Bitcoin ETFs Look to Reclaim $100 Billion in Net Assets

The show of strength from bitcoin ETFs continued into the new week with an $84.17 million fund inflow on Monday, March 24. This marked the 7th straight day of inflows for bitcoin ETFs.

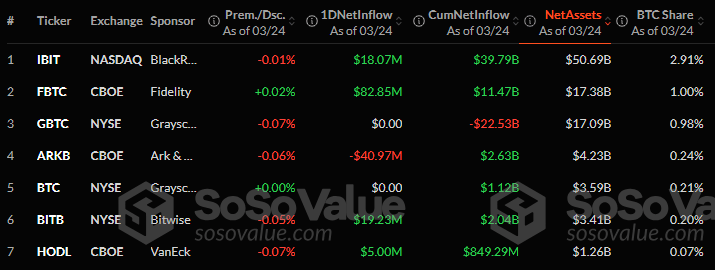

Among the 12 funds tracked, Fidelity’s FBTC led the charge with an $82.85 million addition. Bitwise’s BITB and Blackrock’s IBIT also contributed, bringing in $19.23 million and $18.07 million, respectively.

Vaneck’s HODL added $5 million to the day’s inflows. However, Ark 21shares’ ARKB experienced a $40.97 million outflow, slightly offsetting the gains but not derailing the overall positive trend.

Approximately $1.97 billion in trading volume moved through the 5 bitcoin ETFs, with the remaining 7 remaining neutral, with no recorded inflows or outflows.

In contrast, ether ETFs broke their 12-day outflow streak by recording zero net flows, signaling a pause in the recent trend of capital exits. This stabilization suggests a potential reassessment of investor preferences in ether ETFs.

By the close of trading, bitcoin ETFs’ total net assets looked to reclaim the significant $100 billion milestone, settling at $99.31 billion. This figure represents about 5.7% of bitcoin’s total market capitalization.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。