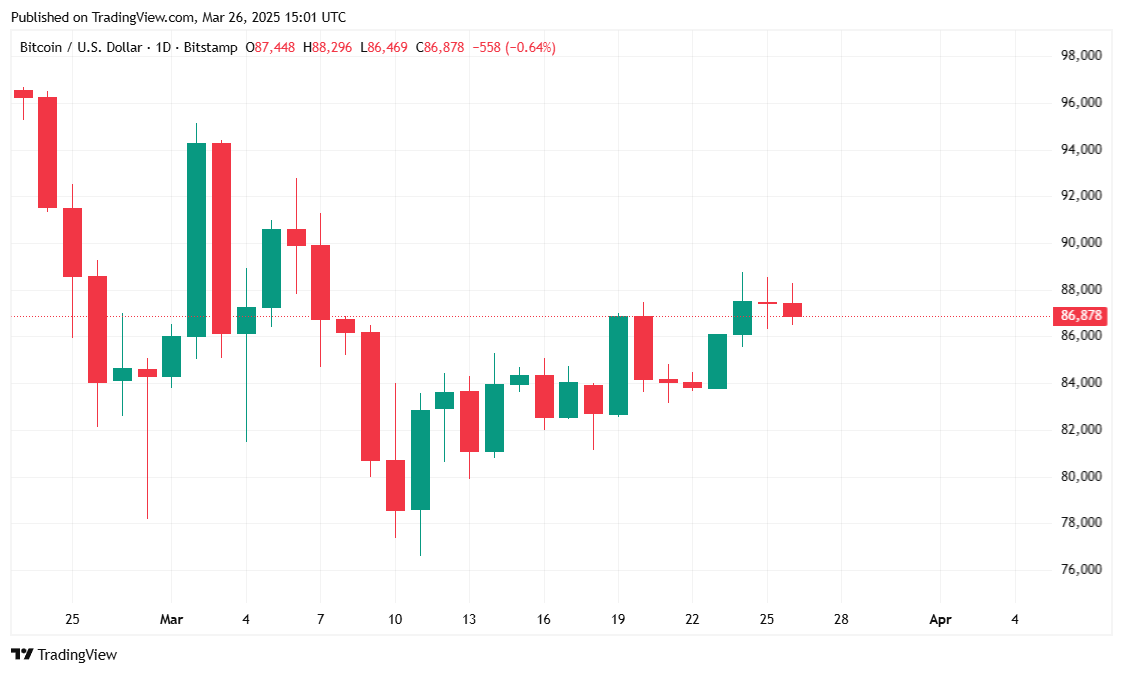

According to Glassnode, large investors have grown their bitcoin ( BTC) holdings by more than 129,000 BTC since March 11, even though the leading digital asset is experiencing a slight decline in its price today. Bitcoin is currently trading at $86,949.16, down 1.33% over the past 24 hours, though it remains up 3.04% over the past week. The 24-hour price range has fluctuated between $86,460.55 and $88,542.39, according to data from Coinmarketcap.

( BTC price / Trading View)

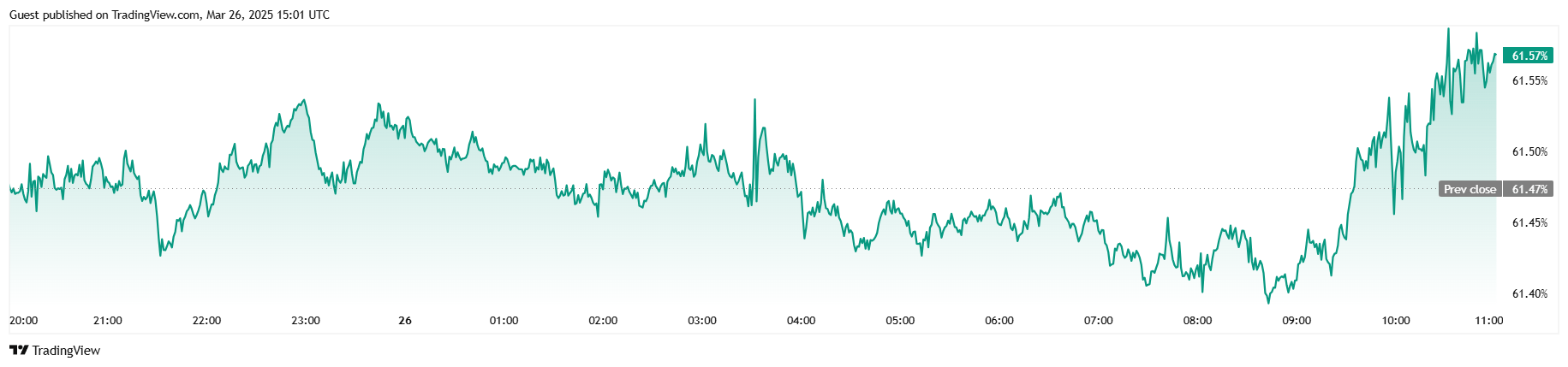

Bitcoin’s 24-hour trading volume stands at $28.56 billion, reflecting an 8.74% decline from the previous day, suggesting a slowdown in market activity. The total market capitalization has also dipped by 1.23% to $1.72 trillion. However, Bitcoin dominance continues to edge upward, reaching 61.57%, an increase of 0.13% in the last 24 hours.

