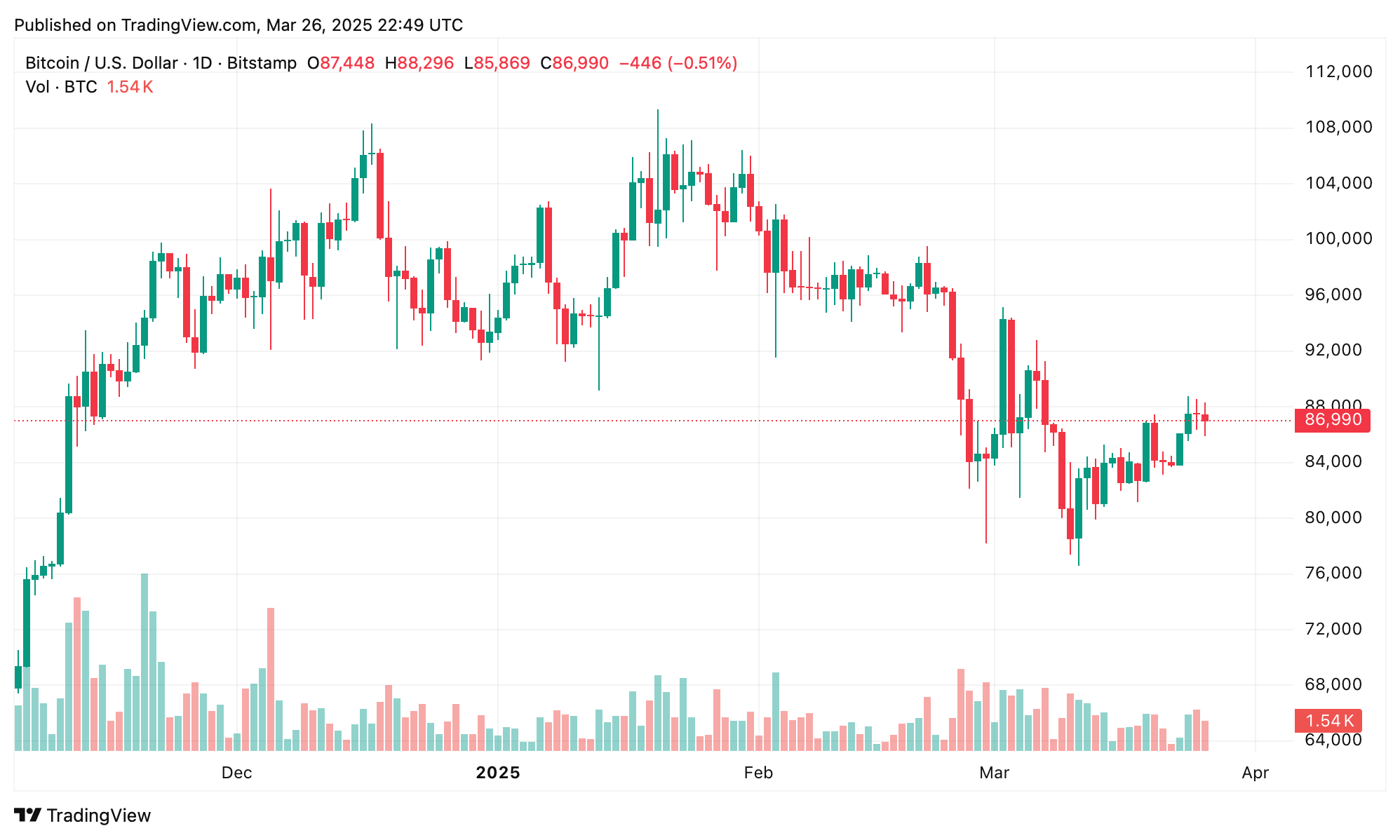

For much of March 26, the top cryptocurrency oscillated within a narrow corridor, briefly slipping to $85,869 around 3 p.m. ET. Global crypto asset exchanges recorded around $79.59 billion in trade volume during the session, with bitcoin’s share accounting for $26.84 billion.

Bitcoin ( BTC) presently hovers below its March 25 peak of $88,539, achieved around 4 p.m. ET yesterday, as traders navigate a familiar script of price stabilization after record-breaking performances.

At the time of writing, BTC is exchanging hands for $86,990 per coin.

The leading digital currency’s current stasis mirrors historical episodes where it lingered in tight corridors post-peak, a choreography of supply and demand etched into its volatile DNA. Market oscillators hint at collective hesitation, with the $90,000 mark looming as a psychological barrier; breaching this fortress could reignite the algorithmic cavalry in a run toward $100,000.

Political tremors from President Donald Trump’s tariff declarations—including a 25% levy on non-U.S. automobiles announced Wednesday—have rippled through equities and crypto markets alike. All of the major U.S. stock indices closed the day in the red. Meanwhile, Gamestop’s $1.3 billion fundraising gambit to fortify its BTC reserves added a subplot to the day’s financial theater.

While BTC is $86,990 per coin on global exchanges like Bitstamp, in South Korea, on exchanges like Bithumb and Upbit, BTC is trading for a premium.

In South Korea, BTC commands a modest premium as the Korean won cedes ground to the euro in trading pair prominence. The asset’s dominant pairings on Wednesday feature USDT, FDUSD, USD, USDC, EUR, and KRW, while Cryptoquant’s Coinbase Premium Index flickers with faint bullish signals.

Bitcoin’s price action meanders through labyrinthine trading channels, its trajectory is still as unpredictable as quantum fluctuations. Potential accelerants loom: Continued institutional embrace via spot bitcoin exchange-traded funds (ETFs) and corporate balance sheet strategies could propel valuations.

A dovish pivot by the Federal Reserve, spurred by cooling inflation or economic headwinds, might similarly electrify bitcoin. Yet, certainty remains elusive—a reminder that bitcoin markets thrive on ambiguity. Trump’s dual role as crypto cheerleader and tariff provocateur further muddies the waters, illustrating how policy whims can both invigorate and destabilize in one breath.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。