tokens could receive $500,000.

- Ecosystem Expansion: STR8FIRE plans to expand its business to include more film content such as TV series and animations, creating a diversified IP investment portfolio to meet the needs of different users.

4. Profit Model: Multi-Layered Revenue Sources

The profit model of Story Protocol and its sub-protocols is cleverly designed, combining blockchain economics with traditional financial mechanisms:

- Transaction Fees: A small fee (expected to be between 0.1% and 1%, with the exact ratio yet to be fully disclosed) is charged by the Story mainnet for each RWIP token traded on DEX or transferred within the ecosystem. As transaction volume increases, this will become a stable source of income.

- Staking Revenue Sharing: When users stake RWIP or Aria Points, the platform takes a certain percentage from the generated rewards. For example, if the staking annual yield is 10%, the platform might extract 1% as an operational fee.

- Service Fees: Aria and STR8FIRE may charge service fees to rights holders when acquiring IP and putting it on-chain, or take a 5%-10% share from revenue distribution to support ecosystem development.

- Value-Added Services: In the future, Story plans to launch premium features, such as AI-driven copyright tracking tools and IP derivative development platforms, charging users subscription fees or pay-per-use fees to further broaden revenue channels.

This model is similar to liquidity mining and fee mechanisms in DeFi, but its uniqueness lies in combining real-world IP assets with blockchain, creating an economic system with both cash flow and growth potential.

II. Who Shares the Dividends: A Win-Win Ecosystem for Creators and Users

The ecosystem design of Story Protocol allows both creators and ordinary users to benefit, building an open and collaborative cultural economic stage.

Creators: From Passive Income to Active Value Addition

For creators, Story offers a disruptive opportunity. Take Justin Bieber as an example; if he tokenizes the copyright of "Peaches" through Aria and sells 20% of the revenue rights, he can quickly obtain millions of dollars in liquidity for new album production or personal investments while retaining 80% of the copyright to continue enjoying long-term royalties. This model is much more efficient than traditional royalty settlements, which often take months or even years. Similarly, BTS's "Like It's Christmas" generates revenue automatically through smart contracts during the holiday season, eliminating the cumbersome negotiations with record companies or streaming platforms.

More importantly, Story supports permissionless collaboration. Fans or third-party developers can remix, adapt, or create NFTs based on the original work, with creators sharing in the profits. This mechanism not only broadens income sources but also stimulates community creativity. For instance, an independent musician could create a remix of "Peaches" and release it, allowing Bieber to earn a 10% share through smart contracts. The transparency of blockchain also protects creators from opaque operations, making the usage and revenue flow of their works clear.

Users: From Consumers to "Shareholders"

For ordinary users, Story transforms them from mere cultural consumers into "shareholders" of IP. For example, consider "Black Mamba," which has 200 million plays on Spotify and generates about $5 million annually. If a user invests $1,000 to purchase RWIP tokens, holding 0.2% of the revenue rights, they could receive $10,000 annually, with a return rate of about 7%-30%. These tokens can also be traded on DEX, and if the song's popularity rises, the token price could double, bringing additional capital gains.

Users can also earn more rewards by staking RWIP or Aria Points. For example, staking $1,000 worth of tokens could yield an additional $50-$300 in Story token rewards each year. This financialization design establishes a deeper emotional connection between users and cultural assets—an investment in the RWIP of Katy Perry's "Daisies" not only generates returns but also makes the fan feel involved in their idol's success. This experience is unattainable in traditional consumption models.