( BTC dominance / Trading View)

Futures markets indicate a cooling off, with total BTC futures open interest dropping by 2.86% to $55.45 billion. Meanwhile, data from Coinglass shows that total Bitcoin liquidations over the past 24 hours amounted to $9.19 million, with long positions accounting for $8.25 million and short positions only $943,000. This suggests that bullish traders bore the brunt of the recent price action.

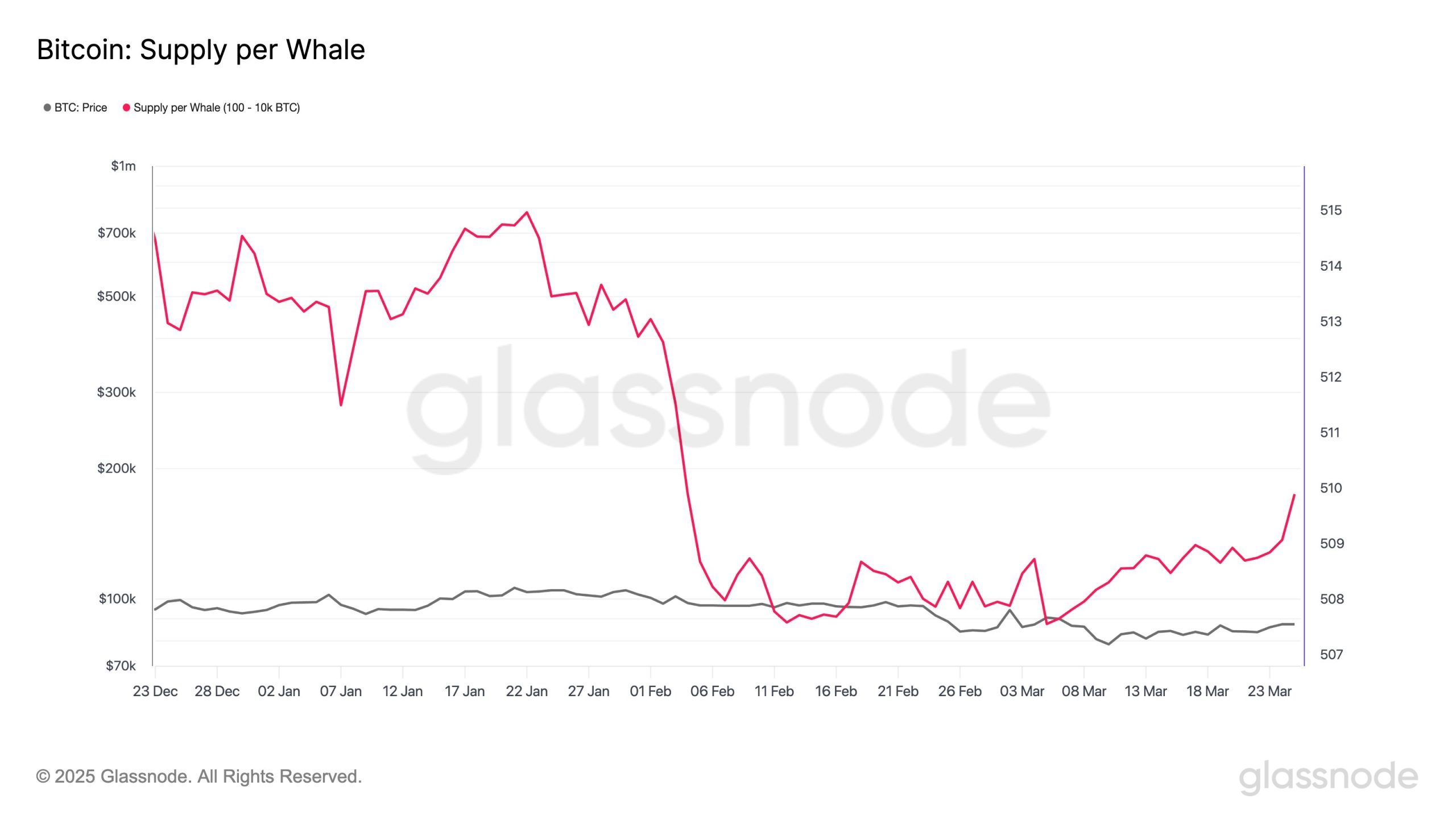

Despite the short-term price dip, onchain data from Glassnode suggests that large bitcoin holders are continuing to accumulate. However, that buying trend is in contrast to smaller holders who remain net sellers.

(The average $ BTC supply per whale has been steadily rising since early March / Glassnode)

Whales have added more than 129,000 BTC since March 11, with buying momentum accelerating over the past two days, pointing to increased confidence from institutional and high-net-worth investors. Glassnode says this represents “the largest accumulation rate since late August 2024.”

“The average BTC supply per whale has been steadily rising since early March, another signal of sustained accumulation,” Glassnode wrote. “Still, it remains below December levels, suggesting there’s more room for growth if the trend continues.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。