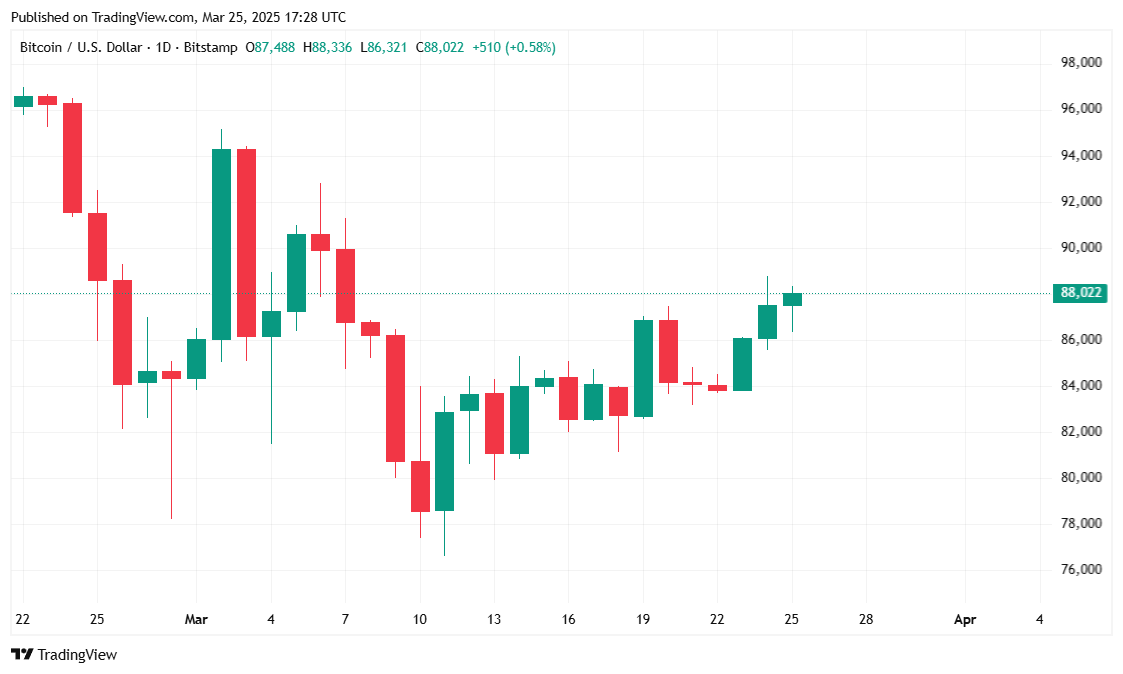

Some 11,501 bitcoins were quietly shuffled around Tuesday morning from Mt Gox, which filed for bankruptcy in 2014, but the activity, which could have depressed the price of BTC, appeared instead to have little impact. The dominant cryptocurrency is trading at $88,040 at the time of reporting, down slightly by 0.26% over the past 24 hours but still maintaining a 7.50% gain over the past week. In fact, BTC remains near its weekly highs, with a 24-hour trading range of $86,346 to $88,538.

( BTC price / Trading View)

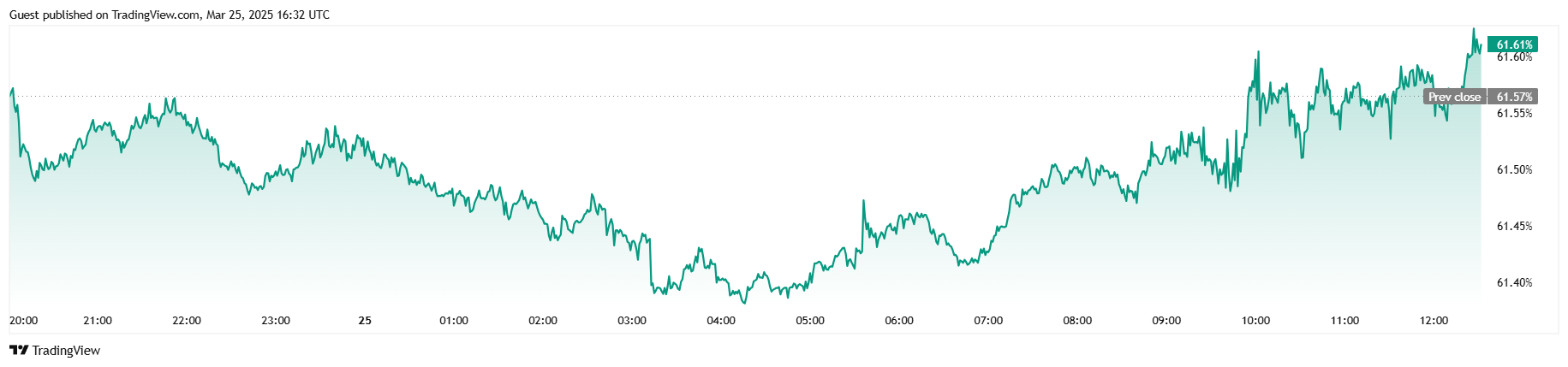

Bitcoin’s 24-hour trading volume has increased by 8.69% to $30.91 billion, with market capitalization at $1.74 trillion, reflecting a slight 0.04% increase since yesterday. Meanwhile, bitcoin’s dominance in the crypto market, according to Trading View, has inched up 0.06% to 61.61%, suggesting its continued stronghold over alternative digital assets.

( BTC dominance / Tradingview)

On the derivatives front, total BTC futures open interest has declined by 2.70% to $56.91 billion, indicating a reduction in leveraged positions. Liquidation data from Coinglass shows that $38.32 million worth of BTC positions were liquidated over the past 24 hours, with long liquidations at $22.77 million and short liquidations at $15.54 million. This suggests relatively balanced trading activity without significant market panic.

World Liberty Financial (WLFI), a crypto initiative backed by U.S. President Donald Trump, has announced plans to launch a USD stablecoin called “USD1.” WLFI, which positions itself as a decentralized finance (DeFi) protocol and governance platform, recently raised $550 million through two separate token sales.

While the announcement has sparked interest in the crypto community, bitcoin’s price remains largely unaffected by the news.

Blockchain analysis firm Arkham Intelligence reported that the defunct Japanese exchange Mt Gox transferred 893 BTC (worth approximately $78.11 million) to its hot wallet and an additional 10,608 BTC (valued at around $927.48 million) to a change wallet. Historically, such movements have sometimes created selling pressure, as they suggest impending creditor repayments.

Despite these transfers, bitcoin’s price has remained relatively stable, indicating strong market confidence and resilience against potential sell-offs.

With bitcoin holding steady despite major market events, the near-term outlook remains cautiously optimistic. Increased trading volume and growing investor interest suggest that BTC could maintain its current trajectory. However, market participants should remain vigilant, as future developments, including Mt. Gox creditor distributions and potential regulatory updates, could introduce volatility.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。