Source: Cointelegraph Original: "{title}"

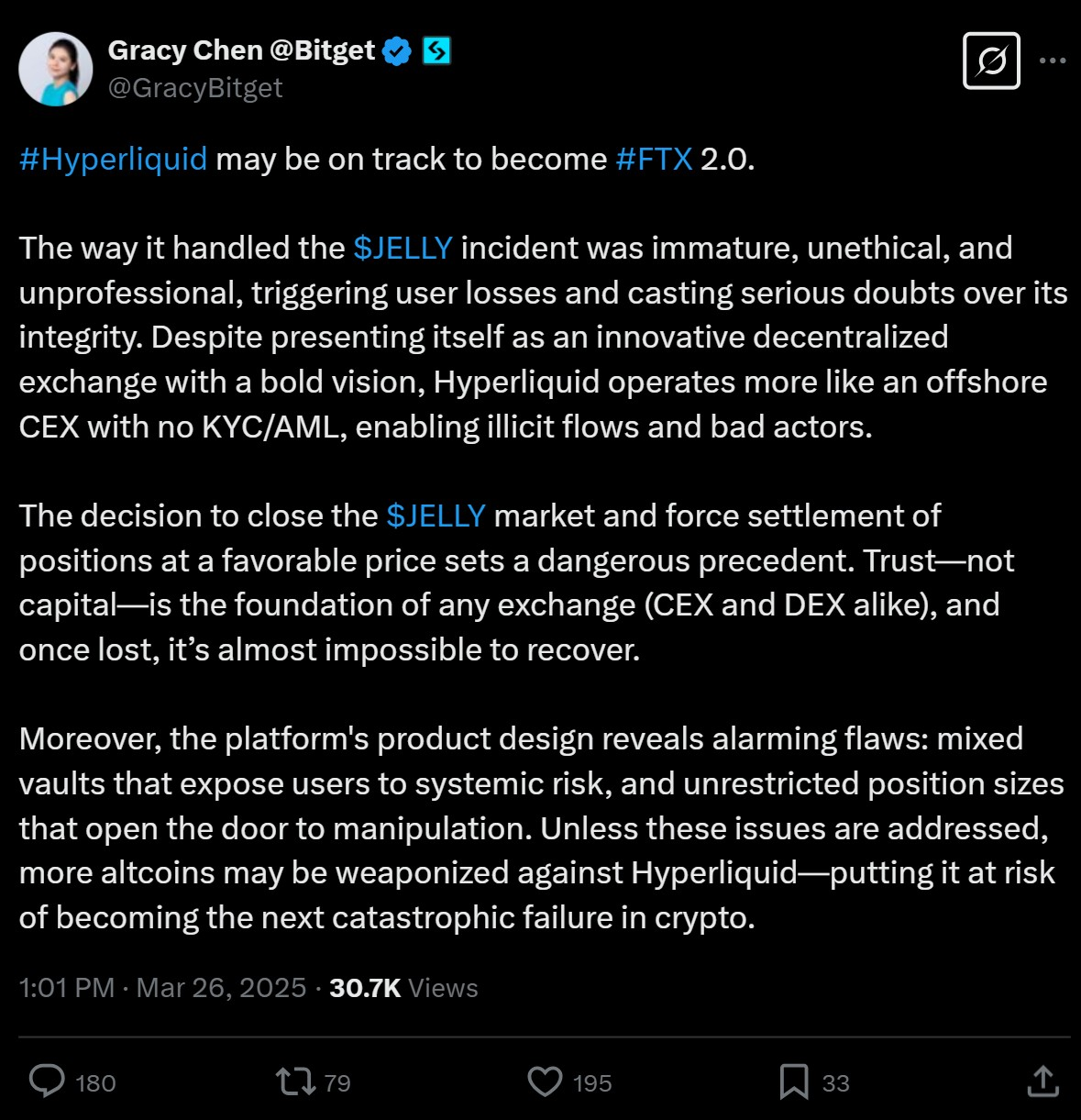

The CEO of cryptocurrency exchange Bitget, Gracy Chen, criticized Hyperliquid's handling of the events that occurred on March 26 at its perpetual contract exchange, stating that it puts the network at risk of becoming "FTX 2.0."

On March 26, the blockchain network Hyperliquid, which focuses on trading, announced that it had delisted the perpetual contract for the JELLY token and would compensate users after discovering "evidence of suspicious market activity" related to the JELLY token.

This decision was reached by a relatively small number of validators on Hyperliquid through consensus, raising existing concerns about the network being perceived as centralized.