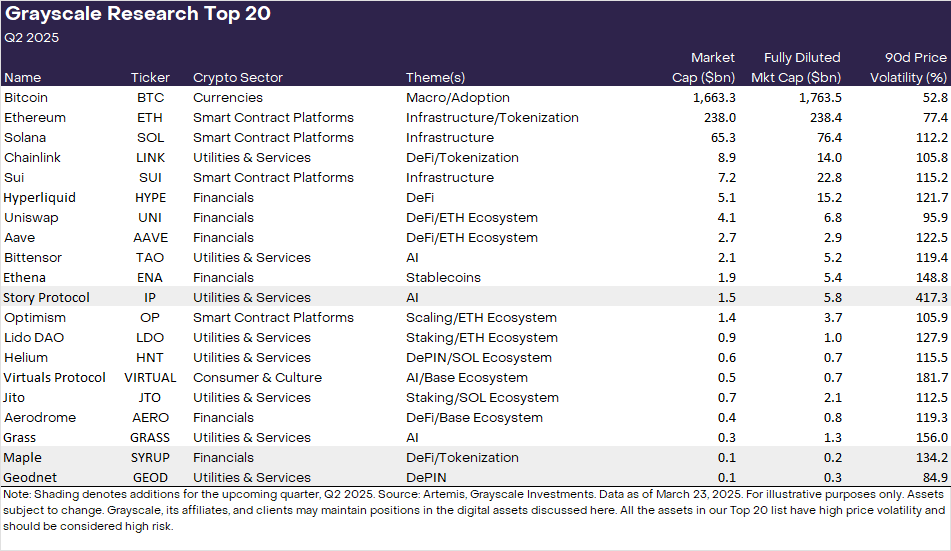

III. Why Grayscale is Optimistic: Signals of Maturity in Non-Speculative Use Cases

Grayscale has included Story Protocol's IP token in its "Top 20" list in the latest report "Grayscale Crypto Sectors," indicating a strong recognition of its potential. In the first quarter of 2025, the overall crypto market was sluggish, with valuations generally dropping by 18%, but Grayscale focused on application-layer assets rather than purely infrastructure projects. Story Protocol perfectly aligns with this trend, as its focus on real-world non-speculative use cases, such as RWA tokenization, decentralized physical infrastructure (DePIN), and IP management, is seen as an important sign of maturity in the crypto industry. Particularly impressive is that after Story launched its IP-focused blockchain and token in February 2025, it quickly attracted heavyweight IPs like Justin Bieber and BTS to the blockchain, showcasing its execution capability and potential.

At the same time, Grayscale has also noticed the enormous market opportunity behind Story. The global IP market is valued at up to $70 trillion, and in the AI era, the value of intellectual property is being redefined. For example, training AI models requires vast amounts of music and text data, and unauthorized use has led to multiple lawsuits (such as The New York Times vs. OpenAI). By putting IP on the blockchain, Story not only allows rights holders to track and manage their assets but also enables them to earn revenue through authorized use. This model addresses industry pain points while providing investors with a stable return channel. Grayscale believes that this application closely tied to the real world is the future direction of crypto assets.

Furthermore, Story's growth momentum also provides data support for Grayscale's optimism. Although specific details have not been fully disclosed, the $10.95 million deposit activity completed by Aria on February 18 attracted 4,156 wallets, demonstrating community enthusiasm. The Grayscale report mentioned that the price of IP tokens increased by 84.9% over the past 90 days. Although this growth is not as explosive as some DeFi or AI-related tokens, its low market cap and high potential make it an investment choice that balances risk and return. Grayscale clearly believes that Story is not just a short-term hotspot but could be a long-term force that changes the landscape of the IP industry.

IV. The Integration of Web3 and the IP Industry: A Quiet Revolution

The rise of Story Protocol is a microcosm of the integration of Web3 and the IP industry. How is this transformation happening, and what new opportunities does it bring?

1. Tokenization and Liquidity: Breaking Down Barriers

The traditional IP market suffers from a lack of liquidity; the copyright of a popular song may be worth tens of millions of dollars, but ordinary people find it difficult to participate. Web3 breaks down these assets through tokenization, allowing users to purchase RWIP with stablecoins and trade on DEX. For example, Aria users can hold a tiny revenue right for "Peaches" by depositing just $100, liberating IP from the hands of the elite.

2. Distributed Ownership and Collaboration: Redefining Creation

Story supports distributed ownership and permissionless collaboration. Fans can invest in the copyright of "Black Mamba" and create remixes or NFTs based on it, with profits distributed through smart contracts. This mechanism allows creators and investors to jointly participate in the appreciation of cultural assets.

3. Value Traceability in the AI Era: Technological Empowerment

The proliferation of AI complicates IP protection, while Story's programmable IP offers a solution. Its collaboration with Oxford University to research AI agent negotiation capabilities will be applied to the Agent TCP/IP framework. In the future, Story's blockchain could automatically track IP usage and negotiate licensing through AI.

4. Diversified Revenue: Financialization Design

Users can not only share profits by holding RWIP but also stake to earn up to 30% APY. This combination of DeFi and IP enhances investment attractiveness.

Conclusion

Story Protocol brings IP to the blockchain through Aria and STR8FIRE, allowing creators to benefit and users to share in the dividends. With Grayscale's recognition, its non-speculative use cases are driving industry maturity. Can this IP revolution reshape the cultural economy? The answer may lie in the next hit song on the blockchain.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。