Bitcoin ETFs Achieve Eighth Consecutive Day of Inflows With $27 Million Addition

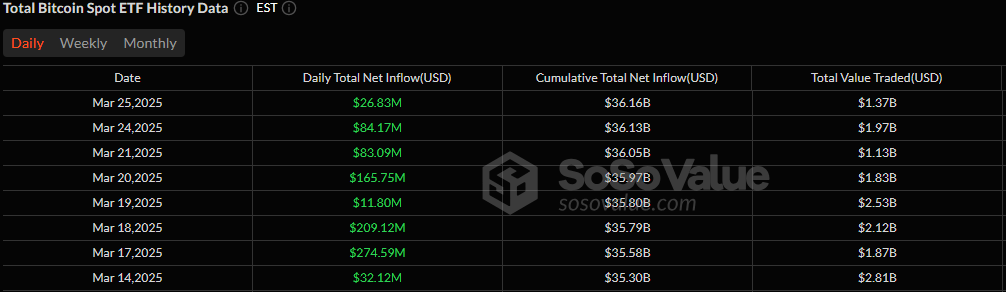

Investor enthusiasm for bitcoin ETFs remained strong on Tuesday, March 25, with an additional funds inflow of $26.83 million, marking the eighth straight day of inflows.

Blackrock’s IBIT was at the forefront, attracting $42.03 million in new capital. This influx was partially offset by outflows from Bitwise’s BITB and Wisdomtree’s BTCW, which saw withdrawals of $10.06 million and $5.13 million, respectively.

The remaining nine bitcoin ETFs reported neutral activity, with no significant inflows or outflows. At the close of trading, the total value traded across bitcoin ETFs stood at $1.37 billion, maintaining total net assets around the $99 billion mark.

Source: Sosovalue

Conversely, ether ETFs experienced a resurgence of outflows, breaking a brief pause, with a net loss of $3.21 million. Grayscale’s Ethereum Mini Trust led the downturn, shedding $1.76 million, while Invesco’s QETH followed with a $1.45 million reduction.

The day’s total trading volume for ether ETFs reached $115 million, bringing total net assets to $7.11 billion by day’s end.

These contrasting movements highlight the divergent investor sentiment between bitcoin and ether ETFs at the moment, with bitcoin continuing to draw substantial interest, while ether faces renewed caution.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。