"Despite positioning itself as an innovative decentralized exchange with bold vision, Hyperliquid operates more like an offshore 'centralized exchange,'" Chen said, previously stating that "Hyperliquid may be on the path to becoming FTX 2.0."

FTX was a cryptocurrency exchange operated by Sam Bankman-Fried. After FTX's sudden collapse in 2022, he was convicted of fraud in the United States.

Chen did not accuse Hyperliquid of specific legal violations but emphasized that she believes Hyperliquid's response to the incident was "immature, unethical, and unprofessional."

"The decision to shut down the $JELLY market and force the settlement of positions at favorable prices sets a dangerous precedent," Chen said. "Trust—rather than capital—is the foundation of any exchange… once lost, it is nearly impossible to restore."

Source: Gracy Chen

The JELLY token was launched in January by Venmo co-founder Iqram Magdon-Ismail as part of a Web3 social media project called JellyJelly.

According to DexScreener, it initially reached a market cap of about $250 million but fell to several million dollars in the following weeks.

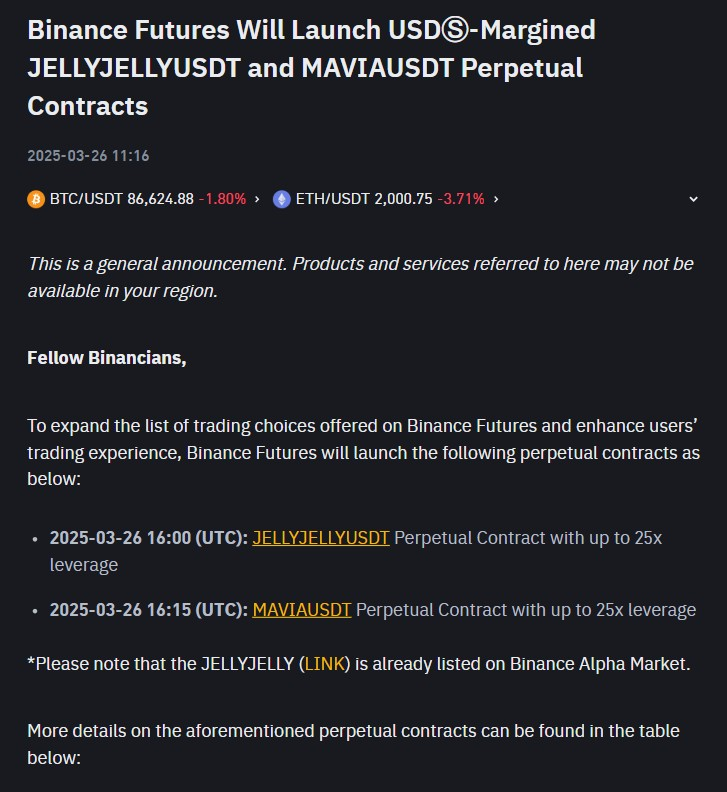

On March 26, after the world's most popular cryptocurrency exchange Binance launched a perpetual contract linked to the token, JELLY's market cap surged to about $25 million.

On the same day, a Hyperliquid trader "opened a massive $6 million short position on JellyJelly," then "deliberately self-liquidated by pushing up the price of JellyJelly on-chain," posted Abhi, founder of Web3 company AP Collective, on the X platform.

Arthur Hayes, founder of BitMEX, stated that the initial response to the Hyperliquid JELLY incident overestimated the potential reputational risk to the network.

"Let's stop assuming hyperliquid is decentralized. Then stop assuming traders really 'care,'" Hayes posted on the X platform. "I bet $HYPE will soon return to where it started because speculators just want to speculate."

Binance launched the JELLY contract on March 26. Source: Binance

On March 12, Hyperliquid responded to a similar crisis caused by a whale who deliberately liquidated about $200 million in Ethereum (ETH) long positions.

After being forced to close at an unfavorable price, this trade caused depositors in Hyperliquid's liquidity pool (HLP) to lose about $4 million. Subsequently, Hyperliquid increased the collateral requirements for open positions to "reduce the systemic risk posed by the market impact of large positions being liquidated."

According to a report from asset management firm VanEck in January, Hyperliquid operates the most popular leveraged perpetual trading platform, controlling about 70% of the market share.

Perpetual futures (or "perpetual contracts") are leveraged futures contracts with no expiration date. Traders deposit margin collateral (such as USDC) to secure their open positions.

According to L2Beat, Hyperliquid has two main sets of validators, each consisting of four validators. In contrast, competing blockchains like Solana and Ethereum are supported by about 1,000 and 1 million validators, respectively.

More validators typically reduce the risk of insider manipulation within small groups.

Related: Analysts say Hyperliquid has launched a "decentralized" crypto whale hunting mechanism.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。